Good day, great steemians, I'm glad to be a partaker in this weeks assignment, with a lot of knowledge gained from the “bid-ask spread” lectured by professor @awesononso, I would say it's a wonderful topic and I will be explaining my homework task.

DEFINE THE ORDER BOOK AND EXPLAIN ITS COMPONENTS

The order book is an analysed computerized data where trades (buying & selling) of a particular market asset placed in the market is shown.

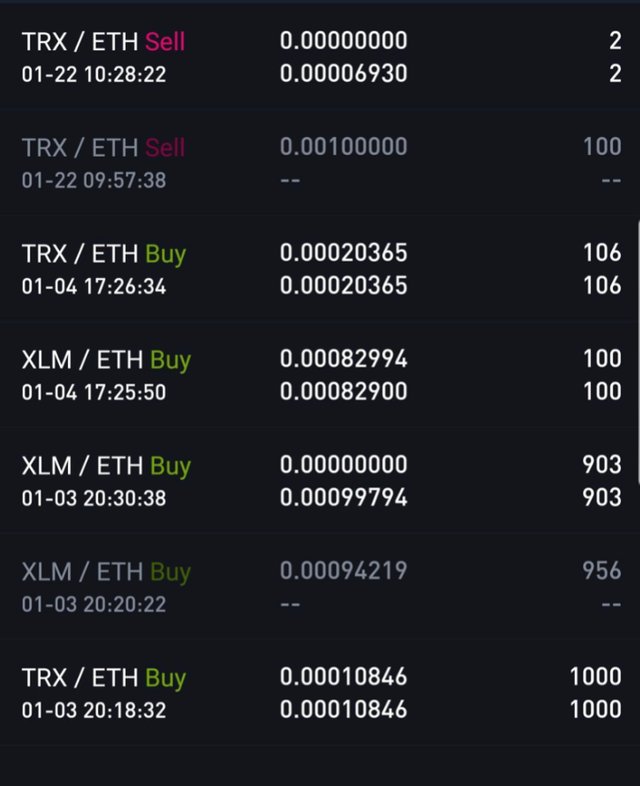

The order book shows the transaction history (buying and selling ) of a particular asset which is the “bid”representing buyers and the “ask” representing sellers.

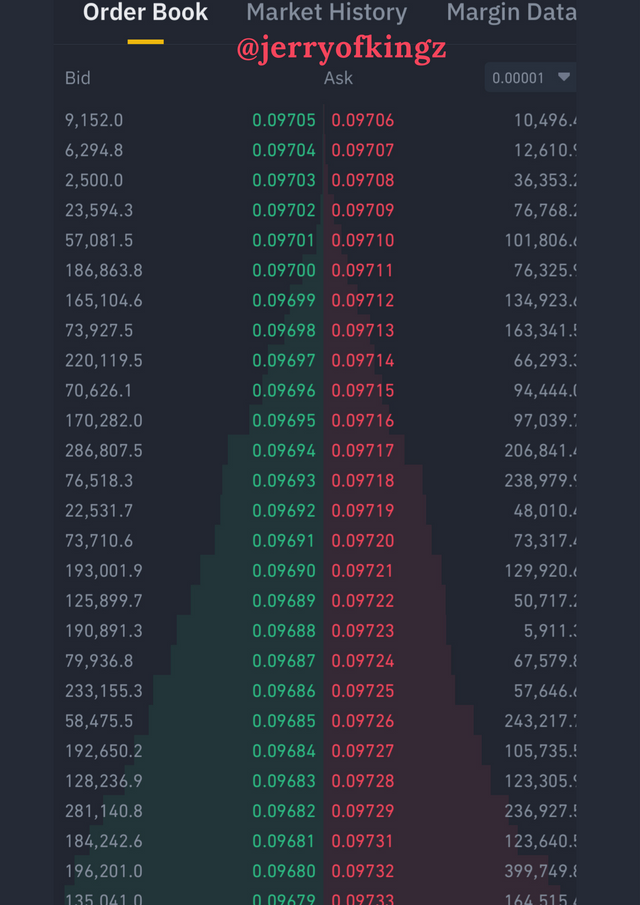

order book of TRX/USDT chart in Binance

Just as a “receipt” is used in an office as an evidence showing the name, date, time and signature of transactions made, so is the order book.

But the order book is made an electronic system due to form and place of activity(online), thus a receipt can no longer be in use here but rather an electronic database, which serves as a ledger to record the time, date, price of an asset bought/sold & several assets bought/sold, etc.

Transparency: The order book shows the transparency of each asset trade made by investors. Here it gives us the impression to trust the system and depend on it to keep making trades.

information of prices: The order books tell us the current price of particular asset, keeping traders updated in the prizes of assets owned or to be owned.

Trade debt: The order book shows us the point at which a particular trade has reached whether in a bullish or bearish direction. This gives traders an upper hand in knowing the time to either buy a trend or sell a trend.

The order book is made up of some features which show current trade activities, and they are as follows;

- Bid

- Ask

- order history

The “bid order” depicts the amount and rate of an asset bought. The Bid order shows the highest buying rate of an asset above at the first column of the table.

The bid order is shown with a green colour, showing the time, rate, price and number of a particular asset bought.

Bid order of the BTC/USDT chart in Binance

NB: As of the time of the screenshot, the highest amount of BTC bought over USDT was 0.29282 for $43,045.62

The “ask order” is the opposite of the “bid order”. It shows the history of sold trades, the time of the transaction, price of an asset sold, and amount of an asset sold.

Ask order of the BTC/USDT chart in Binance

The ask order shows the lowest sold rate of an asset at the bottom of the table. The ask order is shown with as red color showing the time, amount, and price of trade of a particular asset sold.

NB: As of the time of the screenshot, the lowest price of BTC sold for USDT was 0.00800 BTC for $42,273.48

The order history Is mainly for market makers, those who choose/negotiate prices in the market.

The order history shows unexecuted trades yet to be executed dependent on the sell/buy point of the trade. What do I mean by this, let's take a quick study of the image below.

order history of BTC/USDT chart on Binance

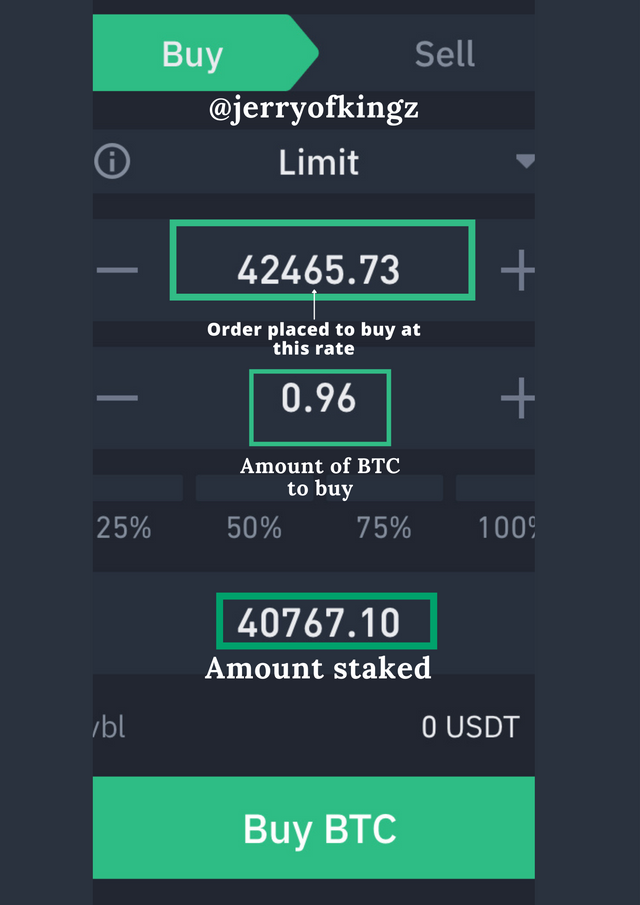

PS: The price of bitcoin is $43,465.73

I changed/negotiated to purchase a total of 0.96 BTC for $42,465.73 when the current market price is at $43,465.73, This kind of trade is stored/shown in the order history until when the market dips and falls to the price negotiated by me until the trade is executed/carried out/placed.

And after the trade has been carried out, since I placed a buy order, the transaction/trade details would reflect and show in the bid side.

WHO ARE MARKET MAKERS AND MARKET TAKERS

Markets makers are individuals who commences a trade by setting there limits to the asset price the want to trade, it could either be to buy or to sell an asset. What does this mean, when a market maker wants to place a trade, the trader adjusts the sell or buy limits of the asset in question.

A market maker do not place a trade, either to buy or sell at the initial or current price of the asset, rather, a market trader adjusts the price, In other to gain more profits compared to a normal trader.

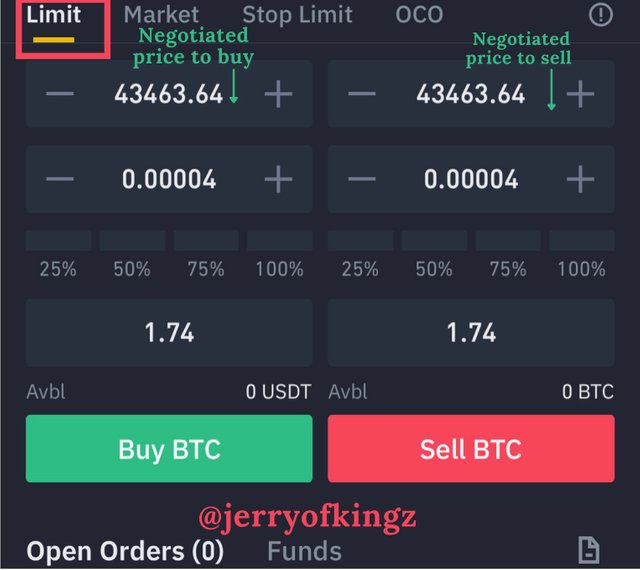

Here is an illustration below to show a clinical example of a market makers trading pattern.

A market maker trading pattern- BTC/USDT chart on binance

With the current price of BTC at $43,465.73 as of the time of this post, I placed a buy order by adjusting the price at which would be suitable for me to buy, which I staked at $42,465.73, Once this market is placed, it is stored in the “order history” where unexecuted trades are placed until the point where the trader sets the price to be before either buying or selling before the trade can be placed.

Market makers help match buyers & sellers of an asset in a market and with this there is an increase in liquidation, which serves as benefits to the market traders.

Liquidity Is the unaffected change in assets marketing price after been converted to fiat currency in cash.

Trading speed in a market gets faster because of the market makers who gives room for liquidation and without them the market progress would be very slow. Below is a full illustration of a market makers trade

Placing Buy & Sell Limit Order source

PS: The trading style used above is just an illustration to help you understand the meaning of market makers according to professor @awesononso. And this trading patter is used mainly by swing traders, giving them enough time to get back to profit if in loose and also to gain more profit if on gain, and this is only when the trade is has been executed. Market takers make use of the market order to initiate a trade either to buy or sell a particular asset. This is just like the opposite of market makers . The market takers do not negotiate/set prices with brokers but rather go for an asset at the initial price staked without the adjustment of price value at the limit order. Market takers places a trade using the market option and not the limit option because of the readiness to place and trade and make a profit quickly . The Market Order option has no room for adjustment of prices at which a trader wants to buy or sell an asset. The market option has fixed and non-negotiable price. The limit option has room for adjustment of prices to how the trader see fit, Prices here can be negotiated. Under the market order style of trading, once the trader clicks on the “buy or sell” option, the trade will be executed Immediately. And would appear in the bid-ask spread order book.

Place a Buy & Sell Limit Order source

Open a Buy Order source

Placing a buy market order: BTC/USDT chart on binance

WHAT IS A MARKET ORDER AND A LIMIT ORDER

The market order is a type of order which serves as a technique to a traders pattern /style of trade. This also could be as a result of preference.

The market order has no adjustment of price option, rather, the price of a particular asset in the market order option is fixed and non-negotiable aside from the fluctuations of market trends which the market order uses to fix prices of an asset.

market order of BTC/USDT chart in binance

What do I mean by this, The price of an asset fixed in the market order is dependant on the trend of the asset.

The limit order is a type of order used as a technique in trading, In the limit order, prices can be negotiated either to reduction, in terms of buying and increasing in terms of selling.

Limit Order trade of BTC/USDT on binance

The limit order helps traders set up a trade at a desirable price suitable to them in trading an asset. Trades placed here is stored first t the order history wiaitng to be executed. Once the trends of the market gets to the point where the trader commenced the trade, automatically it sells for selling option and shown on the “ask order” of the order book, or buys for buying option as shown on the “bid order” of the order book.

RELATIONSHIP BETWEEN MARKET MAKERS & MARKET TAKERS IN RELATION TO THEIR ORDER TYPE AND LIQUIDITY

The market comprises of both the makers and the takers, here, the relationship between this two Individual traders are symbiotic.

Market makers initiate their prices in the market Using the limit order for a particular asset, commencing a trade that wont be carried out at the moment creating liquidity for the market takers. For instance, the current price of BTC being at $43,465.73, market traders would place a buy order at the price lower than the initial price, Let's say $41,465.73.

This makes it easier for buyers and sellers when the trade placed by a market maker is met, That is to say, that market takers occupy the order initiated by the makers.

In terms of liquidity, market makers create high liquidity for the market takers, this relationship between two types of traders keeps the market fast, effective, and interesting.

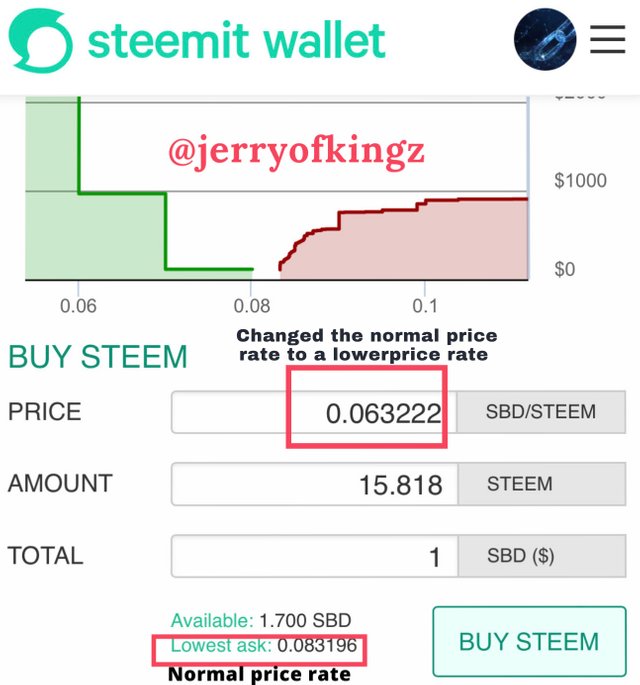

PLACE AN ORDER OF AT LEAST 1 SBD FOR STEEM ON THE STEEMIT MARKETPLACE BY ACCEPTING THE LOWEST ASK, WAS IT INSTANT? WHY?

To place an order of at least 1 SBD for Steem, I logged in to my steem it wallet account, these are the procedures;

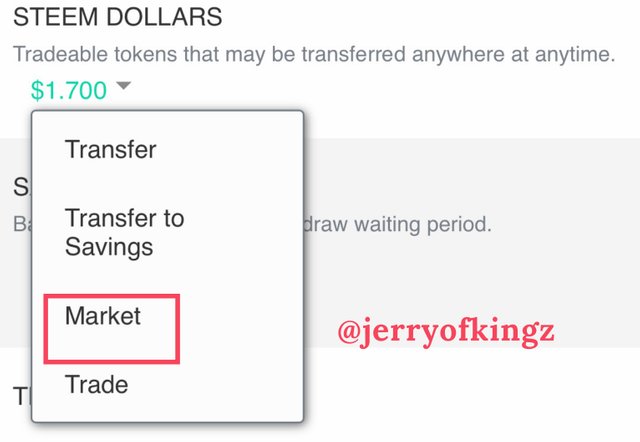

I logged into my steem it wallet and clicked on Steem dollar, it bought out the following options;

- Transfer

- Transfer to savings

- Market

- Trade

I clicked on market to commence the transaction of buying Steem

My Steem wallet account source

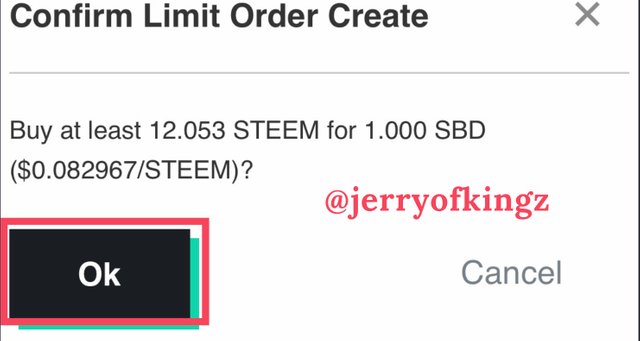

Seeing the market page to either buy Steem from SBD or sell SBD for Steem vice verse, I accepted the lowest price rate which was 0.082967.

At this rate, selling 1SBD for Steem gave me 12.053 Steem, which I clicked on buy afterward.

My steemit wallet account STEEM/SBD source

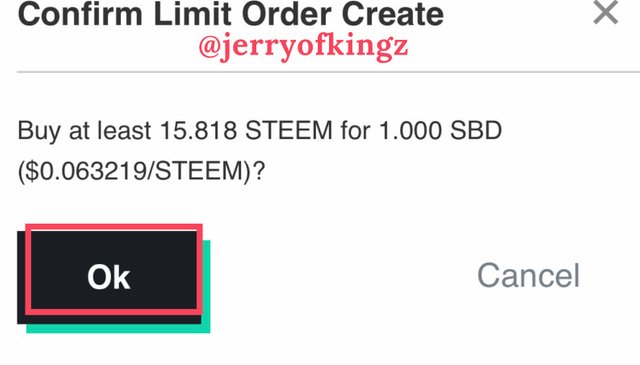

Bringing me to a page in order to confirm my limit order, I clicked on “okay”

My steemit wallet source

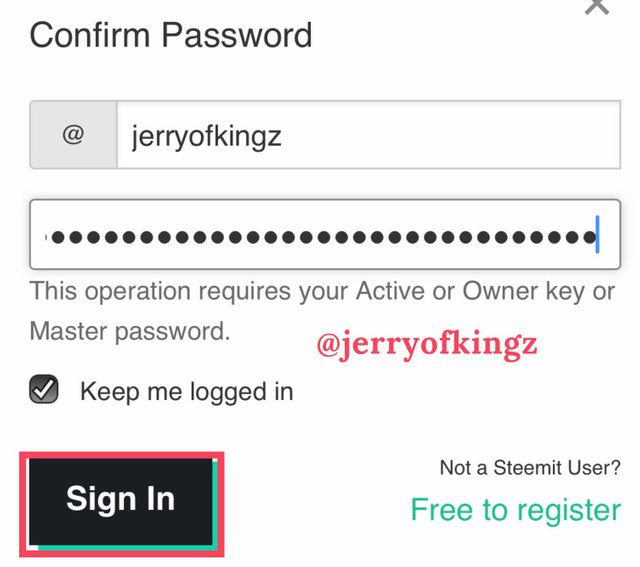

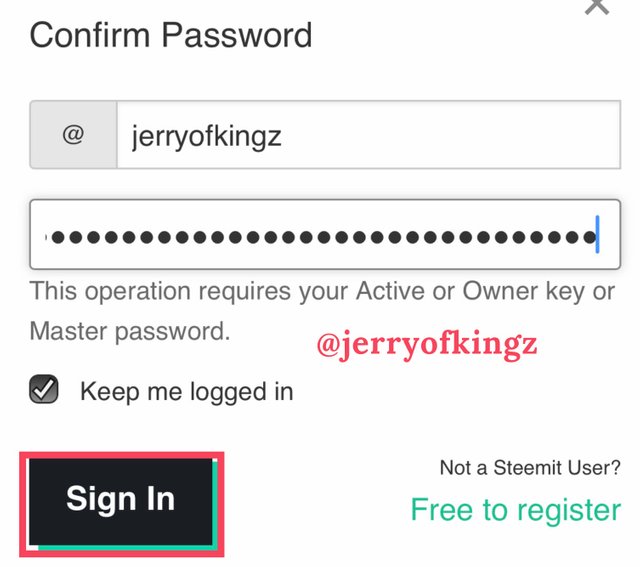

Bringing me to a page where I have to login using my active, owner or master key in order to commence trade/transaction.

My steemit wallet account source

After confirmation of my transaction, it notified me that My order has been placed.

The trade was instant because it was a market order trade carried out by me, with the fact that I accepted to buy with the fixed/initial price of the asset.

CHANGING THE LOWEST ASK RATE WHAT HAPPENED?

Following the previous procedures shown above to the point of buying Steem I would continue from there.

I changed the current/fixed price STEEM/SDB from 0.083196 to 0.06322 in order to buy 15.818 Steem for 1SBD

My Steemit wallet account source

After that, I confirmed the limit order price

My Steemit wallet account source

I posted my active owner key to commence the transaction/trade

My Steemit wallet account source

After confirming my trade, I checked my order history below the market chart.

My Steemit wallet account source

My order/trade was stored in the order history because the current rate of the asset (Steem) bought by me is lower compared to the actual current price until this price falls to my selected price before the trade could be accomplished.

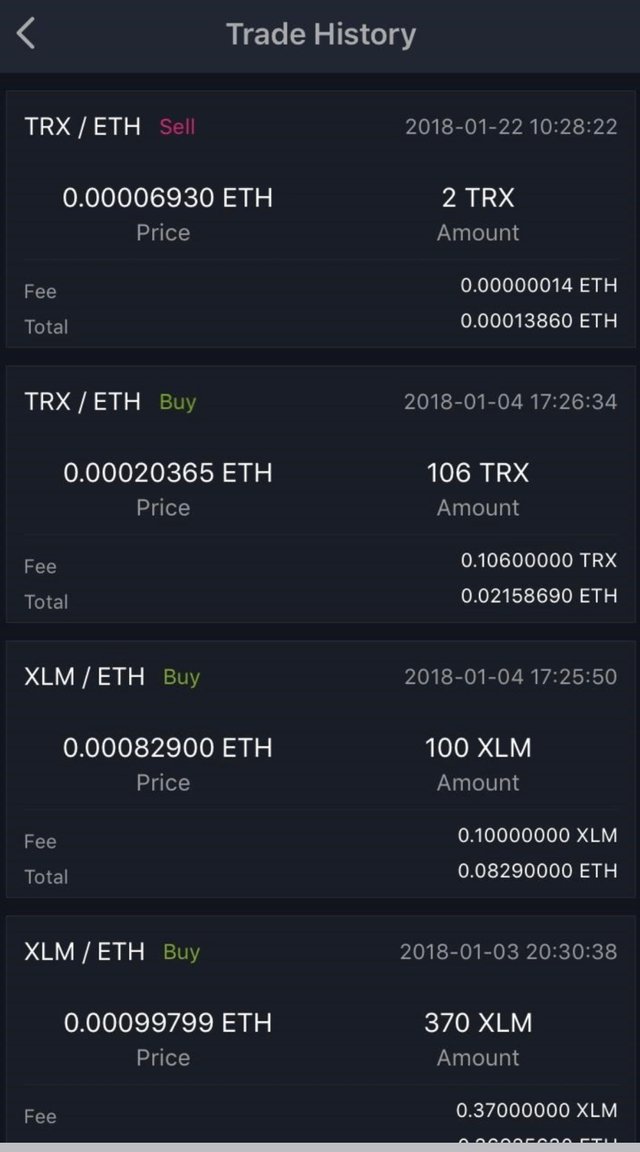

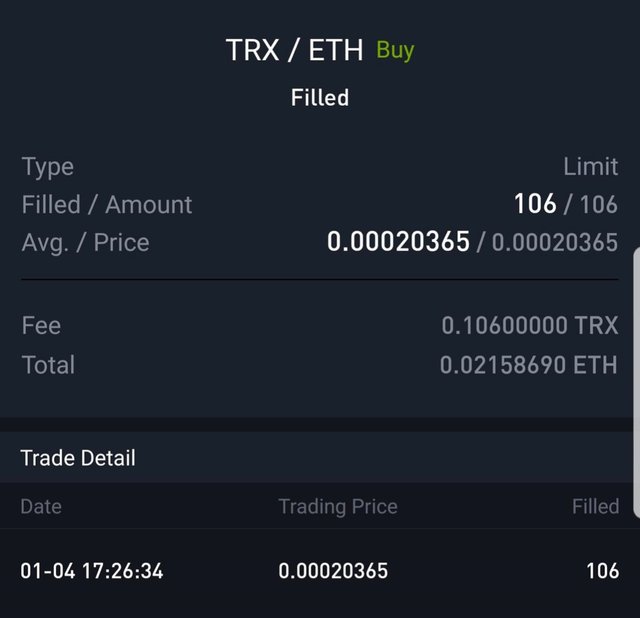

PlACE A TRX/USDT BUY LIMIT ORDER ON THE BINANCE EXCHANGE FOR AT LEAST $15

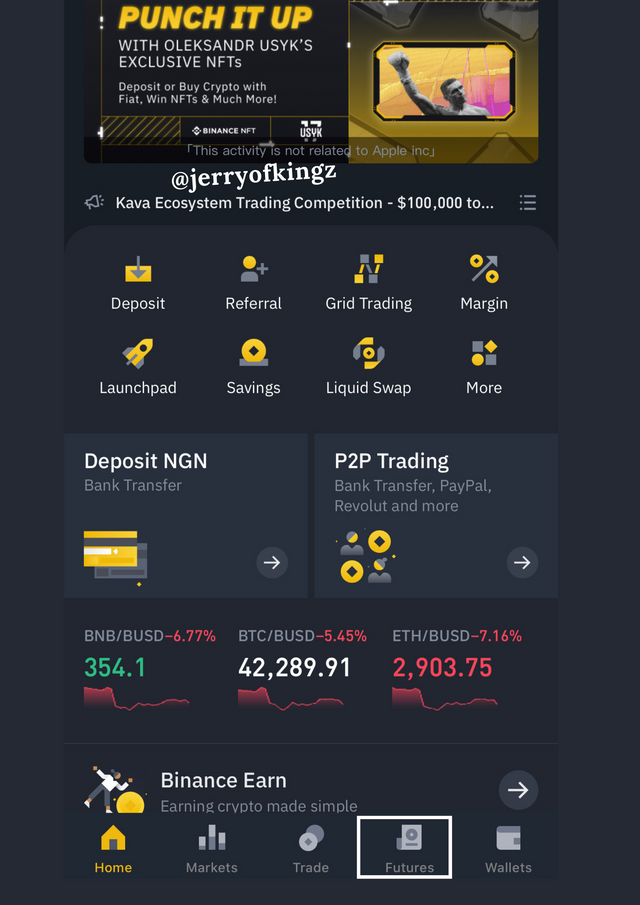

I logged into my Binance account on Binance.com, then I clicked on futures

My Binance application homepage

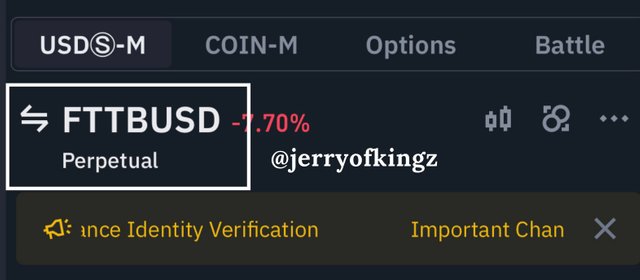

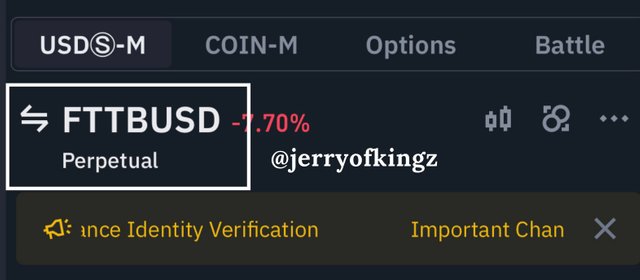

After opening to the next page, I clicked on the reversible & irreversible arrow showing FTTBUSD in other to choose my coin/currency of preference.

My binance application future page

Then I selected my coin of preference which was giving to me as a homework assignment to trade on TRX/USDT. So I searched for the coin pair and clicked on it.

My Binance application, future search page

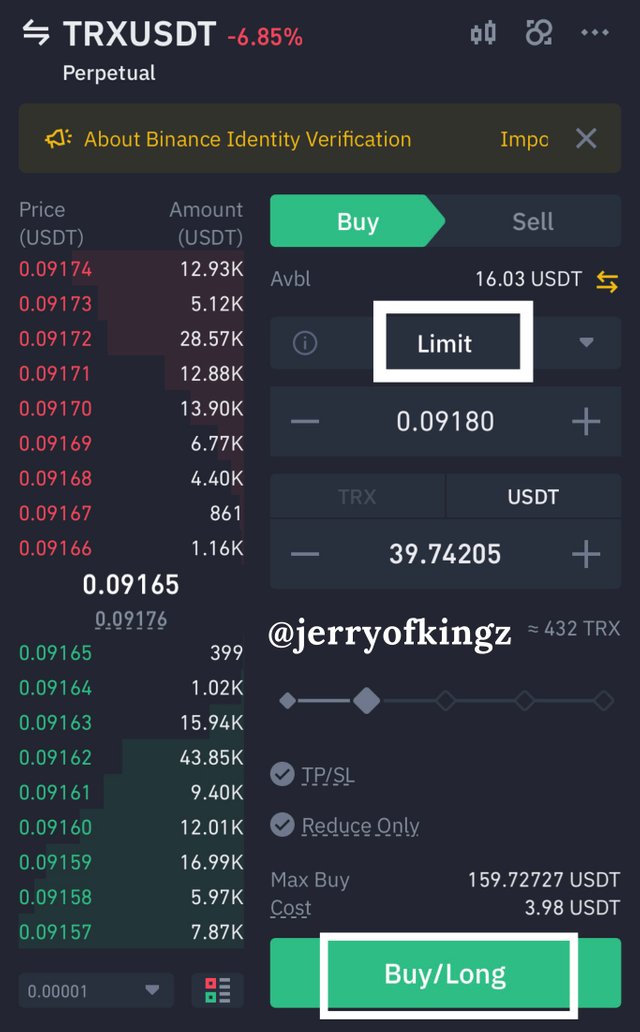

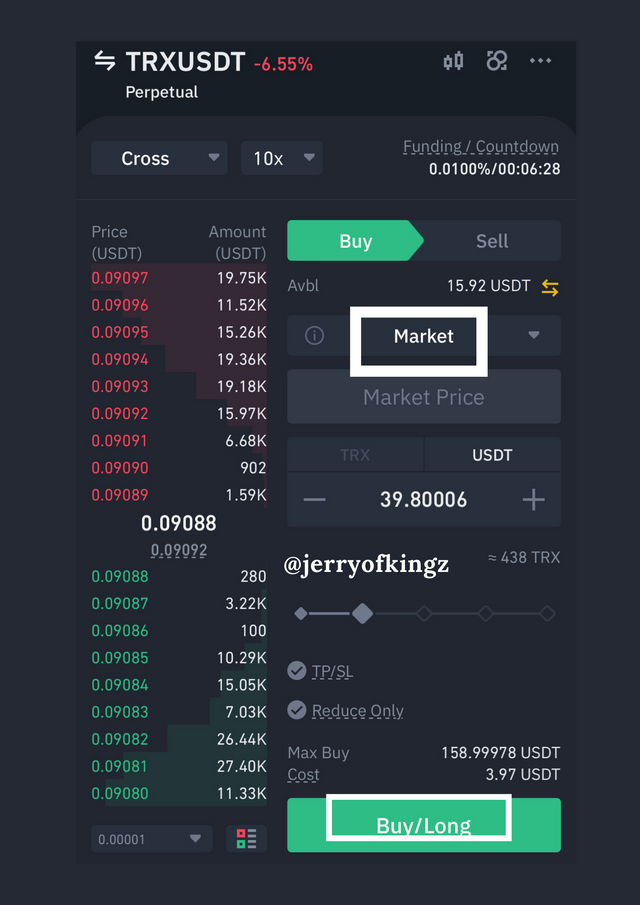

I carried out a trade using a 10X leverage margin on the future trading on TRX/USDT, buying TRX over USDT using the limited order

Buying TRX/USDT using Limit order on Binance

After I placed my trade, I check at the order book under the chart to see the details of the trade I placed, firstly I noticed that the trade was placed immediately and also an increase in TRX after placing the trade, yielding profit.

order book of TRX/USDT on binance

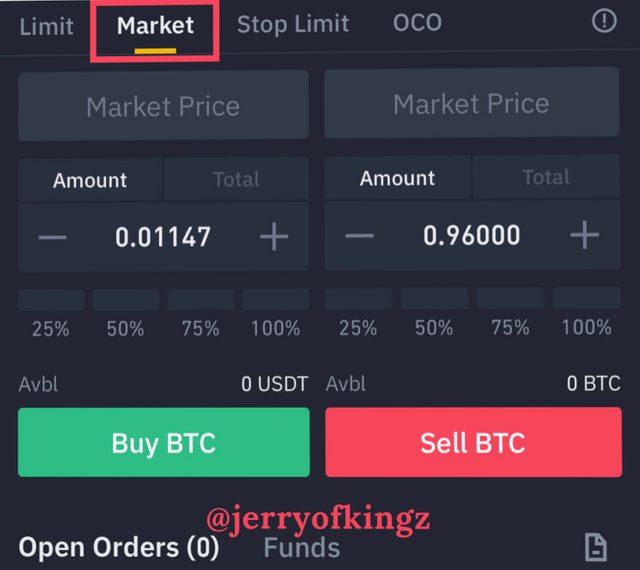

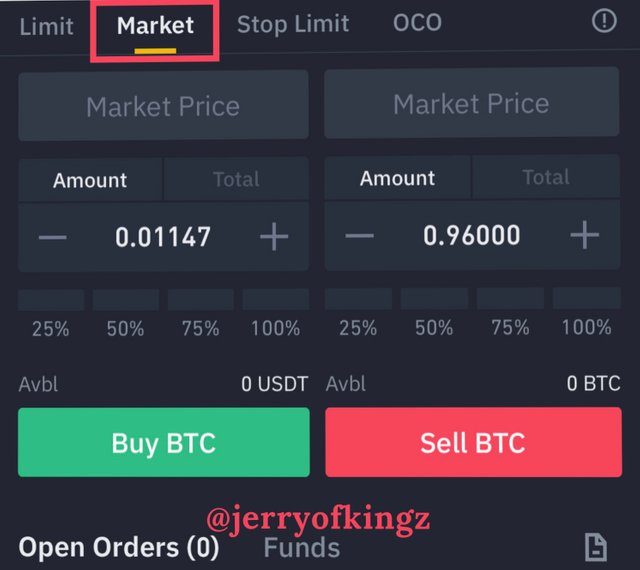

PLACE A TRADE TRX/USDT BUY MARKET ORDER ON THE BINANCE EXCHANGE FOR AT LEAST $15

I logged in to my account on Binance.com, then I clicked on futures

My Binance homepage

clicked on the reversible & irreversible arrow showing FTTBUSD in other to choose my coin/currency of preference.

My binance application future page

Then I selected my coin of preference which was giving to me as a homework assignment to trade on TRX/USDT. So I searched for the coin pair and clicked on it.

My Binance application, future search page

I carried out a trade using a 10X leverage margin on the future trading on TRX/USDT, buying TRX over USDT using the market order this time

buying TRX/USDT using market order on binance

After I placed my trade, I check at the order book under the chart to see the details of the trade I placed, firstly I noticed that the trade delayed a bit before it was placed and also a decrease in TRX after placing the trade, yielding loss but at a lower percentage rate.

market order on Binance, TRX/USDT chart

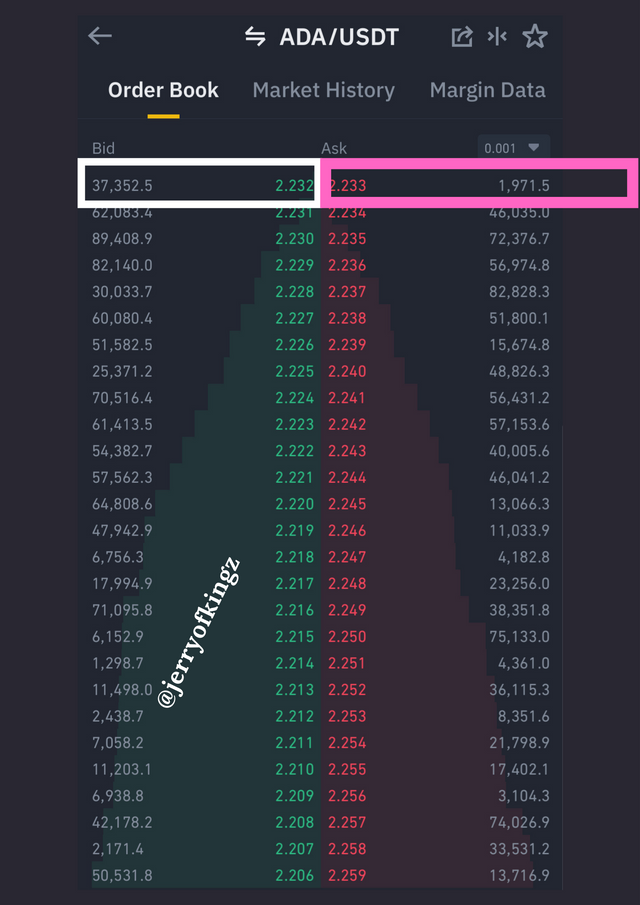

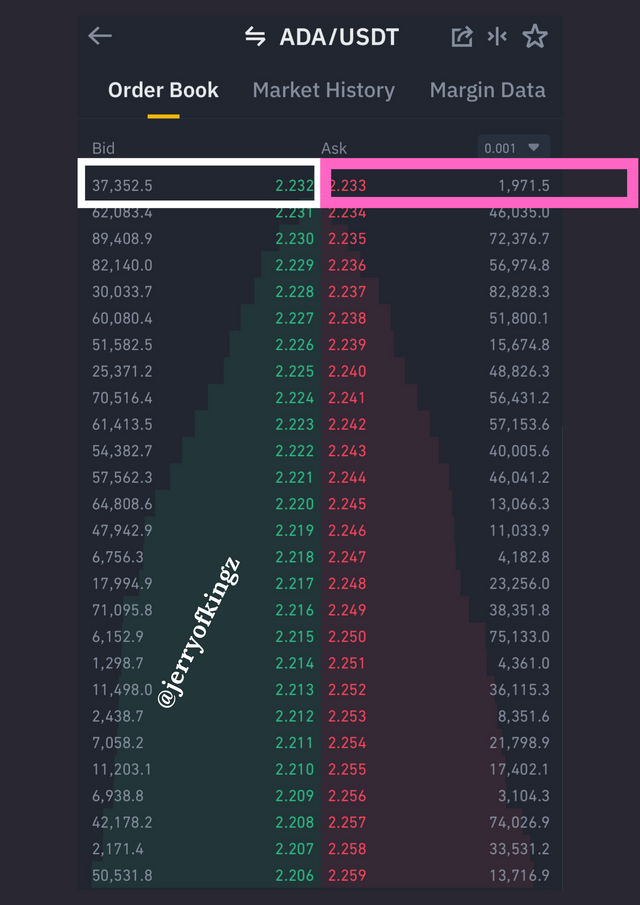

TAKE A SCREENSHOT OF THE ORDER BOOK OF ADA/USDT, CALCULATE THE BID-ASK

Calculating the Bid-Ask was quite confusing with the fact that the highest bid and lowest ask could appear at any place in the order book, so it's something we should look well into before making our calculation.

My binance future order book chart: ADA/USDT

Here, the highest Bid of ADA/USDT is 2.232 at $37,352.5, and the the lowest ask of ADA/USDT is 2.233 at $1,971.5 as shown above.

CALCULATE THE MID-MARKET PRICE

My binance future order book chart: ADA/USDT

With the use of the order book chart above, In other to calculate the Mid-Market price value we would be using the formula:

Highest Bid price of ADA/USDT =2.232

Lowest ask price of ADA/USDT = 2.233

Mid-Market value = (Highest Bid price + lowest Ask price)/2

:• This would be (2.232 + 2.233)/2

= 4.465/2

=2.2325

The Mid-Market price value of ADA/USDT is equal to 2.2325.

conclusion

“Gaining knowledge is power” and I would say that this course was a very useful and important study to me, I appreciate all effort by the professor to enlighten and widen my knowledge on the Bid-Ask spread and also how to calculate its market price value. I say a very big thanks and that you may keep the good work on.