Hi guys,

Welcome to my blog once again. This week I have attended the lecture delivered by the professor in the person of @reddileep where he taught indepthly on the topic Cryptocurrency Triangular Arbitrage. After attending his lecture, I am here to attempt the assignment task given by the professor.

Welcome to my blog once again. This week I have attended the lecture delivered by the professor in the person of @reddileep where he taught indepthly on the topic Cryptocurrency Triangular Arbitrage. After attending his lecture, I am here to attempt the assignment task given by the professor.

1- Define Arbitrage Trading in your own words.

The term Arbitrage Trading is a type of trading that involves a very low, little or no risk at all attach to it. This is a type of trading in which the trader buys a coin in an exchange where it is cheaper and then sell it in an exchange where it is more expensive, the said trader does this with the sole purpose of making a profit.

In a more clear and concise format, we can see Arbitrage Trading as a trading technique that allows buyers of an asset to purchase asset in an exchange where the price of the asset is considerable low and then sell it in an exchange where the price of the asset is considerable a little more expensive than the one he or she bought.

This act is mostly done by traders who operates two or more exchanges. They monitor the price of an asset in one exchange and then compare it with the price of same asset in another exchange. For instance if I want to trade on Steem, I happen to operate two different exchange wallet say Binance and Roqqu. I will consider the price of Steem in Binance and then consider the price on Roqqu and then decide where to buy and where to sell to earn a little profit at the end.

2- Make your research and define the types of Arbitrage (Define at least 3 Arbitrage types)

The types of Arbitrage that we will be looking at in this section include exchange arbitrage, triangular arbitrage and funding rate arbitrage trading. We will be looking at this types of arbitrage one after the other in the blog below.

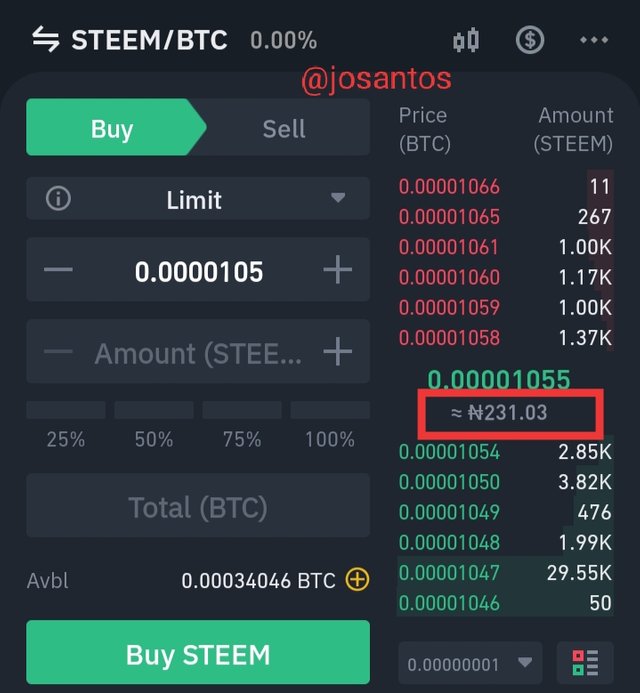

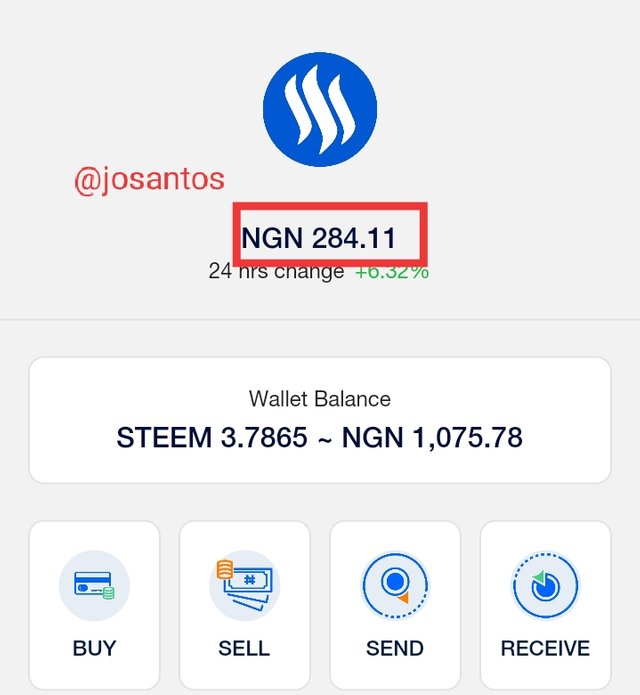

Exchange Arbitrage:- This type of arbitrage involves more than one exchange platform. Here at least two or more exchange platform are carefully monitored and observed by the trader. So the trader buys his or her coins in a platform which the asset is less expensive and then he sells it in an exchange where the price of the asset is more expensive than where he bought the asset. Now let's consider the screenshots below, we will be exploring the Binance platform and the Roqqu platform to see the differences in the price of Steem.

From the screenshot above the price of Steem in Binance exchange platform is #231.03 whereas the price of Steem in Roqqu is #284.11 this means that to use the exchange arbitrage I will have to buy from Binance and then sell in Roqqu in other to make profit.

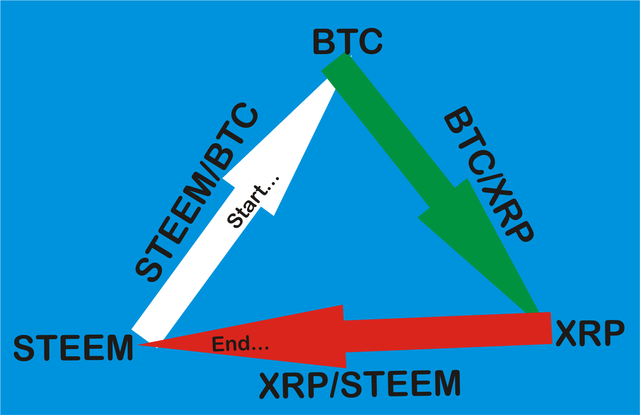

Triangular Arbitrage:- As the name suggest triangular, this type of trading is performed in a triangular manner I.e the trade involves three different coins to be involve for the aim to be achieved. Here in this type of arbitrage we trade crypto for crypto. Let's consider the example below.

From the screenshot above, you will notice the three different coins that are involved in my trade. The first coin is Steem, the second is Bitcoin and the third is Ripple (XRP). What this type of trade does is that I will use my steel to trade the other two different coins and at last I will still trade those coins to get back my steem. In a way of explanation, I began by trading a pair of STEEM/BTC, and when I got BTC I then traded my BTC/XRP as it's pair and when I finally got XRP I then traded it with STEEM as it's pair. This took me round and still brought me to purchase my STEEM at the end. That is a clear explanation of Triangular Arbitrage.

Funding Rate Arbitrage Trading:- This type of arbitrage is usually seen in the phase where we have a future contract. We know that crypto currency is highly very volatile and for traders of this kind to be in a safer side they have to put into place all that will protect them from any form of loss. The traders in these category usually hedge the prices of their asset to avoid any form of loss. Now these hedge is usually about 2% of their entire asset and this helps them to be protected from any loss.

3- Explain the Triangular Arbitrage strategy in your own words. (You should demonstrate it through your illustration)

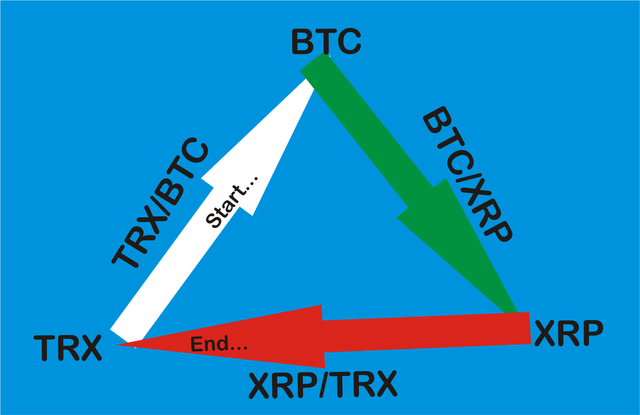

Just as I have earlier explained above, this type of trading is performed in a triangular manner I.e the trade involves three different coins to be involve for the aim to be achieved. Here in this type of arbitrage we trade crypto for crypto. Let's consider the example below.

From the screenshot above, you will notice the three different coins that are involved in my trade. The first coin is Tron (TRX), the second is Bitcoin and the third is Ripple (XRP). What this type of trade does is that I will use my steel to trade the other two different coins and at last I will still trade those coins to get back my steem. In a way of explanation, I began by trading a pair of TRX/BTC, and when I got BTC I then traded my BTC/XRP as it's pair and when I finally got XRP I then traded it with TRX as it's pair. This took me round and still brought me to purchase my TRX at the end. That is a clear explanation of Triangular Arbitrage.

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing arbitrage strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

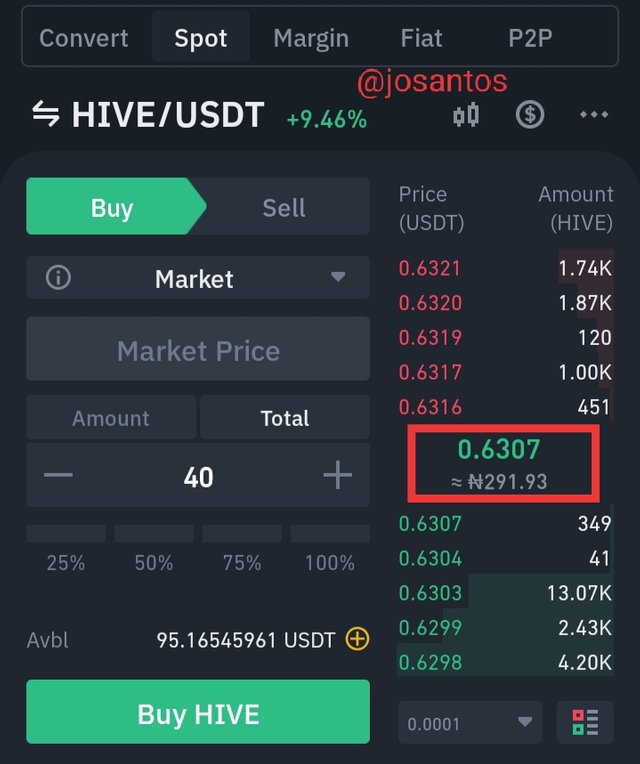

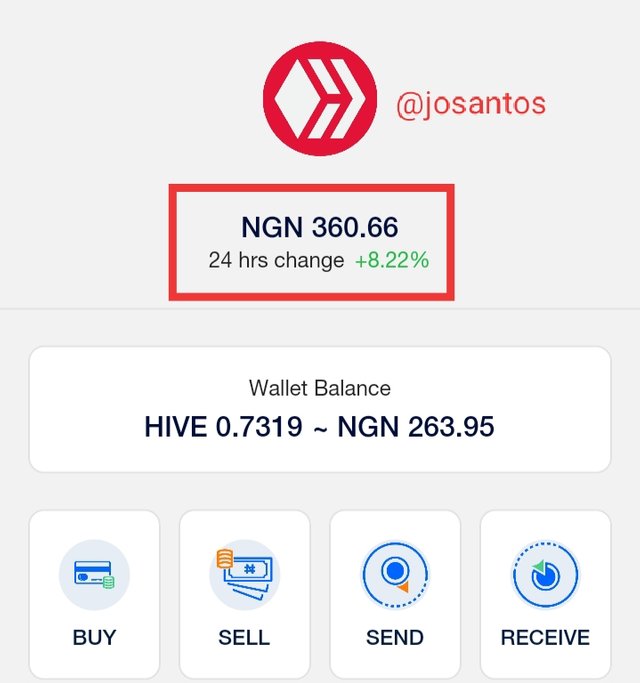

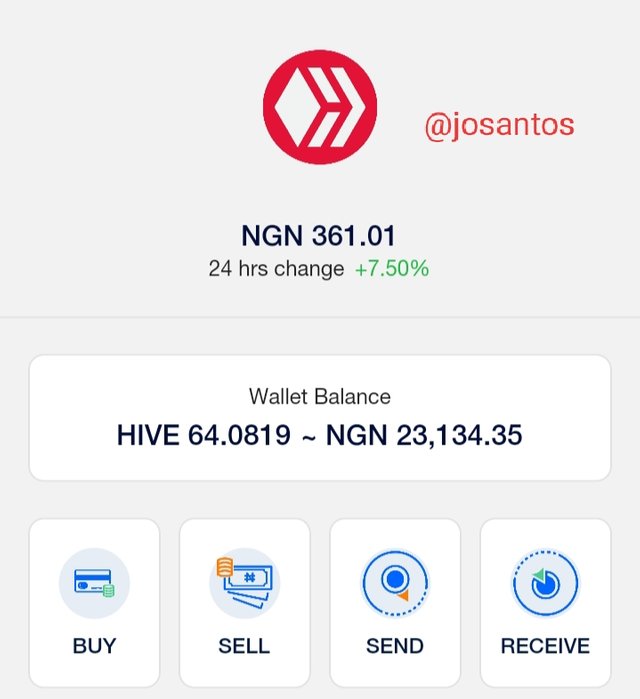

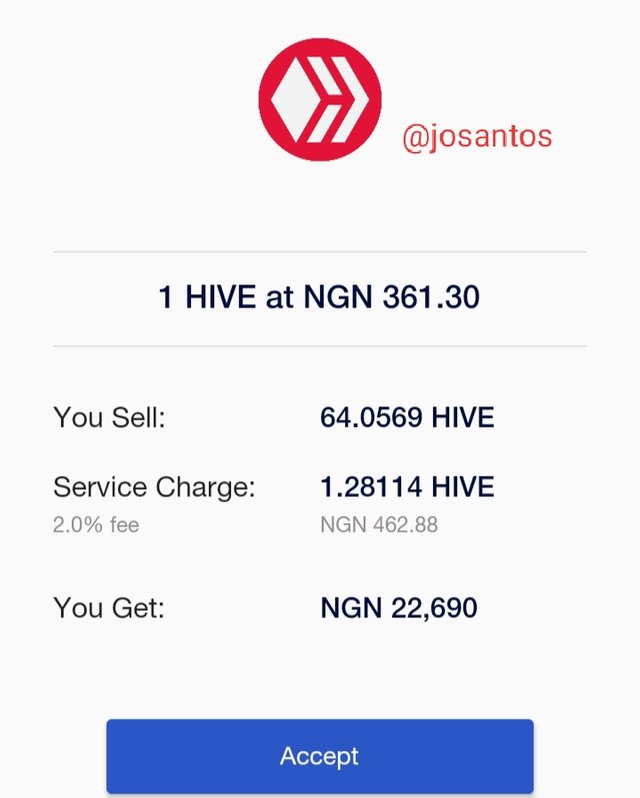

Here in this question, I will be using the Binance Exchange and the Roqqu wallet exchange to perform my transaction. The difference in the prices from the two different exchanges are, in Binance Hive = #291.93 and the price of Hive on Roqqu is = #360.66, see screenshots below.

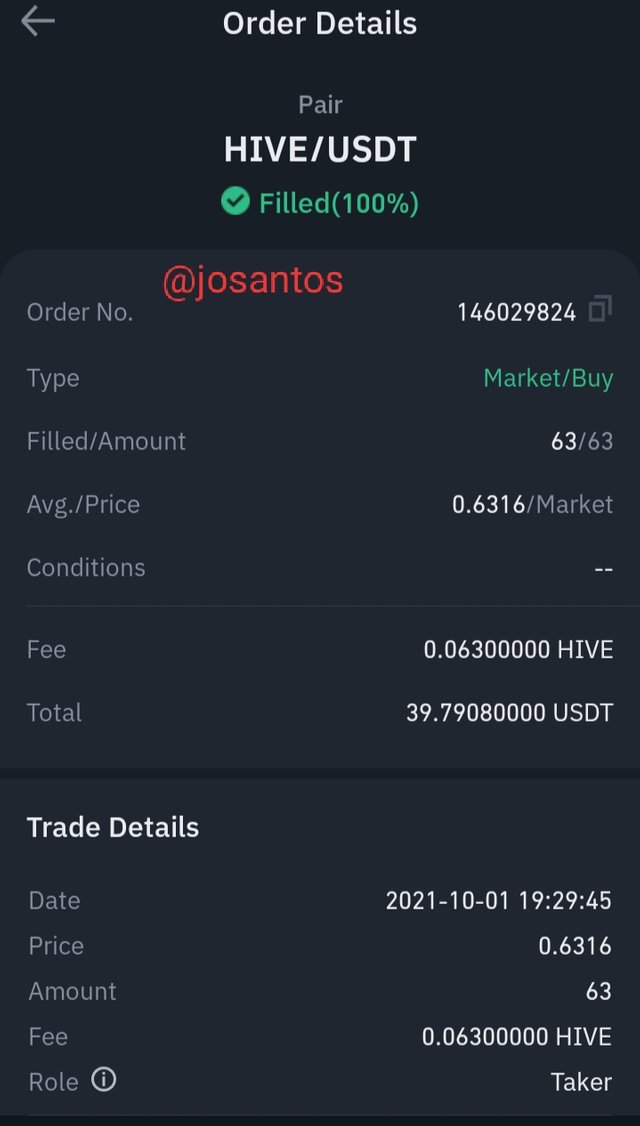

I purchased $40 worth of Hive which is equivalent to 63 Hive. See screenshots below.

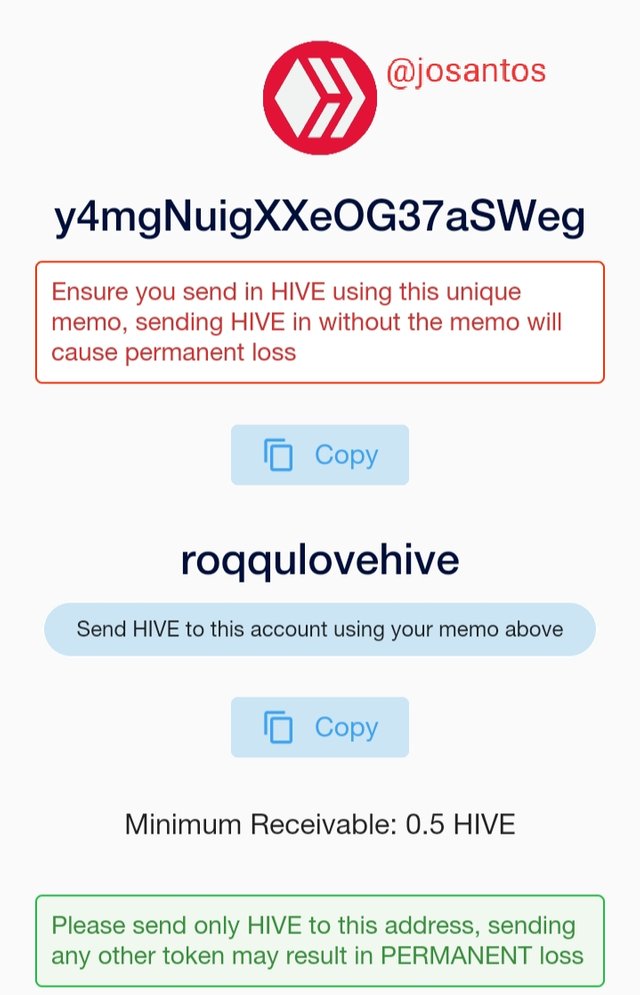

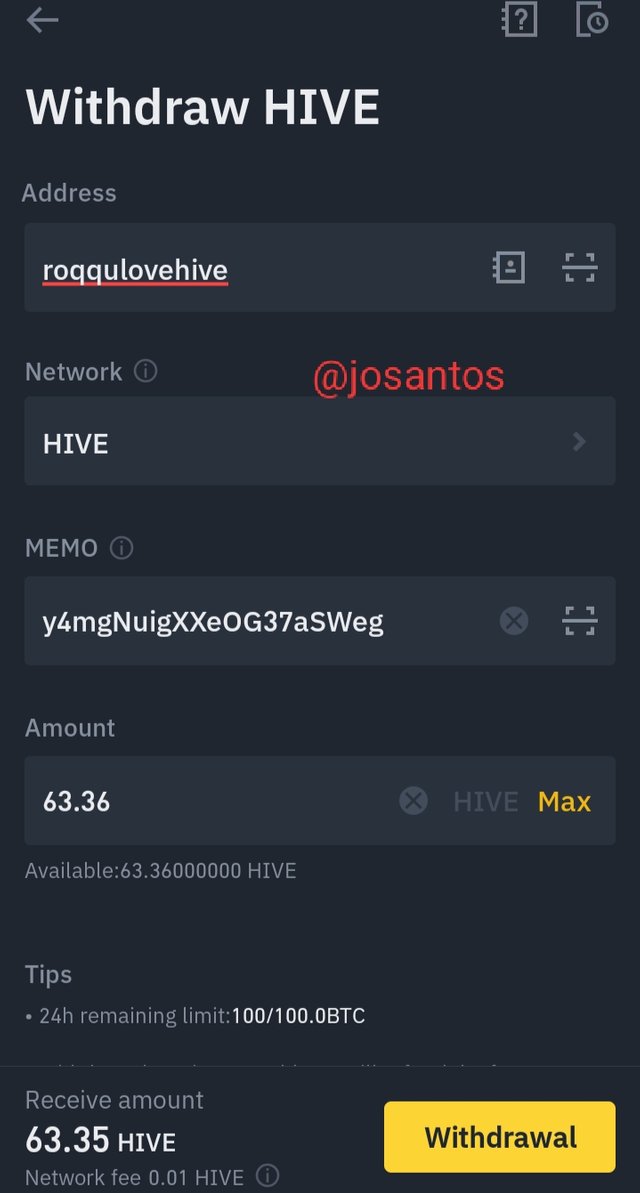

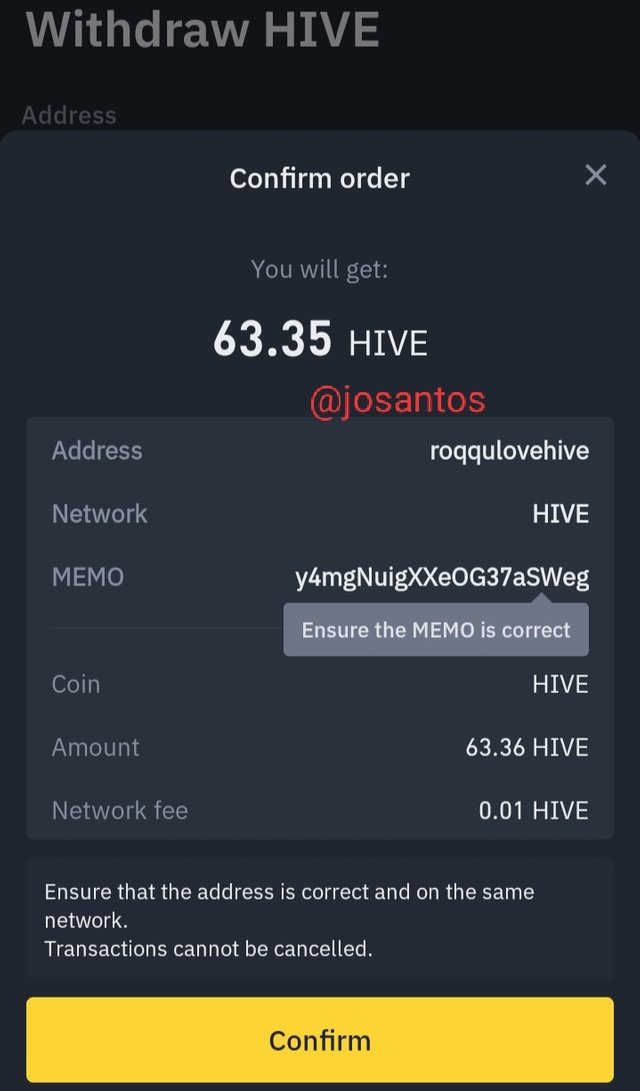

The next thing I did was to withdraw the Hive to my Roqqu wallet. See the screenshots below on the process I used in carrying it out.

The exchange arbitrage profit gain is seen below

Binance total for the amount of hive

291.93 * 63 = #18,391.59

Roqqu total for the amount of hive

361.01 * 63 = #22,743.63

The difference is given as

22,743.63 - 18,391.59 = #4,352.04

Therefore exchange profit = #4,352.04

5- Invest at least $15 worth of a coin in a verified exchange and then demonstrate the Triangular Arbitrage strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing cryptocurrency triangular arbitrage strategy, you should provide screenshots of each transaction)

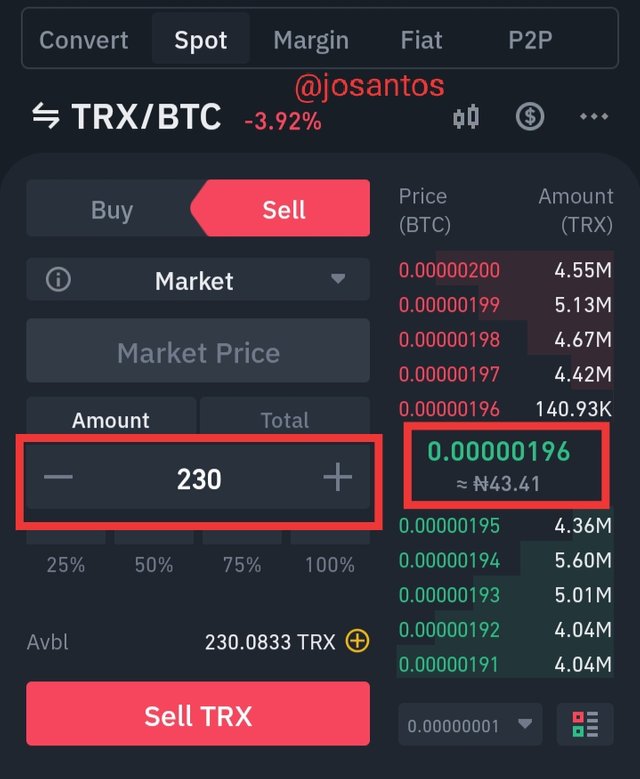

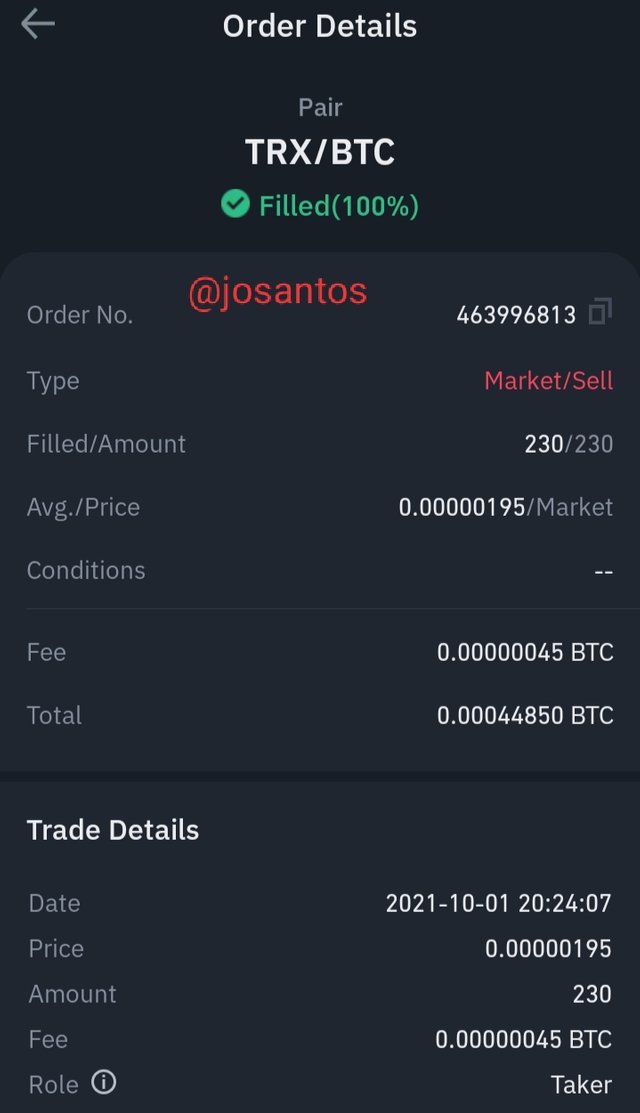

Here in this question I will be using my Binance verified account to perform the said transaction. The three crypto asset I selected are TRX, BTC and XRP.

First I sold 230 TRX to get about 0.00044850 BTC at the TRX/BTC exchange rate of 0.00000196. See screenshots below.

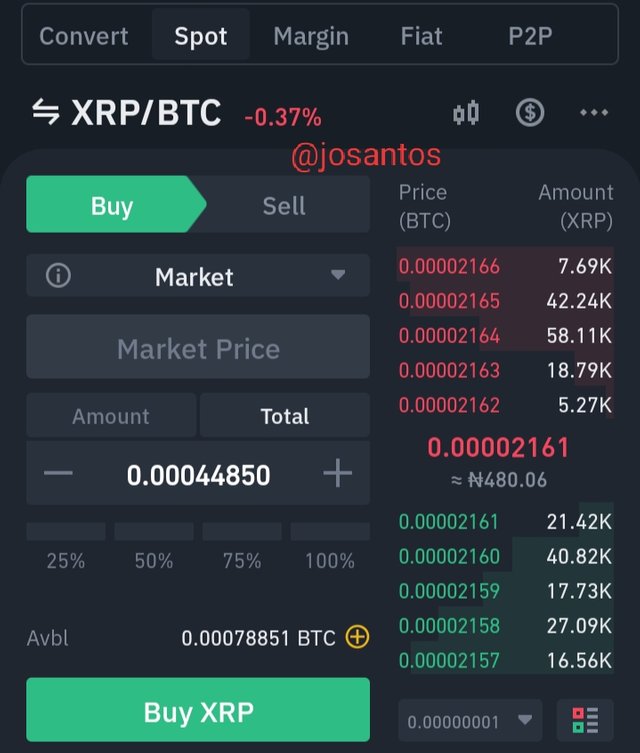

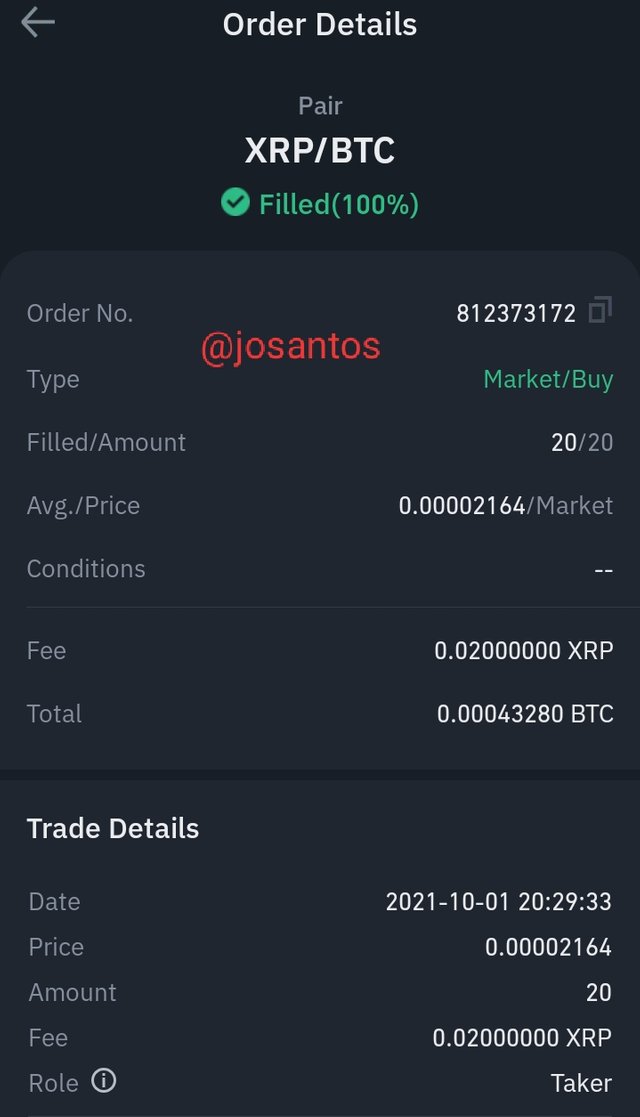

After that I proceeded to purchase XRP by selling the BTC. I sold 0.00044850 BTC to purchase 20 XRP at the BTC/XRP exchange rate of 0.00002161 BTC. See screenshots below.

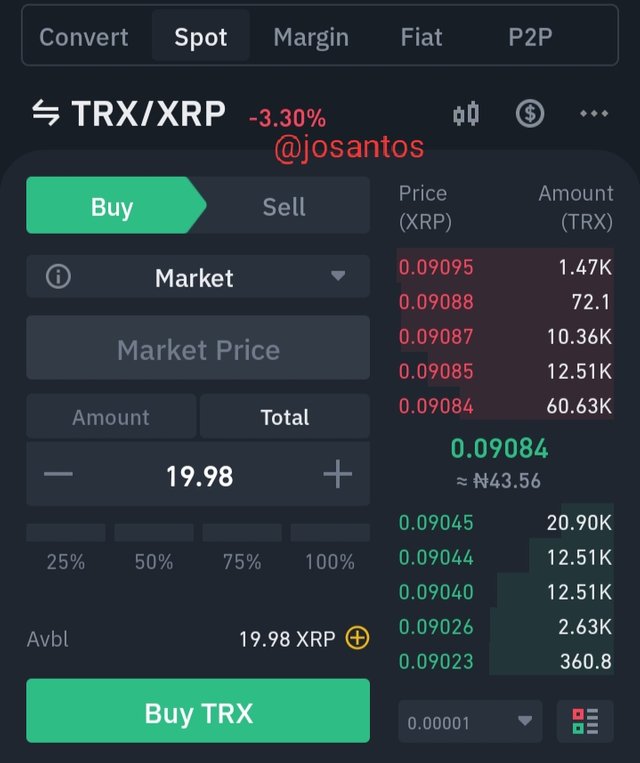

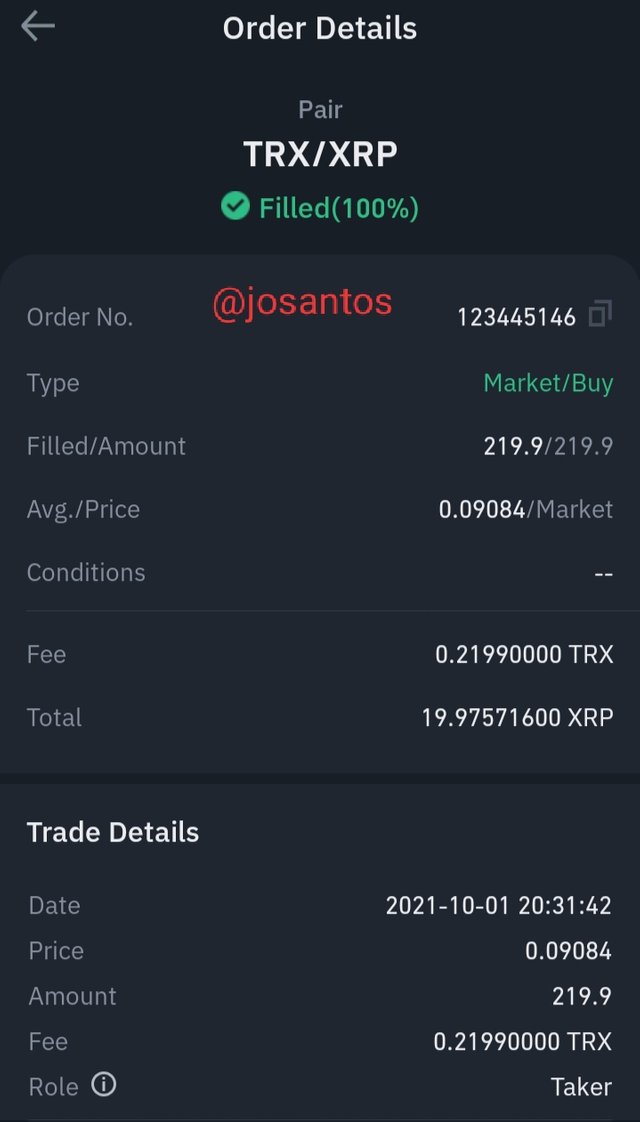

To complete the transaction, I sold the XRP to get back my TRX. The exchange rate of the pair of XRP/TRX is 0.09084 XRP. See screenshots below.

There was no profit in the trade because I sold 230 TRX and while buying I bought less. Though I didn't spend much time in waiting for the price to rise.

6- Explain the advantages and disadvantages of the triangular arbitrage method in your own words.

The table below shows the advantages and disadvantages of the triangular arbitrage.

| S/No. | Advantages | Disadvantages |

|---|---|---|

| 01. | The triangular arbitrage trading has a feature of low risk associated with it. That is the loss in minimal | There are risk when it comes to execution most especially when the opportunity of trade entry is not consumed. |

| 02. | Profit is sure once you observe the market and perform good analysis | Insufficient liquidity in the market can cause loss of resources |

| 03. | Profits can be gotten by traders with just a blink of an eye | When traders are not fast enough, there is a tendency they can loss their asset |

Conclusion

This is really a very interesting and educative lecture on Cryptocurrency Triangular Arbitrage, I have learnt at the course of this lecture what the Triangular Arbitrage is all about. Note also that this strategy makes traders gain more profit while trading because it happens to be one of the simplest strategy use by traders to make profit. Thank you so much professor @reddileep for such an amazing lecture. I do hope to learn more from you shortly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit