.png)

What is Terra Station? Explore the application, Download the wallet and connect the wallet to Terra Station. Screenshots required.

Terra Station is a wallet that houses assets of the Terra ecosystem allowing users to manage and utilize these assets and also allowing users to interact with decentralized apps on the network. Terra station is a decentralized wallet meaning users have total control of their wallets and the resources in them.

Downloading and Connecting the Terra Station

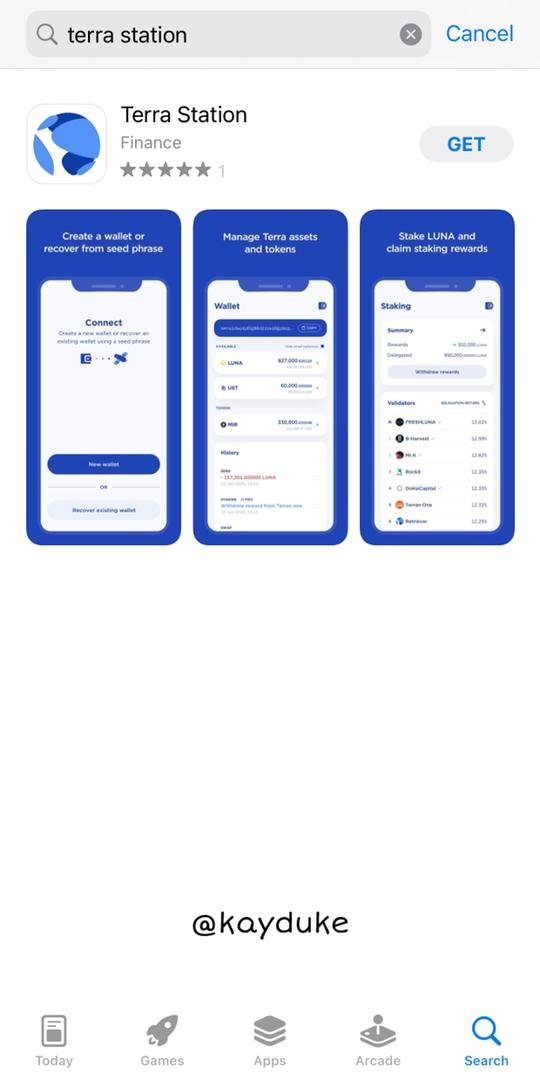

I will be downloading and connecting the Terra Station from the App Store on ioS.

- Open the App store and search Terra Station, Click on Get to start downloading.

- Skip to the Get started page.

screenshot from Terra Station mobile app

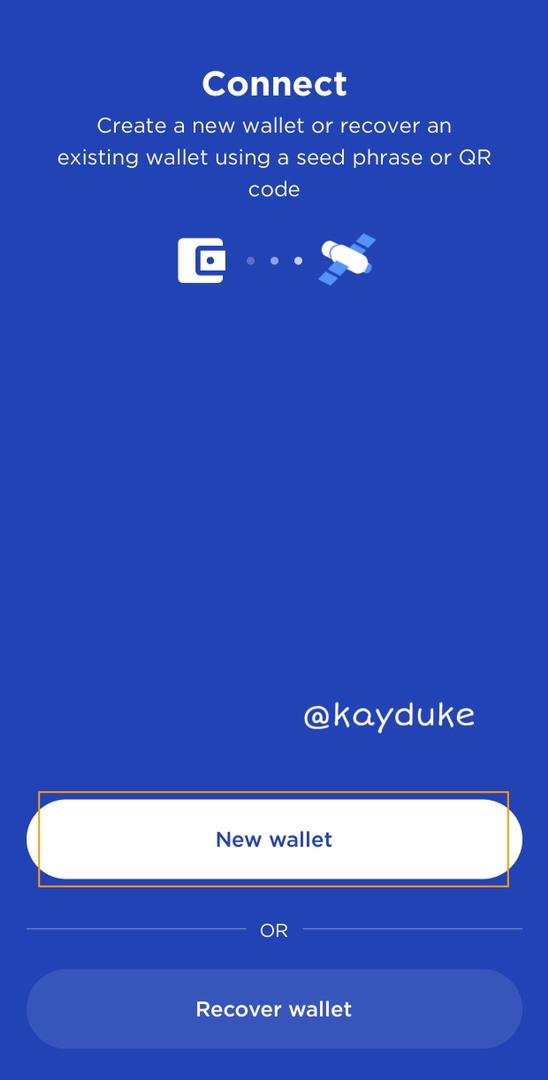

- Tap on New Wallet to create your wallet.

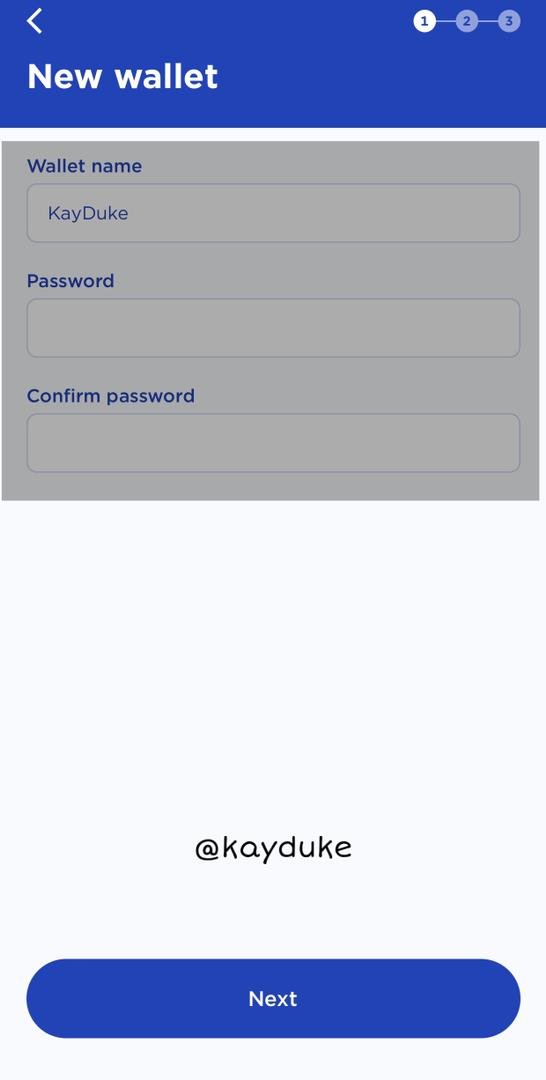

- Enter a wallet name, set a password and confirm the password.

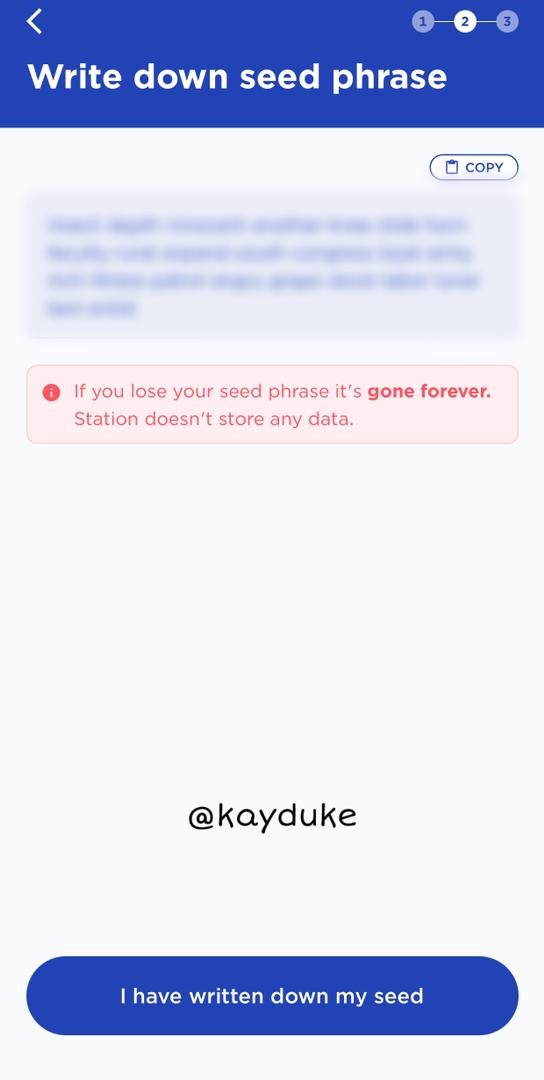

- Copy your unique seed phrase.

- Confirm the seed phrase.

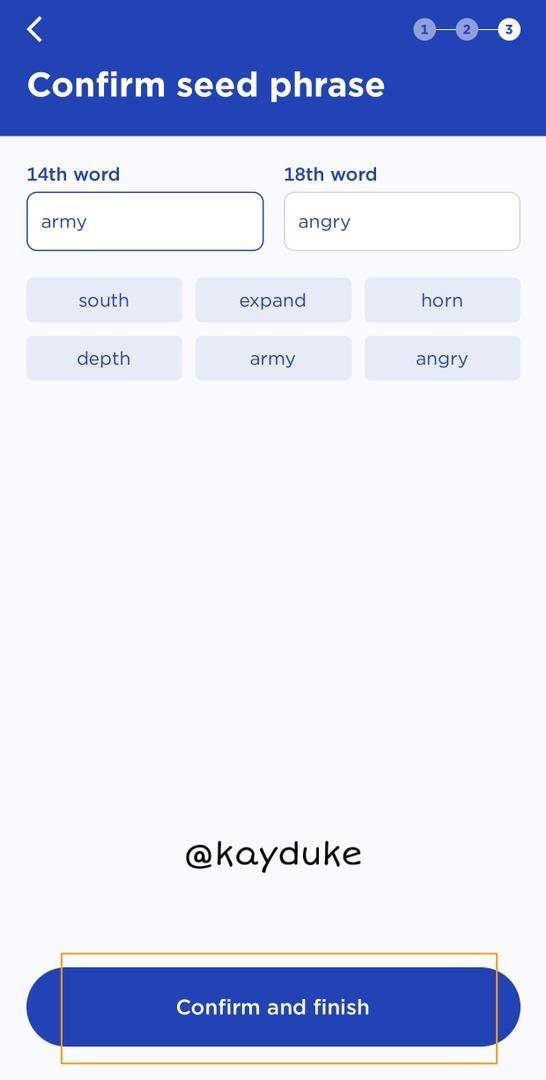

- There you have it, your account has been successfully created.

Exploring the Application.

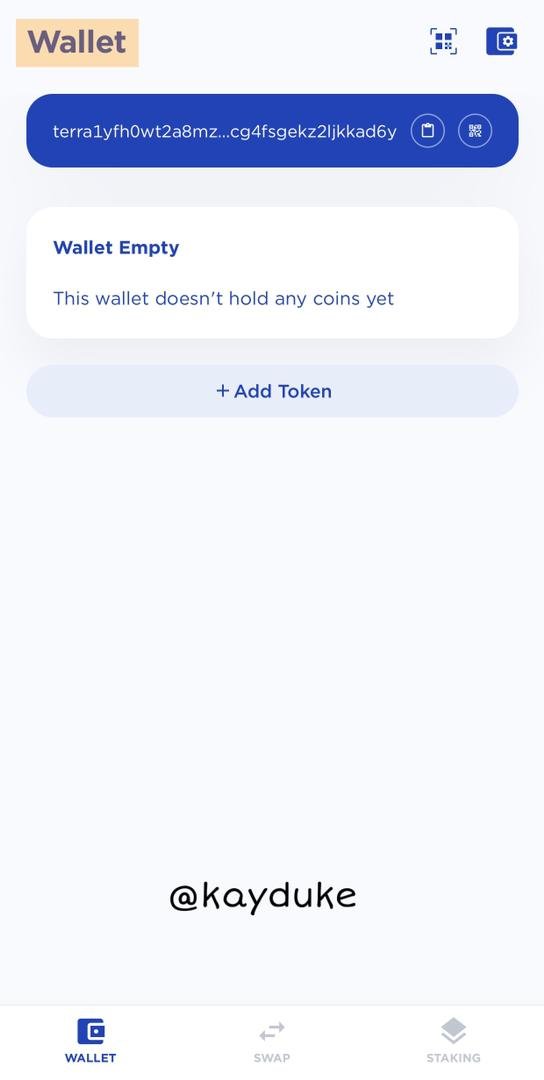

Wallet

Here, users have the overview of their asset balance and can add tokens right from here.

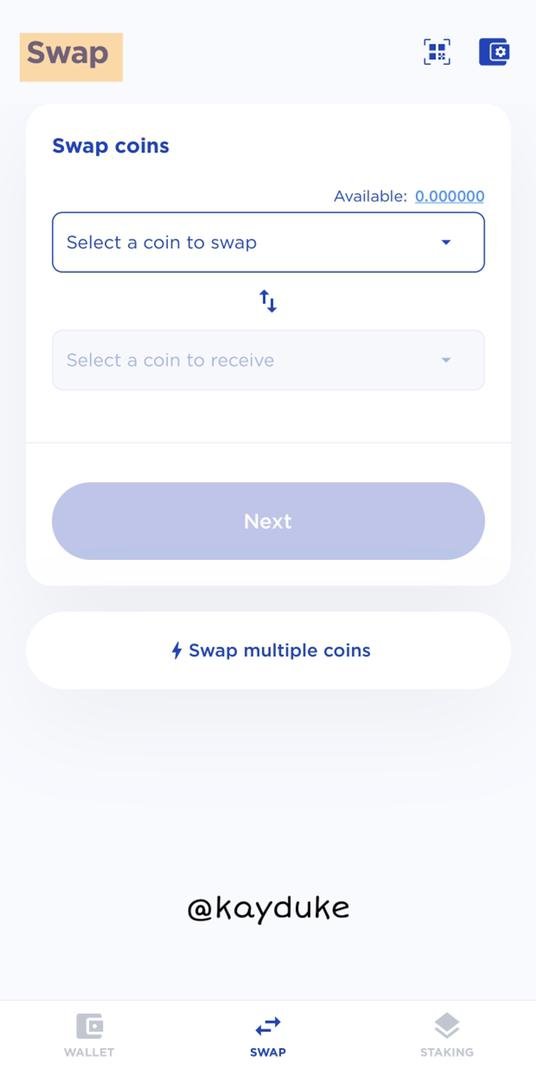

Swap

The Swap feature allows users to swap one coin for another. A user can swap a coin in his wallet for another coin using this function easily. There is an option for multiple swap too.

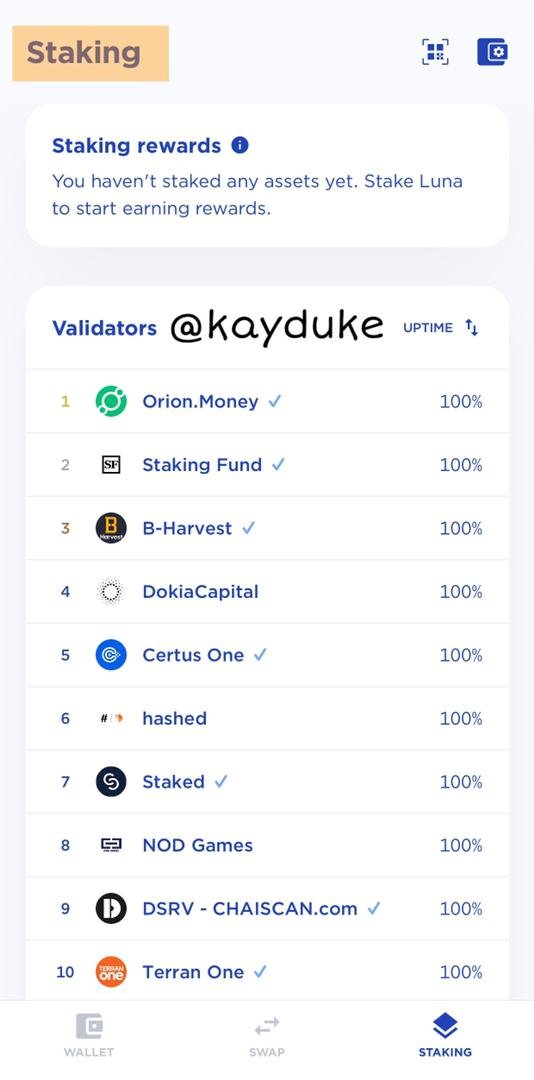

Staking

Like most major platforms, the Terra station has a staking option allowing users to stake their assets to receive rewards in the future.

At the time of preparing this work, there are about 194 validators users can stake with.

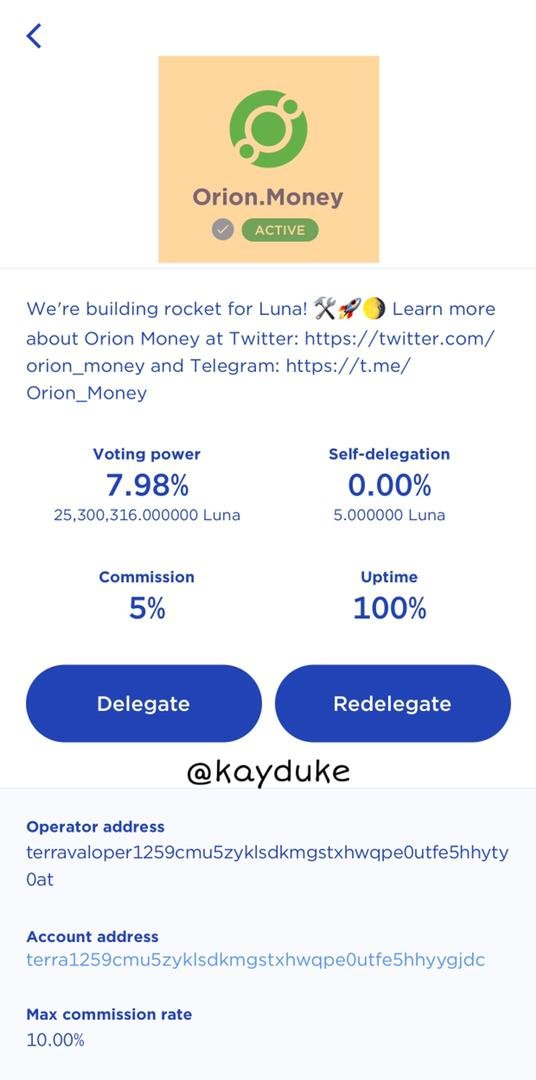

I will explore this function more using the first option, Orion.Money. With a Voting power of 7.98% on the platform, commission of 5% and 100% up-time, users can delegate and redelegate their tokens.

Explain Anchor Protocol, explore the app, and connect the Terra Station wallet.

Anchor protocol is a decentralized app built on the Terra network. Anchor protocol is more like a Defi space allowing users to lend their assets to a liquidity pool and earn rewards in the future.

The Anchor Protocol can be described as a Anchor is a low-volatility savings platform based on Terra stablecoin deposits. The Anchor rate is supported by a diverse stream of staking rewards from major proof-of-stake blockchains, making it far more stable than the traditional financial market interest rates. Anchor is a consistent and reliable source of yield and has the potential to become the crypto space standard reference interest rate.

On the Anchor Protocol, there are lenders (liquidity providers) who seek to earn interest on the assets they make available and borrowers who will want to borrow these asset and pay back with interests. The borrower will have to lock up bonded assets as collateral before assets can be lent to him.

At the time of doing this work, Anchor Protocol token ranked 229 and the price was $3.46. See screenshot below.

.png)

Exploring the Anchor Protocol

Follow the link to get on the official website.

Dashboard

.png)

The Dashboard tries to summarize and presents users with current data on the Anchor Protocol. Users get an overview of the Total Value locked, Total Deposit, Total collateral, ANC price, Circulating Supply, Total Borrow, Total collateral value among other important data.

My page

.png)

Like the name suggests, My page details the user's account details. Users can see their rewards, go to the Earn, Borrow tabs from here and also view their transaction history.

Earn

.png)

Here users can see their total deposits, current APY and expected interest. At the time of preparing this work, the current APY is 19.51%.

Borrow

.png)

This presents users with the collateral value and borrowed value. The Net APR is also available here and at the time of preparing this work, it was around 1.8%.

Bond

Here there are Mint, Burn and Claim options available to users. Under the Mint option, this is changing your assets say Luna to mint-Luna.

.png)

The Burn option is to reverse the minting process i.e. changing the minted Luna (bLuna) back to Luna.

.png)

The Claim option allow users to claim their burnt assets and rewards from Staking.

.png)

Govern

This is where users who have staked can participate in the governance of the platform. At the time of preparing this work, there was an active poll. Present here also is the current ANC price and the total staked.

.png)

Connecting the Anchor Platform to Terra Station.

- On your dashboard, Click on Connect wallet at the top right corner.

.png)

- Select Terra Station (Note, if you are doing this from a computer, you should have added a Terra extension to the browser already).

.png)

- The Terra Station window pops up and tap on Allow to allow access to the wallet.

.png)

- That is it, your wallet has been connected successfully.

.png)

Explain Mirror Protocol, connect Terra Station and explore the Mirror Protocol app. Show screenshots.

The mirror protocol is a decentralized finance (Defi) platform that allow users to create synthetic assets designed as token to match the price of real world assets like stocks and securities. In other words, synthetic assets allow users to hold real world assets through tokens. To create a synthetic asset also known as mAsset, you will have to make a deposit (equivalent to 150% of the current value of the real world asset) to the protocol as collateral.

Mirror Protocol is developed on the Terra network but the synthetic assets created (mAssets) are available on other blockchain networks like Ethereum and Binance Smart chain with the aid of bridges.

Below are the details of the Mirror Protocol token on CoinmarketCap at the time of preparing this work.

.png)

Exploring Mirror Protocol

Use the [link](mirror protocol) to reach the website.

- Select any of the two links available.

.png)

My page

Here, you can connect your Terra station wallet.

.png)

Trade

In Trade, we can see available synthetic assets (mAssets) we can trade with. Eg. mAAPL which is the synthetic asset of real world APPL stock.

.png)

Borrow

This shows a list of mAsset we can borrow. You will need to make some deposits that can be used as collateral.

.png)

Farm

This is where users can start investing in the form of staking. There is a list of mAssets users can opt to stake with varying APRs.

.png)

Govern

Users who have some stakes in the MIR Protocol can participate in the governance of the entire protocol. Users can see the total staked MIR tokens, the community pool and the total tokens staked by the user.

At the time of preparing this work, there were a number of polls going on.

.png)

Connecting Terra Station to Mirror Protocol

Click on My page

You have two options, Connect via Extension or Connect via mobile. (I select Connect via Extension because I am working from desktop).

.png)

- A Terra Station notification appears to allow connection. Click on Allow.

.png)

- Connected.

.png)

What is the Terra bridge? Explain, show screenshots.

Terra Bridge supports cross-chain transfer of all Shuttle-supported tokens, such as Terra native tokens, most mAssets, and other Terra token kinds. Terra bridge seeks to ease and facilitate the transfer of tokens from one chain to another chain. With the integration of wormhole v2, users can easily transfer assets between Terra, Ethereum, Binance smart chain etc. making the Terra bridge a unified interface.

Connecting Terra bridge

Use the link to the website.

- Click on Connect Wallet

.png)

- Select Terra Station (Extension) or mobile depending on where you are working from. (I choose extension because I am working from desktotp)

.png)

- A Terra station notification appears asking you to allow. Click on Allow.

.png)

- That is it. Connected!!!

.png)

Explain how it works and what the Terra Stablecoin are.

In recent times, stablecoins have been identified as important part of the crypto space bridging the gap between cryptocurrencies and real money (fiat). The Terra Protocol has a stablecoin pegged to the US Dollar and some other currencies. The stablecoin for the Terra Protocol is Terra USD (UST) which seeks to reduce the volatility associated with cryptocurrencies in general.

However, it should be noted that Terra USD is not backed by the US Dollar but by smart contract algorithms and the LUNA token. This is to mean that, 1 UST value equivalence to 1 US dollar is achieved with the aid of the LUNA token. In a case where 1 UST value drops below 1 USD, the LUNA token augments the UST supply to maintain the value as pegged to the dollar.

At the time of preparing this work, the price of UST was $1 and a total market cap of $8,621,088,886.

.png)

Below is the price of the LUNA token from CoinmarketCap too.

.png)

You have 1,500 USD and you want to transform it into UST. Explain in detail and take the price of the updated LUNA token.

First check for the current price of UST and LUNA token from CoinmarketCap.

Where; 1 USD = 1UST

1500 USD = 1500 UST

From the screenshot above, the LUNA token is $63.85.

To compute the number of LUNA tokens we get for 1500 UST, we divide it by the price of the LUNA token.

1500/63.85

= 23.49 LUNA token.

Now you have that 1,500 USD and you want to make a profit, since 1 UST = 1.07 USD. Explain in detail and take the price of the updated LUNA token

Where; 1.07 USD = 1 UST

1500 USD = 1500*1.07

= 1605UST

When 1USD = 1UST, we make a profit of 105USD.

Computing the number of LUNA tokens we get with 1605 UST using the screenshots used in the previous question.

With LUNA token price at $63.85 and total UST = 1605

= 1605/63.85

= 25.14 LUNA tokens

Conclusion

The Terra project is one laudable idea with higher prospects of doing well in the near future. The project seeks to create a decentralized stablecoin backed by smart contract algorithms and the LUNA token. There are various protocols linked to this project that enable cross-chain transactions.

Thanks to @pelon53 for this exciting lecture.

Regards