Hello All Steemians !!!

On this occasion, I will try to take a class at Steemit Crypto Academy. I am interested in joining this class because there are many new lessons that I will get here. I will do homework task from professor @imagen. Lesson discussion about Staking. Lets try...

1. Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable

Kraken

Kraken is a very good cryptocurrency exchange platform and has a lot of users. Kraken has a wide selection of coins that can be traded and staked. Users have wide freedom with the crypto pairs available on the platform. With all the facilities and functionalities such as trading, staking, margin trading, and leverage provided by this platform, it is hoped that it will attract more and more users from time to time.

This platform was founded by Jesse Powell in San Francisco in 2011. Jesse Powell thinks that getting as many customers as possible is the most important factor in running a cryptocurrency business. He hopes that users can use and trust their cryptocurrencies on his platform. Kraken has established cooperation with several banks in Germany and Japan. Kraken became the first platform to be included in the Bloomberg Terminal list.

Kraken offers its users fiat currency trading that simplifies and speeds up the process. The level of security in this platform is very high and cannot be hacked. This is evidenced by its offline currency system and has two factor authentication. Where the first password is set by the user and the second password is set by Google Authenticator. Transaction fees on the this platform are known to be very cheap and lowest in the market. Transaction fees are between 0.16% and 0.26%.

Coinbase

Coinbase is the largest and very popular exchange platform for cryptocurrency investors and traders. This platform offers a lot of uses that can bring profit to its users. Users can use the various facilities provided such as trading, staking, storing, and other useful things related to cryptocurrencies. This platform allows its users to buy crypto using fiat currency with the aim of attracting interest and making it easier for users.

This platform was founded by Brian Armstrong and Fred Ehrsam in the United States in 2012. They and the Coinbase team are constantly updating and improving the working system and quality of the platform to become the best and largest exchange platform in the world. To achieve the main goal of getting as much profit as possible, users can manage cryptocurrencies with a web-based system so that they can be accessed and process transactions anytime and anywhere.

Coinbase has a high level of security when it comes to storing cryptocurrencies. No one can access arbitrarily without permission because it is stored in offline cold storage. Abuse or hacking is impossible. Transaction fees on this platform are slightly more expensive, but this is still considered a reasonable price because of the popularity and advantages of this platform. Transaction fees are between 1.5% and 4%.

Compare Kraken & Coinbase

The first comparison between these two platforms is in terms of security. Kraken has two-factor authentication. Where the first password is set by the user and the second password is set by Google Authenticator. Coinbase has an offline cold storage system.

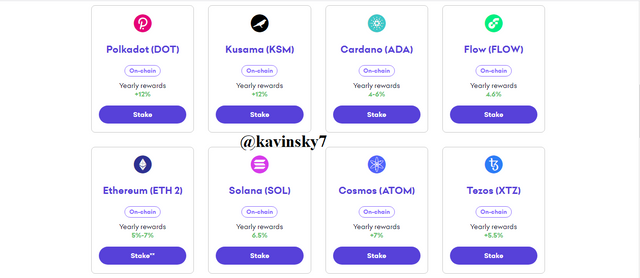

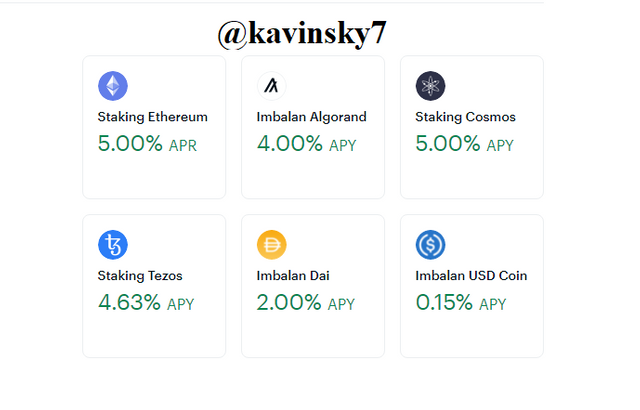

The second comparison between these two platforms is in terms of the types of cryptocurrencies that can be staked. Kraken provides Polkadot, Kusama, Cardano and Flow. Coinbase provides Ethereum, Cosmos and Tezos.

The third comparison between these two platforms is in terms of transaction fees. Kraken between 0.16% and 0.26%. Coinbase is between 1.5% and 4%.

Profitability

I chose Kraken as a platform that profitable for me when it comes to managing cryptocurrencies. This is because this platform has excellent facilities in the form of trading, staking, leverage and cryptocurrency storage. The platform is very suitable for me because it has a display and characteristics that are easy to understand. A high level of security guarantees and provides high confidence in managing cryptocurrencies.

This makes me comfortable in processing transactions as much as possible whenever and wherever. And the most important factor is the low transaction fees. I am not afraid to transact in large quantities. This greatly affects the profit that I can get. All the advantages that Kraken has really helped me in making a profit in the crypto world.

2. What is Impermanent Loss?

In the world of cryptocurrencies, every investor and trader must do many ways and strategies to get profit by contributing to many decentralized applications. This of course relates to impermanent loss as one of the consequences in the crypto exchange or storage process. Here you will experience an impermanent loss situation which means the difference between the value of the asset you previously deposited into the liquidity pool and the value of the asset you stored in your wallet.

This is due to the volatility of cryptocurrency prices. This has often happened and is considered normal by some people. Impermanent loss is only temporary as a guarantee to get profit. Large profits will be obtained if the necessary conditions have been successful. On the other hand, if the necessary conditions fail, you will experience a loss. Large or small price changes are very influential, because losses are directly proportional to price changes.

3. What is Delegated Proof of Stake (DPoS)?

Delegated Proof of Stake (DPoS) is a consensus algorithm mechanism that is more effective in terms of validating transactions and data and adding to the blockchain network. In this case the user can authorize and choose the best delegator to assist in completing the process for the assets you own. This use and development is very useful for anyone who often transacts cryptocurrency because it can make work easier and mutually beneficial.

To become a delegate, they must prepare and provide a good proposal to convey everything that reflects how the vision and mission are to make everything run smoothly and successfully. This all relates to how the system works and the process that will occur. Asset owners or users have influence in selecting a delegate. This is evidenced by the voting power is directly proportional to the number of assets owned.

How DPoS Work

How Delegated Proof of Stake (DPoS) works is to confirm and verify incoming transactions on the network. Further validation is done if everything is correct and safe and adds it to the blockchain. As the process progresses the DPoS system will limit the amount allowed in terms of work. This is meant to make it more efficient.

Delegators have major responsibilities in managing assets such as new block creation, verification, data validation, updates, and network maintenance. All systems must run properly so that no errors will occur. Everything related to the ongoing process must be ensured and supervised by the delegate so that the reputation and sense of trust will be higher. This must be done properly so that the delegates do not change or go in and out because the asset owner or user is the key and the main factor in this.

4. Conclusion

All exchange platforms related to cryptocurrencies have their own features and functions to attract investors and traders. The main purpose of using the platform is to make profit in various ways and forms. Users trade, stake and hold assets over a long period of time. With all the advantages that each platform has, users can choose and use which platform is suitable and profitable to use.

To get profit from various ways and strategies in the world of cryptocurrency, there are several things that must be passed and become obstacles. Impermanent Loss is one of them. This is a situation that needs to be handled with care even though it is highly dependent on volatile cryptocurrency prices. However, technical and fundamental analysis can be used to minimize the worst possibility and reduce the risk of loss.

To complete the transaction process quickly and securely on the blockchain, Delegated Proof of Stake (DPoS) is the right choice and solution. By relying on selected and trusted delegates, asset owners and users can more easily carry out many transactions that can bring profit and mutual benefit. However, in this case the responsibility and honesty of the delegates are highly expected so that all processes run smoothly and successfully.

Hi @kavinsky7. Thank you for participating in Steemit Crypto Academy Season 3.

You made a great effort and you show mastery of the topics requested in the assignment. However, you missed to add relevant information about the APY and/or APR rates of return offered by each platform for users staking their coins, which allows us to know which one is more profitable.

I look forward to correcting your next assignments.

Rating: 8.0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your feedback prof!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit