With all meekness of soul, I welcome you to my first assignment for this new season and I pray that this new season will be more educative and fun-filled than the previous season.

In my blog of season 4 Week1 assignment given by prof @awesononso, we will be learning on the topic Bid-ask Spread. This topic promises to be educative and full of entertainment as we will also explore and gain knowledge on liquidity and slippage of a market.

As we have always done, we begin by attempting the first question of the week;

PROPERLY EXPLAIN THE BID-ASK SPREAD

It will be unprofessional to discuss bid-ask spread without first gaining insight on demand and supply of a commodity.

Demand may be explained as the amount [in quantity] of goods that a consumer is willing to pay for, to own, at different prices over a jurisdicted period of time.

It is also good to bring to our notice that demand differs from wants as want is a strong desire for goods without the monetary power to purchase it.

LAW OF DEMAND

The law of demand can be explained as "with the normal functioning of all things, the increment in price of a commodity leads to decrease in demand of such a commodity and the decrease in price of a commodity results in increment in the rate of demand of such a commodity"

For example, there will be a large number of people rushing to purchase BTC if it's price should dump to $5000 than if the price should escalate to over $100000.

Supply on the other hand may be defined as the quantity of commodities that a manufacturer is willing to give off for sale at a given price over a given period of time.

LAW OF SUPPLY

The law of supply can be stated as "increment in price lead to increment in the quantity of commodity supplied and vice-versa.

In a market, price is one of the most important factor that affects the rate of demand and supply, and we shall be examining two type of prices known as bid price and ask price.

BID-ASK PRICE

As humans that we are, no one loves to be cheated nor extorted and no one loves to loose.

Also, in a market, no human enjoys being at loss when performing a trade, either buying or selling.

This law of nature of always wanting to make profit is what led to Bid-ask price.

For example, let's imagine that I am a trader and I bought goods at the rate of $50 each, definitely I won't sell that commodity at a price lower than it's cost price as my aim of trading is to make profit.

Due to the fact that I want to fulfill my aim of making profit, I can decide to sell such a commodity at a price of $150 so I can make profit of $100.

A consumer will display interest in my commodity but might not be willing to pay $150, he might plead to pay $50 of which I won't agree, then negotiation begins.

From the negotiation of prices, I will set the lowest price for which I wish sell such a commodity, I can decide that the lowest price I'll sell such a commodity is $100, that $100 is acting as the ask price of such a commodity.

The consumer can either accept my price and purchase the commodity or refuse to buy such a commodity, saying is not willing to pay $100, that she can only pay $90 for the commodity.

The $90 she is willing to pay serves as the bid price of the commodity.

From the example above, we can easily deduce that bid price is the highest price that a consumer is willing to pay for given goods and services and ask price is the lowest price a trader is willing to receive inorder to let go of a commodity

Also to explain what a Bid-ask Spread is, is an easy task, as a Bid-ask Spread is the difference between the bid price and the ask price of a commodity.

It can be mathematically represented as

Spread= Ask price– bid price.

The mathematical calculation to the Bid-ask Spread of my above illustration is given as ;

Spread = $100– $90

=$10

And it's percentage can be calculated using the formula

%spread = Spread/Ask price ×100.

Applying this calculation to my illustration, we have;

10/100×100

=10%.

Wow, this adventure is really interesting, I can't wait to move to the next phase of this educative adventure, shall we proceed by exploring the next question

WHY IS THE BID-ASK SPREAD IMPORTANT IN A MARKET

Just as textbooks are important to students, especially those preparing for exams so also is the importance of Bid-ask spread in a market.

Bid-ask spread helps both the buyer and the seller in the following ways:

- It helps the seller a lot in the sense that it helps the seller determines the perfect price tag to place on a commodity that will attract a lot of buyers and at the same time earn him profit.

- It also helps the buyer determine how to beat down the price of greedy sellers that want to extort from them

- It also helps in checking the liquidity rate of a market, that is, the ease with which items are traded in a market.

I will love to bring this important rule to our notice that the higher the bid-ask spread, the lower the liquidity and the lower the bid-ask spread, the higher the liquidity

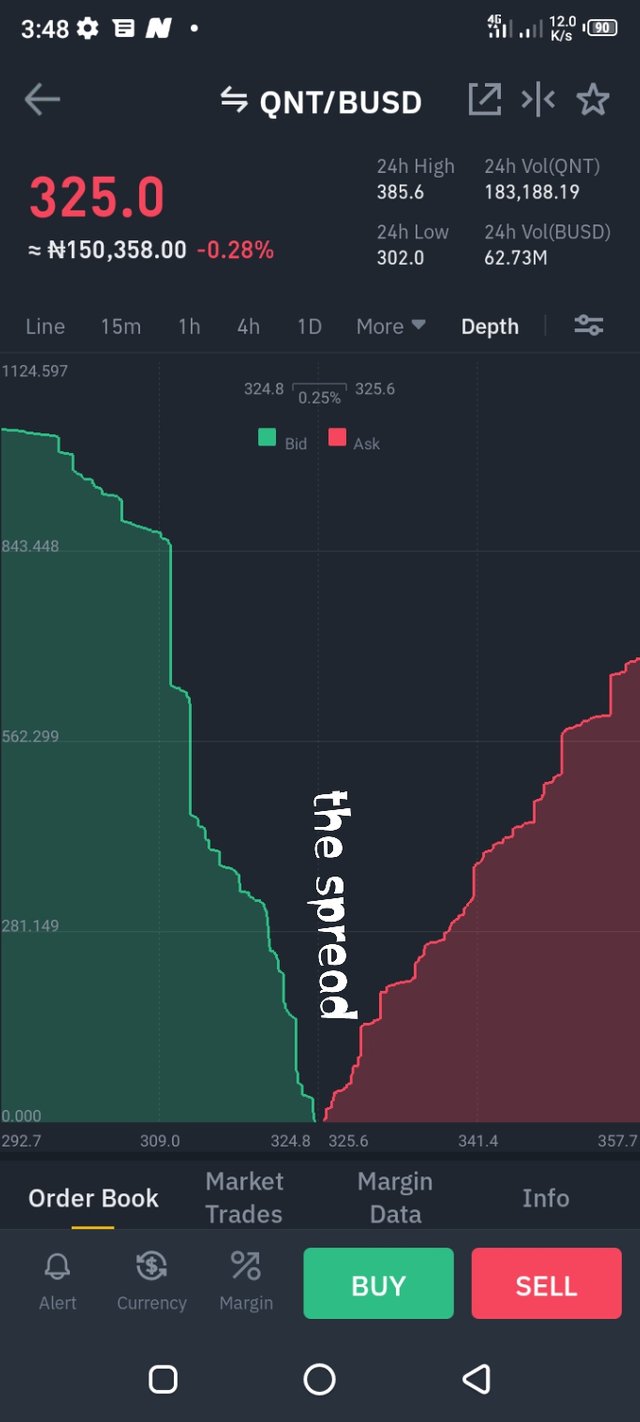

Below are some screenshots of bid-ask spread taken from binance

Screenshot from binance

Screenshot from binance

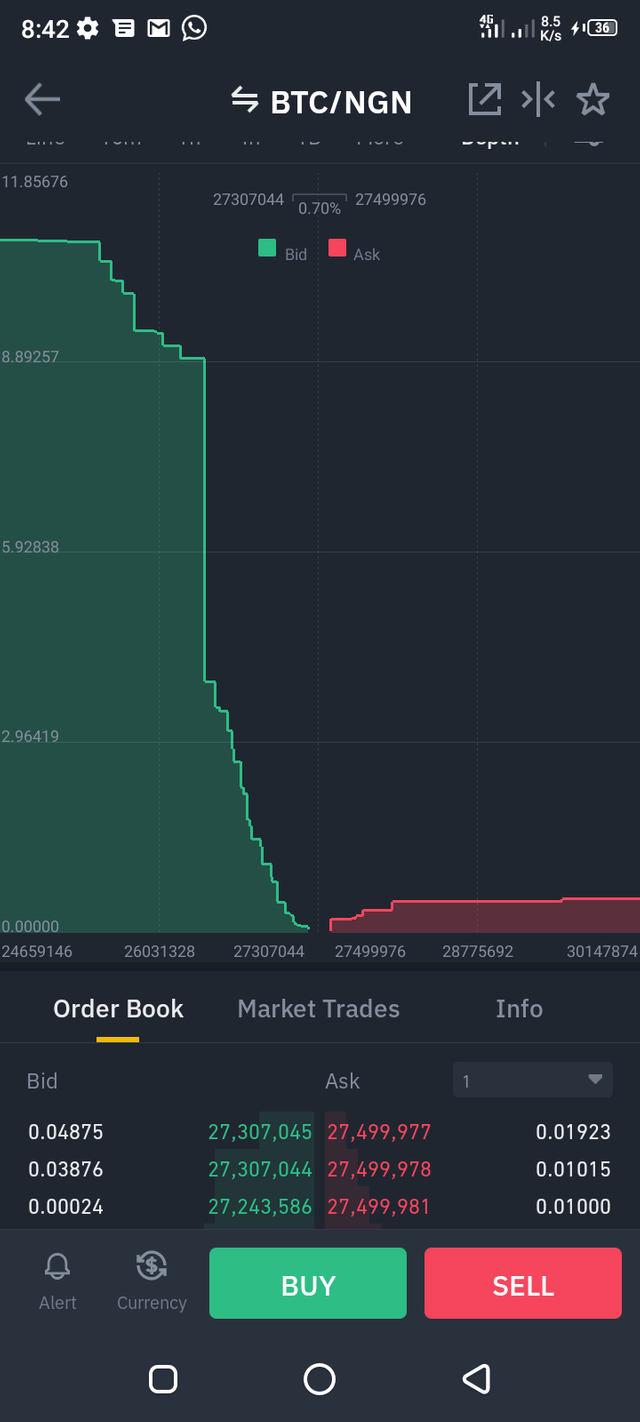

Screenshot of Spread between btc and ngn from binance

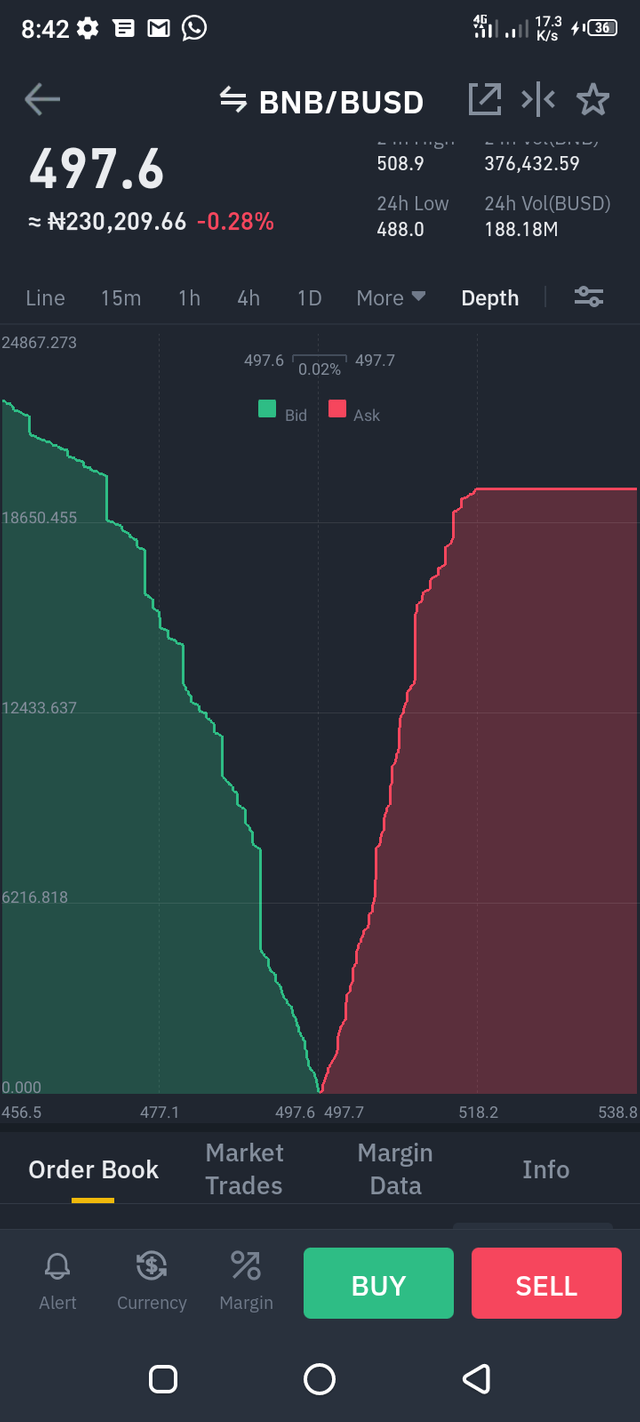

Screenshot of Spread between bnb and busd from binance

The color green represents the bid price and the red represents the ask price

From the above screenshots, the second has more liquidity, this will be further explained as we continue our journey by proceeding to the next task.

Please I encourage all to pay more than usual attention to the next two task as they consist of some calculations.

IF CRYPTO X HAS A BID PRICE OF $5.00 AND A ASK PRICE OF $5.20

A.) Calculate the bid-ask spread

B.) Calculate the bid-ask spread in percentage

SOLUTION

These calculations are easy tasks to do.

Recalling from our adventure in Question 1, the formula for calculating bid-ask spread is given as :

Bid-ask spread = Askprice – Bidprice

And it percentage spread is given as :

Spread/Ask price×100.

Applying this calculations we proceed to

A.)

Askprice = $5.20

Bid price = $5.00

Bid-ask spread = Ask price– Bid price

= $(5.20–5.00)

= $0.20

B.)

Spread = $0.20

Askprice = $5.20

%spread = 0.20/5.20×100

= 3.85% [3.s.f]

Having well understood this calculation, shall we proceed to the next inorder to better our understanding on the calculation aspect as practice makes perfect.

IF CRYPTO Y HAS A BID PRICE OF $8.40 AND AN ASK PRICE OF $8.50

A.) Calculate the Bid-ask spread

B.) Calculate the Bid-ask spread in percentage

SOLUTION

Re-applying our previous formulas, we have

A.)

Askprice = $8.50

Bidprice = $8.40

Bid-ask spread = Askprice–Bidprice

= $(8.50–8.40)

= $0.1

B.)

Spread = $0.10

Askprice = $8.50

%spread = 0.1/8.50×100

=1.18% [3.s.f]

Let's see what our next question have for us, could it be on calculations too? How we love these calculations!

IN ONE STATEMENT, WHICH OF THE ASSETS ABOVE HAS THE HIGHER LIQUIDITY AND WHY?

In a statement, Crypto Y has the higher liquidity.

Crypto Y has a higher liquidity because it has a lower value of Bid-ask spread.

As the rule goes, the lower the bid-ask spread, the higher the liquidity and the higher the bid-ask spread, the lower the liquidity.

We are gradually coming to the end of this fun-filled adventure, follow along as we explore the next task.

EXPLAIN SLIPPAGE

The word slippage is mostly heard of in crypto markets and this occurs due to the fact that crypto markets most times posses low liquidity, that is, they possess a wide Bid-ask spread.

This means that there's a huge difference between the Bidprice and the Askprice and this makes traders to place market order on commodities.

A lot of price fluctuations takes place within the period that a trade takes to be executed and this fluctuations give rise to slippage.

Slippage can therefore be defined as a phenomenal where by the expected or initiated price of a trade is not the same with it's executed price.

It can further be explained as change in price of a commodity from the time a trade was initiated to when it was executed.

Finally, on our way to the last task of this wonderful adventure

EXPLAIN POSITIVE SLIPPAGE AND NEGATIVE SLIPPAGE WITH ILLUSTRATION FOR EACH

It is true, the fact that there are fluctuations in prices means that there can either be increase in price or decrease in price.

These fluctuations gives rise to positive and negative slippage.

POSITIVE SLIPPAGE:

A positive slippage is a phenomenon whereby the execution price of a trade is favourable to a trader.

For a purchase market order, a positive slippage occurs when the execution price is lower than the expected price.

For a sale market order, a positive slippage occurs when the execution price is higher than the initiated price.

For example:

If a buy order was placed at $500 for crypto D but the trade was executed at $450, the trade has experienced a positive slippage of $50 gotten from the difference between initiated price and executed price.

Also, If a sell order was placed at $500 for crypto F and it's execution price is $580, a positive slippage has been experienced by the trade.

NEGATIVE SLIPPAGE:

This is one that happens at unfavorable execution price to the trader.

For a purchase order, a negative slippage occurs when the execution price is greater than the expected price.

For a sale order, a negative slippage is said to have taken place when the execution price is lesser than the expected price.

For example

If a buy order for Crypto A is placed at $500 and the trade was executed at $520, the trade has experienced a negative slippage of $20

If a sell order for Crypto A is placed at $600 and the trade was executed at $570, a negative slippage of $30 has been incurred by the trade.

Slippage in market can be avoided by placing limits on orders.

CONCLUSION

This topic has proven beyond reasonable doubts to be educative and fun-filled.

I have really gained a lot from this topic, I appreciate prof @awesononso for this great lecture, I eagerly look forward to your next lecture sir.