power point

What is the Support zone?

We are talking about where the price always reaches a level where it usually bounces since it is in an oversold and investors seeing these low levels are tempted to buy to sell higher at resistance in this way take profits at those higher levels.

The support zones can be given in any direction of a trend both in range and in uptrend or downtrend, i.e. the direction of the trend will be determined by the supports and resistances.

Be careful, these support levels can be broken at any time to give way to a change of trend or simply to deceive the weak investor and thus liquidate him.

Source

What is a Resistance Zone?

The resistance zone is when the price level reaches a point where investors see that they can collect profits and buying interest decreases by this case creates more supply than demand, as investors are waiting for lower levels to buy the asset.Resistance zones are formed in any temporality and trends in both bullish and bearish and range we will find the important volume resistances.

Resistance levels as well as support levels can be broken either to announce a change of trend or to create a false positive in order to take out of play to users with little experience or lower trading levels. We must pay close attention to prevent this and read carefully this task where I will be explaining each of the most important aspects to avoid falling into this type of deception.

Source

Explain the different types of support and resistance with a proper demonstration.

supports and resistances can go in any direction we are going to explain the most common ones according to the charts and illustrations we are going to be showing now.

Support and resistance in uptrend:

As we see in the chart below the support and resistance in an uptrend let's go with the support firstly we can see a diagonal line drawn to identify the growth of the price according to the trend, the supports reach a level not lower than the previous one this means that we are going to see the peaks of the support getting higher and higher.

As for the resistance we can see resistance peaks higher and higher with respect to the previous one in the direction of the price and direction, this is called uptrend in the 4h time frame.

Source

Support and resistance in a downtrend :

As we see below in the chart we can see a clear downtrend in 4h for the pair BNB/USDT which indicates us peaks of resistance each time lower over the previous one and peaks of support each time lower with respect to the previous one.

Always respecting a trend course we can observe a clear example of a downtrend and observe the behavior of resistance and support as they always respect a price pattern.

Source

Support and resistance in trend in Range:

.As we can see a linear pattern Where support and resistance respect a defined area then reaches levels where sales occur to this is called resistance and then falls to levels sonde purchases occur to this is called support to then form a break and change the trend at the end of the price range.

Source

Identifies false and successful breaks. (demonstrate with screenshots)

Identifying false breakouts is very easy to verify for inexperienced users they really don't know what this means and what consequences it brings for our finances, on the BTC/USDT chart in 5min I can clearly see how 2 breakouts are formed we talk about resistance breakout to then look to test resistance zone and fall back in range.

However we have that within minutes of forming this false entry we can see a false break in support and then come to test again the previous support zone to fall back into the range to this is called false trend breaks and are defined as operations to liquidate orders in these areas.

Source

True break of support:

We can see a true break in support as this we see it break the previous support line to change the trend from range to downtrend we can take it as a trading point to go short in futures or margin.

Source

Resistance Breakout:

We see how the resistance is definitely broken, this is called resistance breakout for change of trend from range to bullish.

Source

Use the volume indicator and RSI combined with breakouts and identify the entry point. (demonstrate with screenshots)

Using the Rsi indicator we can identify that it is overbought and it is time according to some analysis to sell but there is one factor that influences and is very important is the break of resistance above the strongest which leads me to deduce that a trend change is coming with upward strength with high buying volume.

This always happens when there is a change of trend and this is where you have to place the order to buy or long and we do it in the second green candle to ensure the entry by placing a margin of stop loss and stake profit we define well the prices of purchase and sale to make profits.

Source

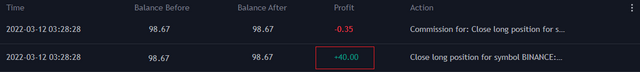

Perform a real trade (crypto pair) on your account after a successful breakup. (screenshot of the transaction is required)

A trade was made on a resistance breakout which corrected back to the resistance level to change to an uptrend at that point I traded with no problems as to the movement it gave at first it was confusing but I relied on the RSI indicator to determine the overbought and oversold levels so I saw that the price stayed in a range above the previous range ie a higher level which gave me profit on that trade. I placed a stop loss below the new support to avoid a liquidation of my assets if a false signal was produced, and I placed the stake profit above the previous strongest resistance before the breakout, that way I would get profits quickly.

Source

Source

Explain the limitations of support and resistance (false breakouts)

To operate in support and resistance really the limitations that we find are false breakouts as they appear at any time ie we can not predict the time that come out false breakouts we have thousands of indicators that can help us to solve or filter these interference signals but not always the indicators are 100% safe.

Therefore to trade we must follow recommended strategies to not lose our profits or that are more profits than losses. in this way it is profitable to make future operations.

Sometimes we can observe a real resistance break that never confirms an entry, that is to say it never goes back to the resistance to make the rebound and give us the correct entry, there are cases that do not even fall but rise with great force and volume.

Source

Conclusion:

We understand that the breaks of resistance and support can not always be determined 100% at the beginning of a break which is true and which is false however we have different tools that if we see any anomaly we can identify 80% that it could be a false signal, also true breaks are increasingly rare when confirming an entry with a rebound as these usually appear with a lot of volume strength and very strong price increase.

We must implement strategies that fit our style of trading the market with all this information and that you and I can know implementing a means by which to obtain more profits of losses could be profitable to operate in the digital market right now.

Cc: @shemul21