Hello every one welcome to my homework post of week14 on Technical: Reverse Strategy | Crypto Prices & Market Source: Review Of COINGECKO Given by the most technical professor @stream4u

Technical Details On Reverse Strategy

To explain what reverse strategy is, I will like to take first of what reversal is and what strategy is and then join them together for better understanding.

Reversal in trading is simply the change direction of the price of a coin. When I say change in direction, what I mean is this; assuming the price of Steem moved from its current price of $0.7 down to $0.3, it simply means that there is a downward reversal in the price of steem. Also if the price of steem moved from $0.7 to $1.5, it means there is an upward reversal in the price of steem.

So reversal can therefore be said to be any upward or downward movement from the current price of a coin.

Strategy is a plan to act in a way to be able achieve something for a longer period of time.

Having explained in simple terms what reversal and strategy is, let me now join them together and see what it means in the crypto market.

Reversal Strategy is a plan by a trader to make profit from the upward and downward movement of the price trends in the crypto market. This strategy is best used in the present day market that is live market.

Most time, when there is an uptrend (bullish) in the price of an asset, a trader might be happy and decide to open a sell position, then all of a sudden, the price begins to go bearish, the trader will lose his trading position and that will make the trader feel so unhappy.

Also, if the market was going bearish and the trader decides to open a buy position, then suddenly, the market goes bullish, he will lose his trading position and run at a loss.

That is why reversal strategy is important. Reversal strategy will help a trader to observe the market trend for about 24hours during which the market is going bullish or bearish at a 20% or more profit or loss. If the next day open market price is near to the close price of the previous day, then a trader can now open a buy position and that will make him more profit when the market goes bull.

If in the bullish market, the open market price rises above the previous close market, then the reverse strategy is telling the trader that it is a good time to open a sell position, sell and take profit. But while opening a sell position, it is good to set a stop loss on the previous low point while still maintaining the sell position to avoid losses.

Coingecko is a website or platform that gives detailed information about the performance of all the available crypto coin. When I say detailed information, I am actually referring to the up-to-date price information of a crypto coin, the trading volume information of a crypto coin, and information about the price fluctuations of a crypto coin from as far back as when the coin was introduced to the crypto market to the present. Coingecko also shows the ranking of crypto assets based on their market capitalization.

Coingecko was birthed in 2014 by TM Lee who is the Chief Executive Officer (CEO) and Bobby Ong being the Chief Operating Officer (COO). Their aim was to provide people who access the site with good and valuable insights about crypto coins.

The good and valuable insights about crypto coins Coingecko provides are the reports they give about crypto coins are the market statistics of the coin which include the all-time high and all-time low of a coin, the trading volume, the 24h low and 24hr high of a coin, the 7day low and 7day high of a coin, the market cap rank of a coin, the current price of a coin, and so much more.

How CoinGecko Can Be Helpful In A Crypto Market

It gives historical briefing about a coin, which helps a trader to know what coin he is about investing his money in or what coin he is about to trade.

It provides a trader with useful links to the official website, social media handle and the blog post of a coin which helps a trader to explore more about the coin before investing in the coin.

It provides its users with the contract address of a crypto coin which could help a trader to know if a coin is centralized or decentralized. Ofcourse we learnt in our previous lessons how safe and profitable decentralized crypto coins are, as opposed to centralized crypto coins.

With a single click, a trader can learn about the top well performing coin for the day. And with another click, he can learn about worst performing coin for the day.

CoinGecko dive deeply into the crypto space and monitors the growth of every crypto coin in the crypto industry and provides valuable information about the newest coin in the crypto industry and also the hottest trending coin in the crypto space.

Exploring COINGECKO Features with Information

There are many ways that CoinGecko could be helpful in the crypto market.Let me list the ways 👇

In Analysis of a Coin:

It is important to note that to make an informed decision in the cryto market,one has to make a thorough analysis of the coin that he intends to buy.With the help of CoinGecko,it is easy to zknow the current price, and last price of any coin over the last hours,days,weeks,months and even years.So with this information provided,one can make a good Technical analysis before Investing.

Information about a Coin:

CoinGecko gives information per the market Capitalization,Price,Trading Volume, Circulation Supply, Dominance and every other thing you want to know about any coin say Ethereum at just a glance.

Information About Exchanges:

Apart from offering information for Technical Analysis of a coin... CoinGecko also provides information on the exchanges that trade that particular coin to avoid the buyers from entering the wrong hands.

We can see that the help that CoinGecko offers in the cryto market cannot be over emphasized.

EXPLORING COINGECKO FEATURES

The features on Coingecko are so so many.This homework has help me to know more about the features.

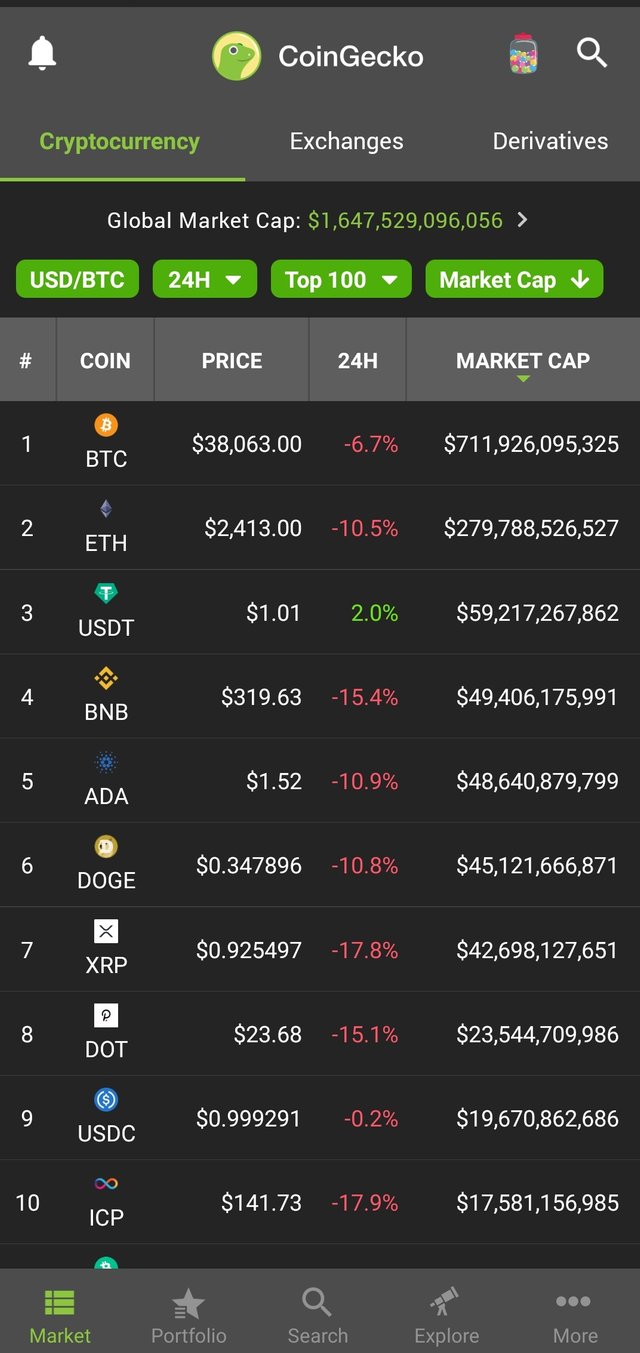

MARKETS

Markets is located down at the left hand side when you open the CoinGecko app,Under this Market,there are plenty of things to explore under the MARKET section.They are 👇

First is CRYPTOCURRENCY:

There is a list of all the cryptocurrencies including Bitcoin,the pennycoins,Stable coins and Altcoins in general.It didn't end there,when you click on each coin.For example I clicked on Bitcoin,you will see

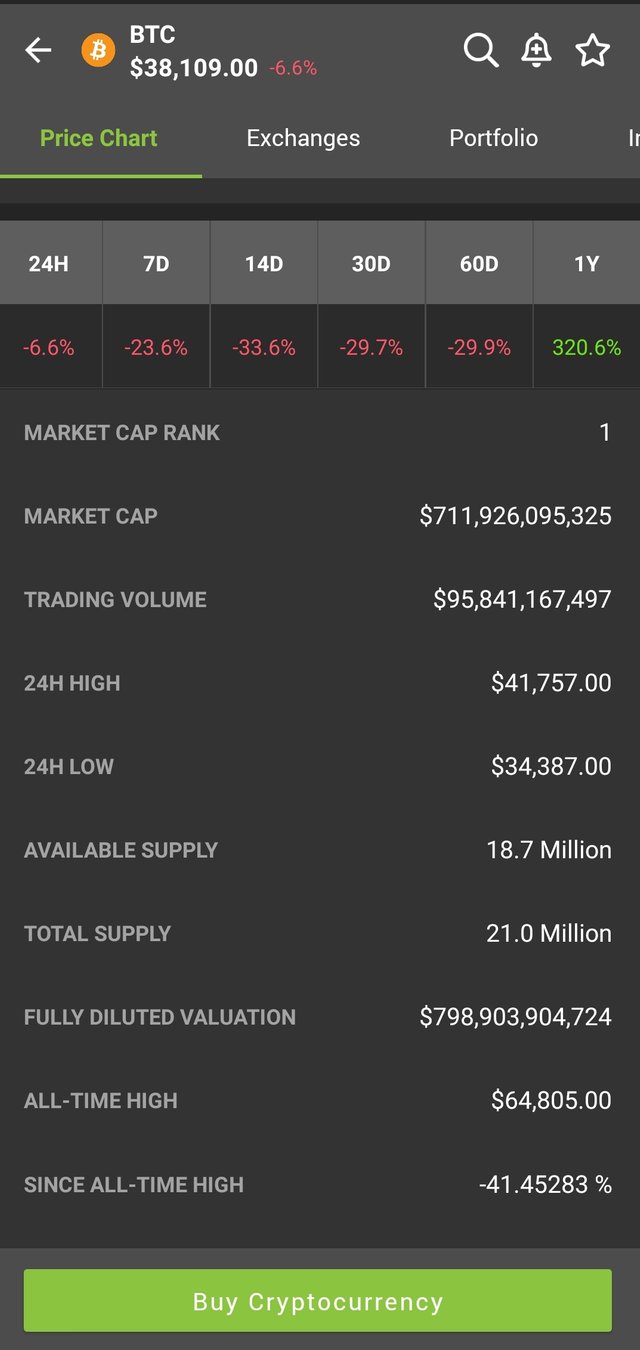

PRICE CHART:

Here we will see the price,the graph for the price for 24 hours,7 days ,2 weeks, 1 month etc...Other information there are:market capitalization,market ranking, devaluation, trading volume,24 hour high and 24 hour low,supply,all time high value and date,all time low value and date and even an option to buy the coin.

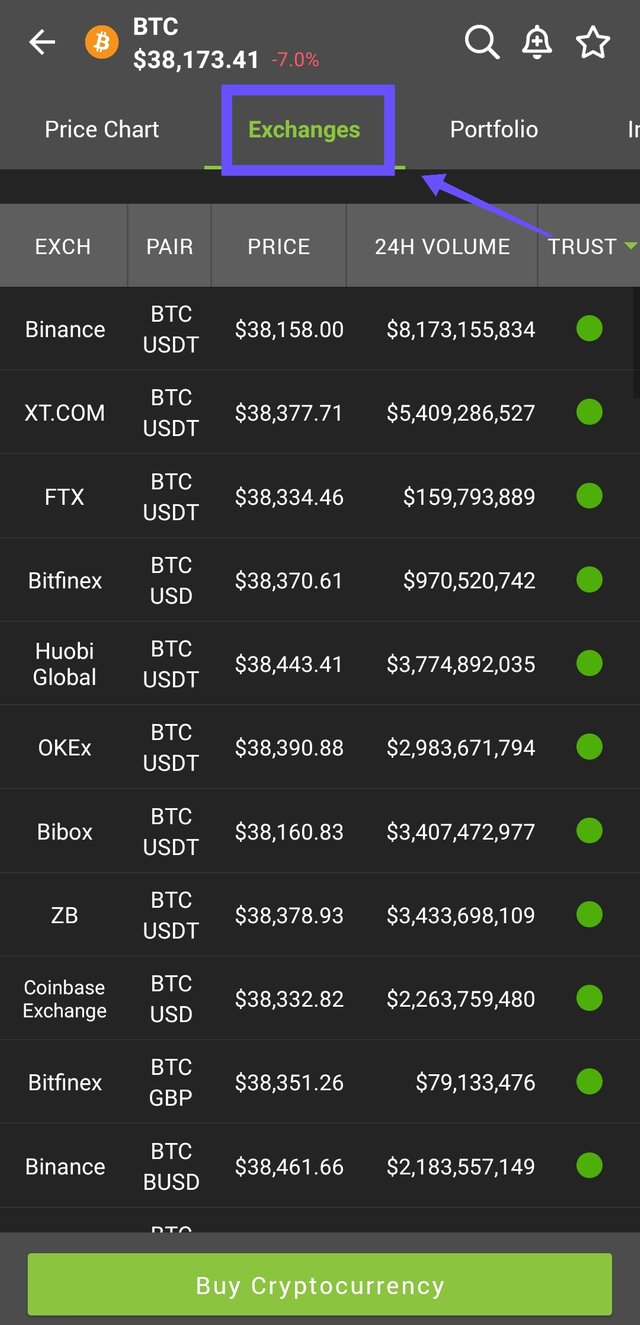

EXCHANGES

Here you will see a list of exchanges that trade Bitcoin (my preferred choice).Each Exchange has their own price although the differences are infinitesimal.You will also see the Pair for each Exchange,some pair BTC/USD,BTC/EURO etc.👇

PORTFOLIO

This is list list of Portfolio with Bitcoin.

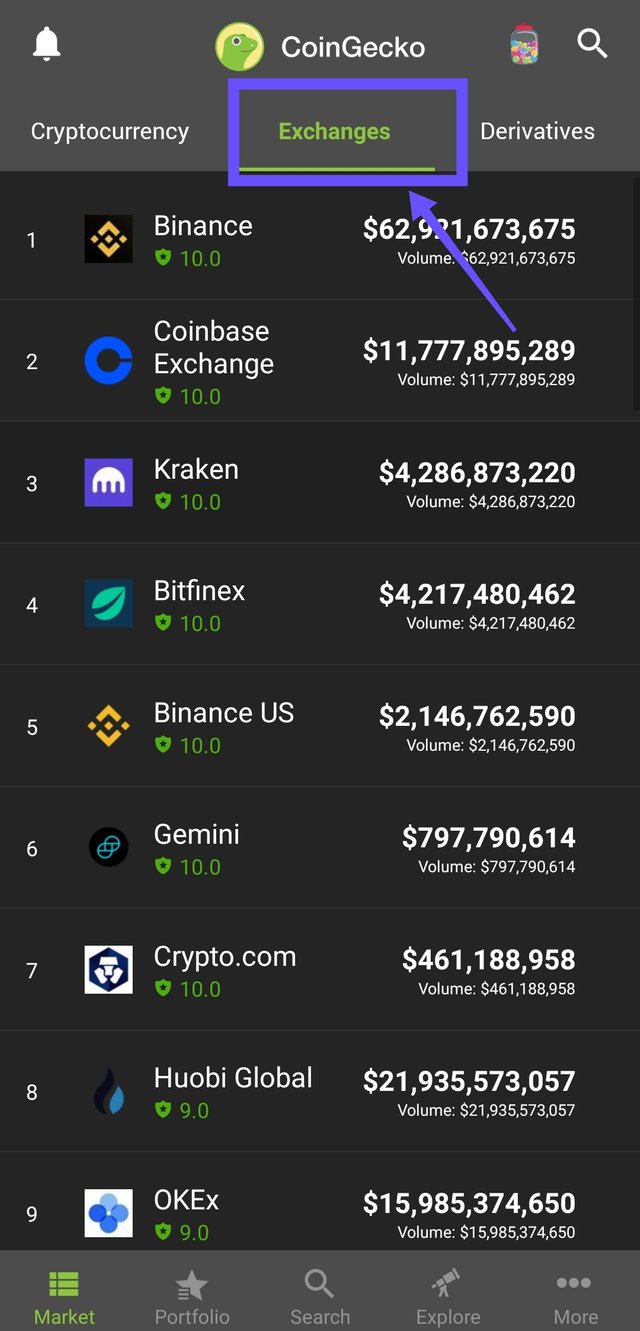

Second is EXCHANGES:

In this section you can see all the popular available crypto exchanges with their trading bvolume.From the information that I have BINANCE is ranking number one with a trading volume of over $53 billion.👇

Thirdly is DERIVATIVES:

These are derivatives of the main exchanges.👇

TOP 300

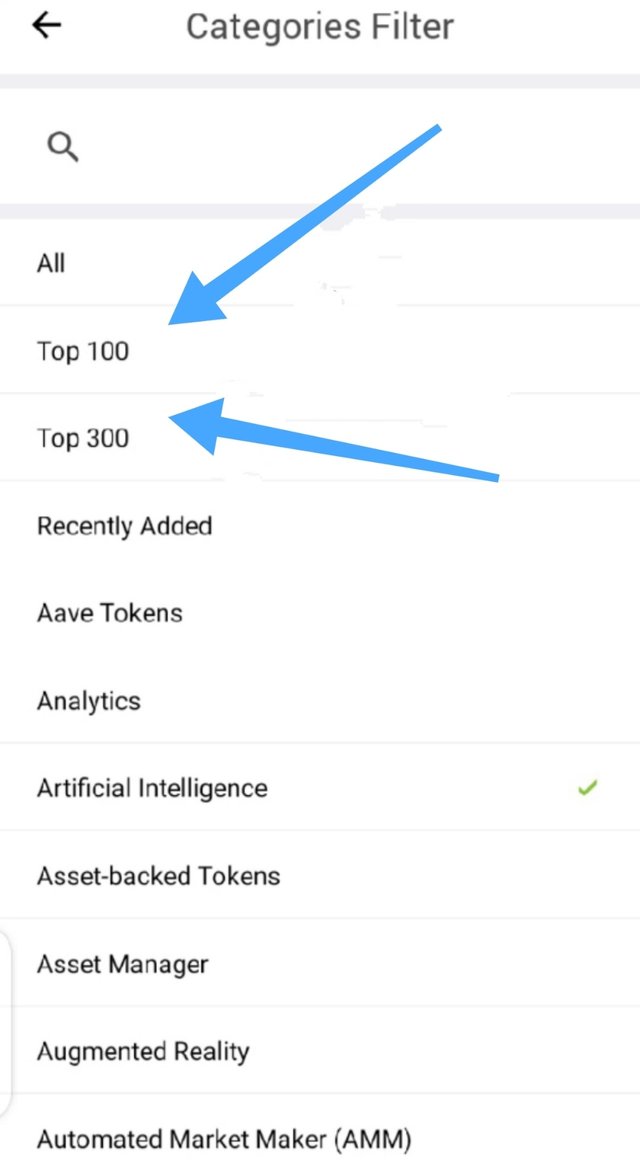

Next I clicked on the top 300.Here I was able to access the top 100 coins,top 300 coins, Recently added coins,Asset backed Tokens, Artificial Intelligence etc.👇

GLOBAL MARKET CAP

When I clicked on the Global Market Cap,I saw the market dominance of coins for 24 hours.

Bitcoin had a Dominance of 41.84%, Ethereum enjoyed a Dominance 17.08%,USDT recorded a Dominance of 3.22 while the other coins had a combined dominance of 37.86%.👇

EXPLORE

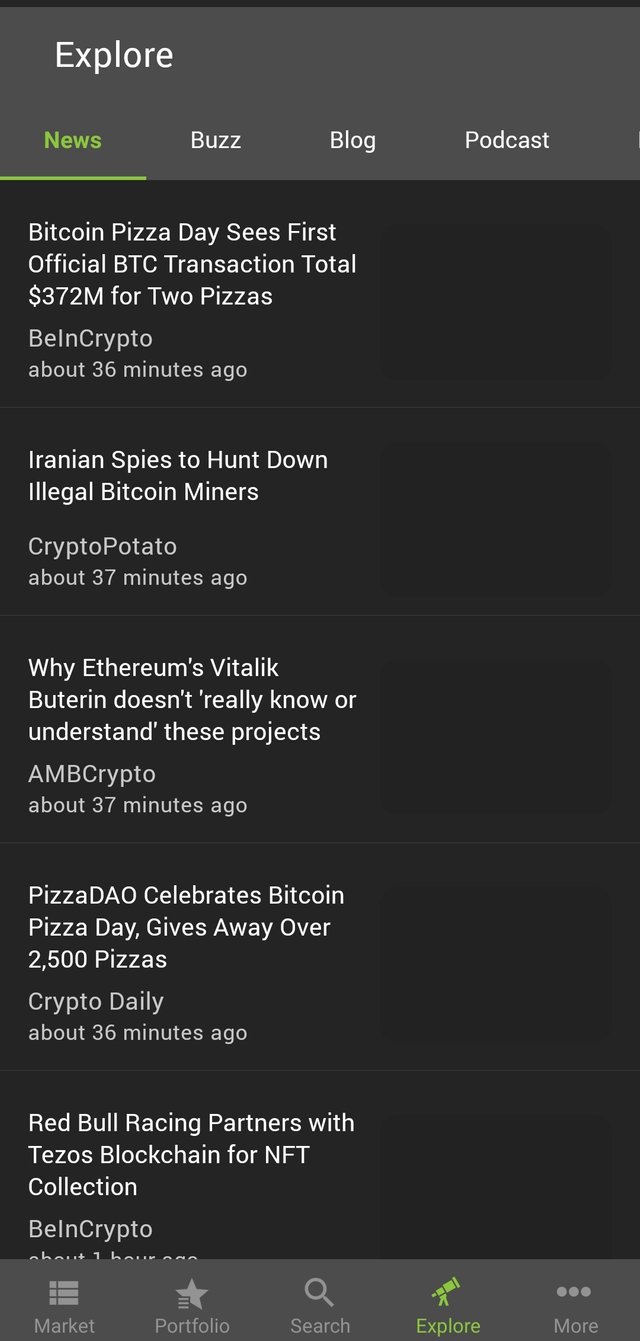

one still click on Explore to see some important news about cryptocurrency which could serve for Sentimental Analysis.👇

SEARCH

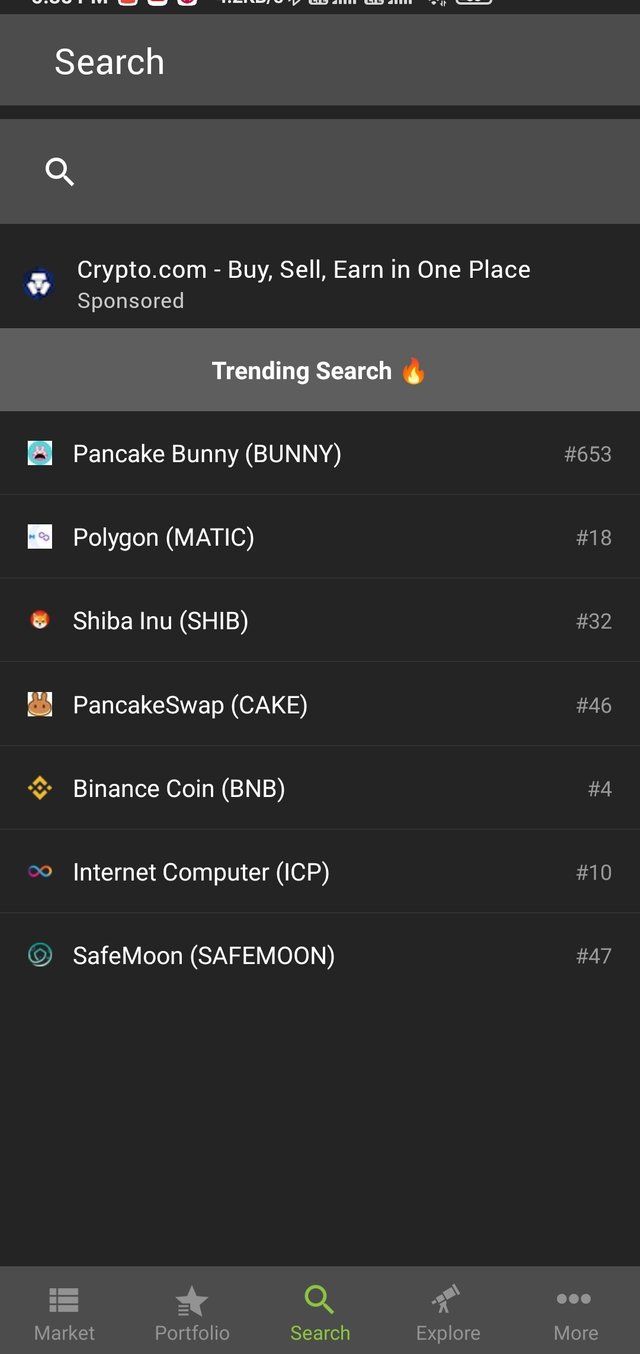

One still click on Search to see more cryptos or to see the trending searches in the crypto world.👇

WEEKLY PRICE FORECAST FOR XRP

BASIC INFORMATION:

XRP is that native crypto in the Ripple blockchain.It is used basically in making payments from one country to another without involving banks or any third party (ies).

This Cryptocurrency caught my fancy because it has got real life application which is transfer of funds from Peer-to-Peer at a faster,secure and less expensive rate.

Apart from that,one can still buy,store and sell XRP to make profits.

WHY XRP

I chose XRP because it is one of the cryptocurrencies that have an important usage (applicable utility) in the world.Here in Nigeria,we handle international transfers(payments)a lot and banks take a lot of charges and still delay the transaction,so XRP has come to eliminate the huge charges and delays that banks inflict on Nigerians for international transfers.We all know that payment is one of the most important aspects of trading and other businesses.

Sometimes one can initiate international trade(eg importation) and would have to make payment for the goods bought.In such a case the Ripple blockchain would be used to make the payment on a Peer-to-Peer basis without the use of banks and the crypto to be used for the transaction would be XRP.

Another reason why I chose XRP is because it is one of the top 10 cryptos over the years and has always maintained the top 10 even as market prices dips.At the moment XRP is ranked number 7 in the list of all the cryptocurrencies available in the world today.

**XRP is also in the list of coins traded by almost all the crypto exchanges.This means that it is an important coin with great utility.

Furthermore,the trading volume of XRP is

is over $10 billion and the market capitalization is over $40 billion over the last 24 hrs at a price of $0.862745...The fall in rice is connected to the dip in price being experienced at the market.

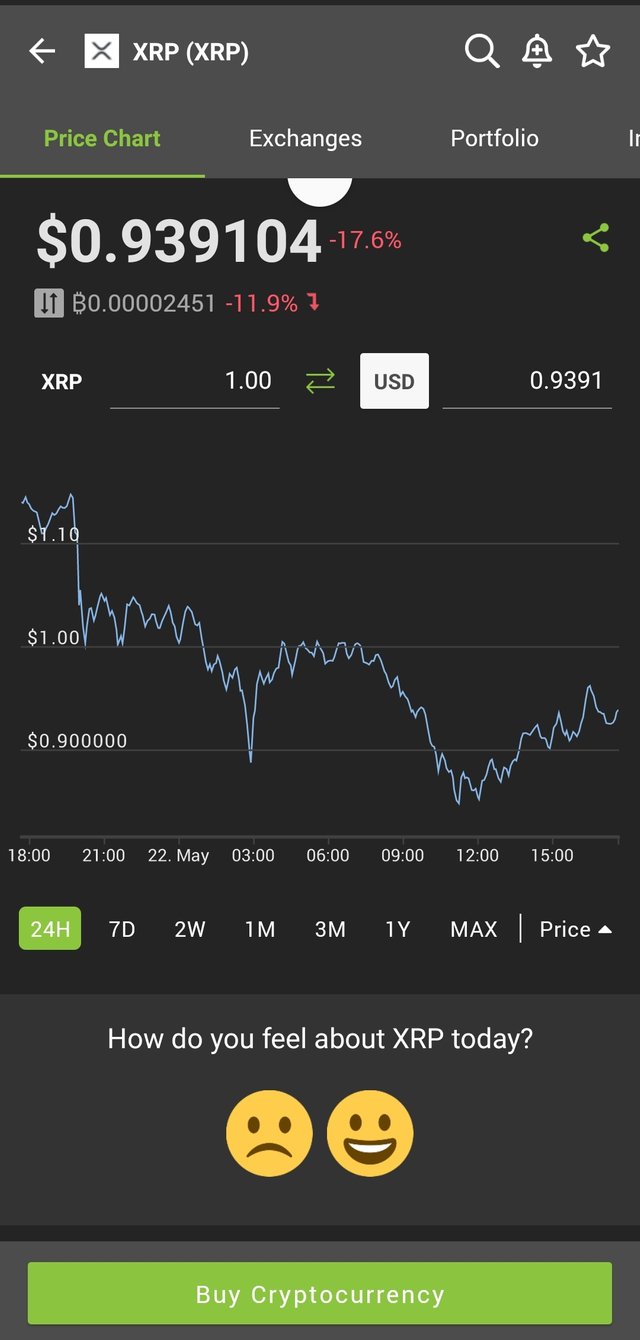

TECHNICAL ANALYSIS FOR XRP

The chat above 👆 is a chart showing the behavior of XRP over the past 7 days.From the chart it is clear that the coin is in the dip.

It started at $1.4 on the 16th of May,and climbed to $1.6 within 24-hours and then dropped to a little below $1.4 on the 17th of May(a God time to buy,since it has fallen back to starting point).

After that,it went up again for the next two days and the price rose to a bit above $1.6...

after the rise to over $1.6,the price dropped to $1 the next day,this time least price it has attained over the from the beginning of this analysis.

The next day,the price rose to $1.2 and on the 7th day the price dropped this time to as low as $0.8 at (over -20%).

My Prediction:With the way the prices of CRYPTOS in general is falling,it is a but difficult to predict the price.

However,I predict that the price of XRP would be at $1.2 in the next 7-days because a lot of people can now buy it at a cheaper rate since it has dipped to below (-20%).

LOW LEVEL AND HIGH LEVEL FOR NEXT

I believe that considering the market and activity of XRP its low level would be $0.7 and the high level would be between $1.2 to $1.3.

REFERENCES👇

Most of the images used are screenshot from my CoinGecko app.

CONCLUSION

The Reverse Strategy is an important way of evading running into losses.This is because it makes traders not to rush to sell off when they see a sharp rise in price or rush to buy when there is a sharp drop in price rather it is wise to wait for about 24 hours to see if the rise or fall will persist before making any move.

CoinGecko is a very important informant for studying the behaviour and all vital information about any crypto currency.