Hello All Steemians !!!

On this occasion, I will try to take a class at Steemit Crypto Academy. I am interested in joining this class because there are many new lessons that I will get here. I will do homework task from professor @wahyunahrul. Lesson discussion about Fear and Greed Index - Market Emotion Measuring Indicator. Lets try...

Explain why emotional states can affect cryptocurrency price movements?

In the world of cryptocurrencies, there are many factors that can influence the price movement of crypto assets. This is evidenced by the situation and conditions that occur in the market which includes the balance of supply and demand, buying and selling transactions, trends, emotions, liquidity, and others. All of this will affect the volatility of the price that continues to occur from time to time. Every investor and trader always tries to make a profit and minimize losses from trading activities carried out in order to increase long-term and short-term investments.

In this case, the concern is the emotions that can affect the price movement of crypto assets. The presence of emotions owned by investors and traders has an influence on trading activities. Here emotions play a role in making the best decision at the end before executing a trade. Every decision taken will have an impact on the rise and fall of the price of crypto assets. In order to reduce risk and make appropriate trades, emotion is a key that every investor and trader should consider.

Market psychology shows that every investor and trader has emotions of fear and greed for what will happen in the market. The thing that underlies the fear is when market conditions begin to turn in an unfavorable direction. This makes investors and traders make decisions by selling and distributing crypto assets causing prices to fall. The thing that underlies the greed is when market conditions begin to turn in a favorable direction. This makes investors and traders make decisions by buying and accumulating crypto assets causing prices to rise. This proves that fear and greed or emotions can affect cryptocurrency price movements.

In your personal opinion, is the Fear and Greed Index a good indicator of the market's emotional state? if not, try to give reasons and examples of other similar indicators for comparison

Fear and Greed Index is an indicator used by investors and traders to observe and analyze the emotions and psychology of the crypto asset market, especially Bitcoin. This indicator is very useful by showing the emotions of fear and greed that cause price volatility in the market over a period of time. The fear phase causes the price to drop and the greed phase causes the crypto asset price to rise. This indicator will provide accurate results on price movements and can be used as a reference for taking the next decision in trading.

Fear and Greed Index has a range of values or like a speedometer that shows the emotional phase of fear and greed in the market. The range of values is from 0 to 100. A range of values 0 - 20 indicates extreme fear. A value range of 20 - 40 indicates fear. A value range of 40 - 60 indicates neutral. A value range of 60 - 80 indicates greed. A value range of 80 - 100 indicates extreme greed. Every investor and trader can read and use it as a reference as a result of analysis in order to place order at the right time.

In my opinion, based on its function, characteristics, accuracy, effectiveness and other advantages, the Fear and Greed Index indicator makes sure that it is very good to be an important point in the emotional technical analysis of the market. All the things provided are able to meet the needs of investors and traders to provide the right strategy to run profitable trades. Fear and Greed Index indicator is very suitable and good for indicating market emotions and psychology.

Give your personal opinion on what data should be added to the Fear and Greed Indicator

I think the Fear and Greed Index needs a more detailed and specific chart timeframe. In this case, the use of timeframes in minutes and hours is a good innovation so that the data provided will be more accurate and clear. Investors and traders of crypto assets have different trading strategies and methods, some of them use scalping and swing methods. Time frame is an important factor that is very influential to support chart analysis to produce profitable trades.

In addition, I think the Fear and Greed Index also requires other data such as its implementation for other types of crypto assets. The presence of this indicator to analyze many types of crypto on the market will be very helpful for investors and traders because investment in the crypto world is very widespread. The presence of this indicator on the Tradingview platform will also be very interesting to wait for because the use and adoption of this platform is very high and has been considered a mecca for technical analysis of crypto assets.

Do a technical analysis for 2 to 3 days (maybe more) using the Fear and Greed Index and the help of other indicators. Show how you made the decision to enter the cryptocurrency market and explain the results of your trade

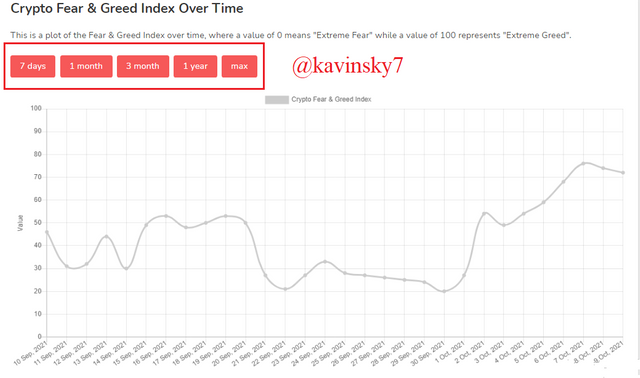

Bitcoin technical analysis using the Fear and Greed Index shows that the current market situation is in the greed phase. This is evidenced by the greed value on October 7, 2021 showing the number 76. On October 8, 2021 showing the number 74. And on October 9, 2021 showing the number 72. In these 3 days the Bitcoin market can be said to be in an uptrend and make many investors and traders buy and accumulate Bitcoins within a certain period of time.

Based on the chart above, I used the Tradingview platform to analyze the Bitcoin market and enter trades at the right time. Here I am using a 5 minute time frame. It can be said that I use the scalping method in this transaction even though it is not suitable. I added MACD supporting indicator to give more accurate results. The MACD 15 and 30 indicators form a Death Cross indicating to place a sell order. I placed a sell order on a bearish candle and placed a stop loss slightly above the resistance level. I set a stop loss and take profit ratio of 1:1. Until this post was made the trade had not been executed. Trade details are as follows:

Conclusion

In the world of cryptocurrencies, volatility in the price of crypto assets is an unavoidable trait. One that affects volatility or price movements is emotion and market psychology. Emotions are closely related to investors and traders, this makes the decisions that will be taken in trading activities can affect prices to go up and down within a certain period of time. In this case the emotions of fear and greed for what is happening in the market are the things that underlie the decisions taken by investors and traders where they definitely want to profit and avoid losses.

Fear and Greed Index is an indicator that is very helpful for investors and traders to provide good data and analysis results on the emotional situation and psychology of the Bitcoin market. This indicator has a value range from 0 to 100 which indicates the emotional phase of fear and greed in the market. Every investor and trader can rely on it as a reference to be able to enter the market and place orders at the right time. The presence of indicators provides many options in carrying out the required trading strategy so as to provide good trading results.