Hello guys,

I believe we are all doing great, I remain with the name Obioma Charles.

I want to use this medium to welcome you to my assignment post for this week, lectured by @reminiscence01 on the trading of Cryptocurrencies.

Please follow along on this assignment as it has proven to educative and interesting.

Without any further ado, shall we proceed to our first task

EXPLAIN THE FOLLOWING STATING ITS ADVANTAGES AND DISADVANTAGES

EXPLAIN THE FOLLOWING STATING ITS ADVANTAGES AND DISADVANTAGES

- SPOT TRADING

- MARGIN TRADING

- FUTURE TRADING

- SPOT TRADING

- MARGIN TRADING

- FUTURE TRADING

As it is popularly known, trading is said to occur when there's a successful buying and selling transaction.

SPOT TRADING

Spot trading, as the name implies, trading on a spot.

Spot trading is the buying and selling of a commodity at it's current market price, sometimes called the spot price.

We can say that spot trading is the buying and selling of commodities in which the commodities bought are immediately delivered.

Spot trading is related to market order, in the sense that market orders are executed at the spot price of a commodity.

In spot traders either looses or gains money with spot trading.

When a trader purchases a goods at it's market spot price, and the good then increase in value, then the trader is in profit.

In contrast, If the commodity should depreciate in value and the traders sells at that point, the trader is in loss.

Spot trading in a sense can be compared to normal trading with our Fiat currency otherwise known as money, you get what you want at the price you paid for, and it is delivered to you immediately.

For example, if I am to purchase a commodity worth $50, the commodity will be delivered immediately the money has been paid.

In spot trading, long term investors are being favoured as they are given the opportunity to purchase goods at a spot price and sell off when there's a great increase in the price of such commodity.

- It delivers goods/commodities with immediate effect

- It has transparent market prices

- Spot traders are given the opportunity to hold to their coins until the spot market price is favourable to them.

- Transactions are made and finalized once, on a spot

- There's no minimum funds requirement to be a spot trader.

- Profits in spot trading are of little value when compared to margin trading

- There's no room to alter a trading transactions once it has been made. This means that when you make an unfavorable trade, you cannot remake that same trade.

- Sometimes spot traders looses money when they purchase a commodity at an inflated price only for such commodity to return to it's normal price.

- Once there's a great downtrend line in a cryptocurrency pair, a spot trader will have to wait for a favourable market conditions before executing his trade and this waiting period might take a long time.

- There's no future plan when embarking on a spot trade. You buy at the spot price.

MARGIN TRADING

Margin trading is a kind of trading whereby traders make use of borrowed funds inorder to carryout trading transactions.

Margin trading gives traders the opportunity to invest more funds in trading, hereby producing more profits.

Let's give an instance, I want to purchase 1btc for trading and I don't have enough funds with me, I will go ahead to borrow with interest inorder for me to execute my trade. Thats how margin trading works.

The importance of margin trading cannot be overemphasized, as it is used by traders to open a short and a long positions.

The short position represents the imagination that the price will go downward and the long position indicates that the price will experience an uptrend movements.

In margin trading, the trader's assest usually serve as collateral when a margin position is initiated.

ADVANTAGES OF MARGIN TRADING

- Maximized potential return is possible due to greater leverages

- Availability of more trading opportunities

- Increment in a trader's income from cash dividend

- Diversification

DISADVANTAGES OF MARGIN TRADING

- HIGH RISK:

To borrow money with the intention of trading is a big risk on a traders part, as 100% success of such trade is not guaranteed. - INTEREST FEE:

Another disadvantage is that a trader must pay the interest attached to the money he borrowed as borrowing money is not free. - Maintenance requirements is another disadvantage of margin trading, where trader will have to give like 40% for maintenance requirements depending on his broker.

FUTURE TRADING

As the name implies, futures trading can be likened to a deal to buy/sell a commodity at a given price in the future irrespective of the price swing of such a commodity.

This type of trading is recommended only to experienced crypto traders as it deals with the future prediction of prices by the trader.

For instance, I want to purchase steem at the rate of $1, I can enter a future trading to purchase that same steem in the nearest future for $1 irrespective of it's price, either high or low.

When the market is correctly analyzed, a trader will be able to detect the best spot to enter and leave the market and inturn, maximizes his profit.

ADVANTAGES OF FUTURE TRADING

- It helps in generating fast wealth if the market is correctly analyzed

- There's nothing like time decay in terms of assets value, this means that its assests are not prone to devaluation.

- Presence of high liquidity rate which enable traders to enter and leave a market whenever they please.

- It's pricing system is easily understood

DISADVANTAGES OF MARGIN TRADING

- A trader has 0% control over it's future price events

- Presence of expiring dates in terms of trading

- Leverages often leads to high fluctuations in future prices and this sometimes go against a trader.

Without wasting time, shall we proceed to the next task

EXPLAIN THE DIFFERENT TYPES OF ORDERS IN TRADING

SCREENSHOT FROM BINANCE

In crypto trading, there are different types of orders with different functions that aids the smooth running of trading, they are;

- Market order

- Limit order

- Stop limit order

- Oco order

- Exit order.

The above mentioned will be further explained, please join me.

MARKET ORDER:

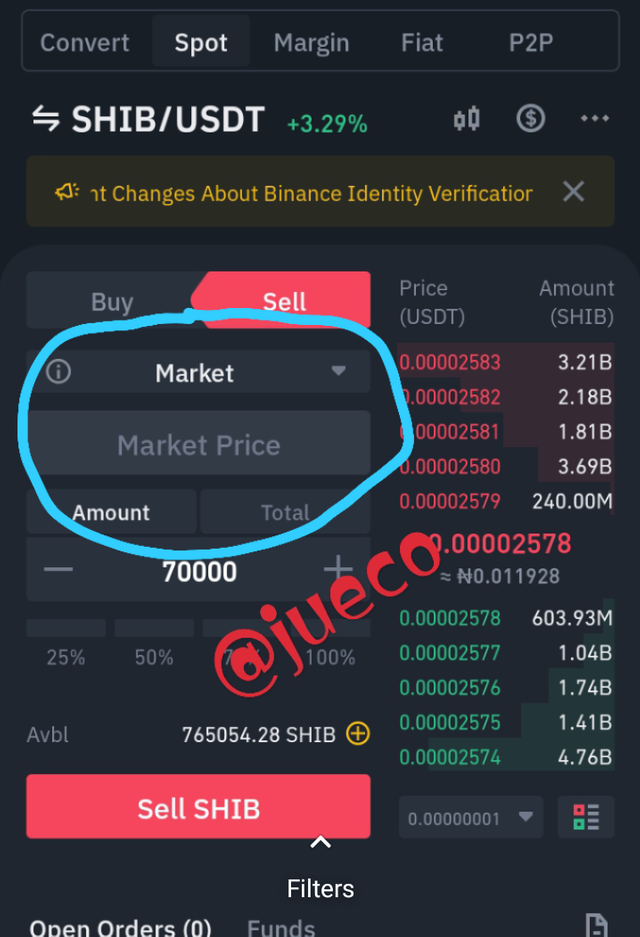

SCREENSHOT FROM BINANCE

A market order is a command to buy/sell a commodity at the current price of the market.

This means that irrespective of the price of the market, the commodity will be bought instantly and the trade executed immediately.

The fixed price of a commodity is not assured when trading with a market order but the quick execution of such trade is guaranteed.

The price an investor agrees to buy/sell a commodity may not be the exact price he will buy the commodity. It's either there's an increase in the market price or a decrease in the market price of such commodity, and this occurs due to the high rate of volatility of a market.

A market order should be opened only during market hours, if not, the order will be executed on the next opening of the market.

Market order is mostly used by market takers, the executors of market.

LIMIT ORDER :

A limit order is an order placed for a trade to be executed at a price more convenient for the trader, than the current market price of such commodity.

The execution of a limit order takes place only at the specified price placed by a trader.

By opening a limit order, a trader is only trying to make a trade at a price most favourable to him.

For example, the given market price of a currency is $40 and a trader wants to pay $30 for that currency, he will place a buy limit order of $30, hereby instructing the market takers to execute the trade at $30 or below.

STOP LIMIT ORDER:

SCREENSHOT FROM BINANCE

A stop limit order,just like every other order, is an order that triggers the initiation of a limit order.

It is also good to note that the ignition of a stop limit order is not a guarantee that the an order will be filled.

When a stop limit order is placed, it goes straight to the exchange and then forwarded to the order book, where it is kept until the order is halted or executed.

The stop limit order is very important, especially to traders that are unable to monitor the market closely.

It helps to make profit by automatically triggering a pending order when it gets to it's execution price.

A stop limit order comprises of the stop price and the limit price

Opening a sell stop limit order indicates that you want your commodities sold once it gets to your stop price.

OCO ORDER:

SCREENSHOT FROM BINANCE

"OCO ORDER" with it's full meaning as "one cancels the other order" is a pair of orders in which the execution of one of the orders leads to the automatic cancellation of the other.

An oco order is usually in pairs, that is, in twos, the limit order and the stop order.

When one of the above mentioned order is attained, the other cancels automatically.

The oco order helps in the mitigation of risk and it is different from the OSO order.

The OSO order is a pair of order in which one is triggered the moment the Other is executed.

EXIT ORDER:

An exit order is an order that helps in selling out a trader's commodity.

The aim of an exit order is to reduce the rate of losses a trader will encounter when a trade goes against him.

In an exit order, a commodity will only sell out when the market is going against the trader, but if otherwise, it won't sell out, it will continue to make profit.

HOW CAN A TRADER MANAGE RISK USING AN OCO ORDER

As earlier discussed, the oco order is a combination of two orders; the limit order and the stop order.

The limit order assists a trader in making profit over a commodity in a market while the stop order helps him alter a trade inorder to minimize loss.

For example, if a trader decides to purchase BTC, he can place an oco order for BTC.

Imagining the market price of BTC is $55000,he can place an exit for profit or I'll rather say a limit order at $60000 and a stop order at $50000.

In such a case, whichever of the two orders fills first, the other will be cancelled.

It is also good to note that in placing an oco order, the stop order should be placed lower than the market price, In order to prevent immediate execution of trade.

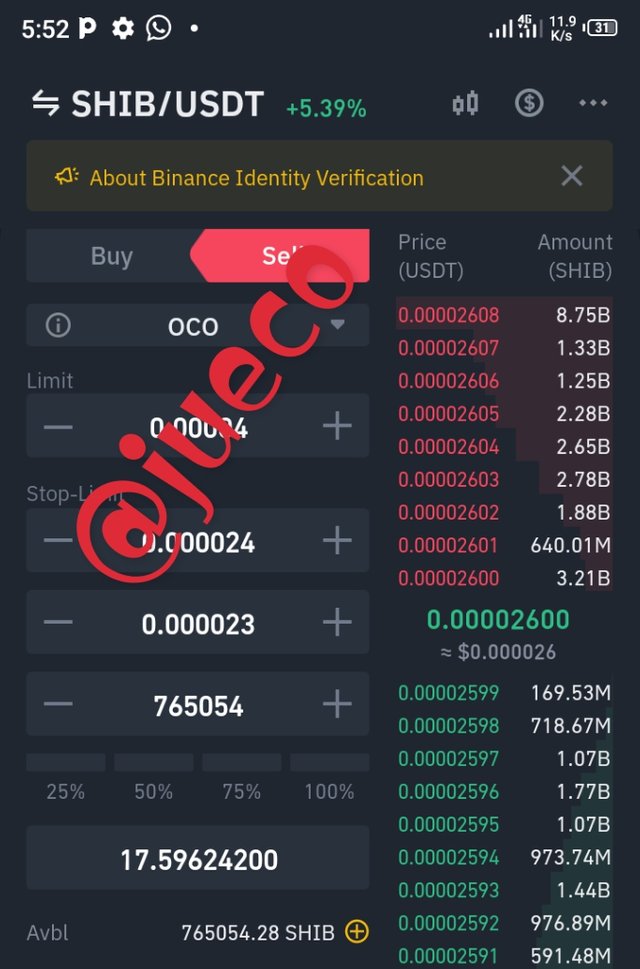

SCREENSHOT FROM BINANCE

From the screenshot above, I placed an oco order on the crypto pair SHIB/USDT.

I have a total of 765054 tokens in my binance exchange and I want to sell all, as of when this post was made, the market price of SHIB is 0.000026, so placed an oco order with a limit price of 0.000024, a little lower than the market price, I then placed a stop order at 0.000023.

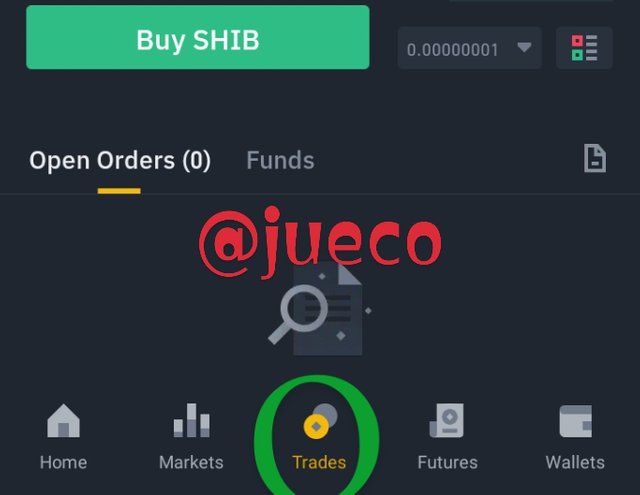

OPEN A LIMIT ORDER ON ANY CRYPTO ASSEST WITH A MAXIMUM OF 5USDT AND EXPLAIN THE STEPS FOLLOWED

I did this by visiting my binance as usual, clicked on trade which will enable me to open a limit order and I placed my order

SCREENSHOT FROM BINANCE

I opened a buy limit order on the crypto pair SHIB/USDT.

I placed my buy limit at 0.00002559 of which the market price was 0.00002583.

Below are the screenshots

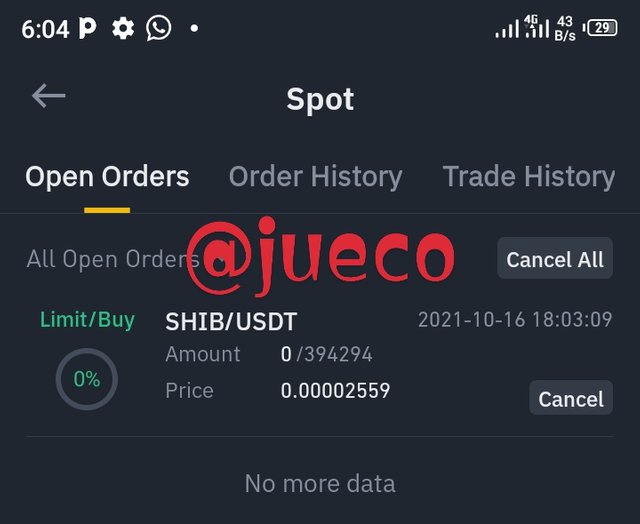

SCREENSHOT FROM BINANCE

SCREENSHOT FROM BINANCE

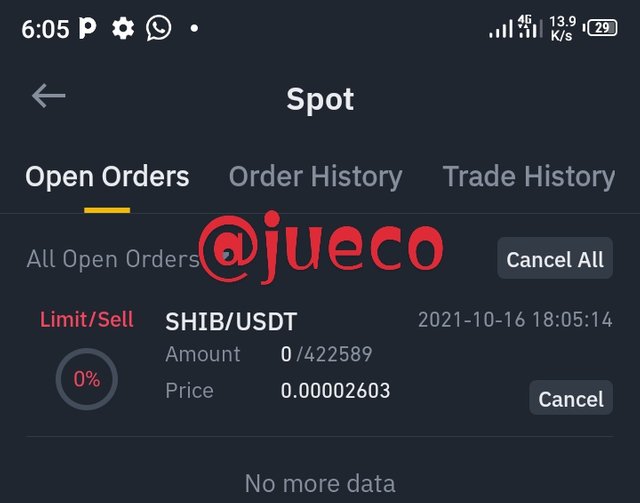

I also went ahead to open a sell limit order on the same crypto pair.

I placed my sell limit at 0.00002603, with the market price at 0.00002586, below are my Screenshots

SCREENSHOT FROM BINANCE

SCREENSHOT FROM BINANCE

USING A DEMO ACCOUNT OF ANY TRADING PLATFORM, CARRY OUT A TECHNICAL ANALYSIS USING ANY INDICATOR AND OPEN A BUY/SELL POSITION ON ANY CRYPTO ASSET. THE FOLLOWING ARE EXPECTED.

i) WHY YOU CHOSE THE CRYPTO ASSET

ii) WHY YOU CHOSE THE INDICATOR AND HOW IT SUITS YOUR TRADING STYLE.

iii) INDICATE THE EXIT ORDERS.

USING A DEMO ACCOUNT OF ANY TRADING PLATFORM, CARRY OUT A TECHNICAL ANALYSIS USING ANY INDICATOR AND OPEN A BUY/SELL POSITION ON ANY CRYPTO ASSET. THE FOLLOWING ARE EXPECTED.

i) WHY YOU CHOSE THE CRYPTO ASSET

ii) WHY YOU CHOSE THE INDICATOR AND HOW IT SUITS YOUR TRADING STYLE.

iii) INDICATE THE EXIT ORDERS.

I proceeded to make use of mt5 and I chose the crypto pair ETH/BTC because that are the two most leading Cryptocurrencies in the cryptoworld and I believe that they will be perfect for this assignment.

SCREENSHOT FROM MT5

From my Screenshot above, it is clear that I made use of stochastic Indicator.

I decided to use Stochastic Indicator because it assists a lot in the prediction of trends reversals.

It also helps in the identification of overbought and oversold level.

The fact that an indicator should not be used solely for technical analysis as it gives wrong signals at times became true in my case, and this made me make a wrong choice of entry and exit.

From my above screenshot, my entry point is 0.06308 and my exit is 0.06304.

So I decided to retake the trade using a different crypto pair, this time around, I made use of what is known as trend in trend strategy.

The trend is acting as my Indicator, which help me Analysis the chart of the market

SCREENSHOT FROM MT5

CONCLUSION

Trading of cryptocurrency is one thing that is inevitable in the cryptoworld as it helps traders make huge amount of money in a little period of time.

As explained, there are different types of orders which assist in the smooth execution of trading, a good example is the oco order, this helps in risk management in market.

I really appreciate Prof @reminiscence01 for this lecture, I look forward to your next lecture Prof.

Hello @jueco, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observation

This is correct, as the market price might not get to the stop limit point for the order to be filled in the near future.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review Prof

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit