Q1: Describe the differences between Staking and Yield Farming.

Before I go ahead to state the difference between the two, first of all let me explain some of the key terms in the question which is Yield farming and Staking so that once we know what they are We will be able to tell the difference between them since a lot of people mistake them for staking. Let’s start with Yield farming.

Yield Farming

Yield farming as i said in my above introduction, many people define yield farming wrongly mistaken it for staking I don’t blame them it’s kinda confusing but am going to make it very simple and understandable. Yield farming is a method users use to gain more crypto or more profit by locking their crypto in a liquidity pool over some time and come back to take profit (APY).

How does yield farming work?? Yield farming works in a way that the person providing the asset in the liquidity pool is known as the liquidity provider (LP). It is the responsibility of the LP to provide the assets mainly two stable cryptocurrencies in equal proportion into the liquidity pool.

The liquidity pool is a smart contract that contains all the funds provided by other LPs. The assets in the liquidity pool are used to supply to other traders or users who want to borrow the assets and once they borrow, they will pay with profit and the profit is shared among the LPs they also earn on fees payed into the platform.

Staking

This is another way users can put into good use of their tokens by letting them work for us. We see the proof of work consensus algorithm used in by BTC where miners use high power computers to solve difficult mathematical problems to generate new blocks upon which they are rewarded. Well this is different from the proof of staking which runs entire on staking.

In the proof of stake consensus algorithm, users stake their assets in the platform. So when we talk about staking it simply means locking or putting away our tokens which will be responsible for verifying and validation of transactions (nodes) at the end of the day the user will earn rewards based on the size of this staked token meaning if you hold large tokens your rewards will be more than users who held smaller tokens.

Actually the proof of stake consensus algorithm is the upgrade of the proof of work and many blockchains are now switching to the proof of stake consensus algorithm in other to increase scalability in their Blockchains.

Now form the above explanation of the terms right away you can be able to tell some differences between them but to make it more easy and understandable I will put them in a tabular form.

Differences between Yield farming and staking

| Yield farming | Staking |

|---|---|

| 1 - In Yield farming the users deposits their assets in decentralized finance platforms to earn on them | In staking the people use their assets to help the blockchain to validate transactions as a result earn. |

| 2 - Yield Farming’s main goal is to make profit or that is the sole reason for its creating | Rewards earned from staking is just a by product of trying to help the blockchain to validate nodes |

| 3 - Yield farming since it’s main purposes is to make profit, hence its more profitable than staking | less profitable as compared to Yield farming |

| 4 - Profit is made when other users borrow from the liquidity pool or from network fees | the profit is gained not from borrowing or network fees or any sort but from the nodes that verify transactions |

| 5 - Users can decide to take out their liquidity | In down platforms when you lock your asset for a year duration you can’t take out your asset until the year time frame is up. |

Q2 : Login to Yearn Finance. Explore the platform completely and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options) Show screenshots.

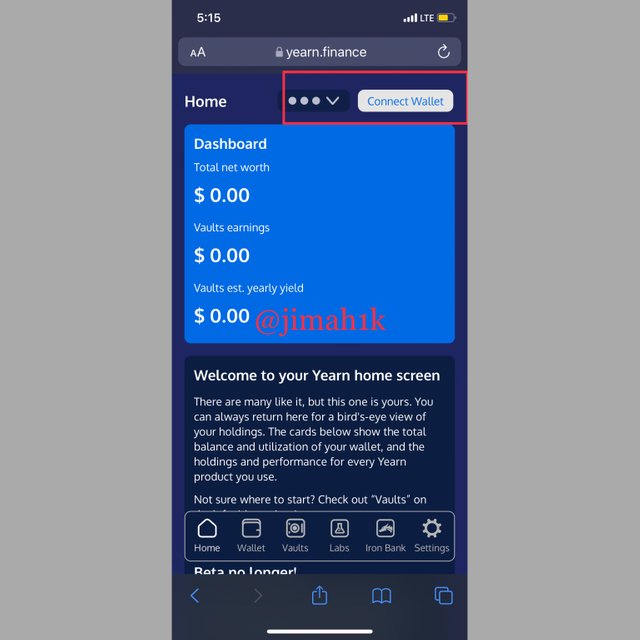

First of all you will need to access the official platform of Yearn finance you can do that by clicking on this LINK. After accessing the website there some interesting features I will to explore to you guys

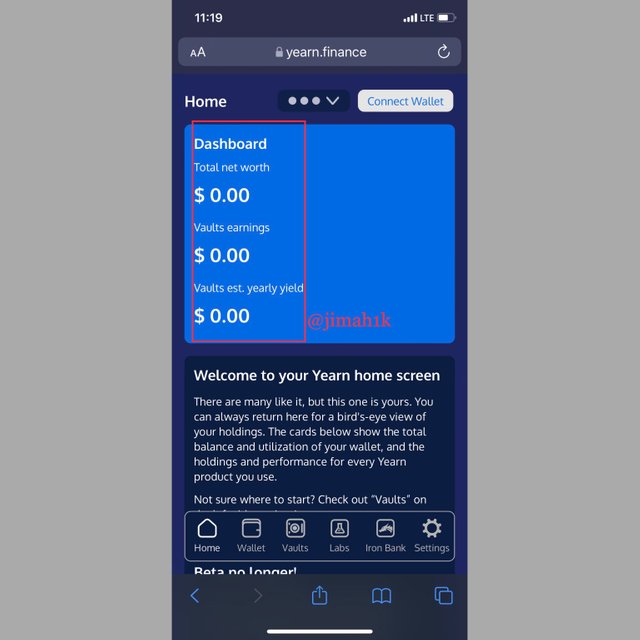

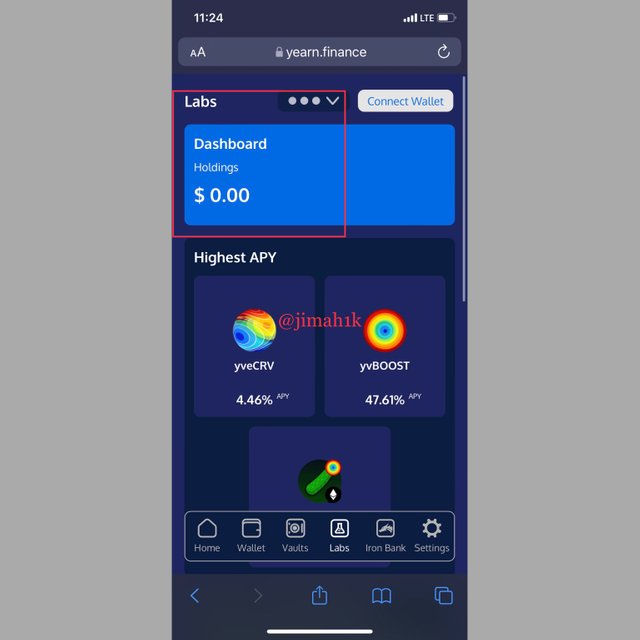

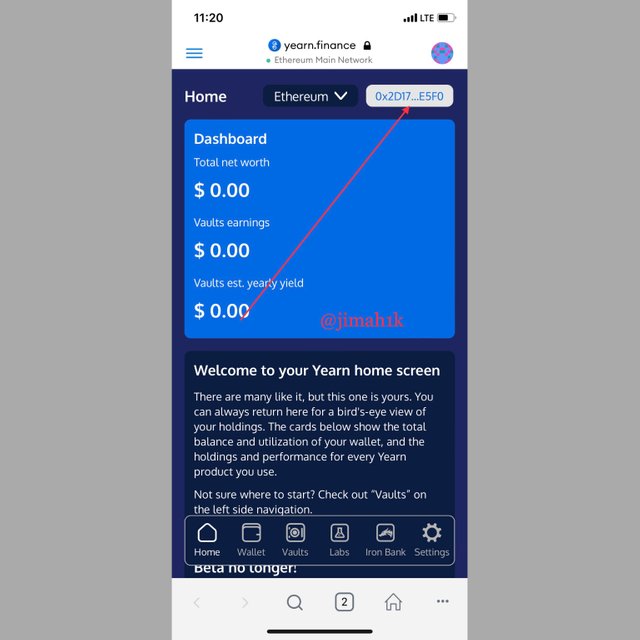

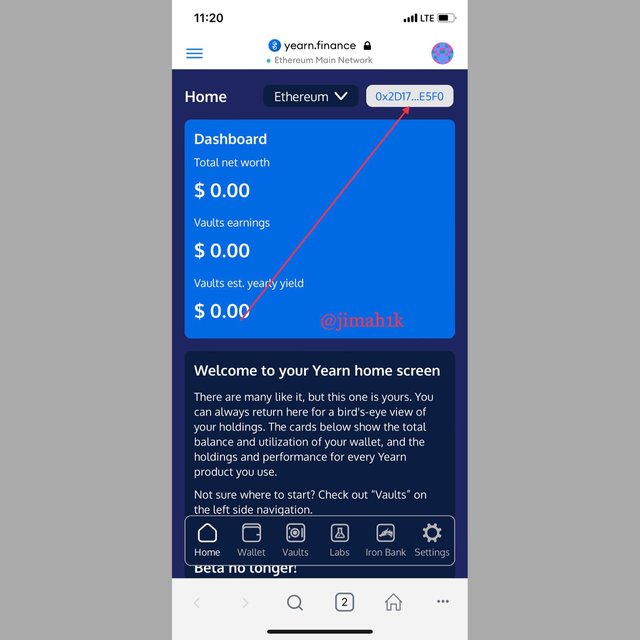

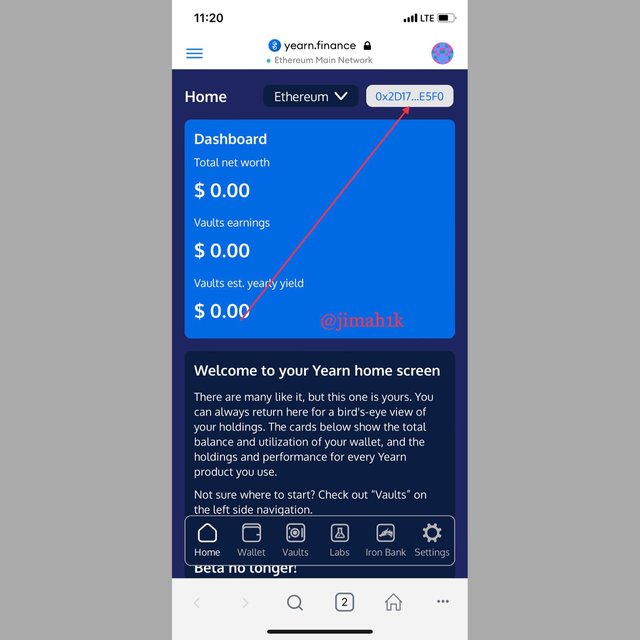

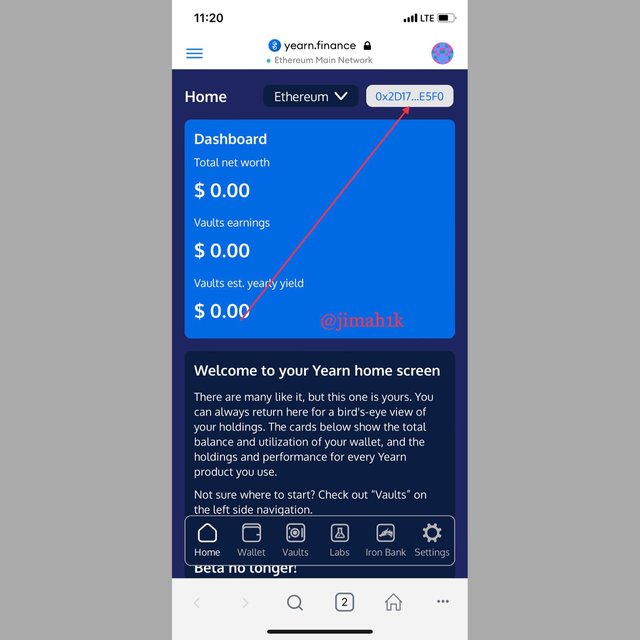

1 - The feature you will see on the platform Is the Dashboard well this feature as can be seen from the screenshot will display the account balance of the users, vault earnings and vault yearly yield.

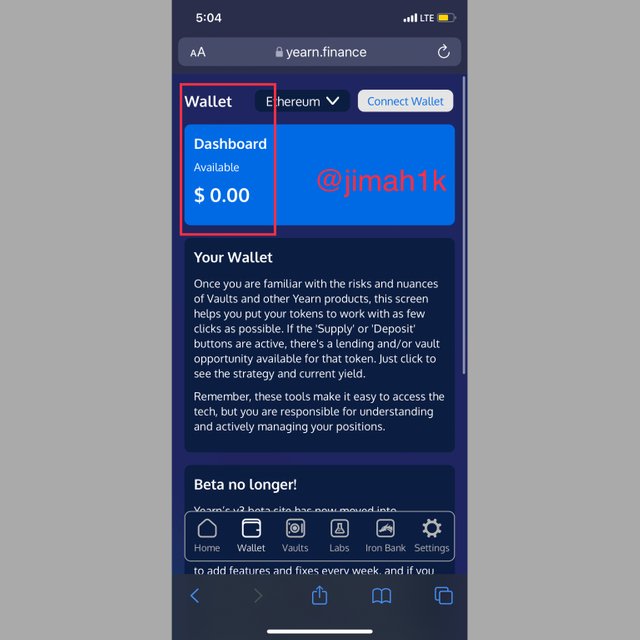

2 - The Second feature is the Wallet which also displays the account balance of the users but doesn’t display the vault earnings. So you can also see from the screenshot I have nothing

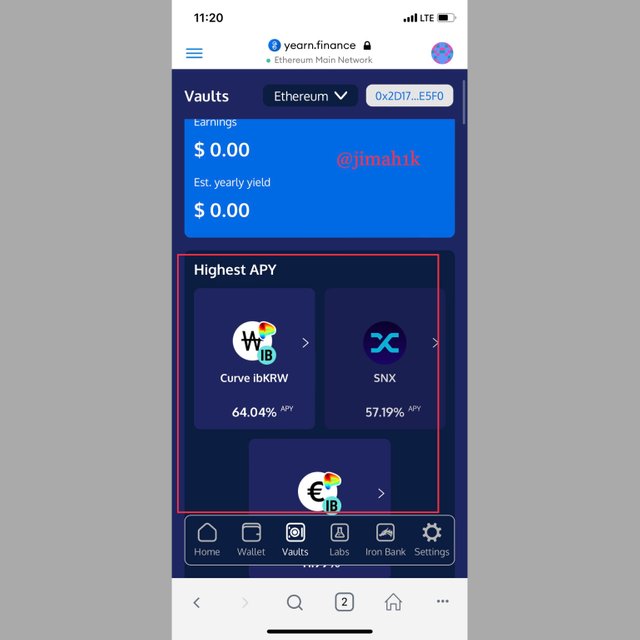

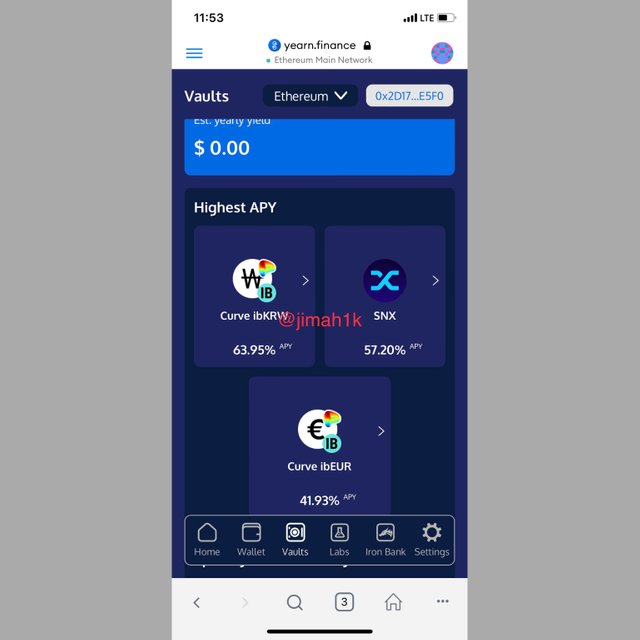

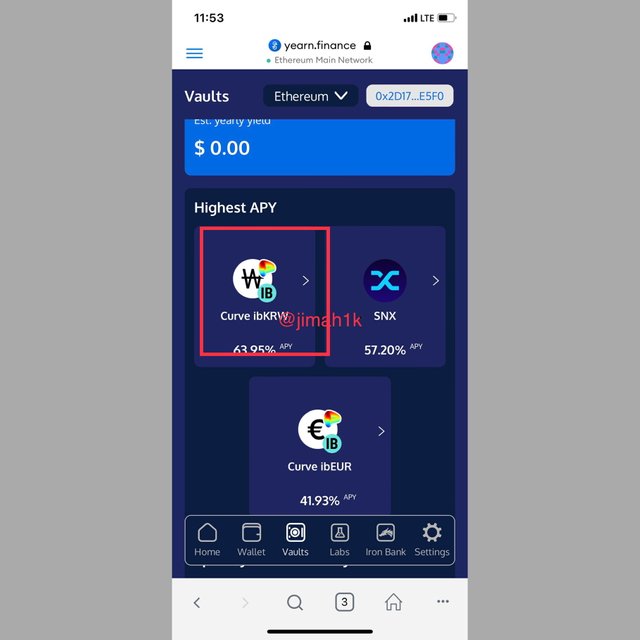

3 - The next feature we have Vaults this feature contains the liquidity pools where the users can add his liquidity and start earning on them. The liquidity pools are usually ranked from the highest APY to the lowest

4 - Labs is the next feature with little difference from the vaults, users can also lock their assets here and earn on the.

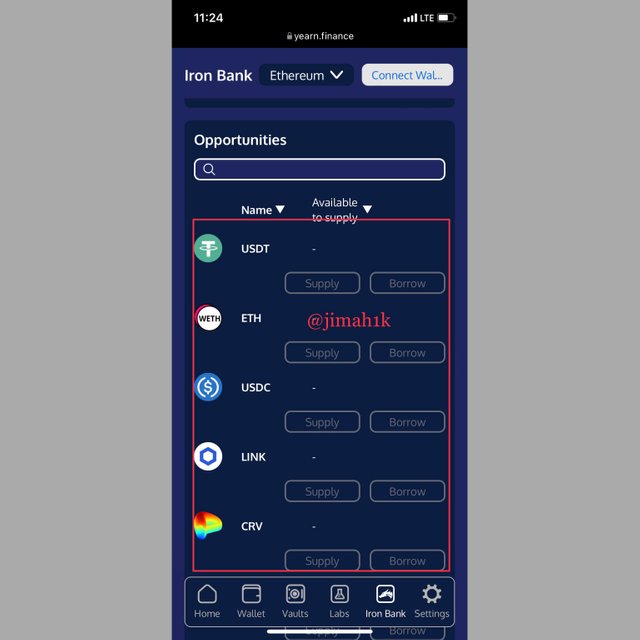

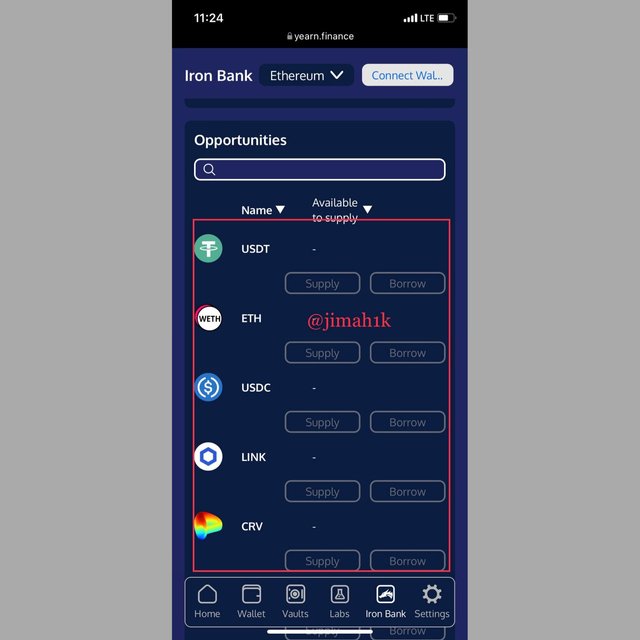

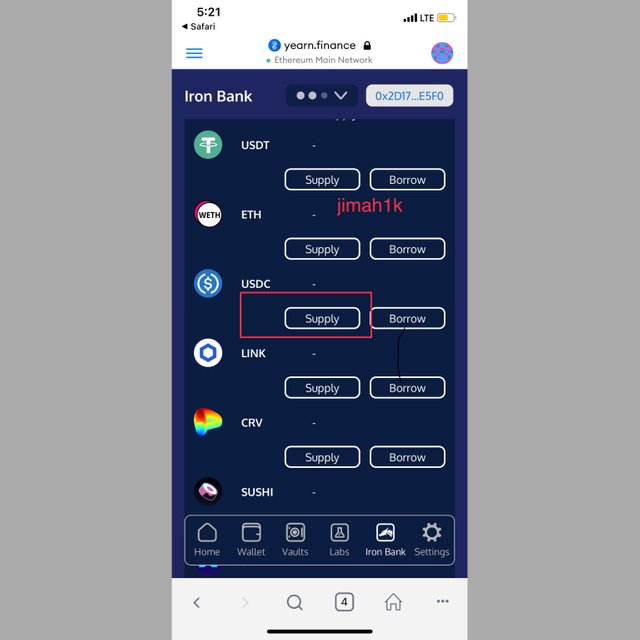

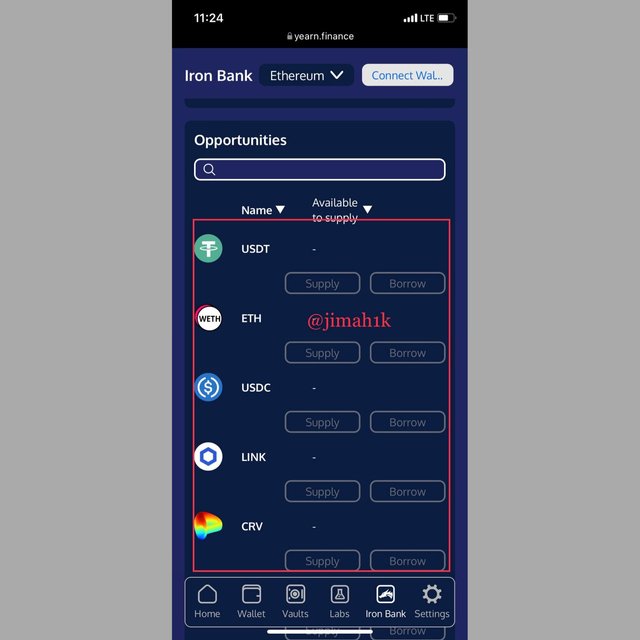

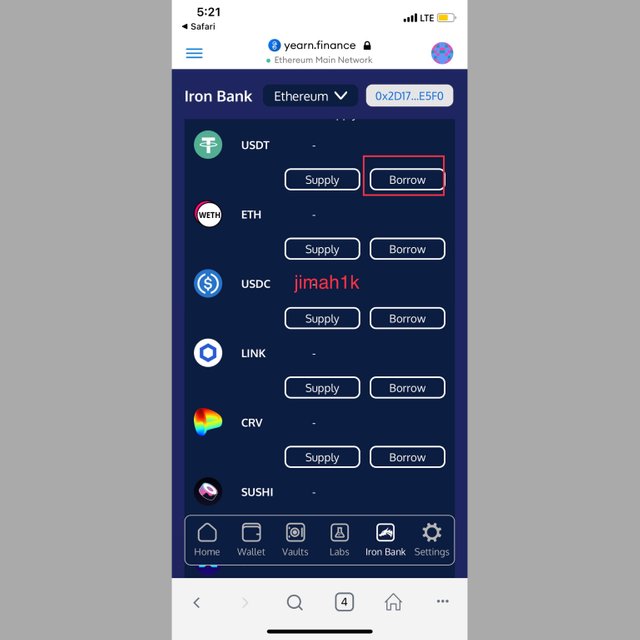

5 - Iron Banks helps the user to borrow assets and pay on interest over a given period remember I said users borrow assets from the liquidity pool and the interest payed is shared among the LPs?? This feature takes care of that. Both supply and borrow

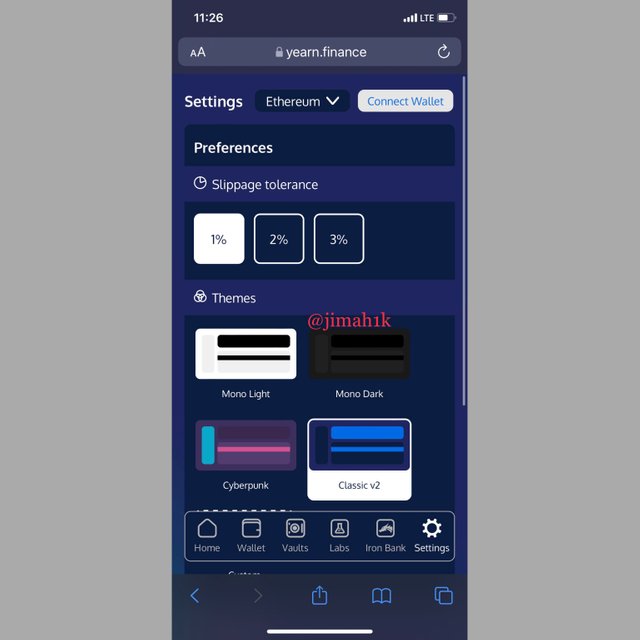

6 - Settings most people usually forget about this feature actually it’s very important because you can be able to change the language, change the themes of the platform, this feature also provides the users with the social media pages of the platform.

please note that all screenshot are from yearn.finance

How to connect your wallet to yearn finance

Again, you will need to visit the official website use this LINK

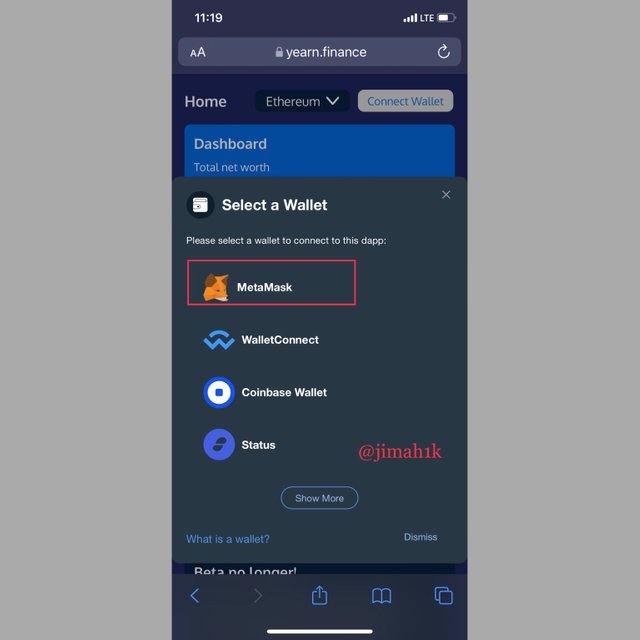

1 - when the website launches, click on connect wallet

2 - From the list of wallets, select your preferred choice I will choose Metamask wallet.

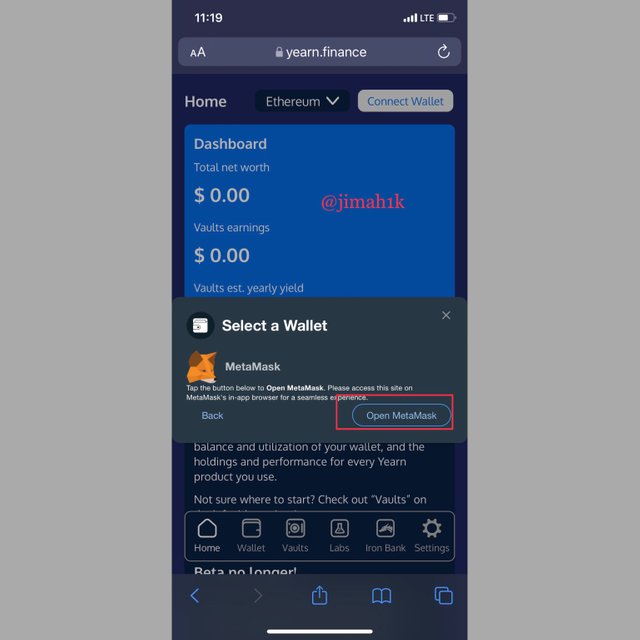

3 - Click on open Metamask wallet that is only if you have the app on your phone which I do.

4 - Click on connect wallet again.

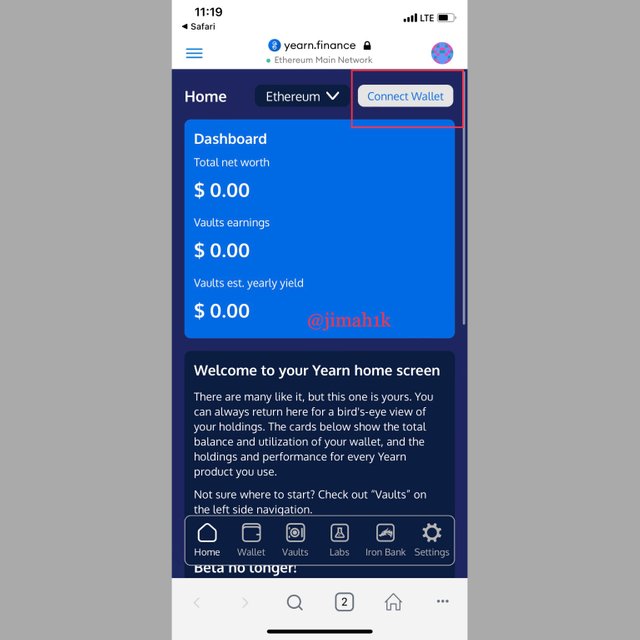

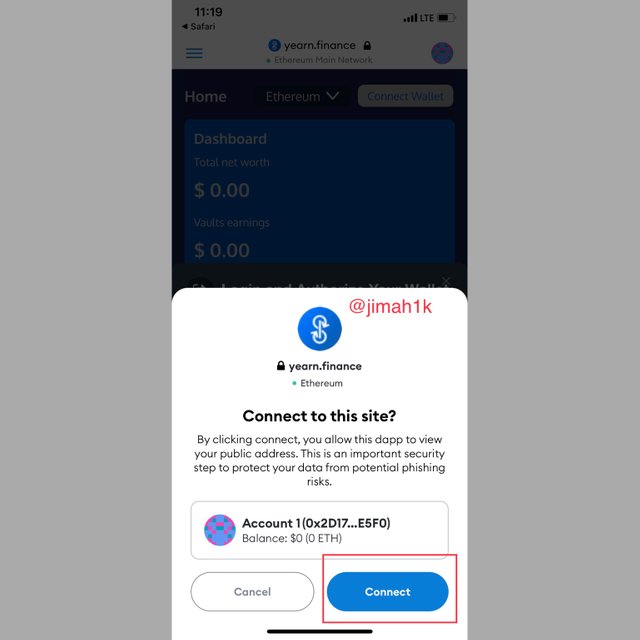

5 - Confirm connection to the site my clicking on Confirm.

6 - Successfully connected.

please note that all screenshot are from yearn.finance and Metamask

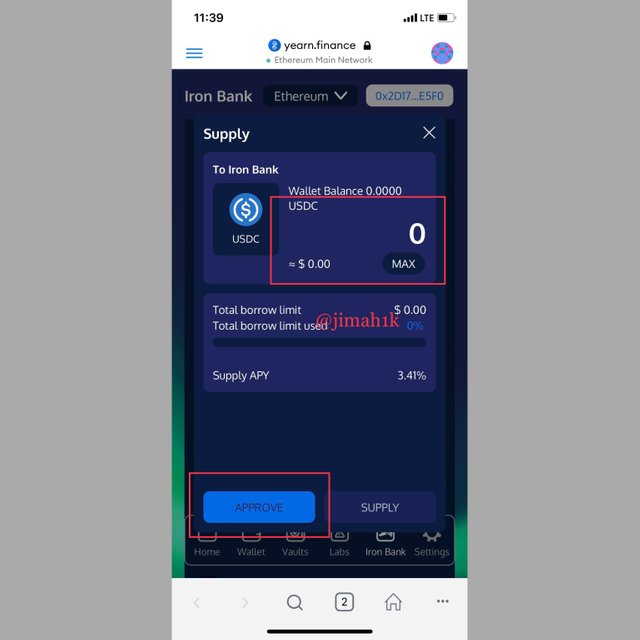

How to supply in iron banks

1 - Navigate to iron banks feature on the website

2 - Make sure you are still connected to your wallet.

3 - From the list of asset provided below look for the asset you choose to supply and click on supply

4 - Enter the amount of asset you want to supply

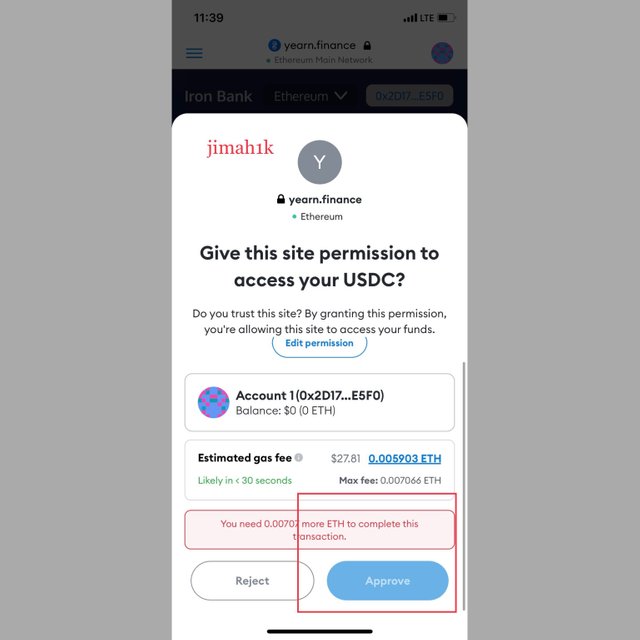

5 - Confirm on your Metamask wallet due to insufficient balance I can’t confirm.

please note that all screenshot are from yearn.finance and Metamask

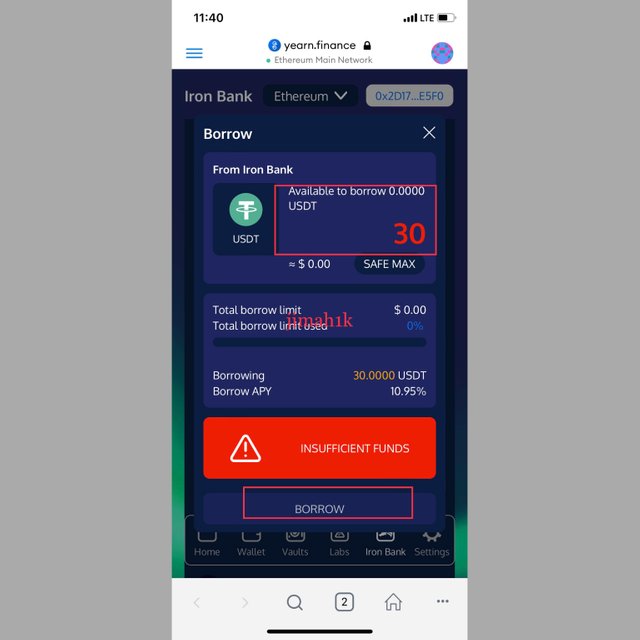

How to borrow in iron banks

1 - Navigate to iron banks feature on the website

2 - Make sure you are still connected to your wallet.

3 - From the list of asset provided below look for the asset you choose to borrow and click on borrow

4 - Enter the amount of asset you want to borrow and click on borrow.

please note that all screenshot are from yearn.finance

How to deposit an asset to be locked

1 - Navigate to vaults feature on the website

2 - Make sure you are still connected to your wallet.

3 - From the list of asset provided below look for highest APY and click on it

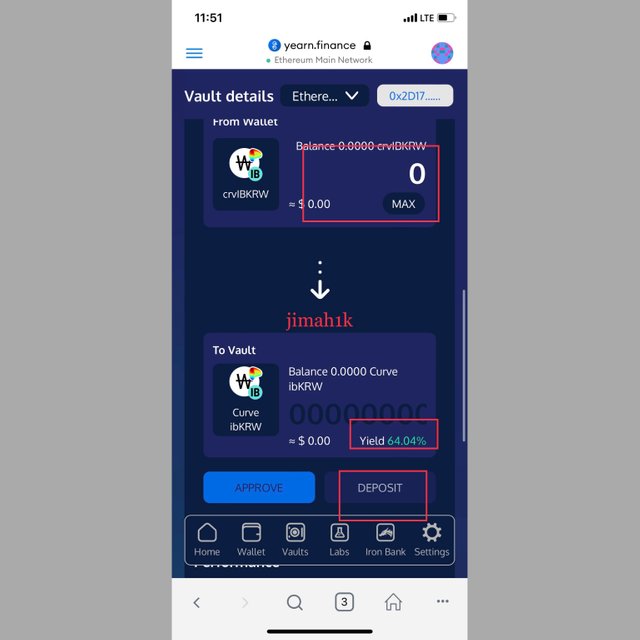

4 - Enter the amount of asset you want to deposit to the liquidity pool from the screenshot below the yield profit is 64.0%

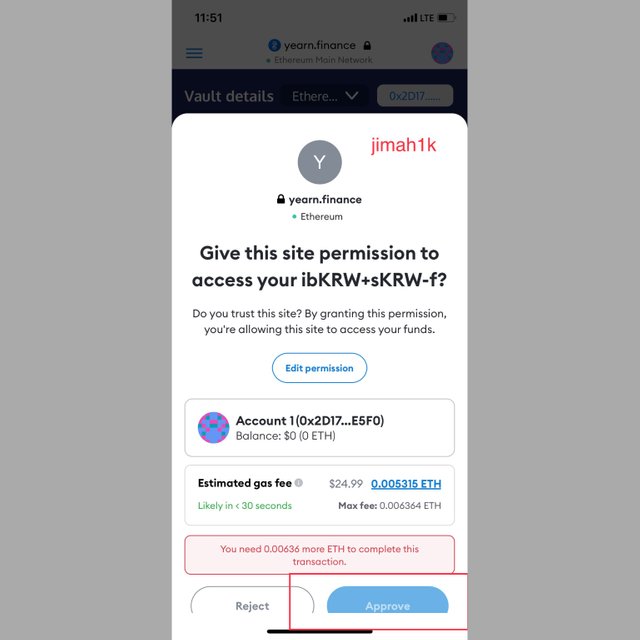

5 - Confirm on your Metamask wallet due to insufficient balance I can’t confirm.

please note that all screenshot are from yearn.finance and Metamask

Q3 : What is collateralization in Yield Farming? What is function?

The word collateralization comes from collateral which is something we mostly see in the centralized finance system (banks) in a principle that when a user wants to borrow money from the bank he or she must put something of more value in place so that when you are not able to honor the agreement that thing you kept in place will be taken as a replacement.

Let me give you an example let’s say I want to borrow 50 million ghana cedis from the bank, the bank will will require me to bring something worth more examples of such items are a car, house a business firm. So they will take the documents of your car and keep it safe and then loan you the money which you will need to pay on the agreed day when you fail to pay your car is taken as a replacement this car will be be sold to replace the money.

This same principle will is adopted in yield farming with a little differences. What happens is that when you want to borrow and asset. The borrower is supposed to deposit 200% more of that asset let’s say you want to borrow 100 USDT you will need to deposit 20,000 before you can be borrowed 100 USDT this 20,000 USDT you will deposit will be held by the smart contracts should Incase you fail to honor your agreement and pay the loan within the given period that amount will be used to pay the lender.

It’s main function is to help safeguard the lenders funds from people who will promise to borrow and not pay the asset. So with this when someone is lending an asset he or she knows that by all means the debt will be paid because of the collateralization system in the yield farming.

Q4 : At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

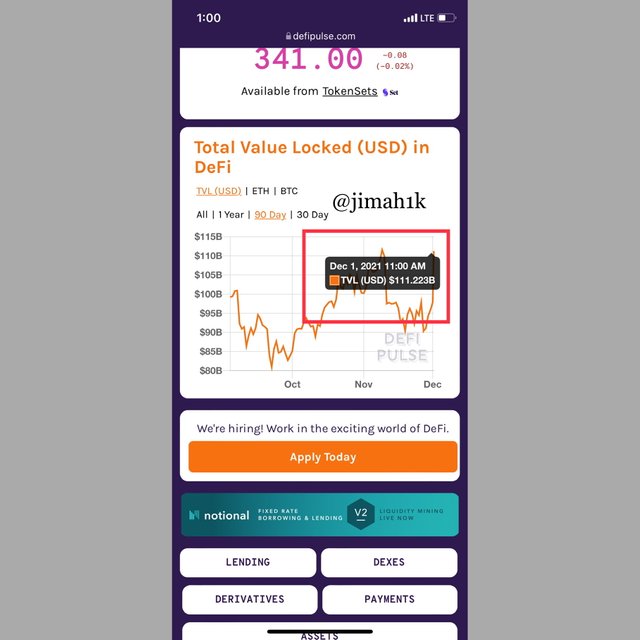

According to the Defipluse.com the total value locked as of today is $111.223B see screenshot below.

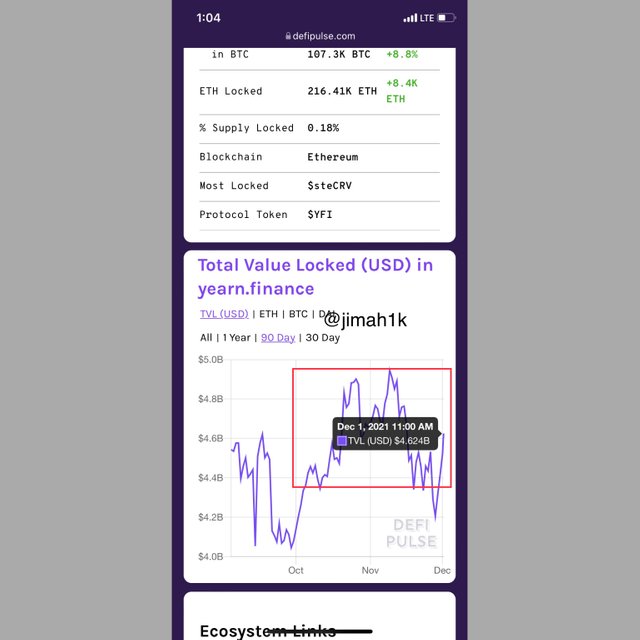

And the total value locked of Yearn Finance Potocol according to the same source is $4.62B as at the time of this home work see screenshot below.

Market Cap / TVL ratio of the YFI Token

We will do some little calculation here from the coin market cap this is the market capitalization 1,092,668,516.19 so will divide it by 4620000000 which will be equal to 0.24.

So mathematically we have ;

1,092,668,516.19/4620000000 = 0.24.

So the Market Cap / TVL ratio of the YFI Token is 0.24

Is the YFI Token Overvalued or Undervalued?

Well my personal opinion is YES! it’s definitely undervalued my reason is that when you look at all the DeFi platforms and the value locked as of today yearn.finance is in the top ten yet the Market Cap / TVL ratio of the YFI Token is at 0.24 which is less than 1 hence undervalued.

If it were valued more the ratio would have higher than 1 even if it wasn’t 1 it would have been closer but 0.25 is very low looking at the number of blues that are locked up on daily bases look at screenshot below.

Q5 : If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

First of all I will launch the chart from TradingView use my date and prices tool and set it from 1st August to 1st December.

BTC/USD

From the screenshot, front the 30days interval BTC/USD has made percentage of 46.72. That’s is a very significant increase of Bitcoin am sure traders who held their asset at this period made a lot of profit. Let’s take a look at the chart of yearn/usd.

The same applies here I used the date and price tool after launching the chart. And set my date to 1st August and 1st December.

FYI/USD

From the screenshot above within 30days yearn made -13.4% decrease in percentage.

Calculating the return on investment on BTC

In other to find the return on investment we will multiply the percentage increase by 500 but before you multiply you will need to convert the percentage by diving by 100.

so mathematically we have ;

Profit = 500 * 46.72/100 = $233.6

So at the end of 30days you will have 500 + 233.6 = $733.6 which will be your return on investment.

calculation return on investment on YFI

The same thing applies here In other to find the return on investment we will multiply the percentage increase by 500 but before you multiply you will need to convert the percentage by diving by 100.

so mathematically we have ;

Profit = 500 * -13.4/100 = $-67

So at the end of 30days you will have 500 - 67 = $433 which will be your return on investment.

Looking at the two it’s very clear that you will have made a lot of profit in trading with the Bitcoin because within that given period when you traded with $500 you earned an additional $ 233.6 which is almost half of your invested amount.

Looking at the investment in FYI, within the last 30days there was an rise in percentage hence saw us loss $67 of our $500 invested.

Q6 : In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

Yield farming is something that needs to be treated with much care. As much as it’s a way for users to make profit it can also be a way lots of traders will make losses. I will be elaborating on some of the risks of Yield farming.

Users can suffer impermanent loss of asset when he or she adds liquidity of unstable or highly volatile coins or assets into a liquidity pool. When you do that the trader will suffer a impermanent loss of his asset. However this loss might become permanent if he or she choose to withdraw his assets at the particular moment in time.

Smart contracts risks this is also another risk which is involved in the Yield farming because smart contracts are actually responsible for holding the asset that will collected as collateral when someone comes to borrow an asset. Remember that the smart contracts are just codes running on the platform, in some cases they make malfunction and the user might Loss all his assets.

High Gas fees the user is at a risk of paying high fees for any little thing he or she does in the platform a pure example is the above illustration I Gave in my above explanation of how to deposi an asset the platform required me to pay $27.81 worth of gas fee which is very high.

I think the traders need to take all this risk into consideration before going into Yield farming, without knowing these risks you will be making a lot of losses and not profits.

Conclusion

From this weeks lecture I have been able to elaborate the differences between Yield farming and stake which are users make a lot of profit form Yield farming. To clear the air you can also make profit from staking but the profit won’t be much as compared to Yield farming.

Exploring the yearn finance, exposing me to some interesting feature like the vault, labs, wallet and iron banker where the users would be able to supply assets and also borrow asset. One thing o noticed about suppling and borrowing of asset is the high gas fees they charge.

Also talked about the use of collateralization where by your bring an asset worth 200% before you can be able to borrow people think the 200% is much but this is because when they say before you can borrow 50 USDT deposit 50 USDT and the price of the USDT falls, it will create problems in Paying the debt. So that is why we pay higher deposit like the 200%.

Thank you professor this has been an informative lecture and I hope we continue in the coming weeks.