Hi Steemians,

I hope you are all doing great. I'm glad to be here today to take an interest in this awesome exercise conveyed by Professor @stream4u on Price Forecasting. The exercise was educational and vital for an amateur into digital money to comprehend. I will try my level best to explain the whole thing.

Q. What Is Price Forecasting?

It alludes to knowing the future cost in a timeframe of a money, there are a few strategies to develop and dive into the examination on the future value that a cash will have, in the following point I will make a concise clarification about these techniques, Forecasting the worth of a money is vital for our venture, since we can exploit a fluctuating business sector to have a financial advantage, it likewise permits us to know the conceivable absolute bottom and the conceivable most noteworthy point through the analysis of a chart.

Q. Discuss about why Price Forecasting is required?

As cryptocurrency traders, we exchange to make benefits by foreseeing accurately the course of the market. We bring in cash when our decrease is right and lose cash when our forecast isn't right. Essentially, in any event, when each sign is advising you to get, you don't simply hop into the market and hit the purchase button, you need to get a decent passage highlighted and make great benefits. Essentially, when we enter a position, we don't have the foggiest idea how far the cost will go prior to remembering back to our entrance position and we don't plan to hold exchanges for eternity. Value anticipating is vital in settling on a decent exchanging choice.

Q. What Methods are best you feel for Price Prediction/Forecasting?

In trading of cryptocurrencies there are so many methods and strategies a man can follow. For price predictions or forecasting all the strategies can be figured out from these 3 key analysis below:

Technical Analysis.

This sort of examination is done based on a candle outline, we should focus on both the volume in the market between time-frames, numerous dominant party financial backers or supposed superiors can have control of the reverse side of the rising or falling chart. Low, though the organic market of the cash is characterized on the off chance that it breaks these protections, this investigation is completed utilizing a few relative and direct strategies.

Sentimental Analysis

Sentimental emerges because of presumptions from dealers. These suspicions can make frenzy and unpredictability in the cost of resources. For instance, when you enter a famous conversation gathering and notice that everybody has a similar predisposition (Buy or Sell) on a specific resource, a large portion of individuals there are proficient dealers and you might not have any desire to conflict with the group. At the point when everybody is bullish on a specific resource, it can make instability at the cost to go bullish on the resources.

Fundamental Analysis:

On the off chance that somebody has an exceptionally high premium on a coin and needs to contribute a great deal of abundance, he needs to do a ton of examination on that coin which is coordinated through Fundamental Analysis. Here one can dissect the information so that no choice is taken by amassing it before the information is mined in such a manner and later it can decide if the cost will go up or down. A wide range of messages are sent through key examinations of how much this coin will influence the market later on or how beneficial it will be for the dealers.

Q. Take any Crypto Asset Chart graph and explain how to do Price Forecasting?

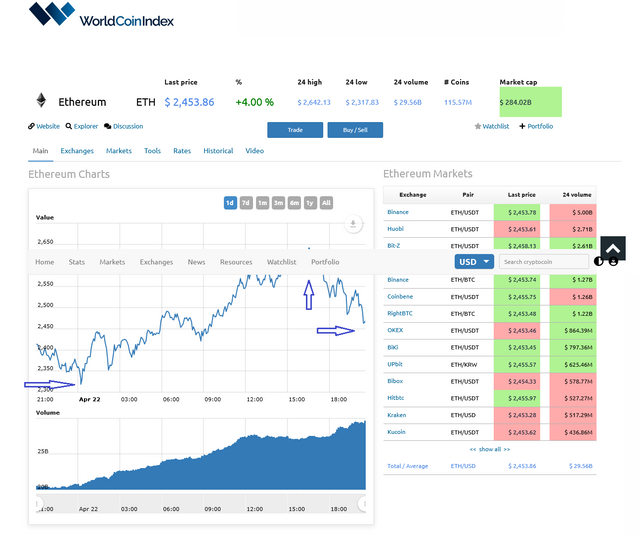

I would take Ethereum/USD as my crypto asset & try to explain how price forecasting can be done.

From this graph below we can see 7 days data. From april 19th to april twenty there is a massive fall down of price which can be noticed. On the other hand from april 20 to april 22 there is a constant raise of prices. After 22 april we can see a slight fall of the graphical line at this moment. So an investor should notice that slight falling of the line and should not invest at this moment. The best suitable moment for investing was between april 20 to 22. Websites like worldcoinindex can put a lot of vital information to the investors mind.

Took Screenshot & Edited Source

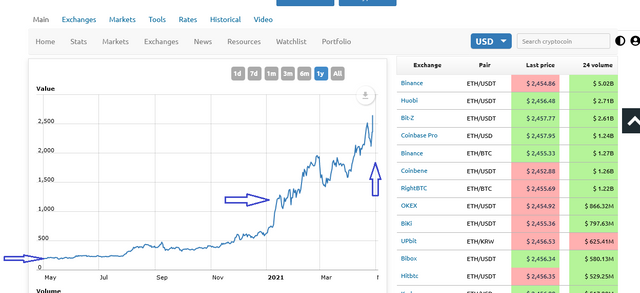

From the graph below an investor can also see the history of price forecasting 1year ago. By this kind of statistics investors can see the gap from start to end of a whole year. Another thing, investors can also gather data from this kind of exchange website for other cryptocurrency coins such as Bitcoin or Ripple.

Took Screenshot & Edited Source

Conclusion:

Taking everything into account, value anticipating assumes a significant part in settling on an exchanging choice as a trader. Digital money exchanging is exceptionally unsafe because of high unpredictable nature of the market. A broker should be set up in both specialized, central, and wistful analysis as these techniques are expected to make an effective exchanging purpose.

Thanks to all, Special thanks to Professor @stream4u.

To the attention of professor @stream4u

.jpg)

Referred Post Link:

https://steemit.com/hive-108451/@johnsand/crypto-academy-week-10-or-homework-post-for-stream4u-or-all-about-price-forecasting#@stream4u/qsbcyh

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit