Hello All Steemians !!!

On this occasion, I will try to take a class at Steemit Crypto Academy. I am interested in joining this class because there are many new lessons that I will get here. I will do homework task from professor @reminiscence01. Lesson discussion about Technical Indicators. Lets try...

Explain Technical Indicators and Why it is a Good Technical Analysis Tool

Technical indicators are tools used by crypto traders to analyze and observe various conditions that occur in the market. Traders use technical indicators as a tool in the form of graphical displays that are presented based on data to show trends, volatility, momentum, price movements, support & resistance levels, stop loss & take profit and all things involved in the market. Technical indicators can be added to the chart of a crypto to predict all the possibilities that will happen and help traders make decisions to get profitable results from the trading process.

Everything that happens in the crypto market is influenced by several factors that make market conditions tend to repeat themselves over time. This is because there is a balance of supply and demand that always occurs in the market by traders. Technical indicators have an important role and a positive impact for traders in producing accurate information and analytical data. Traders can use various technical indicators that are suitable for trading needs and can also be combined with several other technical indicators that will be very helpful for traders.

Technical analysis is an important factor that must be carried out and considered by every trader to make good trades so that they can bring profits and minimize losses. The results of technical analysis can be used as a reference to determine when is the right time to enter and exit the market. As a smart trader, technical analysis using technical indicators applied to crypto charts is the right step to take before trading so that traders will improve experience in the world of crypto trading.

Are Technical Indicators Good for Cryptocurrency Analysis?

In my opinion technical indicators are an important factor and a part that every trader in the cryptocurrency world should not miss because they are very good and helpful in various fields trading process. This has been proven to be true among beginners to professional traders where now there have been a lot of learning, online classes, social media, and discussions about this.

Technical indicators will help provide data analysis and information about conditions that occur in the market in terms of crypto prices, market trends, volatility, liquidity and others. In this case, every trader has believed in the importance of technical indicators capable of producing good cryptocurrency analysis results.

Illustrate How to Add Indicators on the Chart and Also How to Configure Them

TradingView is a platform that almost all traders use to analyze crypto charts in carrying out trades. Tradingview allows users to add useful technical indicators and helps traders to make profitable trades.

- Here I will analyze the XMR/USDT crypto pair on Tradingview. You can also analyze various other crypto pairs in the red box that I have marked below.

- Addition of technical indicators can be done in Tradingview by clicking Fx in the red box that I have marked below.

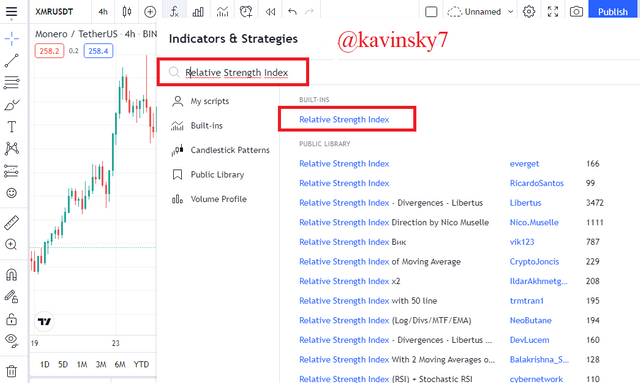

- Many technical indicators are available and can be added to the charts of the XMR/USDT crypto pair. Fill in and select the technical indicator you need in the search field in the red box that I have marked below. Here I choose the RSI indicator.

- The RSI indicator has been added to the charts of the XMR/USDT crypto pair. The RSI indicator can be viewed and used for technical analysis in the red box that I have marked below.

- To configure the RSI indicator can be done by clicking and selecting settings in the red box that I have marked below.

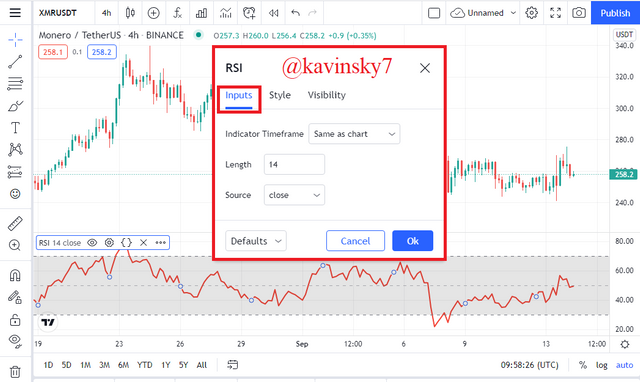

- Inputs settings can be done by selecting the time frame, length, and source indicators in the red box that I have marked below.

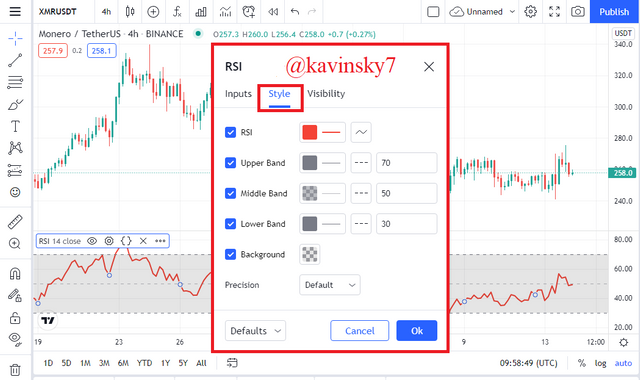

- Style settings can be done by selecting the RSI line color, upper band, middle band, lower band, background, and precision in the red box that I have marked below.

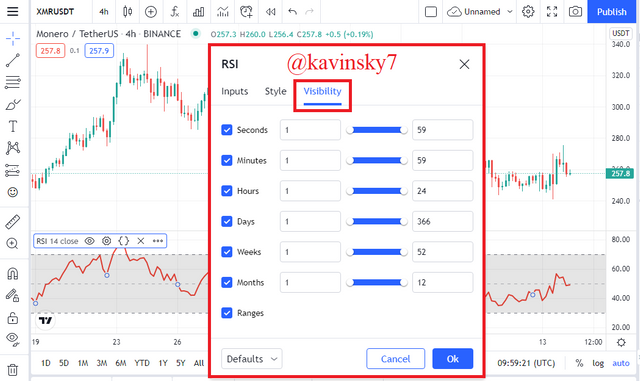

- Visibility settings can be done by selecting the time in the red box that I have marked below.

Explain the Different Categories of Technical Indicators and Give an Example of Each Category

Trend Based Indicator

Technical indicators can be used to analyze the trend of the crypto market. Uptrend, Downtrend and Sideways are the types of trends that exist in the market. Trend analysis is very influential for traders to make profitable trades and minimize losses. Average Directional Index (ADX) is one of the indicators used to identify trend strength in the market. The presence of the ADX indicator is useful for providing an indication of the strength of the market trend and helping traders to be able to determine when to buy or sell orders.

Based on the chart above, the ADX indicator on the XMR/USDT crypto pair shows a value of 28.82. The ADX value indicates that the market is in a strong downtrend. ADX values have an underlying 0-100 value against trend strength. ADX Value of 0-25 is a weak trend, ADX Value of 25-50 is a strong trend, ADX Value of 50-75 is a very strong trend, and ADX Value of 75-100 is an extremely strong trend.

Volatility Based Indicator

Technical indicators can be used to analyze the volatility that occurs in the crypto market. Volatility analysis is very influential for traders to make profitable trades and minimize losses. Bollinger Band is one of the indicators used in analyzing market volatility by watching crypto price movements go up and down and create highs and lows at certain times. The presence of the Bollinger Band indicator is useful for providing an indication of price movements and everything possible in the crypto market.

Based on the picture above, the Bollinger Bands indicator shows the movement of the XMR/USDT price going up and down in the market at a certain time. This indicator is 3 bands namely the upper band, lower band and middle band. Bollinger Bands indicate the volatility of the XMR/USDT price in the market where when the band widens it indicates increased volatility and when the band shrinks indicates decreased volatility. The 3 bands indicate the price of resistance above, the price of safety in the middle, and the price of support below.

Momentum Based Indicator

Technical indicators can be used to analyze momentum in the crypto market. Momentum analysis is very influential for traders to make profitable trades and minimize losses. RSI is one of the indicators used in analyzing the strength of crypto price movements in the market. The influencing factor is the supply-demand strength which shows high trading volume at a certain time. RSI indicates time and momentum a crypto is overbought in an uptrend and oversold in a downtrend in the market. Traders can take advantage by placing sell orders at overbought moments and placing buy orders at oversold moments.

Based on the chart above, the RSI indicator shows the strength of the price movement of the XMR/USDT pair on the uptrend and downtrend in the market. The RSI value of 49.05 indicates that there is no overbought or oversold momentum in the market. The market trend is sideways and does not indicate the strength of a strong price movement. The RSI value 0-100 is the basis which indicates overbought and oversold moments, where the RSI value above 70 is overbought and the RSI value below 30 is oversold.

Explain the Reason Why Indicators are not Advisable to be Used as a Standalone Tool for Technical Analysis

Each technical indicator has different functions and characteristics. The use of indicators that match the needs of the trading strategy is the most important thing. The addition of other related indicators can help traders make better and more accurate analysis. Therefore, the use of one indicator is not recommended to stand alone and there must be a support indicator. This aims to reduce analysis errors and false signals that may occur. The combination of the functions and characteristics of 2-3 indicators will strengthen and improve the quality of analysis before trading execution.

Based on the picture above, the combination of the Average Directional Index (ADX) and Directional Index (DI) indicators is able to provide additional information in producing a better and more complete analysis. The DI+ and DI- indicators serve to provide a relationship between the direction and movement of crypto prices on the chart. DI+ indicates the strength of the uptrend and DI- indicates the strength of the downtrend. In addition, the support of the RSI indicator and Bollinger Bands will also provide more good information and analysis results so that traders can determine the right decision and time to trade.

Explain How an Investor Can Increase the Success Rate of a Technical Indicator Signal

Understanding the function and characteristics of each technical indicator is the key and the factor that influences the success rate of the analysis results. The use of indicators must be in accordance with trading needs where indicators can provide analysis of all things involved in the market such as trends, price movements, momentum and others. Configuring indicators correctly and appropriately can also provide complete and accurate information.

The right combination of indicators is what traders need to improve the quality of analysis and minimize errors and false signals that may occur. A lot of experience and good reading of crypto charts can also be applied in order to make profits and eliminate losses. Confidence and patience are also needed by traders in self and mental control so that they can have a good effect. All of these are positive things that really help traders in carrying out the crypto trading process.

Conclusion

Technical indicators play an important role in the world of cryptocurrencies where they can be used by traders to perform technical analysis on the charts of crypto pairs. The indicator will provide all the things and information that traders need in the market. It aims to provide good analytical results that can be used as a reference for the trading process. There are so many indicators that can be used based on different functions and characteristics. The combination of 2-3 suitable indicators can provide good, maximum, accurate and complete analysis results. Technical indicators are components or parts that must be carried out by traders to make successful trades.

Hello @kavinsky7, I’m glad you participated in the 2nd week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

This is very important. Every indicator has a specific role to play in your trading style. Using the right indicator increases your chances of making good trading decisions.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit