Q.1. What is Zethyr Finance?

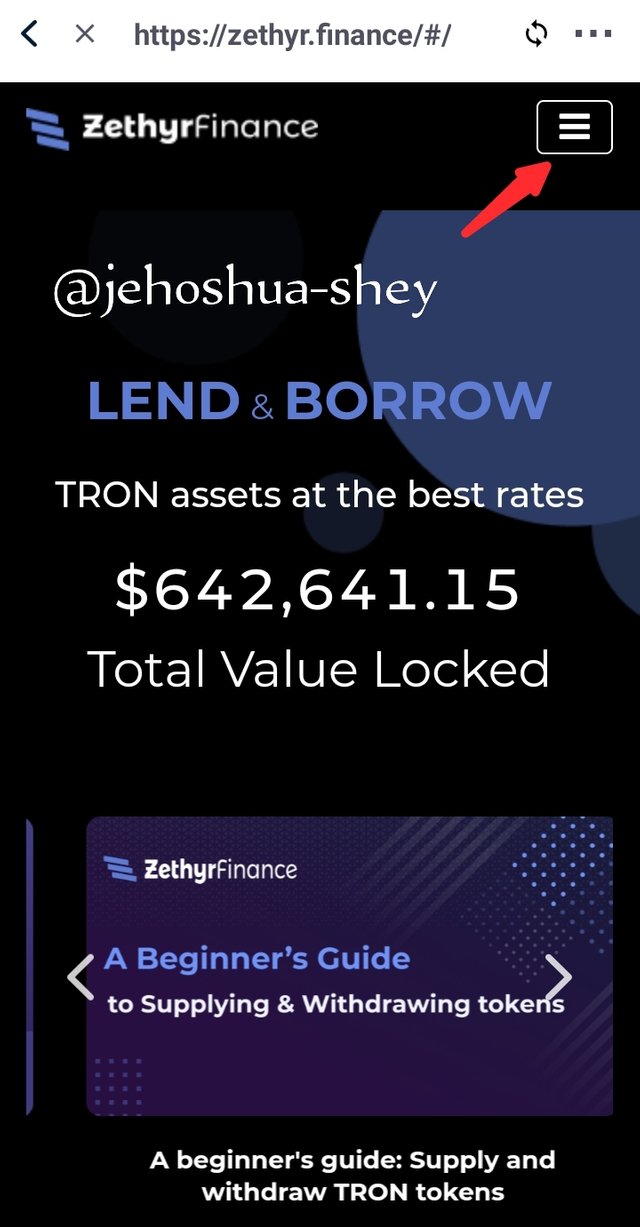

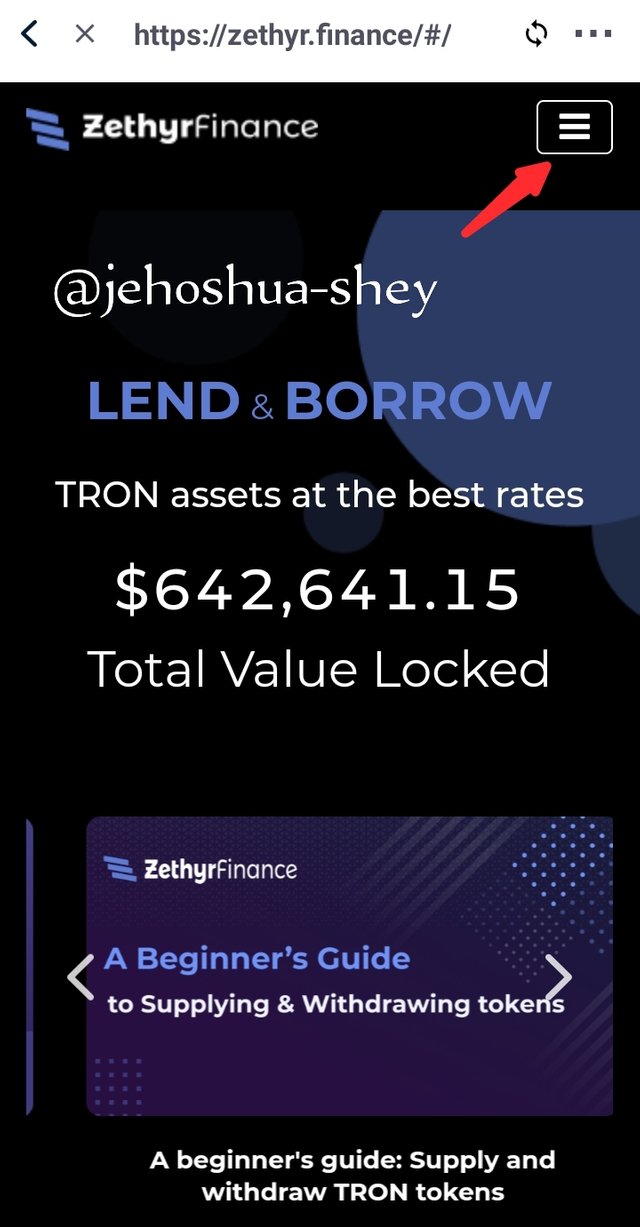

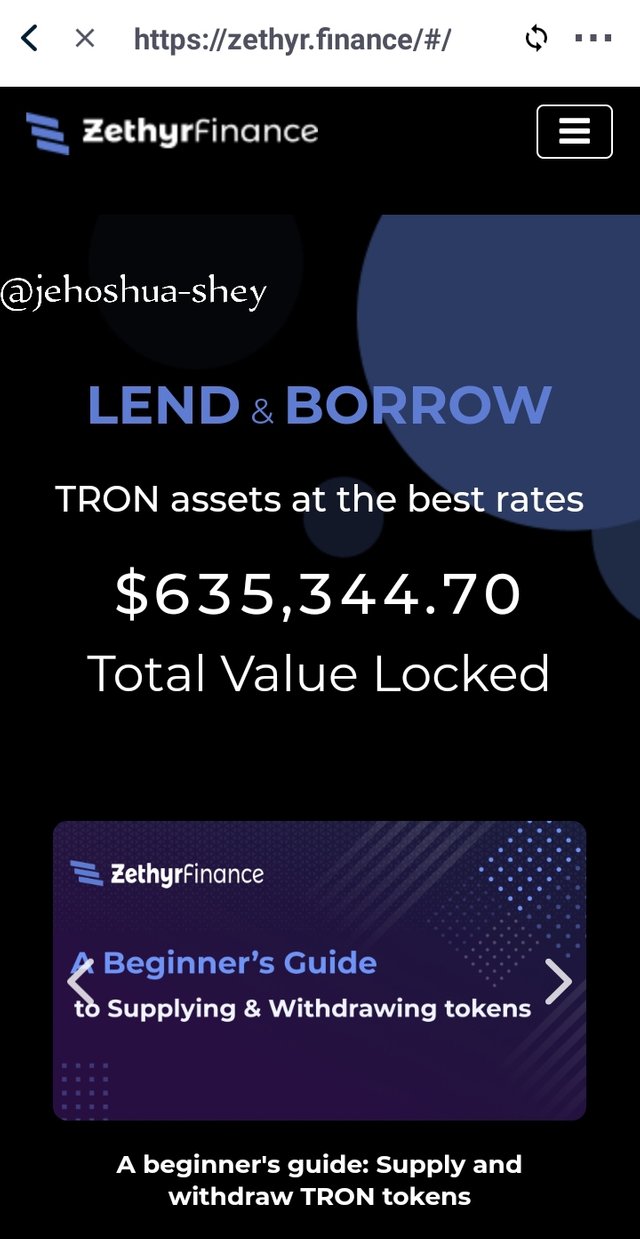

Zethyr finance is a decentralized platform built on the TRON blockchain that enables users to carry out decentralized financial transactions. This platform allows users to carry out transactions like lending, borrowing, and exchanging without a middleman. Though not the only lending protocol on the TRON blockchain, Zethyr finance boasts of significant additional features that makes it different from many other blockchains.

The TRON blockchain is notorious for industry low fees and charges, hence, the proportional adoption of this blockchain for dApp and decentralized protocols creation. Many platforms have been built on the TRON blockchain with very unique selling points and excellent features. Some of this are just difficult to ignore including JustSwap and JustLend.

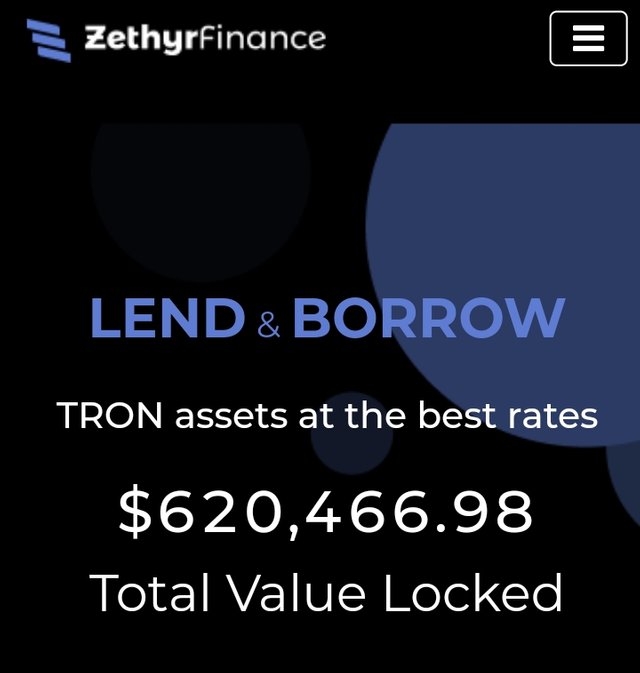

Zethyr finance however stands out from most of the other platforms on the TRON blockchain as it is a decentralized financial platform offering both lending, borrowing, and exchanging. The platform has +$620k locked in. It also offers profitable APYs for users who wish to lend on the platform.

Image credit

Users of this platform can benefit from the profitable APYs offered for lending on the Zethyr finance platform. They can also borrow to repay at a reasonable APY. If they find an APY for another asset they don't own, they could as well exchange to acquire that asset.

Q.2. What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Zethyr finance offers four main features. They include lending, borrowing, stable swap and exchanging and they are discussed in detail below.

1. ZETHYR LENDING

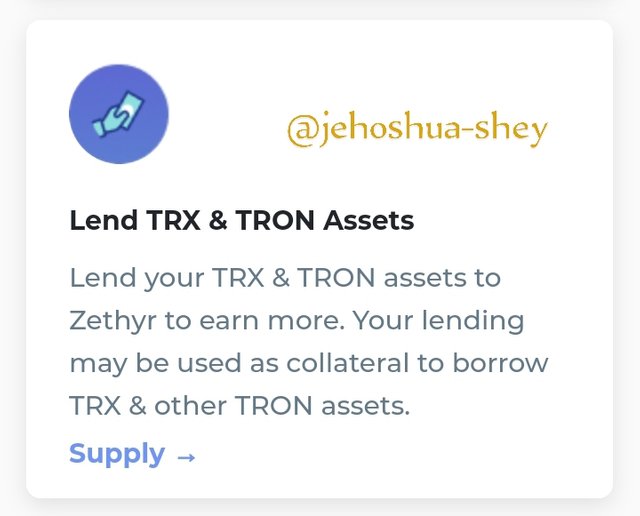

On Zethyr finance platform, users who have tron based assets or TRX can lock them in the platform's lending protocol. One good thing about Zethyr lending is that the asset locked in can be used as a collateral to borrow. Lending on Zethyr finance platform can be done through the 'Supply' section from the homepage.

Clicking on the 'Supply' link on the homepage as shown in the above image, takes the user to the lending/borrowing section of the website. There the user can see the various markets available to lend to and there respective dividends quantified in APYs.

On the supply section shown in the image above, users can select assets to supply and earn dividend according to the respective APY.

2. ZETHYR BORROWING

Just like lending, borrowing is also offered by Zethyr finance on the lending/borrowing section. Users who seek loans can collaterise their assets and get these loans. They'll have to pay interset as stipulated in the respective APYs. The good thing about Zethyr finance borrowing is that it allows you to collaterise assets that has been locked into the lending protocol.

To asses the borrowing feature on Zethyr finance platform, simply click on the borrow link on the homepage of the platform's website.

Clicking on the 'borrow' link on the homepage as shown in the above image, takes the user to the lending/borrowing section of the website. There the user can see the various markets available to borrow from and their respective interests quantified in APYs.

On the borrow section shown in the image above, users can select assets to borrow and pay interest according to the respective APY.

3. ZETHYR EXCHANGE

There's a possibility that a user is interested in supplying assets for lending but finds an asset with a higher APY than theirs. In this case, the simple thing to do is to exchange their asset for that asset. Zethyr finance ensures that users don't need to go out from the platform to do this. The platforms provides a native exchange that's quite sophisticated.

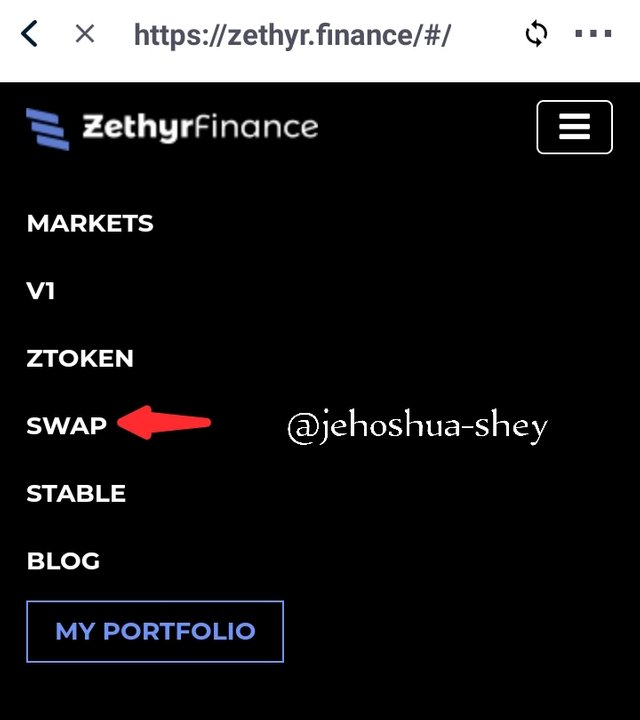

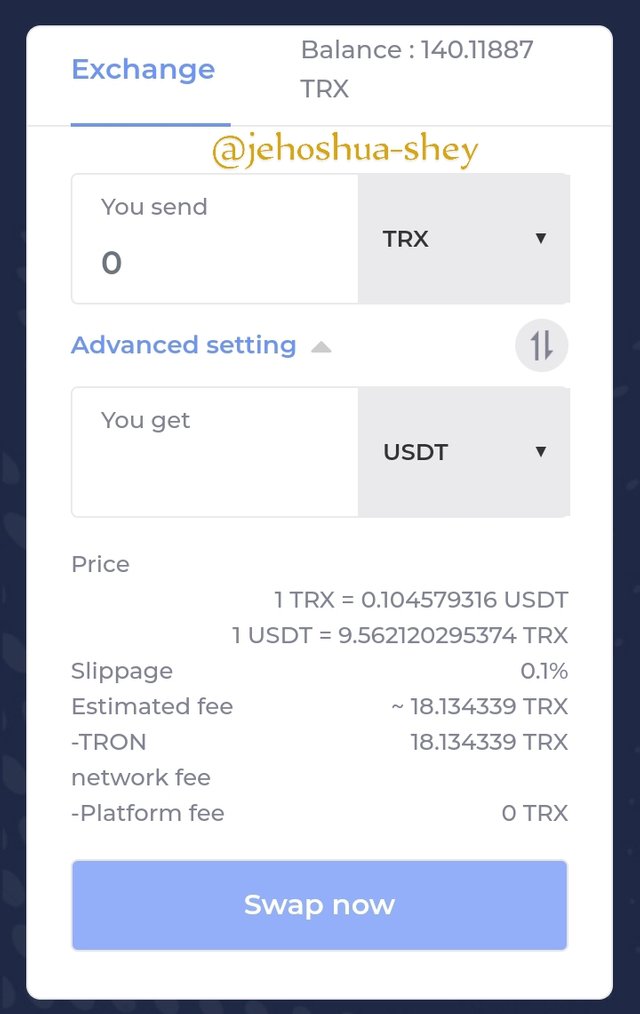

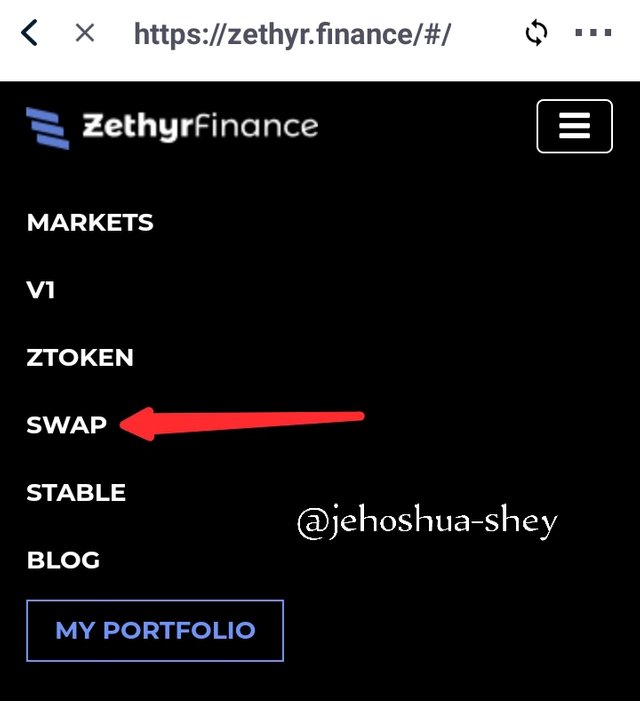

To access this exchange, the user can click on the left menu and then select the swap option.

The downside to the Zethyr Exchange is the fees charged. As can be seen below, there's a flat fee of about 18 TRX shown even when no values have been entered. For a transaction involving small values, this is not feasible as other exchanges offer cheaper exchange transactions.

It would actually cost 1 TRX to send to Binance and not up to 1 TRX for an exchange of 100 TRX, then 1 TRX to send back from Binance to TronLink wallet, totalling 3 TRX in fees, whereas Zethyr exchange demands 18 TRX.

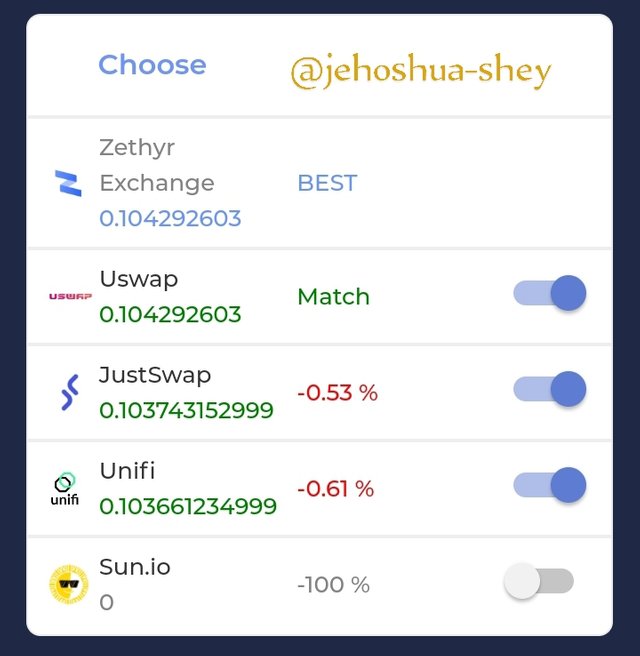

On the bright side, this exchange is a DEX aggregator and is rather simple to use. Being a DEX aggregator, it compiled the prices from various platforms and also compares them, to present the user with the cheapest alternative.

It offers the user with a very simple interface to use which involves just swapping and none of the unnecessary features that usually crowd exchanges.

4. ZETHYR STABLE SWAP

Lots of users make use of stable coins. They prefer to hold this and use it to buy other coins. This stable coins derive their importance from their nature. They have approximately stable values that don't fluctuate like others. So if a user wants to hold a coin, looking to buy another coin in the future, they would prefer to hold a stable coin so as to ensure that the value of their coin doesn't depreciate so much when they're set to buy their dream coin.

Most stablecoins are found on other blockchain outside TRON and as a result, are built with standards other than TRC-20. If a user with a TRC-20 standard stablecoin were to need to use their coin on another chain, they would need to do several swappings and transferrings especially if it's to be used on another non-custodial wallet.

With Zethyr stable swap, users can easily cross-chain swap their TRC-20 USDT for ERC-20 USDT. The good thing is that they'll receive the swapped USDT directly to the wallet address they need it.

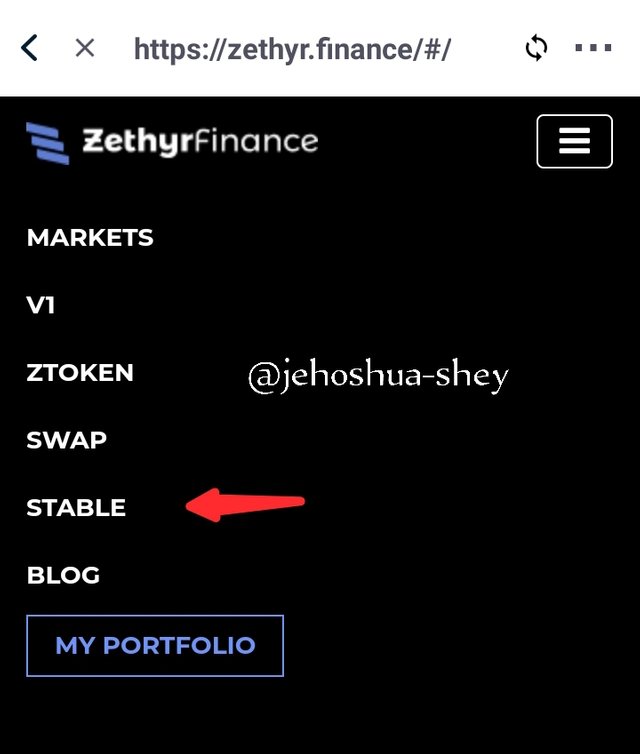

This stable swap feature is accessible through the top menu bar at the right and selecting the stable option.

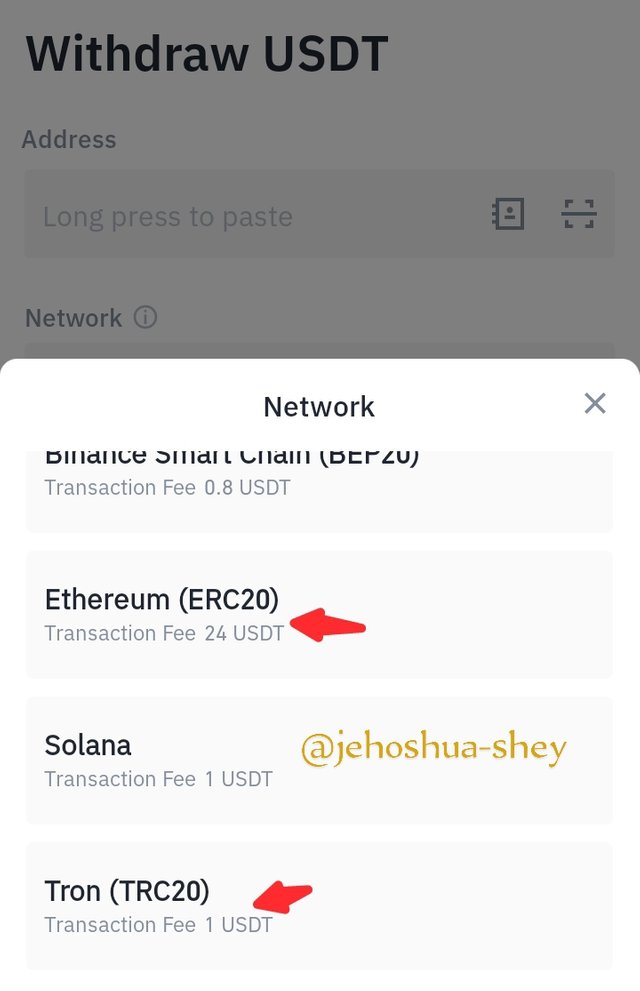

Here, it is cheaper than other alternatives. Infact, it's a cheaper way to transfer USDT via ERC-20. An exchange like Binance charges 24 USDT to transfer USDT via ERC-20 but 1 USDT to transfer USDT via TRC-20.

So a Binance user who has 30 USDT and needs it on an Ethereum-based protocol should be thinking of Zethyr stable swap. This is because sending it directly will cost 24 USDT but it will cost 1 USDT to send to TronLink wallet, and 10 USDT to swap to their Ethereum wallet i.e 11 USDT in total.

So since Zethyr will cost 11 USDT while direct transfer from Binance will cost 24 USDT, Zethyr is the go-to platform for cross-chain stablecoins transfer.

Q.3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

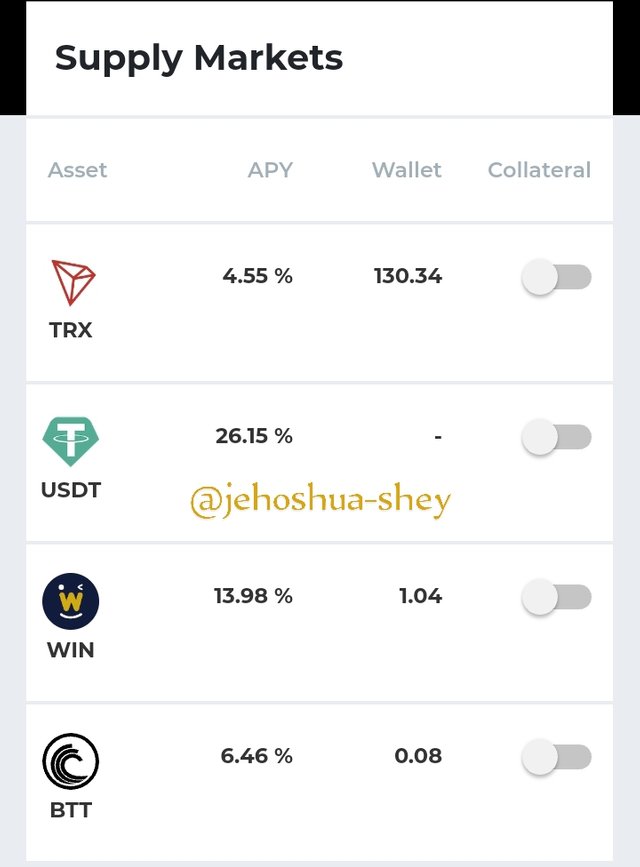

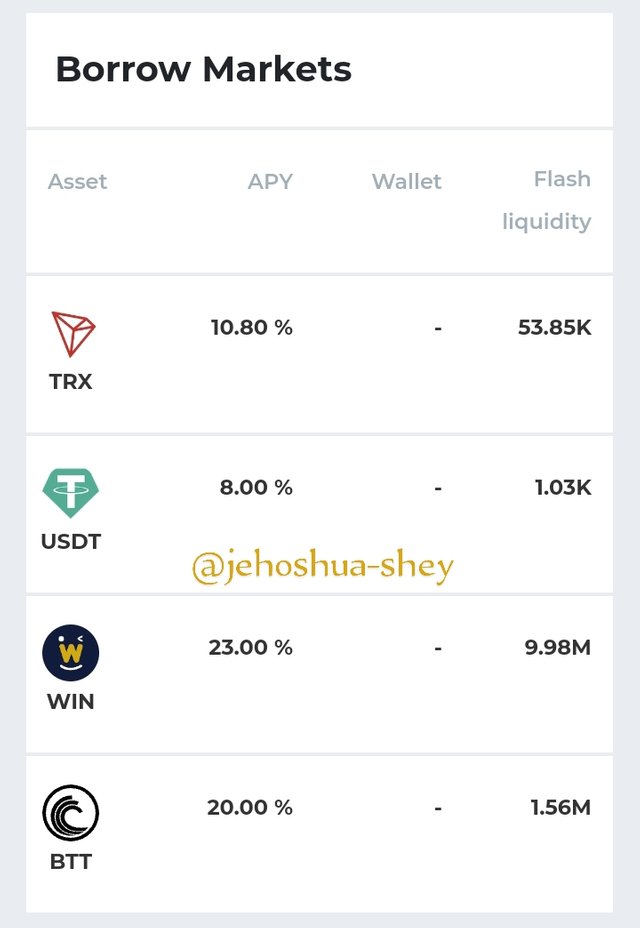

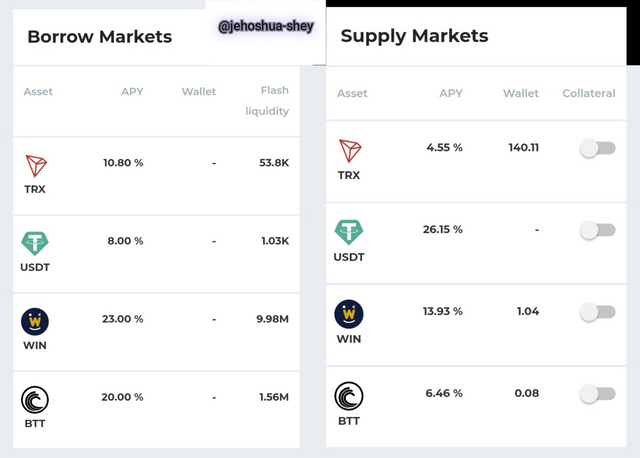

The Zethyr finance platform offers borrowing and lending to users of the platform. This is found on the borrowing/lending section of their website. On this section, there are various market to borrow from and to lend to. They are shown in the image below.

From the image above, we see 4 markets available. And they are TRX, WIN, USDT and BTT. These markets apply to both lending and borrowing. Of these 4 market, only one is stable and that is USDT. Also, there are varying supply and borrow APYs attached to these markets which means the dividends earned or interest paid are not equal for all markets.

BEST SUPPLY API

Below is a table ranking the markets by Supply APY and indicating market volatility in order to ascertain the best supply APY.

| Market | Supply APY | Volatility |

|---|---|---|

| USDT | 26.15% | Stable |

| WIN | 13.93% | Volatile |

| BTT | 6.46% | Volatile |

| TRX | 4.55% | Volatile |

This data above means that if a user supplies any of the assets in these markets, after a year, the principal supplied would have increased by a percentage equal to the APY of the asset. Here, we assume that all things will be equal.

For the records, APY stands for Annual Percentage Yield (i.e by how many percent will the principal increase after one year.)

From the table above, we see that USDT which is the only stable coin among the markets, has the highest yield at year end. If a user supplied 100 USDT, the user will be getting an additional 26.15 USDT at the end of the supply year. This percentage yield surpasses all others listed above.

Therefore, the best supply APY on Zethyr goes to the USDT market.

BEST BORROW APY

Below is a table ranking the markets by Borrow APY and indicating market volatility in order to ascertain the best borrow APY.

| Market | Borrow APY | Volatility |

|---|---|---|

| USDT | 8.00% | Stable |

| TRX | 10.80% | Volatile |

| BTT | 20.00% | Volatile |

| WIN | 23.00% | Volatile |

This data above means that if a user borrows any of the assets in these markets, after a year, the amount payable would have increased by a percentage equal to the APY of the asset. Here also, we assume that all things will be equal.

Note that the APY here was not ranked from highest to lowest but rather from lowest to highest. This is because for borrowing, the lesser the APY, the better there deal as the lesser the interest to be paid.

From the table above, we see that USDT which is the only stable coin among the markets, again tops the chart as it accrues the lowest interest at year end. If a user borrowed 100 USDT, the user will be required to remit an additional 8 USDT at the end of the supply year. This borrow APY is the least of all the borrow markets listed above.

Therefore, the best borrow APY on Zethyr goes to the USDT market.

Q.4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

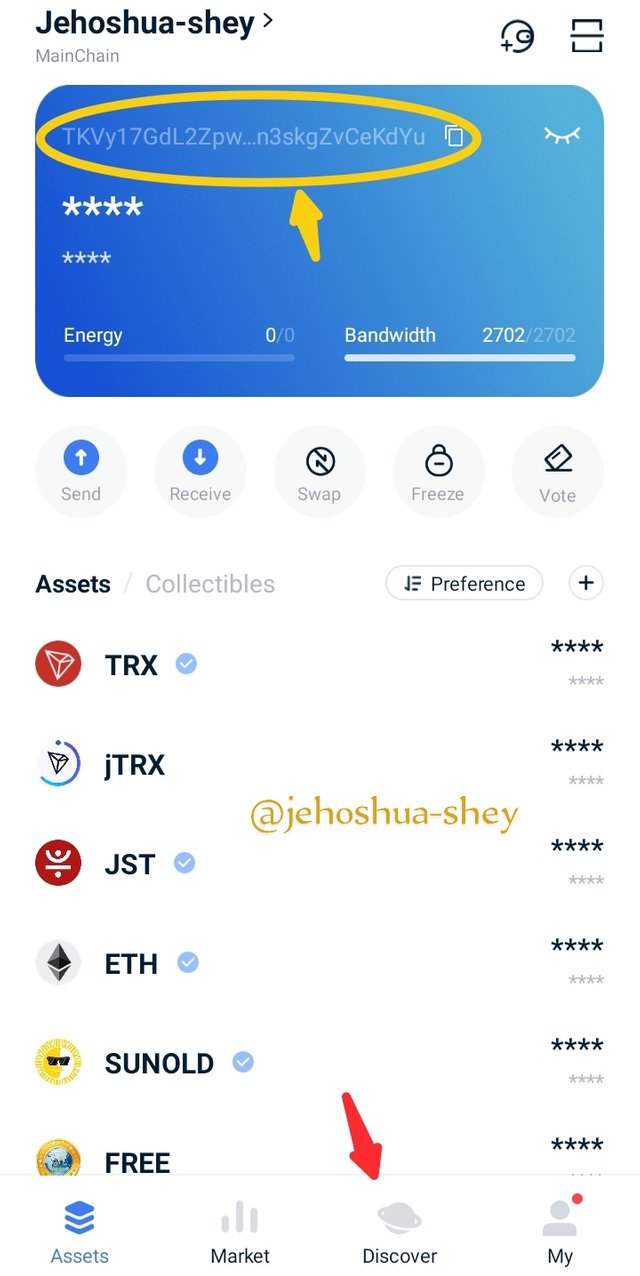

In other to follow the easiest path to linking my wallet to any dApp platform, I usually access the platform through my wallet. This way, it almost always links automatically.

This holds true for Zethyr finance. By accessing it through my TronLink wallet, it got automatically connected. Here's how that was done.

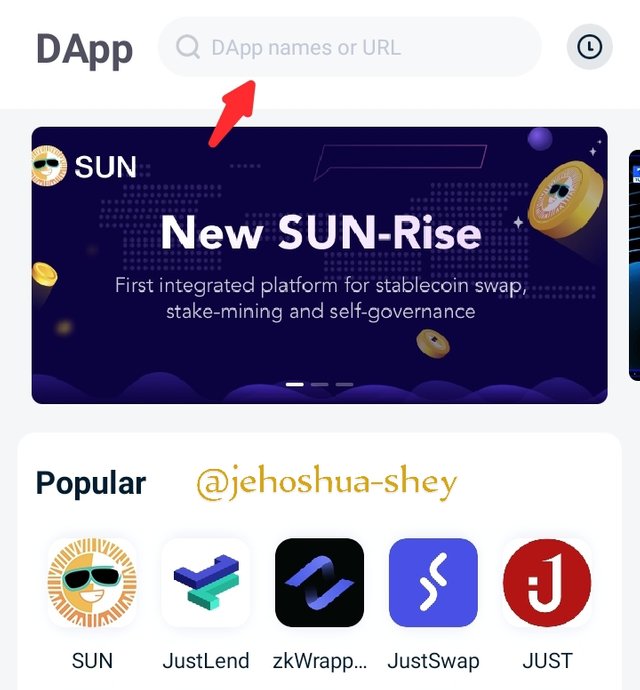

- First I open my wallet and clicked on 'Discover' in the lower tab. Take note of my wallet address circled yellow

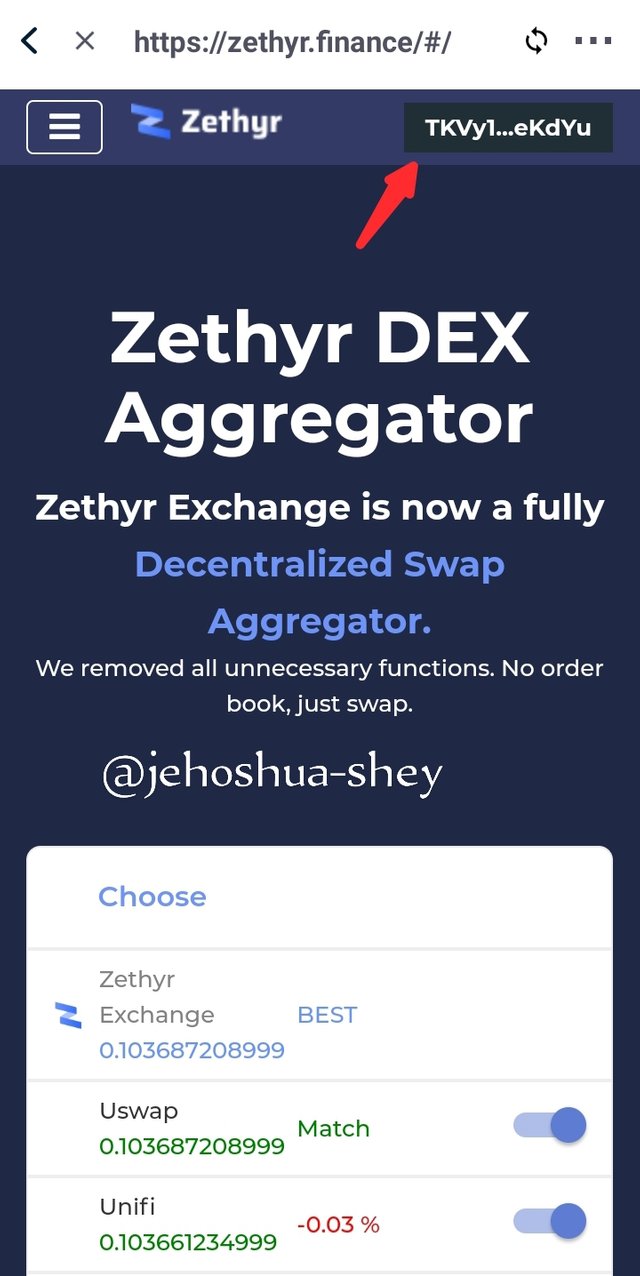

- Next, I click on the search bar and input the url - https://zethyr.finance/#/ and search it.

- When it opens, my wallet is automatically connected.

- To prove this, I click the menu bar on the top right.

- Then click on 'swap'

- The swap page opens up, with my wallet address displayed on the top right corner, showing that my wallet is connected.

Q.5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

Ztokens are crypto vouchers issued to users who supply assets for lending. In traditional financial systems, when we have institutions that accept deposits and in return issue vouchers that represents the value of deposit committed. These vouchers are simply representative of the deposit committed. They can be spent wherever they are recognised and they can be redeemed for the deposit committed at the issuer.

In crypto, these vouchers are also employed. Some decentralized protocols issue this voucher to users who have committed assets to the their lending protocol. These ztokens have values pegged 1:1 to the value of the asset committed and are not generic but identified according to the asset committed to the lending protocol.

If a user deposits USDT, then they'll receive the zUSDT token in the exact amount that they deposited USDT. Consider the table below to understand how these tokens are issued.

| Asset Deposited | Amount | zToken Issued |

|---|---|---|

| USDT | 24.80 | 24.80 zUSDT |

| WIN | 126.34 | 126.34 zWIN |

| TRX | 842.00 | 842.00 zTRX |

| BTT | 1779.88 | 1779.88 zBTT |

USES OF zTOKENS

Substitute For Deposited Tokens: zTokens are minted when assets are deposited into the Zethyr finance platform. These ztokens are substitute for the deposited assets and can be used wherever the assets can. They can be traded, transferred, etc.

Use as Collateral: These ztokens can also be used as collateral. Just like the normal assets can be used as collateral. The platform accepts these ztokens as substitutes for the main tokens.

jTOKENS

One token project that serves the same purpose as the zTokens is the jToken. jTokens are native to the JustLend protocol still on the TRON blockchain. They are crypto receipts minted whenever assets are deposited into the JustLend Protocol. They also serve the same purpose of substituting the assets deposited, just like the zTokens.

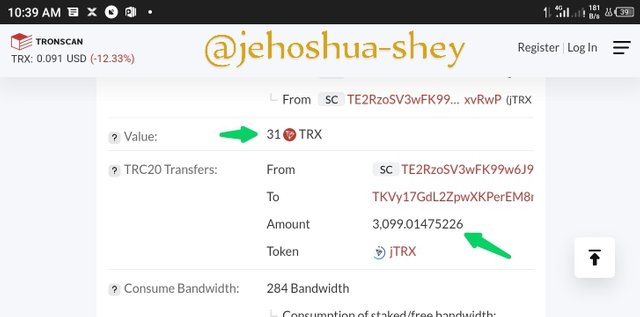

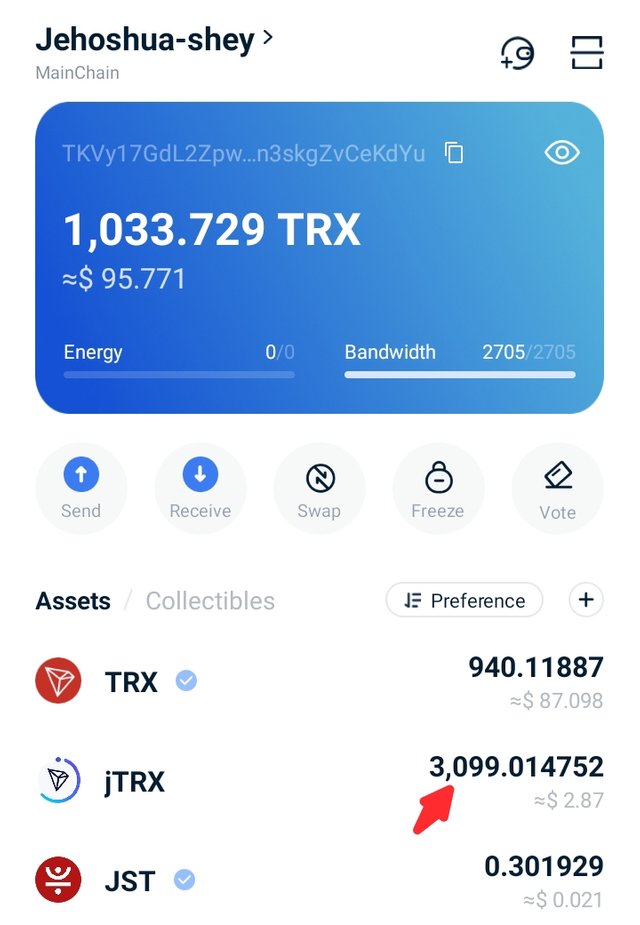

The last time I used the JustLend platform, I got some jTokens after making some deposit. From the image below, I deposited about 31 TRX and was issued about 3,099 jTokens.

Just like zTokens, the jTokens are issued according to the assets deposited. jTRX is issued for depositing TRX, jBTT is issued for depositing BTT, and so on. There are also similarities in the utilities of both zTokens and jTokens. These similarities however end at the values of the jTokens. They are not pegged 1:1 with the value of the deposited assets.

Similarities Between zTokens and jTokens

Both zTokens and jTokens are

Both native to protocols built on the TRON blockchain.

Issued as a receipt for deposit made.

Not generic in nature but issued according to the asset deposited e.g for a deposit of USDT - either zUSDT or jUSDT will be issued.

Can be redeemed for the deposited asset.

Can be used as substitutes for the deposited asset.

Differences Between zTokens and jTokens

The difference between jTokens and zTokens is given below

| zTokens | jTokens |

|---|---|

| Native to Zethyr finance platform | Native to JustLend platform |

| Pegged in value 1:1 to value of deposited assets | Not pegged in value 1:1 to value of deposited asset |

Q.6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

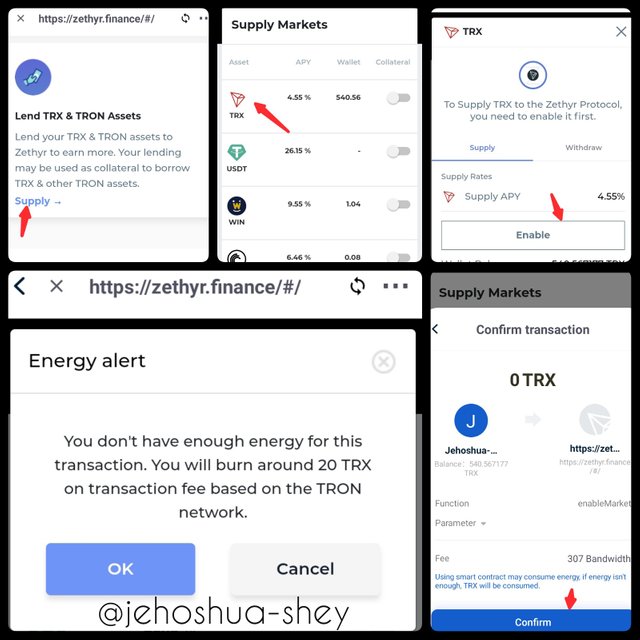

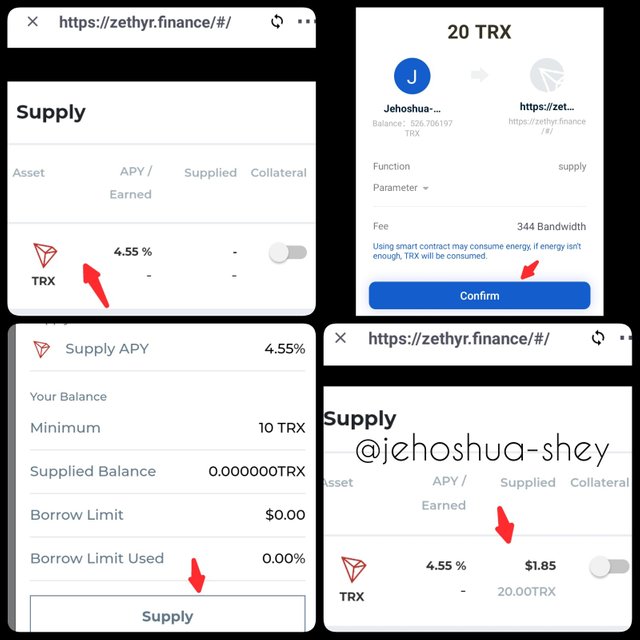

I performed a real supply transaction where I supplied TRX to the Zethyr protocol.

First click on the 'supply' link on the homepage of the platform's website and then I enabled the TRX by selecting TRX from the supply market and clicking on enable

Next, I supply TRX by selecting it again and supplying the relevant details

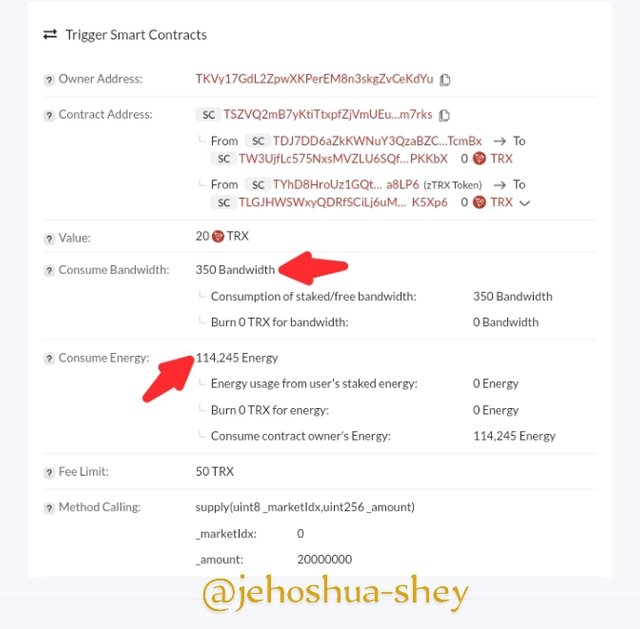

The hash of the transaction is given below

24638450fdcda0c2997d42826bd0b79e75ade059c836c5383e85d17bcc00fee5

The transaction used up 350 bandwidth, and no TRX.

Q.7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

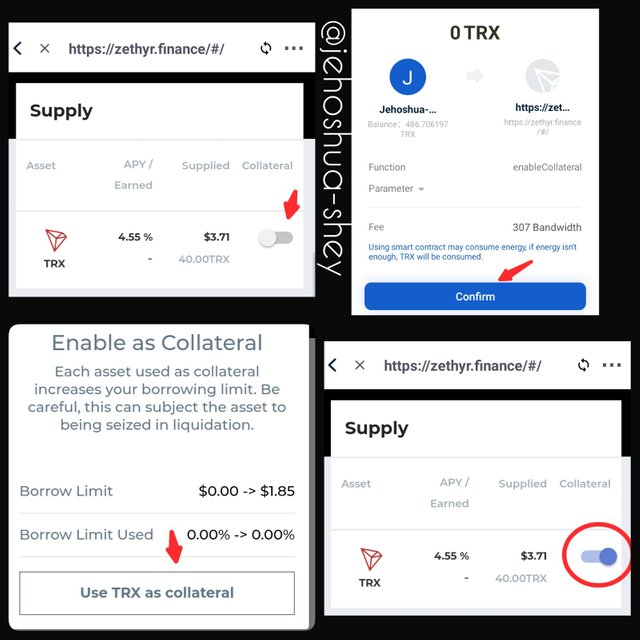

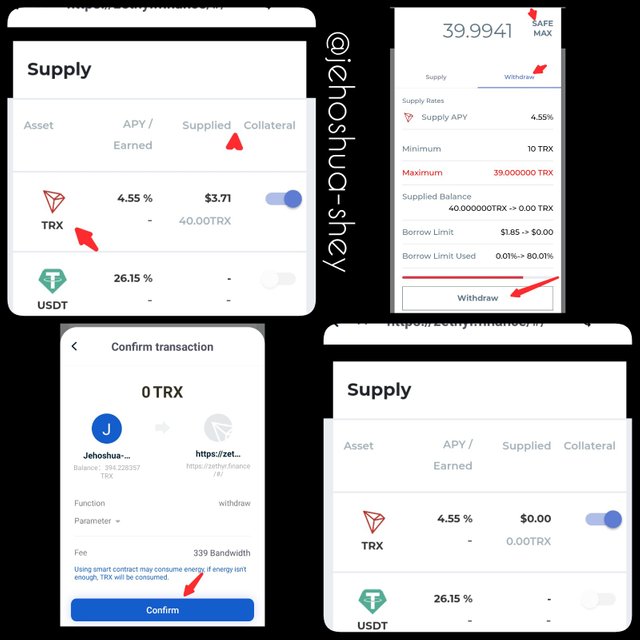

To collaterise my asset, I click on the toggle beside the asset, then I accept to use it as collateral. When this is done, the toggle turns blue

BORROWING

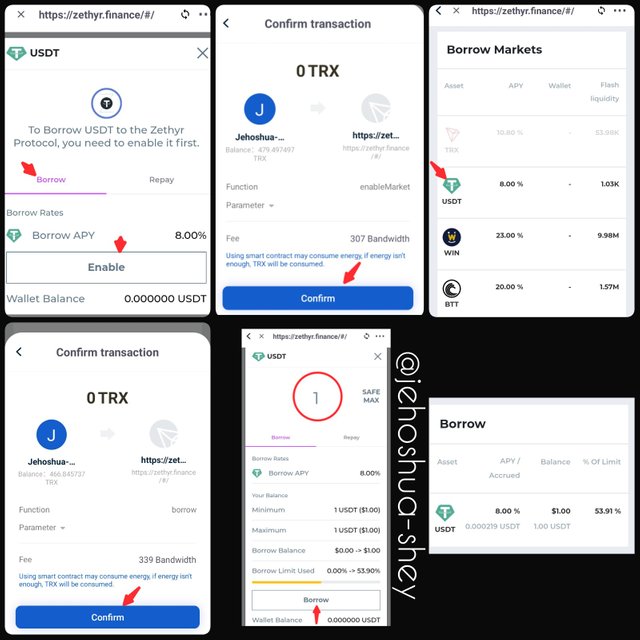

For this illustration, I borrowed USDT. To borrow, I selected USDT from the borrow market and enabled it.

Then, I selected USDT again from the borrow market and borrowed it.

The hash of the above transaction is given as follows

ed6e94732ff008937c5ecc768c41413f346374a7adccefaa81e01400f7dabfb1

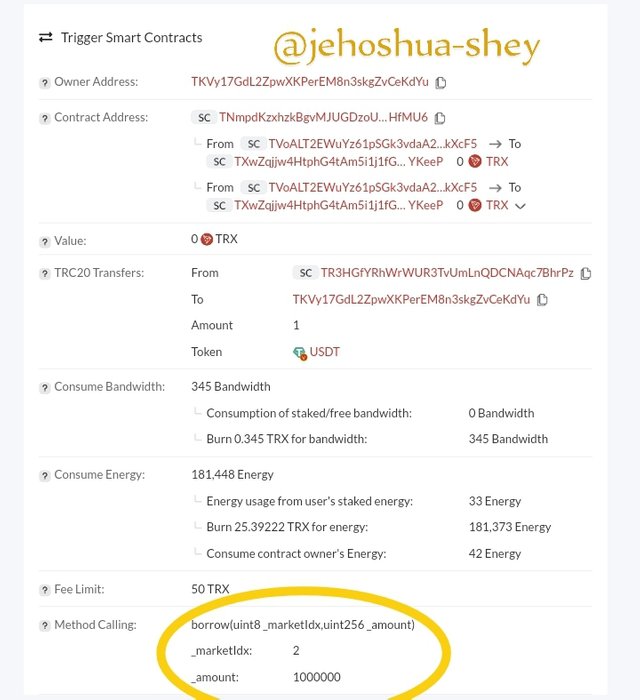

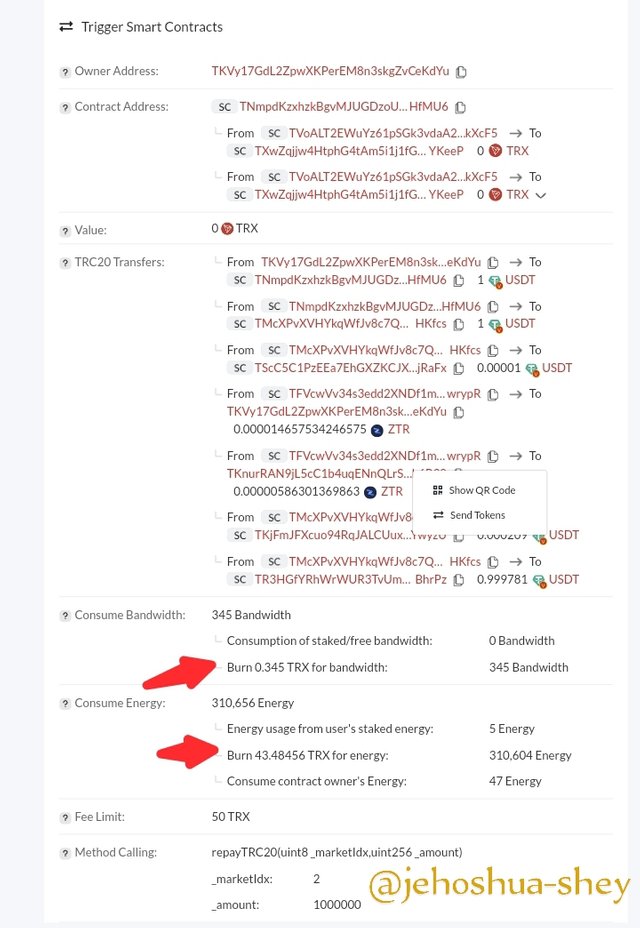

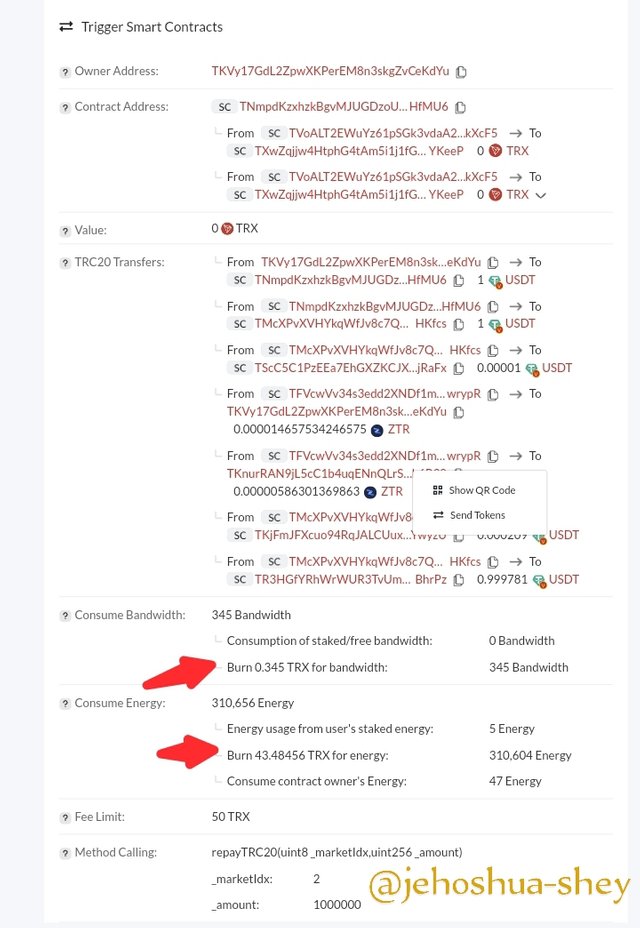

The fees charged can also be seen from the tronscan page corresponding to the above hash

REPAYING

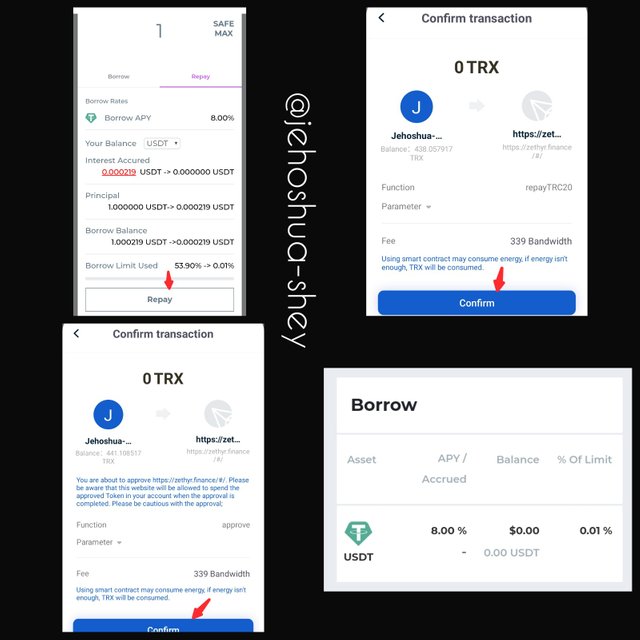

To repay, I simply click on the asset borrowed and select repay rather than borrow, in the top navigation bar. Next I fill out the amount I wanted to repay and click on repay to repay its.

The transaction hash for this transaction is given below

a029ea53767aabb16f0172ddc578eecdc83210f8142d2212271c57f5b7865fce

WITHDRAWING SUPPLY

Just like repaying, I click on the asset supplied and selecting withdraw rather than supply, then filling in the withdrawal details and clicking on withdrawal.

The hash for this transaction is given as

5a2a3ef12099e1484cd4c08c5e8a01481b72f246333304a0c9cb253cf0653974

The fee is shown below

Q.8. What do you think of Zethyr Finance? Is it great or not? State your reasons.

Zethyr finance platform looks like an innovative attempt to offer decentralized lending but the truth is, it's not as good as it seems.

My verdict on the Zethyr finance platform is that it is not a great platform and this is because of fees. The fees of this platform is just simply exorbitant. One will require to burn a lot of TRX to carry out every action on the platform including some insignificant ones.

On the platform, every thing has an energy requirement attached to it. Each action done on the platform require TRX to be burned to produce energy. This means that before successfully completing an activity on the platform one would have expended a lot of TRX which questions the feasibility of the platform.

Thanks for reading

Cc:

@fredquantum

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit