Hello All Steemians !!!

On this occasion, I will try to take a class at Steemit Crypto Academy. I am interested in joining this class because there are many new lessons that I will get here. I will do homework task from professor @awesononso. Lesson discussion about Stability in Digital Currencies. Lets try...

Explain why Stability is important in Digital currencies

The presence of digital currency or cryptocurrency that continues to grow until now has increased the effectiveness and efficiency of the financial world. However, cryptocurrency is known as a digital currency that has risks because there is no underlying certainty. This is because cryptocurrencies do not have a central authority that controls all activities.

In this case, the role of investors and traders is very influential and has an impact on what will happen in the market. Here the difference between fiat currency and cryptocurrency is very visible, where the central bank and government have the authority and regulation in controlling the price of fiat currency, while cryptocurrency has price volatility that continues to occur in the market. The balance of supply and demand is the main factor that influences prices to rise or fall within a certain period of time.

Stability is an important factor that digital currencies or cryptocurrencies must have so that investors and traders can invest and store assets. However, due to the volatile and volatile nature of cryptocurrencies, all matters relating to it must be carefully considered by investors. It aims to gain profit and increase capital from the results of good investment or trading activities. In this case, cryptocurrencies have many choices of assets or the best solution in overcoming the volatility.

In the world of cryptocurrencies, Stablecoins are the right choice and solution for investors to store and invest long-term assets. Presence of stablecoins is very useful in terms of maintaining assets from the risk of loss and beneficial for users as their prices are based on real world assets.

Stablecoins based on fiat currency or USD are the top choice of many investors. This is very profitable because investors don't lose a lot of assets when market volatility is high. Commodity based stablecoins are a good choice for investors. This is very profitable because investors will store assets in the form of gold which has a high level of security. Stablecoins based on crypto are a very profitable choice for investors. This is very profitable because investors have guaranteed stability from other cryptos.

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position

I think the future of CBDC may not be good. CBDC are digital assets whose prices are based on the price of the currency of a particular country that issued them. The reason is not good for me is clear because of course the asset has a central authority so that everything related to it will be controlled and regulated by the authority and regulations of the country. This makes many users do not have the flexibility to carry out financial activities and transactions. In this case, various problems in terms of time, permits, documents, and more maybe will happen and it's not good.

Pros

- Legality

CBDC has definite legality and is suitable for use by many citizens of the country. Users will feel the ease and effectiveness in carrying out activities and transactions in the financial world digitally. - No third party

CBDC allows no third party to carry out all financial activities and transactions. This increases the trust and security of every transaction made by the sender and receiver. - Stable

CBDC will provide price stability because the prices are based on the country's currency and are supported by the central authority.

Cons

- Centralization

CBDC makes the user not have full control over the asset and feel uncomfortable. All activities and transactions must comply with and follow the authority and regulations of the central authority. - Privacy

CBDC allows central authorities to access and search for any information so that user privacy will be disturbed. All activities and transactions that occur will be monitored directly. - Adoption

CBDC requires citizens to have special technology devices and be able to adopt them properly. Some people may still need time, money and sufficient socialization of this.

Explain in your own words how Rebase Tokens work. Give an illustration

Rebase token works with a rebase mechanism that adjusts the supply circulating in the market when the price changes up or down. This is evidenced if the demand for tokens in the market increases, then the circulating supply also increases or is directly proportional. If the demand for tokens in the market decreases, then the circulating supply also decreases or is directly proportional. Here the price change is an important point where if the availability of tokens is high, the token price will decreases. If there is a shortage of tokens, the price of tokens will increases.

The illustration is that Philips buys 10 rebase tokens for $10. If there is an increase in demand in the market, the price will increase. Here the supply will be adjusted and the rebase tokens owned by Philips must increase to 20 and the price remains $10. If there is a decrease in demand in the market, the price will decrease. Here the supply will be adjusted and the rebase tokens owned by Philips should be reduced to 5 and the price remains $10.

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

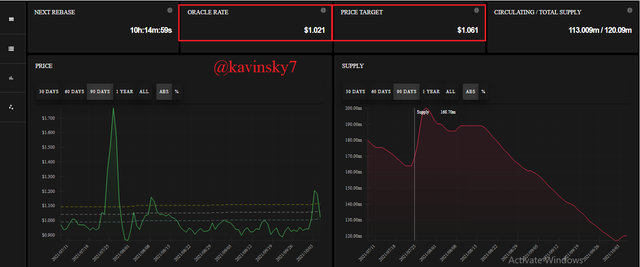

Rebase % = {[(Oracle Rate - Target Price) / Target Price] x 100} / 10

Oracle Rate= $1.021

Target price= $1.061

Rebase% = {[(1.021-1.061) /1.061] × 100} / 10

= {[(-0.04) /1.061] × 100} / 10

= {[-0.0377] × 100} / 10

= {-3.77} / 10

= -0.377%

On the page, you can find a white paper that containing all the data and information you need.

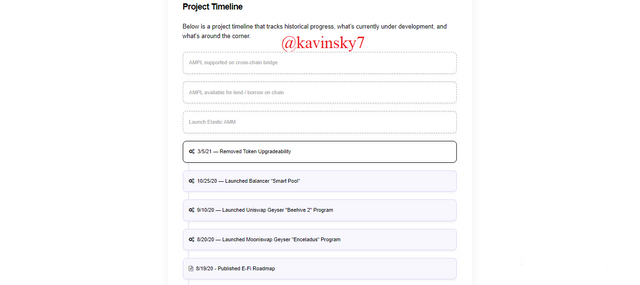

Source On the page, you can find a roadmap containing the scheduled project times.

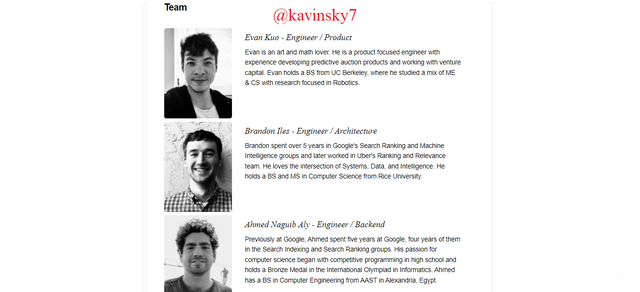

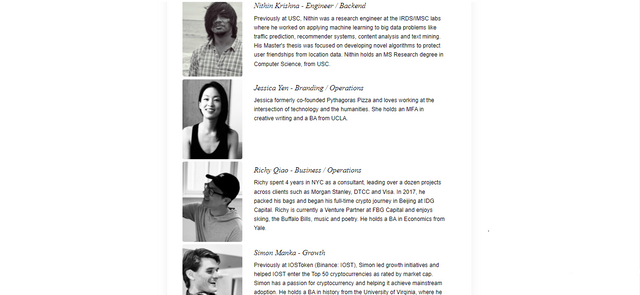

Source On the page, you can find founders containing teams and important people here.

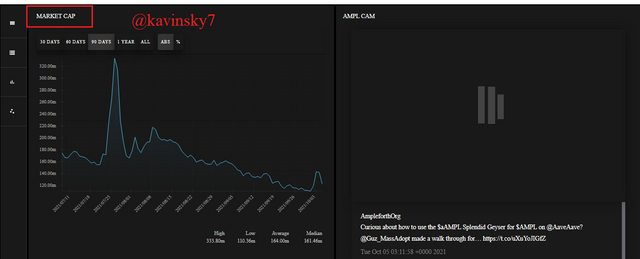

Source On the page, you can find a marketcap that shows a chart over time.

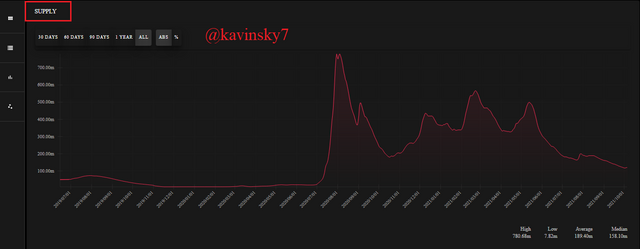

Source On the page, you can find supply that shows a chart over time.

Source

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps

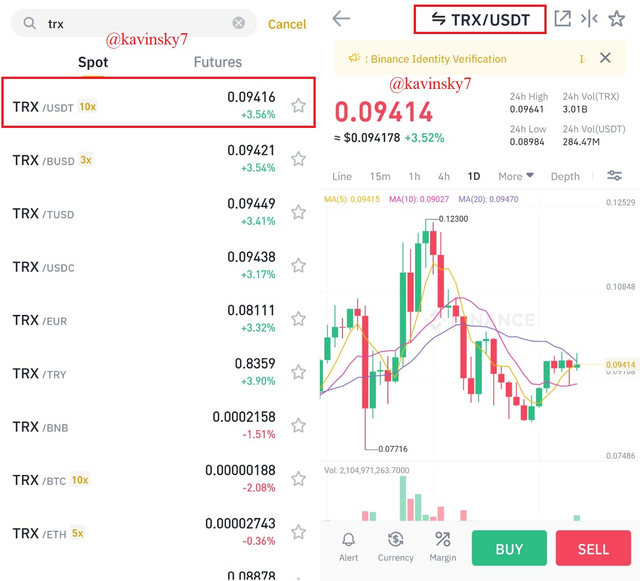

Here I open and log in to a Binance account. I select the TRX/USDT trading pair and click on the sell option like the 2 screenshots I have combined on the screen.

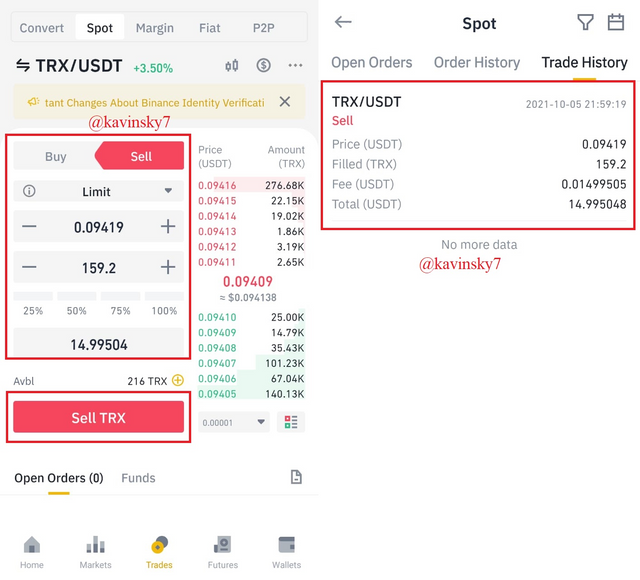

Screenshot From Binance Here I fill the amount of 15 USDT with Limit order option. I clicked sell TRX. The trade was successful and the transaction details are available like the 2 screenshots I have combined on the screen.

Screenshot From Binance

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions?

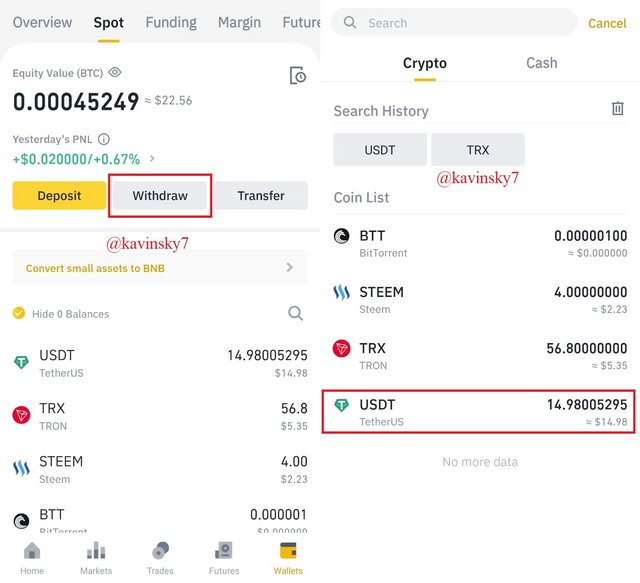

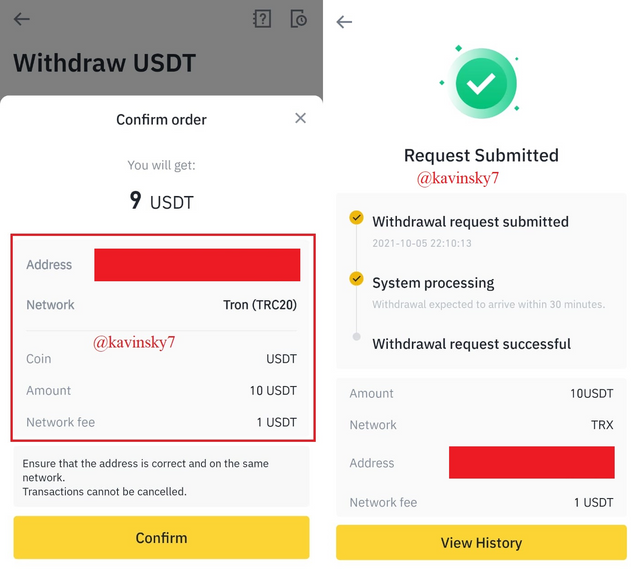

Here I will transfer USDT to TronLink wallet. I clicked on the withdraw option and chose the available USDT coins like the 2 screenshots I have combined on the screen.

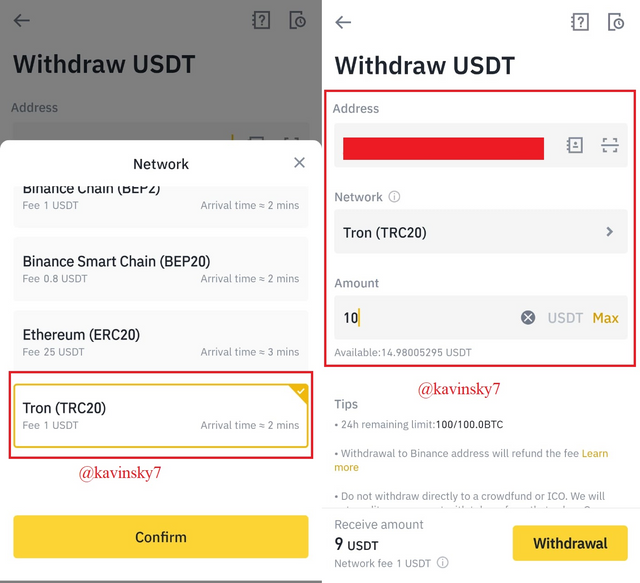

Screenshot From Binance Here I choose the Tron network (TRC20) with a fee of 1 USDT from several other options. I filled in the address and the amount of 10 USDT like the 2 screenshots I have combined on the screen.

Screenshot From Binance Here the transaction details will appear. I will get 9 USDT and fee 1 USDT by using Tron network (TRC20). I clicked confirm. The withdrawal was successful and the transaction details are available like the 2 screenshots that I have combined on the screen.

Screenshot From Binance

Pros Stablecoin Over Fiat Money

- Easy and Fast System

Stablecoin transactions have a system that is easy for users and has a high level of speed compared to fiat currency transactions. I transacted from Binance to TronLink in seconds. - Cheap Transaction Fee

Stablecoin transactions have cheaper transaction fees compared to fiat currency transactions. This applies if cross-border transactions are carried out by users. - Full Asset Control

Stablecoin transactions give users full control compared to fiat currency transactions. Central authorities have no involvement.

Conclusion

In the world of cryptocurrencies, price stability is an important factor that every investor must consider in managing digital currency investments. Stablecoins are the best choice for storing assets that can be used as long-term investments and reduce the risk of loss due to volatility. The development of cryptocurrency is believed to be increasing and it is hoped that other new innovations will emerge that will be useful for users.

Hello @kavinsky7,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You did not really get the point in question 1.

Your illustration and explanation in question 3 needs some work.

You can improve on your explanations and expression.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit