CFDs is an abbreviated version of Contracts for differences which is the arrangements made in a future contract whereby differences in settlement are made by cash payments, rather than by the delivery of physical goods and are categorized as leveraged products.

Contract for differences (CFDs) allow a trader to exchange the difference in the value of a financial product between the time the contract will opens and the time it closes without owning the actual underlying cryptocurrency asset.

Instead of owning the underlying asset ( like the cryptocurrency), derivatives and CFDs are used to predict and speculate on the price of the underlying asset (cryptocurrency). So an Ethereum CFD tracks the price of Ether, allowing you to trade it without having to own or manage any Ether itself.

A person who thinks the value of a cryptocurrency will rise, he can go long; to go long means that he will buy a CFD and if he expects the value if a cryotocurrency to increase and, a person can go short by selling the units of CFDs he has, if he thinks that the value of a crypto asset will decrease. This offers the possibility for a trader to make a profit in both rising and falling markets.

One of the things that should be noted is that a person needs to understand fully well before that trading cryptocurrency CFDs is leverage, which is both a key benefit and disadvantage of this type of derivative.

To open a CFD trade, a person only needs to deposit a small percentage of the trades total value. This could be 30%, 20%, 10%, 5% or even less of the total transaction and is known as the margin requirement. So if a person is opening a trade worth $20,000, for example, he may only need to pay a deposit of $1000. However, he can still receive 100% of gains if the price moves the way he predicts and can lose all if the direction moves against his predicted direction..

When a person opens a CFD trade, he predicts on whether he expects the value of that underlying asset to increase or decrease. Though as a CFDs trader a person never actually own the asset, but instead, he can make a profit or loss based on whether the Crytocurrency's value rises or falls in value. As such crypto CFDs are usually settled in money (such as paper currency) not convertible into coin or specie of equivalent value rather than the associated cryptocurrency.

For every point the price moves in a trader's predicted direction, he will be paid multiples of the number of units he has earlier bought or sold. However, if the price moves in the opposite direction to the one predicted, that may result in a greater loss.

Nevertheless, trading on margin allows a trader to increase his returns, providing the potential for a much bigger return from a relatively minimal initial amount. By and large, it also means that losses too are magnified as they are calculated based on the full value of the position. This means a trader can end up losing much more than his initial investment.

This is an important risk that a person who wants to trade must be aware of before getting into crypto CFDs.

HOW DO I KNOW IF CRYPTOCURRENCY CFDs ARE SUITABLE FOR MY TRADING STRATEGY?

There are different strategies as per cryptocurrencies trading strategy, some of which are listed below:

Staking coins and tokens

Fundamental analysis trading strategy

Arbitrate trading strategy

Automated trading bots strategy

Scalping trading strategy, among others.

Each of the aforementioned strategy has its own approaches and it is supposed to be followed, for instance; using the scalping trading strategy a person takes the advantage of small market movement, by punctually entering and exiting trades during a day.

One of the benefits of trading using this strategy is that it is safer than other trading strategies. More so, this strategy employs minimal time frames and so, it is possible to exit the trade should in case the market isnt moving as expected.

In summary, before a person trades using the CFDs, he should assess and make researches on all strategies and go for the one that will benefit him the most.

ARE CFDs RISKY FINANCIAL PRODUCTS?

CFDs can be sometimes risky because of low industry regulation, lack of the ease at which an asset (cryptocurrency) can be converted into cash and the need to maintain an adequate margin that may result from leveraged losses.

Though, trading CFDs, stop-loss orders can be helpful to lessen the apparent risks. Some CFDs providers offer an assured stop loss order, which is a pre-determined price that, when met, will automatically close the contract.

However, with a small investment and a possibilty for large returns, CFD trading can result in severe losses.

DO ALL BROKERS OFFER CRYPTOCURRENCY CFDs?

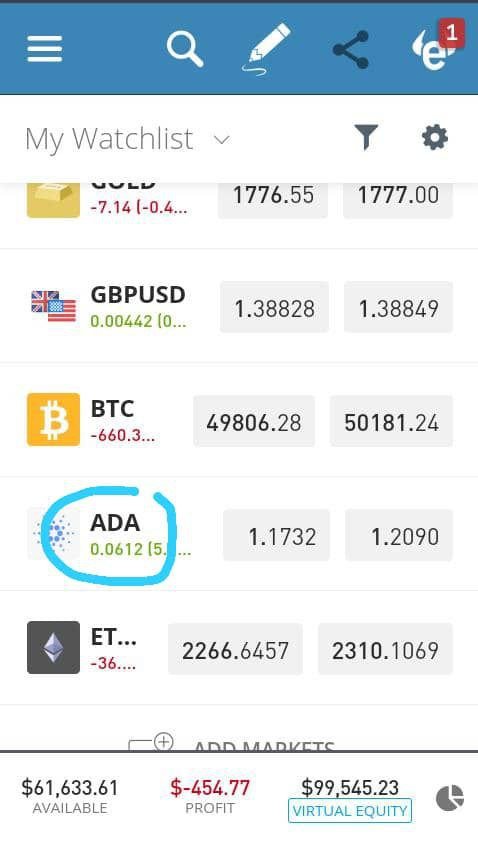

Not all of the brokers offer Crytocurrency CFDs. Examples of brokers that offer Crytocurrency CFDs are; eTORO, OCTAfx, e.t.c.

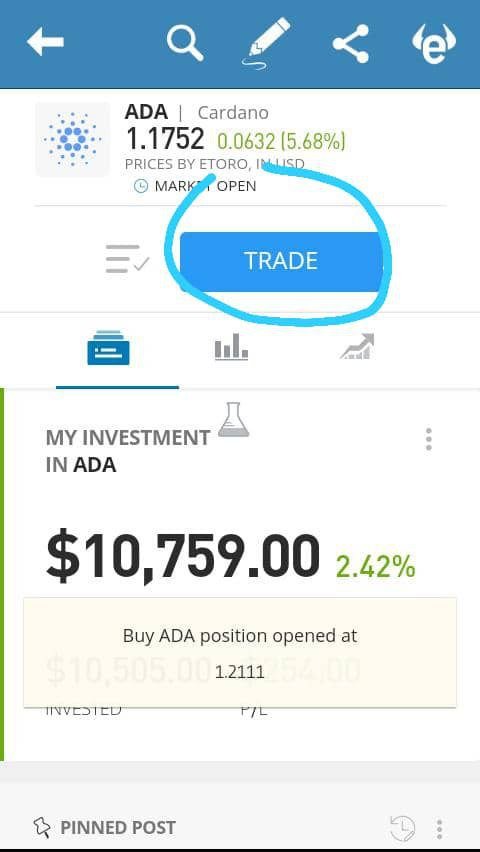

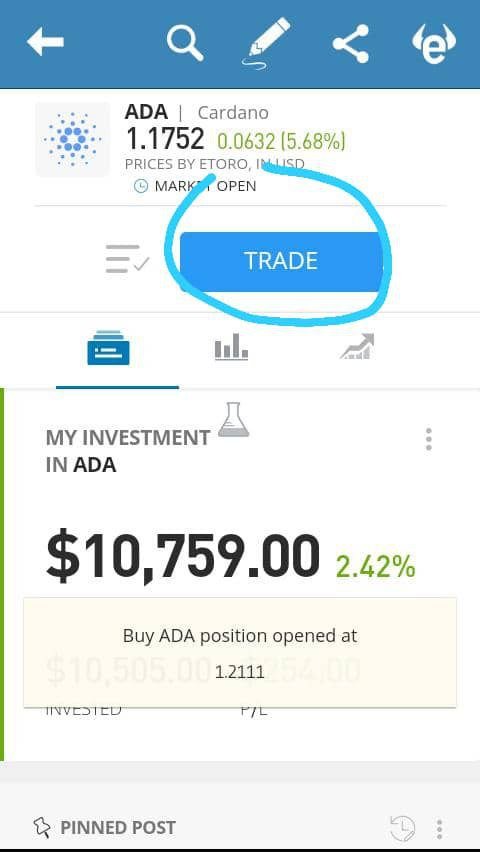

HOW CRYPTOCURRENCY CFDs CAN BE TRADED ON ONE OF THE BROKERS (using a demo account):

A demo account is a type of account that trading platforms offer to prospective traders who want to trade using their platform, which is funded by fake money to experiment the platform and the how trading should be done.

The steps are listed below:

Be ready to face risk

make your mind up on the trading platform

(broker) you want to trade with

Download the broker's application from playstore

Enter your details

Confirm your details

Choose the Crytocurrency asset you wish to trade

Enter the number of units you want to trade

Start trading by either going long (buy) or going short (sell).

Hello @jessica999,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 3/10 rating, according to the following scale:

My review :

Despite the amount of information provided, it was not well used. Absence of analysis and opinion.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit