Source : https://www.pixabay.com

Hello,

in this post i will try to follow for professor @reminiscence01 about Japanese Candle Charts. This is my homework.

Explain the Japanese Candlestick Chart? (Chart screenshot required)

Japanese Candlestick Chart are a specialized examination apparatus that brokers use to diagram and break down the value development of protections. The idea of candle graphing was created by Munehisa Homma, a Japanese rice broker. During routine exchanging, Homma found that the rice market was affected by the feelings of merchants, while as yet recognizing the impact of interest and supply on the cost of rice.

As an unbelievable rice broker of monetary instruments, Homma overwhelmed the rice showcases and got mainstream for finding the candle outlining strategy. At the point when the Japanese financial exchange started during the 1870s, nearby specialized examiners consolidated Homma's candle system into the exchanging cycle. American specialized expert Steve Nison acquainted the method with the West through his book "Japanese Candlestick Charting Technique." Japanese Candlestick graphing is currently a famous specialized pointer that dealers use to dissect monetary business sectors.

Source : https://coinmarketcap.com/currencies/steem-dollars/

We are additionally conceivable to see the most elevated and least costs in the time that we can set ourselves utilizing the Candlestick outline. Kindly note that candle outlines are utilized for market developments dependent on past diagrams. Exchanging is emphatically impacted by exchanging brain science and market brain science, and furthermore a few inclinations that significantly influence an individual in exchanging yet with candle graphs we can understand them and know the brain science of the market that is going on.

Candles are planned like candles however have an upper and lower wick, the wicks educate us regarding the most noteworthy and least costs or generally called upper shadows and lower shadows. Green or white genuine bodies show that the market is bullish, while red or dark genuine bodies demonstrate that the market is bearish.

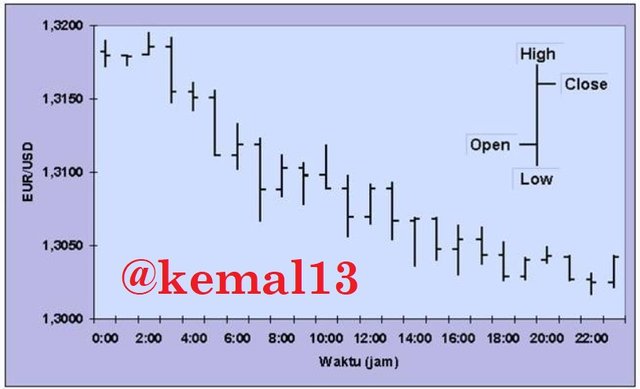

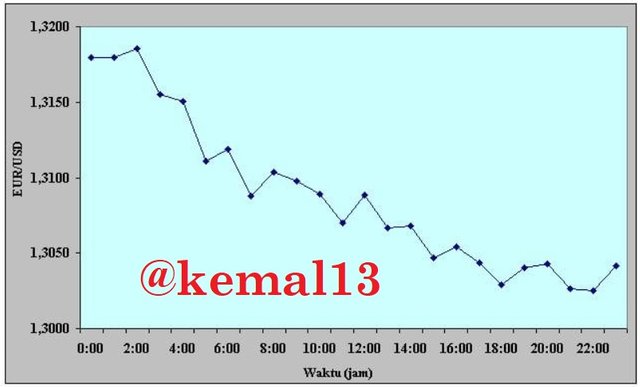

Describe any other two types of charts? (Screenshot required)

I will provide knowledge about the chart which I explain below is the Bar Chart and Line Chart

- Bar Chart

Barcharts are found as bar diagrams and bar lengths that show the period of time of every action by L. Gantt Chart and Fredick W. Taylor. Barcharts are an assortment of exercises that are shown as diagrams as bar graphs, subsequently barcharts are likewise frequently alluded to as bar outlines. Barcharts are typically used to see correlations between information. Barchart comprises of four snippets of data, specifically open, high, low, and close. Along these lines, in the barchart you can see an examination between the information comprising of the four data.

- Line Chart

Line diagram is the least complex chart as a line. The line graph shows close information, barring open, high, and low and takes a gander at patterns between information.

In your own words, explain why the Japanese Candlestick chart is mostly used by traders.

I have several reasons, including:

The shading distinction in showing the bullish and bearish pattern and furthermore the presence of shadows have made it simpler for dealers to break down the market and patterns.

Candle graphs can rapidly recognize changing business sector members and furthermore give flags quicker than other specialized examination apparatuses.

The body of the candle outline can show the connection between the opening and shutting costs, in this way the candle diagram will give dealers an admonition about market brain science. This market brain science is risky for merchants since it can change patterns in the short or long haul.

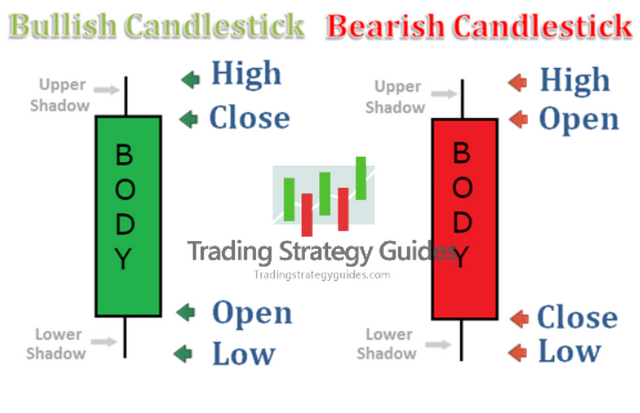

Describe a bullish candle and a bearish candle identifying its anatomy? (Screenshot is required)

- Bullish Candle

There is likewise a genuine body which means that the volume of purchasing power, the more extended the green genuine body, it shows the degree of purchasing volume is assuming control over the market, while the short genuine body means that the purchasing volume isn't excessively solid (comparable among purchasing and selling), then, at that point the upper shadows demonstrate meeting high and lower shadows show meeting low.

In Bullish Candle there are have four anatomical parts, as :

- High

- Close

- Open

- Low

in Bullish Candle the opening price is lower than the closing price on the bullish candle.

- Bearish Candle

Long genuine bodies show individuals are assuming control over the market in selling their resources, more limited genuine bodies are a sign of selling inside sensible cutoff points, shadows are equivalent to bullish candles, upper shadows demonstrate the greatest cost during a bearish pattern and lower shadows show the most reduced cost during a bearish pattern.

In Bearish Candle there are have four anatomical parts, as :

- High

- Open

- Close

- Low

In Bearish Candle the opening price is usually above the closing price because the price has gone down at the same time.

Conclusion

To comprehend Japanese candles diagrams and what they address, you should initially see every part and what they represent. Candle diagramming can be very convoluted and could be difficult for some individuals to fathom. However, you're not simply anybody. You hunger for information. Indeed, simply on the off chance that you need some assistance with the essentials, we should begin by investigating what a Japanese candle design is, and what it can conceivably uncover to you about an instrument.

Japanese candles are worked to show us the opening and shutting costs, just as the every day highs and lows of a particular time-frame.

Hello @kemal13, I’m glad you participated in the 2nd week of the Beginner’s class at the Steemit Crypto Academy.

Unfortunately, we can't review your assignment because you submitted after the dealine which is 11:59pm UTC on Saturday, July 10th 2021.

Please ensure you meet up with time and submit your assignments before the deadline. I hope to see you in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

okay prof, thanks before

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Shared on Twitter :

https://twitter.com/kemal13steem/status/1414087153886253056

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit