Hello All Steemians !!!

On this occasion, I will try to take a class at Steemit Crypto Academy. I am interested in joining this class because there are many new lessons that I will get here. I will do homework task from professor @yohan2on. Lesson discussion about Risk Management in Trading. Lets try...

Buy Stop

Buy Stop is a order that will be executed when the price of a crypto asset experiences a price movement and indicates an uptrend in the market. The price rising above and breaking the resistance level of the current price is a confirmation to place a buy order. In this case the trader sets a buy stop order by analyzing price movements during the bullish phase and ensuring that if the price reaches and breaks the resistance level, the price will continue to rise.

Based on the chart above, I placed a buy stop order when the price of the XMR/USDT crypto pair was in an uptrend in the market. Here the price of XMR/USDT shows a price increase from the current price. XMR/USDT has resistance level at $204.67. After the price reaches and breaks the resistance level, here I place a buy stop order slightly above the resistance level. This is an order type that is very profitable for traders because it places a buy order for a crypto asset when the price is experiencing a significant price increase.

Sell Stop

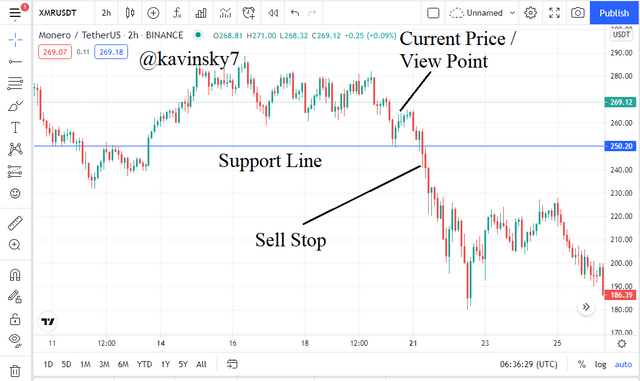

Sell Stop is a order that will be executed when the price of a crypto asset experiences a price movement and indicates a downtrend in the market. The price dropping below and breaking through the support level of the current price is a confirmation to place a sell order. In this case the trader sets a sell stop order by analyzing price movements during the bearish phase and ensuring that if the price reaches and breaks the support level, the price will continue to fall.

Based on the chart above, I placed a sell stop order when the price of the XMR/USDT crypto pair was in a downtrend in the market. Here the price of XMR/USDT shows a decrease in price from the current price. XMR/USDT has a support level at $250.20. After the price reaches and breaks the support level, here I place a sell stop order slightly below the support level. This is an order type that minimizes the loss for the trader by placing a sell order for a crypto asset when the price is experiencing a significant price decrease.

Buy Limit

Buy Limit is an order that will be executed when the price of a crypto asset experiences a significant decrease in price and indicates a downtrend in the market. The price is set at the support level below the current price. This support level is a confirmation to place a buy order. In this case the trader sets a buy limit order by analyzing price movements during the bearish phase with the aim of getting the lowest price and maximizing profits. It is expected that the price will rise after reaching the support level.

Based on the chart above, I placed a buy limit order when the price of the XMR/USDT crypto pair was in a downtrend in the market. Here the XMR/USDT price shows a price drop from the current price. XMR/USDT has a support level at $178.54. Once the price reaches the support level, the buy order that has been set will be executed at the lowest price and can maximize profits when the price will rise afterwards. This is a very profitable order type for traders as it places a buy order for a crypto asset when the price is experiencing a significant price decrease.

Sell Limit

Sell Limit is an order that will be executed when the price of a crypto asset experiences a significant increase in price and indicates an uptrend in the market. The price is set at the resistance level above the current price. This resistance level is a confirmation to place a sell order. In this case the trader sets a sell limit order by analyzing price movements during the bullish phase with the aim of getting the highest price and maximizing profits. The possibility that happens is that the price will go down after reaching the resistance level.

Based on the chart above, I placed a limit sell order when the price of the XMR/USDT crypto pair was in an uptrend in the market. Here the XMR/USDT price shows a price increase from the current price. XMR/USDT has resistance at $275.83. After the price reaches the resistance level, the set sell order will be executed at the highest price and can maximize profits even though the price will drop afterwards. This is a very profitable order type for traders as it places a sell order for a crypto asset when the price is experiencing a significant price increase.

Trailing Stop Loss

Trailing Stop Loss is an order that serves to lock in profits and protect losses for traders by placing a stop loss and take profit percentage of 1:1 or 1:2. This is intended to provide gradual profits for traders by relying on market trend analysis of a crypto asset that shows an uptrend or downtrend. This order will protect the trade and run when the price rises above a certain entry point or when the price drops below a certain entry point.

Trailing Stop Loss is very helpful for traders in making profits and protecting losses against trades executed in volatile markets. If the price moves according to the trader's expectations, then take profit at a predetermined percentage will be obtained. However, if the price moves against the trader's expectations then a stop loss at the set percentage will be executed and the trade will end at the current price. This is a very good order type and trading strategy.

Margin Call

Margin Call is a call made by the broker to the trader to resolve a margin issue that has occurred. In some cases in the trading world, traders often experience very large losses and make all their assets disappear. In this case the broker has good intentions by giving calls and instructions via social media so that the trader can survive and protect against other losses. This call intends to notify the trader to make an additional deposit because he no longer has free margin in his account and can no longer trade.

Things like this happen because traders have created accounts with brokers to be able to carry out trades. Traders will usually pay a certain amount of money to the broker thus forming equity. The next thing is that the trader will also deposit a certain amount of money which will be deposited on the account which is called margin. The amount of margin relates to the amount of equity which will determine the free margin that is on the trader's account. Free margin is what determines the margin call if the trader's account no longer has free margin to trade.

Risk Management in Trading

Trading is an investment made by investors and traders in the cryptocurrency world to generate profits and increase capital. It can be said that trading is a great way to make money even though it has risks. Of course, everything that happens and is involved in the market is not certain. Every gain related with a loss. Potential losses that occur are trading risks.

As a reliable and good investor and trader, all trading risks can be minimized and prevented by creating and implementing good trade management. Not only that, adding and combining good trading strategies and analysis is also needed. Risk management has a big influence in the world of trading and will have a positive impact if it goes according to procedures and runs smoothly.

Risk management can be done in various ways by investors and traders to control risks and potential losses. Thought and action are key in making trade management. Good thinking suggests that if you invest to earn a profit then you have to be willing to take risks in the market and the potential for losses if a bad situation occurs. Good actions show that you should create portfolio management as one of the actions that can protect capital from potential losses if a bad situation occurs.

Portfolio Management

Portfolio management is a factor that investors and traders must consider and do to get the maximum profit from the assets they have. Management of these assets should be profitable in the long and short term. Portfolio management will provide options in distributing assets across many types of assets into small and medium scale investments. For example, investing in 5 assets will provide profits divided into many assets so that it can reduce the risk that can occur in only 1 or 2 assets.Risk/Reward Ratio

Risk/Reward Ratio is a factor that investors and traders must consider and do to get the maximum profit from the assets they have. They have to set this ratio when we trade so that they can accept any situation that occurs in the market, either to gain profit or reduce losses. For example, the risk-reward ratio that traders usually set is 1/2 or 1/3. Price movements that show an increase will give a predetermined profit ratio or price movements that show a decrease will give a predetermined loss ratio.Risk Understanding

Understanding Risk is a factor that investors and traders must consider and do to get the maximum profit from the assets they have. Thoughts and understanding of trading risks must be studied properly so that they can manage asset investments that can be profitable if they meet expectations or detrimental if they do not meet expectations. The assumption which states that asset investment is lost money is the key. For example, invest 1 asset based on salary at a ratio of 1/10. This is an investment risk that is taken from a small part of the salary so that in the event of a loss it will not have much effect.Stop Loss and Take Profit

Stop Loss and Take Profit is a factor that investors and traders must consider and do to get the maximum profit from the assets they have. Technical analysis of an asset is very useful for providing the right decisions and timing in carrying out trades. For example, setting the stop loss and take profit ratio of 1:1 or 1:2 will provide profit and minimize losses on buying or selling assets. Defining this area will help the trader to execute trades on any trend in the market. This setting is very useful because the market is very volatile.

Trading Strategy using EMA

Based on the chart above, the 50 EMA line has crossed the 200 EMA line. The situation that occurs on this chart is called the “Golden Cross”. In this case the 50 EMA line acts as a strong support which indicates a trend reversal from downtrend to uptrend. Here I will place a Buy Order above the Golden Cross or Support point at $169.09. I set Stop Loss below at $145.32 and Take Profit above at $216.63. Risk/Reward Ratio is 1:2. The details are as follows:

Buy Price = $169.09

Stop Loss = $145.32

Take Profit = $216.63

Risk = Buy Price - Stop Loss = $169.09 - $145.32= $23.77

Reward = Take Profit - Buy Price = $216.63 - $169.09 = $47.54

Risk : Reward = $23.77 : $47.54 = 1:2

To run profitable trades in the cryptocurrency world requires risk management and technical analysis that is managed and executed properly. This is evidenced by the 1:2 risk/reward ratio that was successfully obtained when placing an order to buy the DASH/USDT crypto pair on an uptrend in the market using the EMA indicators which is very useful for traders in carrying out trading. Setting stop loss and take profit is very important for traders when buying or selling assets because they can maximize profits and minimize losses.

Conclusion

Risk Management is an important factor that needs to be created, considered, managed and implemented properly so that investors and traders can maximize profits and minimize losses when investing and trading cryptocurrencies. There are many ways and strategies that can be done to find a good management formula and arrangement for the assets. Profitable types of buy and sell orders can be done by predicting prices during an uptrend or downtrend using indicators and trading tools. It is hoped that investment and capital will increase in the future by relying on risk management and good analysis in trading.

Hi @kavinsky7

Thanks for participating in the Steemit Crypto Academy

Feedback

This is excellent work. Well done with your practical study on Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit