Today in this post I will share with you my Homework Task (Season 5/Week-8) for Professor @fredquantum. The course professor @fredquantum has discussed with us "Dark Pools in Cryptocurrency". I have learned a lot about The Dark Pools in Cryptocurrency from this lecture of the professor.

1. Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Dark Pools is basically a private cryptocurrency exchange service. This service allows a user to operate in isolation from the general public. There are individuals or individuals who wish to complete their transactions without disclosing them, maintaining confidentiality, and some anonymity and privacy issues are permitted by some cryptocurrency exchange sites. There are many individuals or organizations who choose these Dark Pools for their transactions. Because here they can hide their own name and if any organization uses it, they can exchange thousands of dollars there by keeping the name of their organization secret.

As I said before, these Dark Pools operate in isolation and a user can use Dark Pools to buy and sell any cryptocurrency asset. But before selling or buying, he has to set his own price. Because there is no order book and the price that is in the order book is not given. These are hidden from other users, when the person wants to sell it and the person who wants to buy it, the order is complete. So they trade there or buy and sell, they place orders from here, they can't see what anyone else is ordering. Those who use these Dark Pools can only trade through their own funds. Margin trading is not allowed here.

We already know that trades are a bit different here. Here traders sell or buy assets at a predetermined price. Market volatility can be seen here because in this type of market, just like limit order, the actual price and the ordering price can be much different and there is a difference. So the chances of slipping here are much higher.

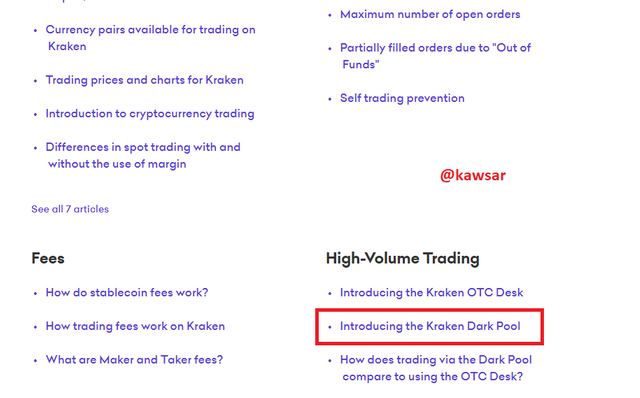

2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

We must know that there are many exchange sites for exchanging cryptocurrencies. Kraken Exchange Site is a well known and very popular site for trading cryptocurrencies and these Kraken Dark Pools are supported on their platform. It was established in 2011. This Kraken site allows buyers and sellers to trade cryptocurrency anonymously and keep their orders confidential which other users cannot see.

How does its dark pool work?

There is no order book in Kraken dark pool. One user cannot see the location of another user's order and cannot take advantage of it. Here the purchase and sale are placed anonymously and the trade is completed when matched. Market traders are not allowed here, as there are no order books. Nothing is registered in the order book as there is no order book here, so cross trading is done here to mirror the limit orders.

3. What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

What are the supported assets

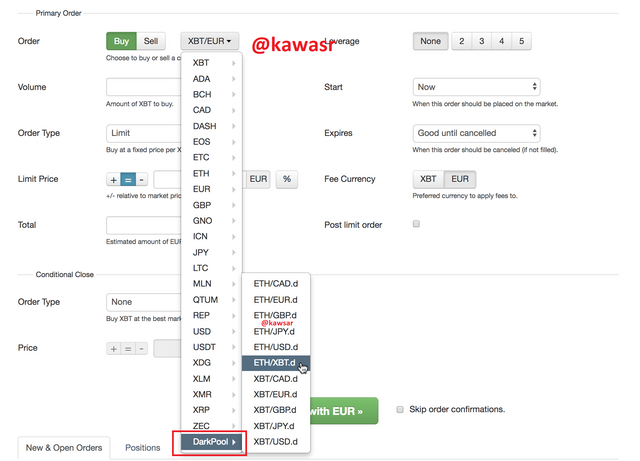

As I complete this task, the asset support at the Kraken Exchange site is complete. These are:

Bitcoin/Ethereum:

- ETH/BTC

Ethereum Pairs:

- ETH/CAD

- ETH/EUR

- ETH/GBP

- ETH/JPY

- ETH/USD

Bitcoin Pairs:

- BTC/CAD

- BTC/EUR

- BTC/GBP

- BTC/JPY

- BTC/USD

What are the requirements

- Only those who are in Pro level and who are verified in Kraken will get permission for dark pool here.

- The minimum order to trade on the BTC pair I have given above is 100K USD.

- The minimum order to trade on the ETH pair I have given above is 50K USD.

- Only limit orders are supported in Kraken pool here.

Is there any fee attracted?

Of course, we know that if we are trading on trading platforms, then we have to pay a fee according to the way we trade. The fee for kraken dark pool is fixed at 30 days depending on the trading volume. The fees range from 0.20 percent to 0.36 percent

4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

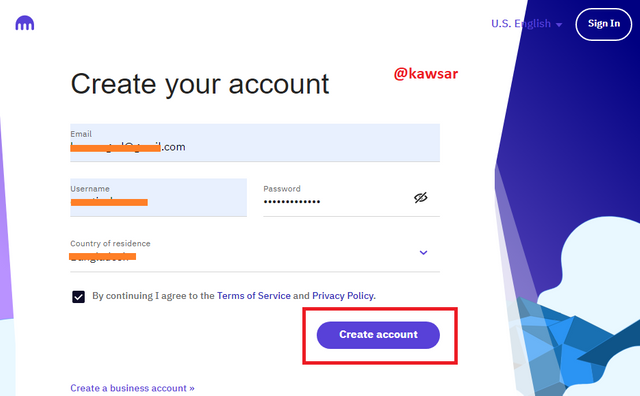

To complete this sting we must login to the Kraken platform. For this we first need to create an account. To create an account I will first go to Kraken's official website.

STEP-01: To create an account we will first come to the signup option. Then we will have an interface like this. Here we will give a valid email. We will give a username, password and our country name will be selected automatically then we will click on Create Account button.

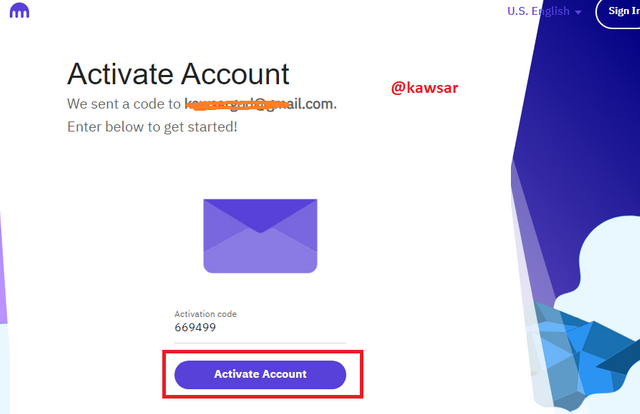

STEP-02: A code will be sent to the e-mail address that we provided when creating the account above. We will get that code as soon as we check our mail. Click on the Activate Account button with the code.

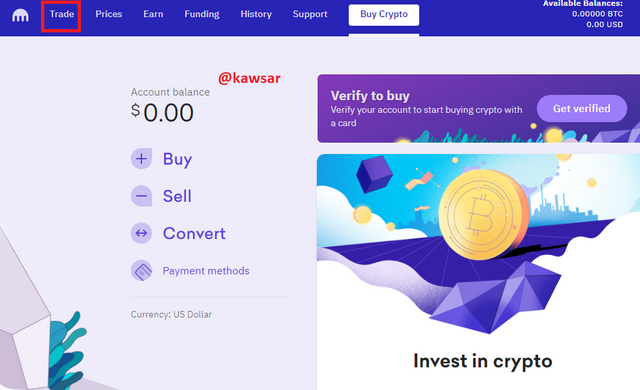

STEP-03: Clicking on the Activate Account button will automatically login to our account and then we will get such an interface then we need to click on the Trade button.

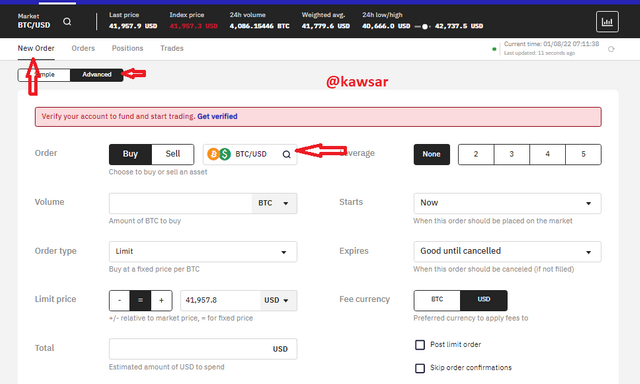

STEP-04: Then we will go to Advance by clicking on the New Order option here. Currently Dark Pool is not available on kraken.com, so you can't see Dark Pool pairs here.

STEP-05: Above I took a screenshot of the pairs that were available in Dark Pool, from Kraken Support

5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

What's your understanding of the Decentralized dark pool?

We have already mentioned above what kind of facilities a user gets in Dark Pools. A user can complete the transaction without disclosing privacy and anonymity. And decentralized platforms and those offering services, follow the same rules. However, their level of protection is much higher. Decentralized platforms have far more advantages than centralized exchanges when it comes to security.

We must know that we have to do KYC on centralized exchange platform sites, we also have to create an account with our name, identity and other information. That means someone is controlling us and we have a controlling body. But we must know that decentralized platforms do not have any third party and here we can use anything without giving us any information without any third party interference. This decentralized platform allows a user to perform crypton training without disclosing transaction details. It allows users to keep themselves safe on decentralized platforms and it is much more secure.

What do you understand by Zero-Knowledge Proofs?

Zero-knowledge proof is an authentication cryptographic protocol, also called Zero-Knowledge Protocol (ZKP). It will verify the authenticity of a piece of information without disclosing any information about the person whose work it will prove. It does not save any data with any data or allows authentication without backup. This cryptographic system consists of a prover and a verifier. In this way, it is possible to verify and verify information without disclosing any information to third parties. It provides much higher security. In terms of privacy, it provides anonymous and complete privacy to a user. In this decentralized platform a user does not have to provide name, personal information, date of birth or any type of ID card for trading. Apart from these, a user can easily complete his transactions through the Dark Pool system here.

6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

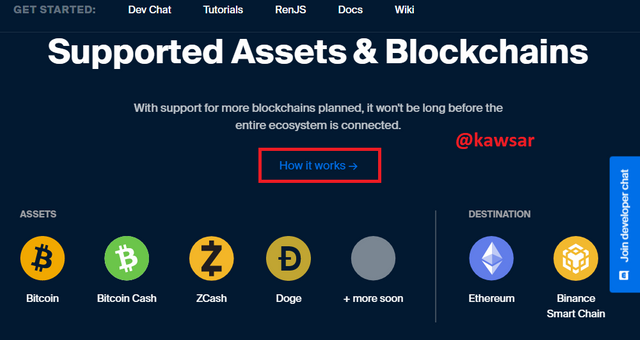

One of the decentralized dark pool in cryptocurrency is REN. It is a very popular decentralized dark pool in cryptocurrency. Formerly known as the Republic Protocol. REN currently offers decentralized dark pool services to users for trading and allows them to exchange tokens using zero-knowledge proof. This protocol allows users to send various blockchain crypto asset.

How does it work?

REN is basically a virtual machine (RenVM) that allows the transfer of currencies across the blockchain using this process. The Ren Exchange allows interactions between several exchanges, after which the blockchain token is exchanged via the REN Bridge. RenVM is a network. RenVM is a network operated by a decentralized virtual machine. Here is a cryptographic policy called Shamir's secret sharing.

7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

| Centralized dark pool | Decentralized dark pool |

|---|---|

| There is third party intervention. | no third party intervention. |

| Centralized dark pool cannot use smart contracts. | Decentralized dark pool can use smart contracts. |

| Personal information is required. | There is no need to provide personal information here. |

| In comparison, it is less confidential. | It is much more confidential. |

| In comparison It is less secure. | It is much secure. |

| The exchange fee is require. | here only the bridge fee is required |

8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

The example I will give about the recent huge sales is the example of Bitcoin. It happened on December 4, 2021. Due to the closure of Bitcoin sales these days, the price of Bitcoin has gone up a lot. Because of this others who are small traders start selling assets and this brings down the price of bitcoin a lot. On the same day, the price of Bitcoin dropped by 22%

If the transaction had been on a dark pool platform, however, it would not have affected the selling pressure. Because the details of the transaction were hidden here, other users could not see it and they would not panic in any way and therefore the price would not go down much.

9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

The first thing I want to say about this is that if cryptocurrency transactions can be done through the dark pool, then the price for it cannot be affected too much. Because in the above question we have discussed the fact that when an event happened on December 4, 2021. There are small traders here who have always noticed that the bitcoin market is now under selling pressure. So as soon as they saw it, they started selling Bitcoin as they wished, and the price of Bitcoin dropped by about 22 percent that day due to selling pressure. This has only been possible through this order book.

But we must know that there is no order book in the dark pool and one person's order cannot be seen by another or other users. So if the order book users hadn't seen it that day, there wouldn't have been so much pressure on sales and the price might not have been so low. So I think dark pool will definitely protect a user from market volatility in the same way that it gives a lot more security. It can take investors to a much better profitable stage. Because we know that cryptocurrency market volatility is in nature, so if this can be done then this volatility is likely to decrease.

10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages of Dark pool in Cryptocurrency

- Fees are very low here compared to other trades.

- The order book can be hidden from everyone.

- Reduces price volatility, in a word, allows asset prices to remain stable.

- It provides additional security to users.

- This helps a lot to avoid slippage.

Disadvantages of Dark pool in Cryptocurrency

- It is difficult to choose the best price for trading.

- Since there is anonymous trading here, there is a possibility of fraudulent work.

- There is a lack of transparency.

- The use of it by big traders here will reduce liquidity in the market.

Conclusion:

Finally I can say that Dark pool is a very unique thing in the world of cryptocurrency. In addition to reducing the volatility in the cryptocurrency market as a result of its use, I think it will give cryptocurrency investors a much better return. It gives a businessman privacy and keeps him anonymous. Traders can complete transactions here without revealing their own names, which gives them a lot of personal protection.

Through today's lecture I learned a lot about Dark Pool and got to know the subject fairly well. This seems to be a very important issue for me. So I am very grateful to the professor for discussing such an important subject with us and thank you for giving us the gift of a well-explained lecture.