Q.1. Explain why Stability is important in Digital currencies.

Currencies generally are for all practical purposes considered to be money 💰. Thus they are considered to be a store of value. Being a store of value means having a very minimal radius of gyration with respect to price changes. When a currency is considered, it is expected to have a great level of stability so that user of such currency can be sure to an extent how much it will be worth in the bear future.

Be it digital or physical, a currency that's susceptible to price fluctuations and has stability issues is harley ever recognized as an acceptable legal tender. This is not to say that the price of every currency must be fixed at all times, even the dollar is worth less than it was years ago. However, a good deal of stability is required for a currency to function as such.

For a digital currency to be used as a currency, widely accepted and a legal tender, it has to prove to be a currency indeed. It has to have a good deal of stability inherent in it. People have to be sure the coin will not double down in the near future.

Most times, people want to hedge their money against assets during inflation and they turn to gold and other precious metals due to the level of confidence in the stability of those precious metals. If a digital currency can command such level of confidence, it will no doubt gain wide acceptance as a currency.

Q.2. Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

Central Bank Digital Currencies (CBDCs) are digital versions of physical currencies issued by Central Banks. At the end of the day, the success of a CBDC will depend on a government and how they'll decide to run their CBDCs.

Generally, I think it will be a good fit for the future because it will be backed by the government and the majority of the world population trusts a currency backed by the government... depending on the government that is.

Let's consider the pros and cons of CBDCs

PROS

Government Issued: CBDCs will be issued by the government and this is a plus. The popularity of the government will definitely help with mass adoption. Corporate institutions will adopt it and so will so many other individuals.

Government backed: Government backing CBDCs will mean they easily get adopted and will stand strong. Most coins today are backed by a community of users and secured by Proof of Whatever consensus mechanisms. For a government backed coin, add the nations military, security intelligence, federal financial institutions and other cohesive federal apparatuses.

Legal tender: When it the government handing out the CBDCs, it no doubt gets the reputation of being a legal tender, something BTC has only been able to achieve in a currencyless El-Salvador.

Regulated: The government will bring in regulations and that's going to boost confidence in the digital currency. Most individuals and corporate entities express worry over the prevailing cryptocurrency because they are unregulated. Having a regulated digital currency will bring confidence to those quarters.

CONS

Centralization: Because CBDCs are centralized, there's going to be lots of challenges facing them. First, most of the people using digital currencies today enjoy the decentralized feature. The fact that no government can seize your BTC hits different. With CBDCs, this is not the case as they are controlled by the government. Expect people to avoid them like cancer ♋.

Political Instability: Another problem CBDCs will suffer from is what physical currencies are already suffering. Political instability can even make an existing CBDC to be abolished. It can make it better and it can make it worse. Where there's no continuity in government, expect to hear of new governments coming up and embargoing its own CBDC.

My stance on CBDCs is that, depending on the government manning it, it is likely to or not be a successful venture.

Q.3. Explain in your own words how Rebase Tokens work. Give an illustration.

Rebase tokens are a special type of cryptocurrencies that adjust to keep their prices stable. Here's how they work.

First, the law of demand and supply tells us that if demand increases and supply is constant, price will increase and if supply increases and demand is constant, price will decrease

More demand, higher prices, more supply, lower prices

So, with rebate tokens, whenever the demand increases, the distribution of the token is automatically adjusted so as to negate the effect of increased demand on price. Hence, price won't increase but the number of tokens will.

On the other hand, whenever the supply increases, the distribution of the token is automatically adjusted so as to negate the effect of increased supply on price. Hence, price won't decrease but the number of tokens will.

A good example of this is the Ampleforth token (AMPL). It is priced at $1 and has a rebase scheduled every 24hrs at 2:00 UTC. At this time, whenever the price of AMPL > $1 tokens will be increased in the various wallets to increase supply and negate price increase. If AMPL < $1 tokens will be reduced to negate price decrease.

Q.4. Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

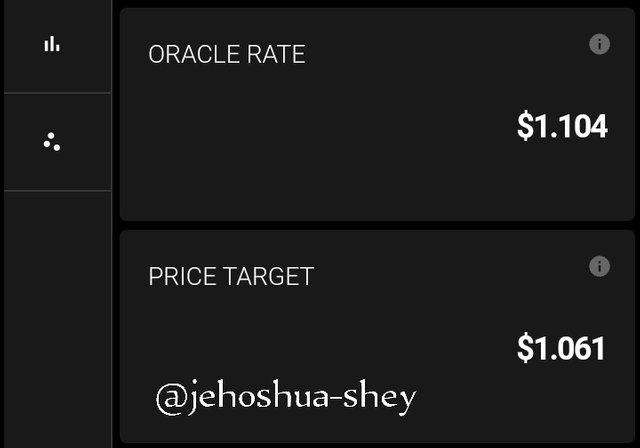

From this course's post, he formula for calculating rebase is given by

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

From https://www.ampleforth.org/dashboard/, we can obtain the following parameters

Oracle Rate = $1.104

Price Target = $1.061

Rebase % = {[($1.104 - $1.061) / $1.061] x 100} / 10

Rebase % = {[($0.043) / $1.061] x 100} / 10

Rebase % = {$0.0405 x 100} / 10

Rebase % = {4.05} / 10

Rebase % = 0.405

Asides from the oracle rate and the target price, some other things found on the website included

Next rebase

Circulating/total supply

Price chart

Supply chart

Market Cap Chart and

AMPL CAM

Q.5. Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

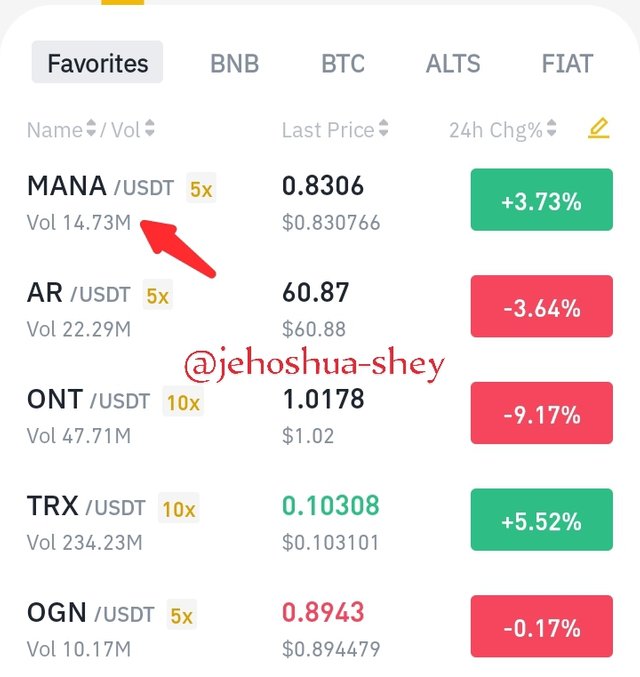

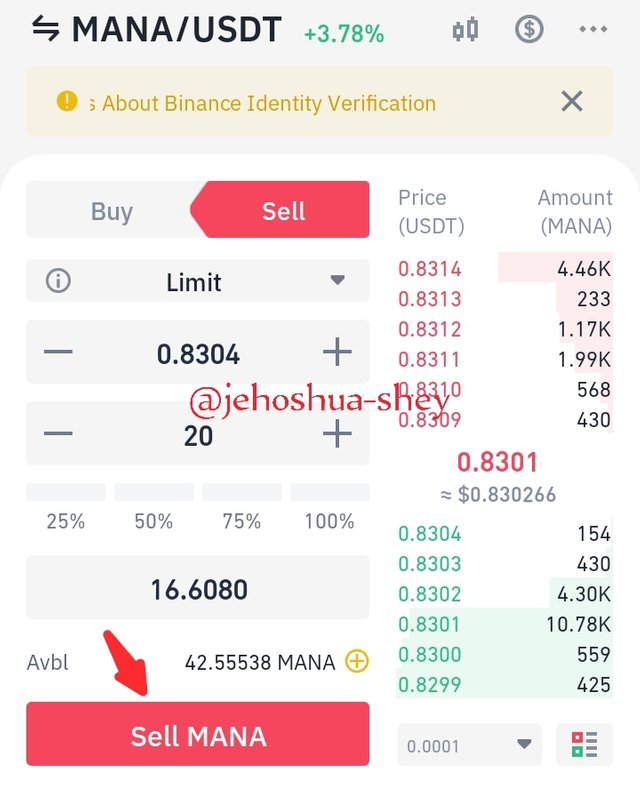

I decided to sell some MANA for this excercise.

I went on my Binance mobile app and selected MANA/USDT pair.

Next I clicked on sell and entered the details, after which I clicked on Sell MANA.

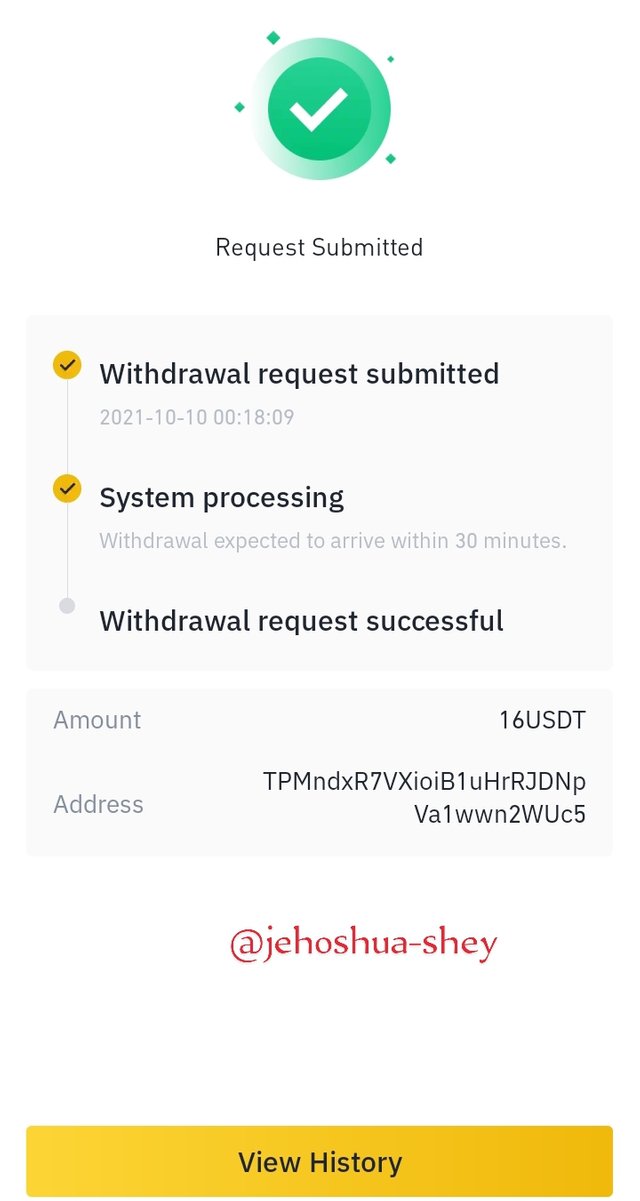

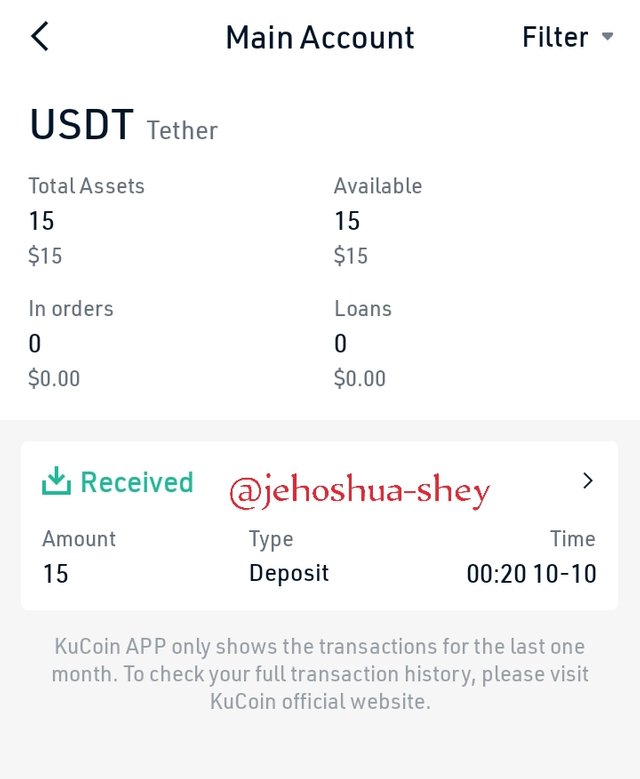

Q.6. Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

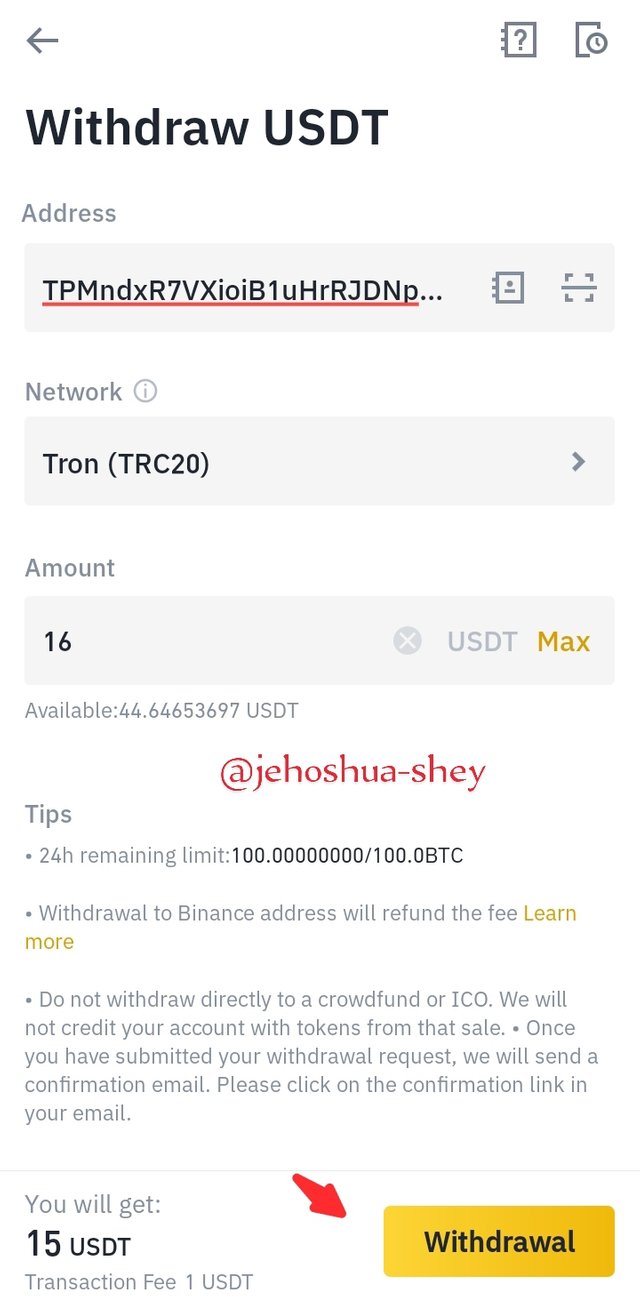

I decided to transfer about 15 USDT to my Kucoin wallet and I used the TRON network as was instructed.

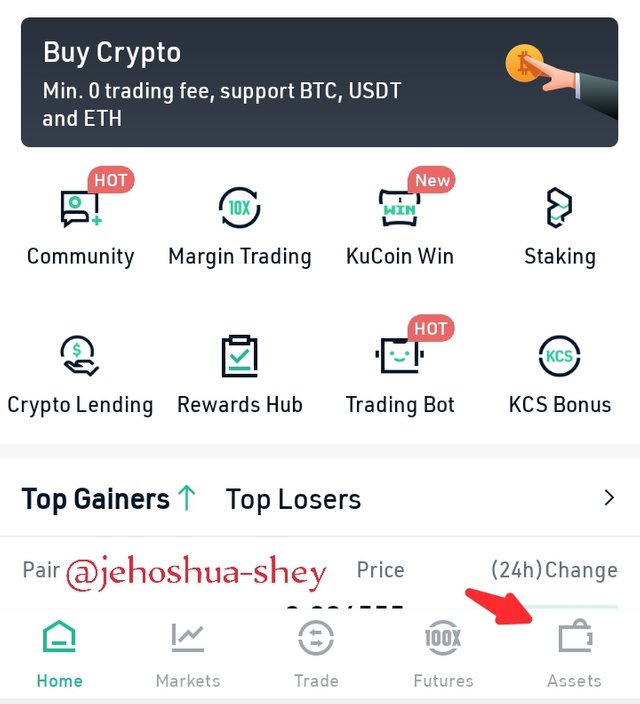

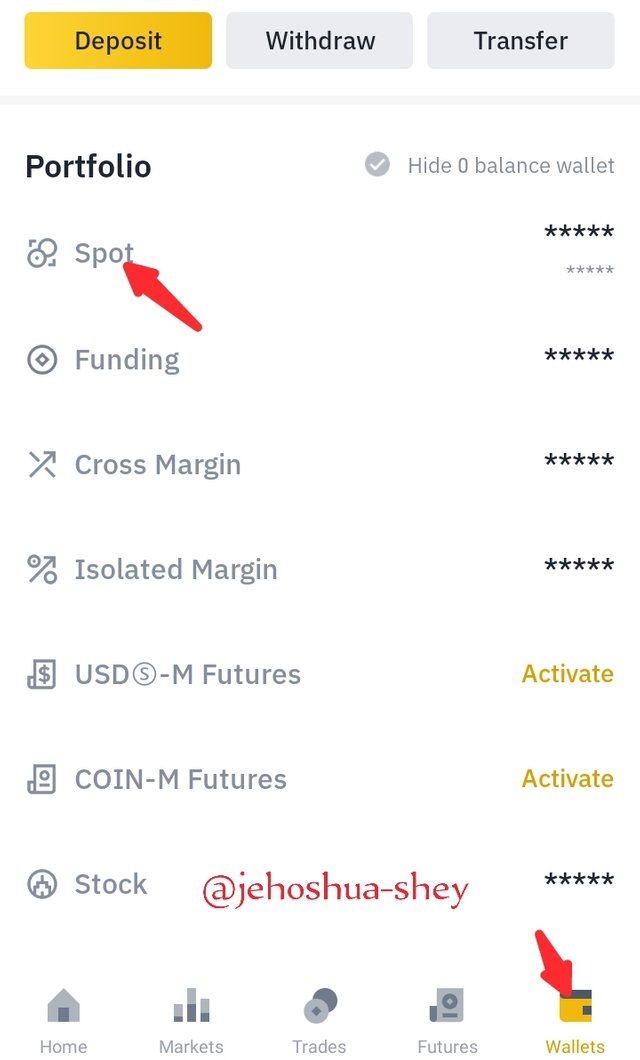

I opened my Kucoin mobile app and clicked on the wallet icon

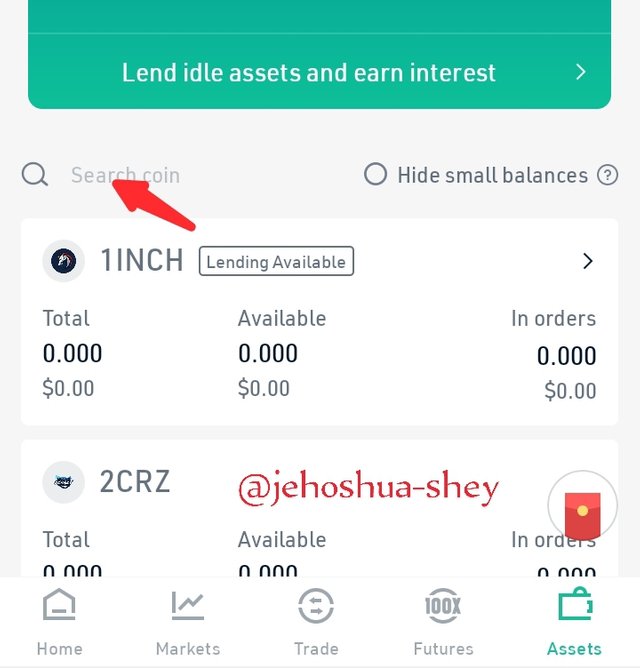

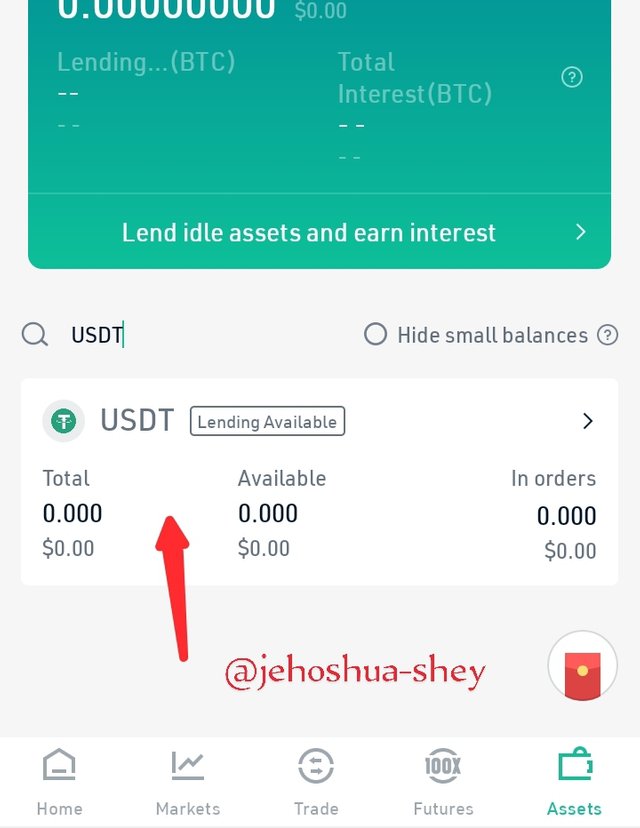

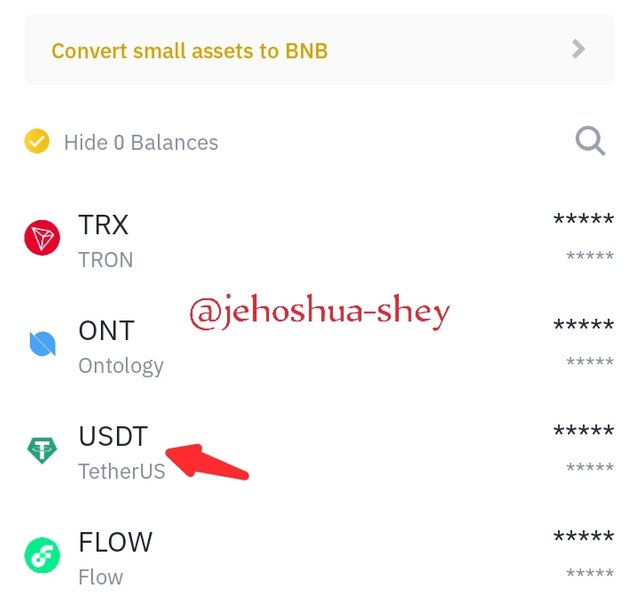

Next, I searched for USDT, then I selected it

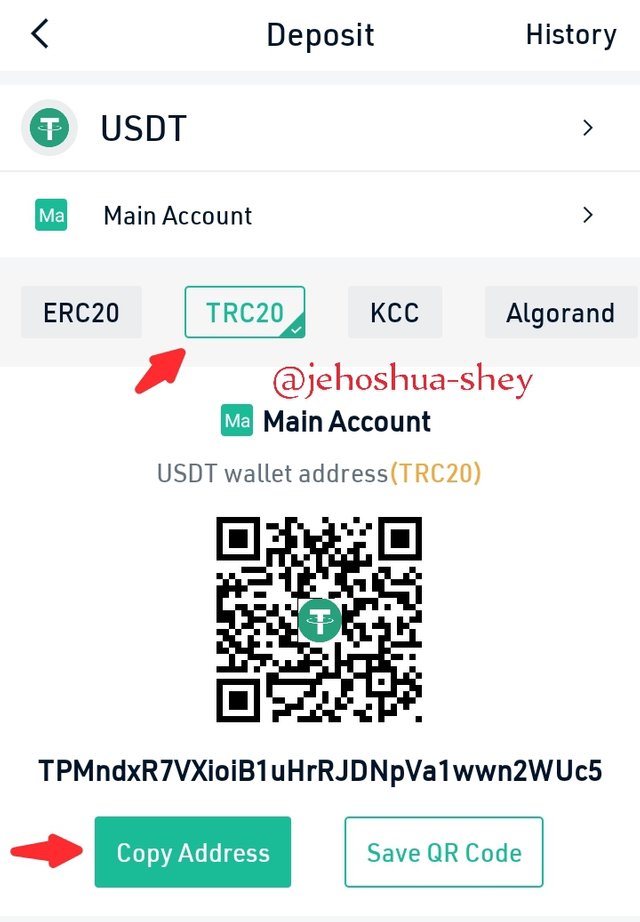

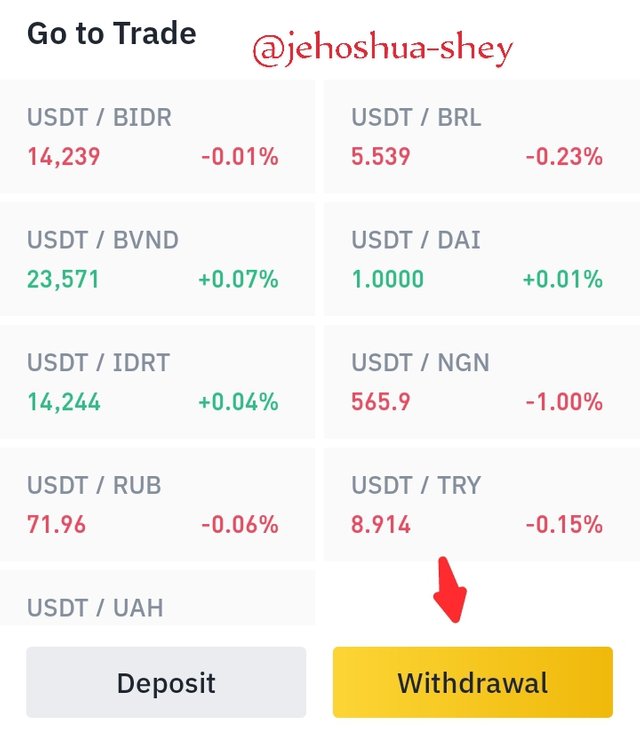

Then I click on deposit, then TRC20 and copied my deposit address

I went back to my Binance wallet and clicked on spot and selected USDT.

Then I filled in the correct TRC20 wallet address and other details and authenticated the transaction.

BACK TO BINANCE.

CONFIRMATION IN MY KUCOIN WALLET

That's it.

From the transaction we saw the fee was 1 USDT. Thanks to TRON, we pay that low for USDT transfers over the TRON network. The advantage of transferring USDT over other coins is that the amount remains the same from source to destination.

CONCLUSION

Stability is an important characteristics of a currency. Whether digital or physical, any currency will be judged by it stability or ability to retain value despite fluctuations in the market.

Some coins like stable coins came with a Peggy stability solution while other called rebase tokens introduced some interesting form of adaptability to maintain prices. All the same, they will make a lengthy case for use as currencies should they prove to be relatively stable over time.

One other option is CBDC. Although the success of this is debatable but you can't look away front the fact that government backing and control will bring some positives along with its inevitable list of negatives.

Thanks for reading

Cc:

@awesononso