Hello All Steemians !!!

On this occasion, I will try to take a class at Steemit Crypto Academy. I am interested in joining this class because there are many new lessons that I will get here. I will do homework task from professor @reminiscence01. Lesson discussion about Trading Cryptocurrencies. Lets try...

Explain the following stating its advantages and disadvantages

Spot Trading

Spot trading is a common way for investing by traders and is suitable for beginners who are new to the crypto world. This is a standard trading activity that all traders can carry out at any time with an easy system and operation. Traders can buy any crypto in the market to make it an investment asset. Over time, traders hold crypto assets for a certain period of time while analyzing price movements in the market. Traders can sell crypto assets when the price goes up to make a profit. In this case, all transactions made by buyers and sellers of crypto assets show the spot price and occur on the spot market.

Advantages Spot Trading

All traders can buy any crypto asset in the market and have full control over everything involved with it.

All traders can hold crypto assets when the price is down until the price goes up again and makes a profit.

All traders can trade crypto assets with small or large capital.

Disadvantages Spot Trading

All traders cannot sell crypto assets when the price is falling because it will be detrimental.

All traders have a high risk when buying crypto assets when prices are rising significantly.

All traders need time to sell crypto assets to make a profit.

Margin Trading

Margin trading is a way of investing by traders by utilizing third parties to make loans. Traders can get a loan of capital or money from the exchange platform and other traders to buy more crypto assets than the initial capital owned to take advantage of the market situation and potential. Traders have a high risk that is proportional to the results obtained in making transactions because if trading goes according to plan, they will get big profits. On the other hand, if the trade does not go according to plan, they will get a big loss. Traders can 2x, 5x, 10x and 100x leverage to increase the profit percentage.

Advantages Margin Trading

All traders can take advantage of loans from third parties to buy crypto assets.

All traders can increase the profit percentage by leveraging on the exchange platform for crypto asset investments.

All traders can trade even with small capital.

Disadvantages Margin Trading

All traders should have sufficient reserve funds in case crypto asset trading does not go according to plan.

All traders must be prepared from various sectors to face unexpected crypto asset trading results.

All traders have a high risk of losing capital in trading crypto assets.

Futures Trading

Futures trading is a way of investing by experienced traders and is not suitable for beginners who are new to the crypto world. Analysis of market trends and price movements of crypto assets is a key thing to consider. Here the trader will place a buy or sell order for crypto assets according to the prediction to get profit or will suffer a loss if the prediction is wrong. This allows traders to place orders in a bullish or bearish phase which is equally profitable. This is a high-risk trade where the trader buys the agreed contract according to the price of the crypto asset. Traders can 2x, 5x, 10x and 100x leverage to increase the profit percentage.

Advantages Futures Trading

All traders can increase their investment capital with one transaction of trading crypto assets.

All traders can profit when the crypto asset market is in a bullish or bearish phase.

All traders can increase their profit percentage by relying on leverage.

Disadvantages Futures Trading

All traders do not have full control of crypto assets because they buy contracts according to the price.

All traders need good experience in analyzing market trends and price movements of crypto assets.

All traders have a high risk in trading crypto assets.

Explain the different types of orders in trading

Market Order

Market Order is buy or sell orders that are transacted by traders on the exchange platform at prices that follow the current market of crypto assets. Here the order will be executed in a short time. The transaction process of buying or selling crypto assets will not require waiting time. The system is when a trader enters the price of a crypto asset according to the current market into the order book and another trader is ready to make a transaction at the same time. The illustration is that the price of 1 SBD in the market is $7. I will buy the 1 SBD at a price $7 by placing a market order.

Limit Order

Limit order is buy or sell orders that are transacted by traders on the exchange platform at prices above or below the current market price of the crypto asset. Here the order is not executed immediately because the trader provides a price limit. The process of buying and selling crypto assets takes time with the aim of getting a profit so that this order is suitable for traders who want to maximize profits. The system is that when a trader enters the price of a crypto asset, the order will be executed once the price is reached. The illustration is the price of 1 SBD in the market is $7. I will buy 1 SBD when the price drops to $6 by placing a limit order.

Stop Limit Order

Stop Limit is buy or sell orders that are transacted by traders on the exchange platform by setting stop and limit prices before orders. This is an order that combines the features of a stop loss and a limit order. Here the order is not executed immediately because the trader provides a stop and limit price. The process of buying and selling crypto assets takes time in order to lock in profits and prevent losses. The system is when a trader enters the price of a crypto asset with a stop above and a limit below the price of a crypto asset in the current market. The illustration is that the price of 1 SBD in the market is $7. I will buy 1 SBD to make a profit at $6 and to prevent a loss at $8 by placing a stop limit order.

OCO

OCO is buy or sell orders that are transacted by traders on the exchange platform by relying on a combination some of order features in one transaction. Here the order is not executed immediately because the trader provides several prices in the order so it is suitable for use when the crypto asset market is experiencing high volatility. The system is that when a trader enters the price of a crypto asset and one of those prices is executed then the other prices that have been entered will be automatically cancelled. The illustration is that I will buy SBD by setting the limit and stop limit orders. If the limit order is executed in the market then the stop limit order will be canceled automatically and vice versa.

Stop Loss and Take Profit Order

Stop Loss are buy or sell orders that are transacted by traders on the exchange platform to exit a trade automatically if a trade does not go as expected. The stop loss is set at a certain price based on the analysis results because if the market and the price of the crypto asset move in the wrong direction from the prediction, the stop loss order to exit the trade will be executed. Take Profit are buy or sell orders that are transacted by traders on the exchange platform to exit a trade automatically if the trade goes as expected. Take profit is set at a certain price based on the analysis results because if the market and the price of the crypto asset move in the right direction from the prediction, the take profit order to exit the trade will be executed.

How can a trader manage risk using an OCO order?

In the world of cryptocurrency all traders expect profits and try to minimize losses from every trading activity. One such strategy is that traders can manage risk by using OCO orders. This is an order type that can reduce the risk of loss by relying on a combination of several order features by setting several prices that match the expected result. Traders can analyze the market and the price of crypto assets that can be used as a reference to place some prices that are predicted to be profitable.

Here traders can enter two orders simultaneously in one transaction, namely limit orders and stop limit orders. Traders can manage trading risk by setting appropriate stop losses based on market analysis and crypto asset prices to minimize losses if trading does not go as expected. In this case, if the price of the crypto asset reaches the limit order then the trade will be executed and the stop limit order will be canceled automatically. On the other hand, if the price of the crypto asset reaches the stop limit order, the trade will be executed and the limit order will be canceled automatically. These are orders that greatly assist traders in managing trading risks, especially during the high volatility of the crypto market.

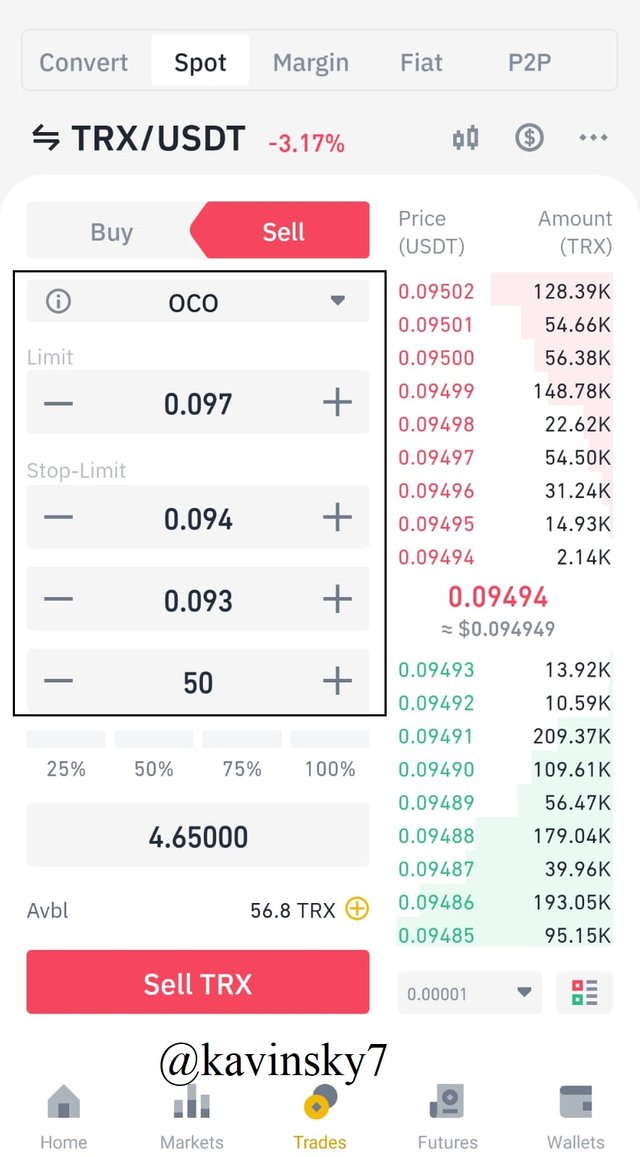

Based on the image above, I used OCO orders to trade TRX/USDT on the Binance exchange platform. Here I will sell TRX/USDT by setting the limit order at $0.097. I set a stop limit order at $0.093 if the stop price reaches $0.094. The current price of TRX/USDT is $0.09494.

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed

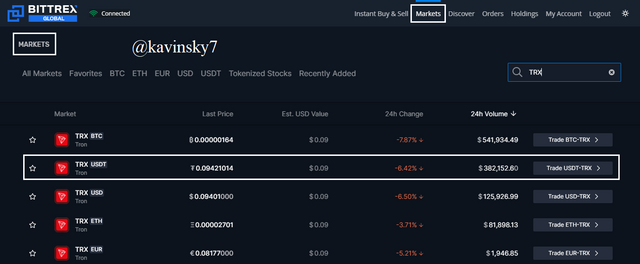

I use Bittrex to make transactions.

In the market feature, I typed TRX and selected the TRX/USDT crypto pair.

Source Bittrex The price chart and the TRX/USDT order book will appear on the screen.

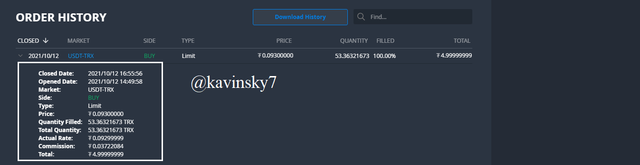

Source Bittrex On the Buy option, I used the limit order and placed an order of 5 USDT. I set the limit price below the current TRX/USDT price.

Source Bittrex In the Open Order feature, TRX/USDT buy transaction is available.

Source Bittrex Transaction details are as follows:

Source Bittrex

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset

Here I analyze and place a sell order for the TRX/USDT crypto pair using Tradingview platform and the Exponential Moving Averages (EMA) indicator. Transaction details are as follows:

Based on the chart above, I added 50 and 100 Exponential Moving Averages (EMA) to the TRX/USDT chart. The price movement shows a decline and is below the 50 and 100 EMAs. The EMA shows a Death Cross which indicates a trend reversal from an uptrend to a downtrend. The EMA also acts as resistance which shows when the price touches the EMA lines, the price bounces back and moves down following the trend. I placed a Sell Entry when the price left the EMA line and continued to move downwards. I set the Stop Loss slightly above the 50 and 100 EMA lines with Stop Loss and Take Profit ratio 1:1.

I chose TRX because I believe in the great potential for growth that TRX has over time. The presence of TRX in the crypto market and blockchain ecosystem has attracted me to invest it for a certain period of time. My participation in Steemit also gives me a great opportunity to earn TRX and make it an investment asset. TRX has a low price making it has a small risk of loss. TRX has good fundamentals and its development in the market continues to increase. In my opinion, TRX is a crypto asset that is suitable suitable for long term investment.

I use the Exponential Moving Averages (EMA) indicator in technical analysis and trading of the TRX/USDT crypto pair. The EMA is a great indicator that show indications to place buy or sell orders at the right time. Golden Cross and Death Cross are the main factors that indicate a trend reversal in the market. This helps traders to analyze trend reversals and place entry positions. The EMA also acts as a dynamic level of support and resistance that traders use to place exit positions by setting stop loss and take profit levels based on the EMA line.

Conclusion

In the world of cryptocurrencies, there are many types of trading that novice and professional traders can do to increase their investment in crypto assets. Spot, Margin and Futures trading have their respective functions that can be relied on to get profit even though the trading risks are different. The order feature on each exchange platform can also be used by traders to place orders to buy or sell crypto assets that can bring profits and minimize losses. Market, Limit, Stop Limit, OCO, Stop Loss and Take Profit order have their respective characteristics that can help traders make transactions at the expected price according to the results of analysis and predictions of the crypto asset market. All trading requires good strategy and decisions to make a successful trade.

Hello @kavinsky7, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit