Hello great Steemians, I am happy to be here again and I trust we all are doing great. I want to sincerely thank Professor @reddileep for this wonderful lecture delivered. I will be submitting the solution to my assignment below:

1- Introduce Leverage Trading in your own words.

The word leverage trading is all about a broker allowing a trader to have more open position in the market with little amount of money. Here they are allowed to pay lesser than the full amount of the investment. However, traders are allowed to open greater position in the market without having to pay the full cost price

I want you to know that leverage trading is very risky but very important skill that can change your life for good when trading Crypto. One thing you need is the ability to trade both more and the capital we have. For example, if we have $15 in our exchange wallet, with the help of leverage trading, you can make ten times of that trade.

Here the trader stand the chance of making profit either by bullish or bearish trend. Bullish trend is when the market is going up, while the bearish is when the market is falling. But i want you to know that leverage trading involves risk, because you can make reasonable amount of money when you execute the trade well but it can still leads to loss of you full investment if the market goes against you and this is what is known as liquidation. That is why you need to learn and apply specialized strategy when trading with leverage.

2-What are the benefits of Leverage Trading?

When we talk of leverage trading, it is a very special kind of trade as listed below:

√ The trader stand the chance of making more profit multiple time more than his investment.

√ In leverage trading, only part of the trader's capital is used is involved.

√ Actually, when trading the underlying asset, you can decide of opening a large portion everly expected.

√ It gives room for diversification of investment into different asset, instead of just using one or two assets

√ The broker is willing to give us the opportunity to get more by opening more position in the market at minimal cost. Note, in leverage you don't need to repay the borrowed amount.

√ You can make provision by adding additional funds when we look at the market movement and we noticed that it's slow, using cross margin will aid this by keeping the position open.

√ You have the choice of closing your positions when you have an advantage in the market or making profits.

√ Traders can still make fast profits by closing an existing order.

3.What are the disadvantages of Leverage Trading?

The followings are the Disadvantages of Leverage trading:

√ There is absent of gaining ownership of an asset.

√ Reasonable amount of funds (margin) will be required to cover the loss, if the market goes against you.

√ If proper care is not taking, vast loss of capital can occur when the market goes the opposite direction of your trading.

√ You should know that there is always periodical charged from your account unlike spot trading that is free from charges.

√ Note that whenever your lost equates the capital in your trading account, we can say that liquidation has occurred.

4.What are the Basic Indicators that we can use for Leverage Trading? (Need brief details for any essential Indicators and their purposes)

Below are the basic indicators that can be used in leverage trading:

Parabolic SAR is a method of trading that give signals of buying and selling. It was devised by J. Walles Wilder, Jr., The aim is to find possible price reversal of assets in the market. This can be found in different exchange such as forex.

This indicator helps a trader to spot buy and sell position in the market. However, we can say that it helps in giving Market signal in either directions mentioned above.

Now you can spot a buying signal when the indicator is below the market (candlestick chart) or any of the charts you are using for trading. However, the indicator appears above the market indicating a sell signal.

For the purpose of this work, the default settings of the indicator are used. But the color can be modify.

Screenshot fromtrading view

This is a momentum indicator normally used in technical analysis that measures the magnitude of recent price changes. However, it helps to evaluate overbought or oversold situation in the price of an asset.

This indicator was develop by J. Welles Wilder Jr. I want you to understand that the RSI display a line graph that which move towards two extremes. I equally want you to know that the RSI settings can be entirely modified and this indicator can be used for leverage Trading. When the Relative Stregnth Index reaches 70 threshold, at this point we are expecting that the price will have a reversal because it's at the end. Also the same senerio occur when the price reaches the oversold region that is 30 thresholds. A trader can open an order when this RSI is in line with parabolic SAR and the EMA with full assurance to make a profit in the market.

Screenshot fromtrading view

The Exponential moving average (EMA) is an indicator that can be used to identify a trend. It was the lag in simple moving average that create room for the Exponential moving average when it involved data with greater load. The EMA has very fast response compared to the SMA in identifying the market trend.

For you to know how this indicator works, when the market price is above the EMA, you should be looking for a buy signal or we can say that it's a bullish trend. While when the market price is below the EMA, we can say the market is bearish. Here we will be looking for a sell trade. We can set our EMA to 200 period, this signifies price data in the last 200 days if we are using the day candle chart.

Screenshot fromtrading view

5.How to perform Leverage Trading using special trading strategies (Trading Practice using relevant indicators and strategies, Screenshots required)

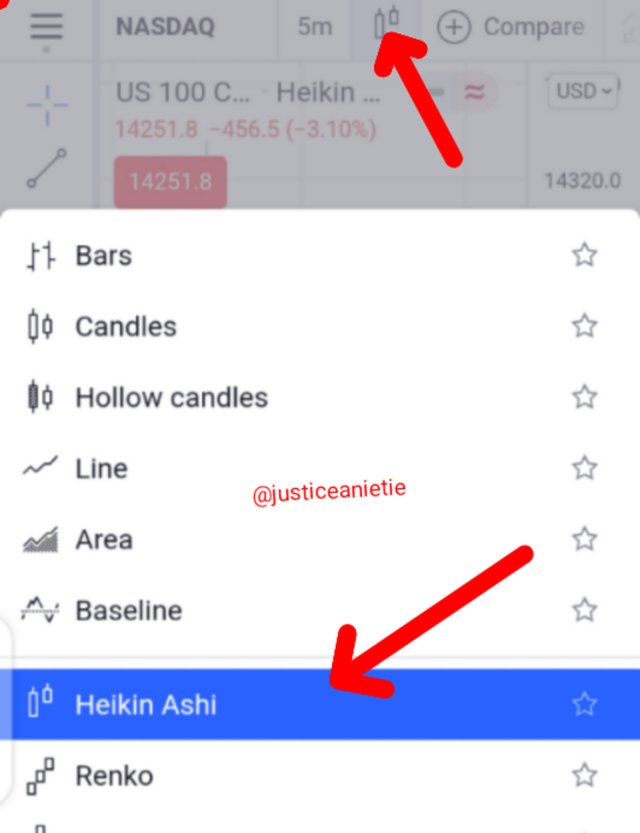

In leverage Trading, there are some special trading strategies that can be employed in order to make a better trading decisions. Using trading view, we will make use of Heikin Ashi Chart as this will help us to get a better signals of the market trends. However, the time frame should be set at 5 minutes.

Screenshot fromtrading view

Buy and sell Position

The following conditions should be put to place before considering to go long in the market:

The market price should be above the EMA

The parabolic SAR dots should be beneath the market price.

The Relative Stregnth index below the mid-range then bullish entry is considered. Note, our tow hints above can be confirmed from the RSI indicator. However, you should have an understanding of thses indicators because the three indicators must have the same signal results before you can execute the trade, otherwise your trade is not save thereby turning against you.

All the conditions needed to take a buy trade has been listed and explained in the above paragraph, however, the reverse is the conditions to execute a sell (bearish) trade. On that not I will not go in details about it again. But remember to follow the settings and time frame of the chart as explained above.

Screenshot fromtrading view

Screenshot fromtrading view

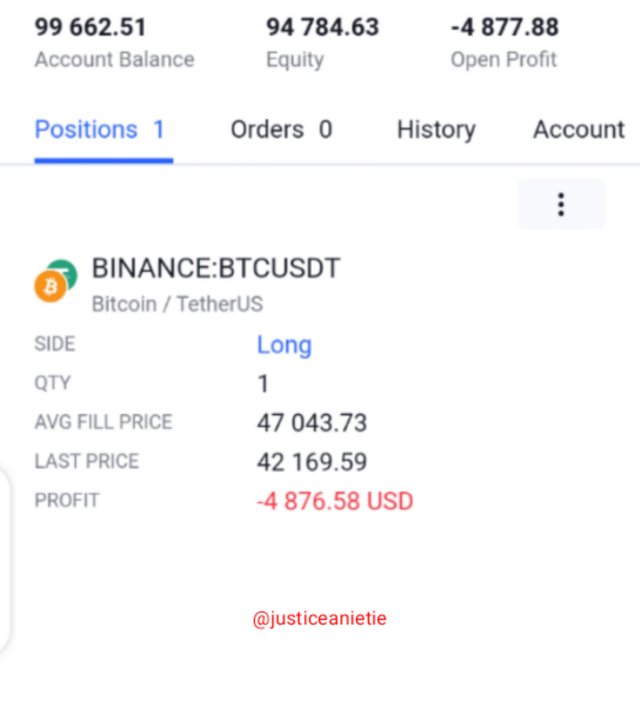

In carrying out this trade, I will be making use of the EMA, Parabolic SAR and the RSI as explained above in placing my order.

Screenshot fromtrading view

Screenshot fromtrading view

I have to Close the trade immediately I saw the Parabolic SAR going over the price chart.

We can see that leverage trading is a way in which a trader can make huge amount of funds but at the same time If proper care is not taking, vast loss of capital can occur when the market goes the opposite direction of your trading.

I have explained a lot concerning this topic above, please kindly read in details to get the inside.

Thank you for your time.