.png)

This is my submission for @asaj homework task.

In your own words define the random index and explain how it is calculated

The Random Index is one of the many technical indicators employed by traders to understand the price movement of assets, spot market trends, predict future price and trends in the market and sends buy and sell signals to traders. Random Index indicator is also called the KDJ indicator because it has a K component, D and J component. Random Index can be said to have been carved from the Stochastic Oscillator but the only difference between the two is an additional J line which is to indicate the divergence between the K and D values.

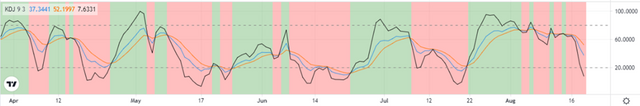

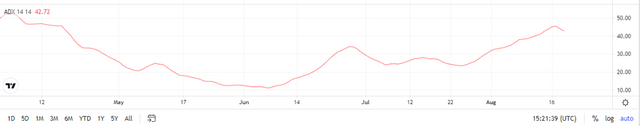

Below is an illustration of the Random Index indicator

Features of KDJ indicator

The green areas in the indicator depicts a bullish trend in the market whereas the red areas indicate a bearish trend in the market.

The K line by default is blue in color (users can modify the color to suit their preference)

The D line by default is the red line

The J line by default is black in colour whenever the black line treads over the K and J lines, it means the market is in a bullish trend and when it is below the K and J lines, the market has entered a bearish trend.

The convergence of these lines sends buy and sell signals to traders. Where the J line trends upwards and crosses the K and D lines indicates a buy signal to traders whilst a downward trend of the J line to cross the K and D lines is a sell signal.

Just like the stochastic oscillator, one downsides of the KDJ indicator is it may give false signals in a flat market.

How the Random Index is calculated

Calculating the Random Index is a bit complicated. Three variables are needed: highest price of the day, lowest price of the day and the closing price of the day.

You first compute for the Random Index Value for the day (RSV)= (Cd-Ld)/(Hd-Ld)*100

where: Cd = closing price of the day; Ld = lowest price of the day; Hd = highest price of the dayThe next thing is to compute the K and D values

In an event where there are no previous K and D values, 50 can be used instead.

We can now compute the J value

Is the random index reliable?

Just like any other indicator, traders cannot rely solely on one indicator to make conclusive trading decisions, the case is the same with the Random Index Indicator. Though it is has an additional line different from the Stochastic oscillator that enables trader to spot trends and show how divergent the K and D values are, the random index indicator still needs support from other indicators to get strong, conclusive results. Also note that, the random index indicator may give false signals in a flat market so it cannot be relied on entirely but complemented with other indicators like the Average Directional Index (ADX) and the Average Real Interval (ATR) which is able to determine market's volatility will help traders get close to accurate if not accurate analysis and results.

How is the random index added to a chart and what are the recommended parameters?

I will perform this part of the work via the TradingView platform.

- Open the TradingView website and launch charts

.png)

Choose your preferred cryptocurrency pair

Tap on Indicators (fx)

Use the search box and enter KDJ to add the Random Index indicator

.png)

- A number of KDJ indicators appear, tap KDJ ll21LAMBOS21 to be added to the chart

.png)

- The indicator is added below the chart as shown below

.png)

- Modifications can be done to the default parameters by tapping on settings at the top left corner of the indicator.

.png)

As default, the period is set at 9 and signal, 3.

.png)

The black line is the J line where the blue line is the K line and the red line line is that of the D line, these colours are default and users can make changes to them.

.png)

When the J line (black line) crosses 80 points, the asset has entered the overbought area and when it falls below 20 points, the asset has entered the oversold region.

Differences between KDJ, ADX, and ATR

KDJ

KDJ also known as the Random index indicator is one of the many technical indicators used by traders to analyze market trends and identify buy and sell signals in the market. KDJ is a derivative of Stochastic oscillator indicator with an additional J line that measures the divergence between the K and D values. When the J line rallies over the K and D lines, it indicates a bullish trend and sends a buy signal to traders whereas when it rallies below the K and D lines, it indicates a bearish trend and sends a sell signal to traders. Traders can also identify if the underlying asset has entered the overrbought or oversold regions using this indicator. It is an easy to understand indicator but for the most accurate analysis, it should be complemented with other technical indicators like ADX and ATR because it usually gives false signals in a flat market.

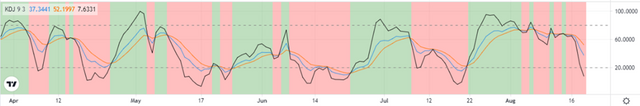

ADX

The Average Directional Index (ADX) is an equally important technical indicator used by traders to measure the strength of trends in a chart. Unlike the KDJ, it is a single line indicator that is used to measure how strong a current downtrend or uptrend is. Using a scale of 0 to 100, a level over 50 indicates a strong trend (it can be either a downtrend or an uptrend) whereas a level below 20 indicates a weaker trend.

ATR

Average True Range (ATR) is a technical indicator used to measure the volatility of price of the asset. This indicator helps traders measure how much the price of the assset has moved on average over a period. It is also a single line indicator just like the ADX. This indicator is important it helps traders identify when to enter the market and also know where to set stop losses. It should be complemented with the Moving Average indicator for better analysis.

Use the signals of the random index to buy and sell any two cryptocurrencies.

With the knowledge obtained here, I will take on a practical trading exercise using the KDJ indicator as a guide. I will perform this exercise using TradingView for analysis and MetaTrader 5 for trading.

Below is the BTCUSDT chart on Trading View

.png)

From the chart, I entered the market at a point where the J line was rallying below the K and D lines. That notwithstanding, it has entered the oversold region and that sends a buy signal.

I quickly went on the MetaTrader 5 platform and placed a Buy order. I expected a trend reversal and the price should go up. Not long after, the price went up and I made a profit of 107.94 from this trade.

.png)

Below is the ETHUSDT chart on Trading View

.png)

From the chart, I entered the market at a point where the J line was rallying below the K and D lines but has left the oversold region and is climbing up. This indicates a buy signal.

I went on the MetaTrader 5 platform and placed a Buy order. Not long after the price went up and made profits of 1.40 from this trade.

.png)

Conclusion

Traders in an attempt to understand market trends and predict future trends come up with indicators to aid their analysis. The KDJ or Random Index Indicator is one of such technical indicators used by traders to analyse market trends and also spot buy and sell signals. The KDJ indicator is just like the Stochastic oscillator but with an additional J line to measue the divergence between the K and D values. The KDJ may give false signals in a flat market so the period should be prolonged for better analysis.

Thanks for reading. Kudos to @asaj for this informative lecture.

Superb performance @kayduke!

Thanks for performing the above task in the eighth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 8 out of 10. Here are the details:

Remarks

Overall, you have displayed a good understanding of the topic. You have performed the assigned task excellently. However, you did not provide new information to this course, as most of the points mentioned have been indicated by several participants.

That said, this is good work. Thanks again for your contributing your time and effort to the academy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit