INTRODUCTION

In the wonderful lecture by @reminiscence01, we were taught about Cryptocurrency investment tools that are needed by any trader/investor planning to enter into the cryptocurrency market. We learned about the CoinGecko website and platform and its great features that provide a trader/investor with the necessary information required for good decision making concerning different cryptocurrencies. We also reviewed the Tradingview platform which helps a trader/investor know when best to invest into his choice of coin or token. And finally, we explored the concepts of a Cryptocurrency Watchlist and Portfolio and their importance to any trader/ investor.

Let’s get down to the questions.

Question 1

a) Explain CoinGecko and why it is a good cryptocurrency investment tool.

CoinGecko is an online Cryptocurrency Information platform. It was developed by a Singapore-based company with the idea of providing all necessary and important information an investor/trader would need to navigate the vast world of cryptocurrency. It is a great investment tool because it is well-structured to enable its users to carry out a greater level of fundamental analysis and exploration of the majority of cryptocurrencies.

One can look through the statistics and metrics of any given cryptocurrency in order to make a good investment decision. These metrics include market capitalization, total supply, circulating supply, 24hr volume, and others. It also sometimes provides links to the cryptocurrency's website if it has one.

b) Explore CoinGecko and explain at least 5 unique features of the platform (Take a screenshot of the page).

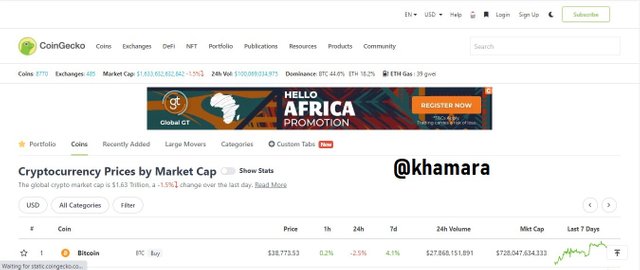

CoinGecko is an easy-to-use, user friendly, well-structured and organized platform. When one visits CoinGecko they are first taken to the landing page

On the landing page, one of the first things we can notice are the different tab links we can visit outlined at the top. There we have “Coins” “Exchanges” “Defi” “NFT” “Portfolio” “Resources” “Products” and “Community”.

Below that we can see statistics including Coins, which at the time of the completion of this assignment are 8,770; Exchanges, which are currently 485; Market Cap; 24h Volume; BTC and ETH Dominance; and ETH current Gas fee which is 39 Gwei.

Below that, most noticeably is the “Cryptocurrency Prices by Market Cap” and we can see Bitcoin as number 1 in that category with a market cap of over $7.2 Billion. In that same table, we can see the current price, 1h, 24h, and 7d percentage change as well as a little line chart of the past 7 days. Below Bitcoin there are other cryptocurrencies ranging from Ethereum coming in second to Polkadot coming in 9th and all the others after that.

Feature 1

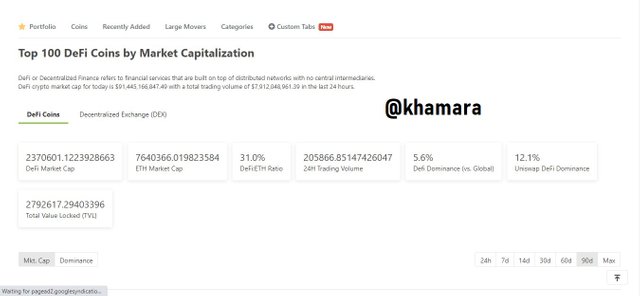

One of the unique features I can see is the “Defi” section. Clicking on the link takes you to this page:

On this page, you can see the top DeFi coins by market cap and explore them.

Feature 2

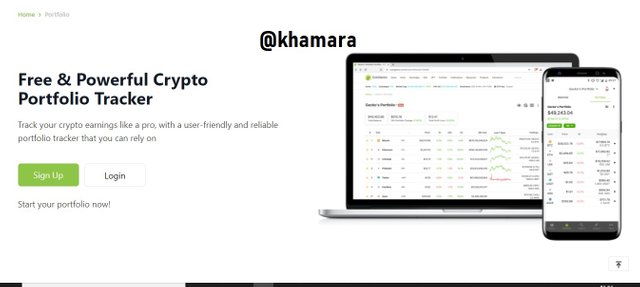

Another unique feature of CoinGecko is their “Free & Powerful Crypto Portfolio Tracker” which I could not access because I did not have an account.

Feature 3

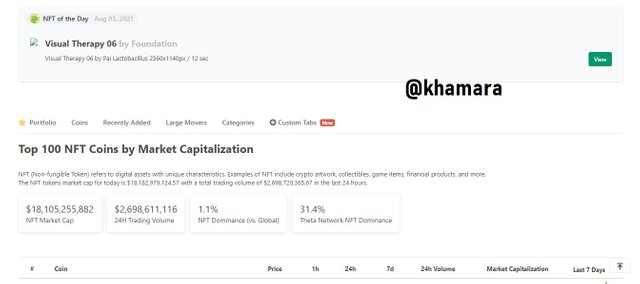

Another feature I really liked was the NFT section. NFTs are really gaining a lot of traction these days and this section helps you track NFT coins by market cap.

Feature 4

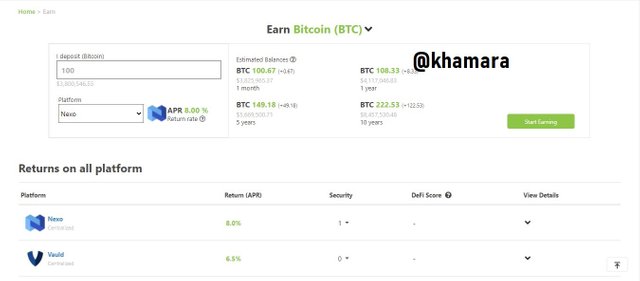

An interesting feature I also found was under the “Resources” tab. If clicked on, the first section is an “Earn Bitcoin” section. In this section, you can register to earn a certain amount of Bitcoin over time.

Feature 5

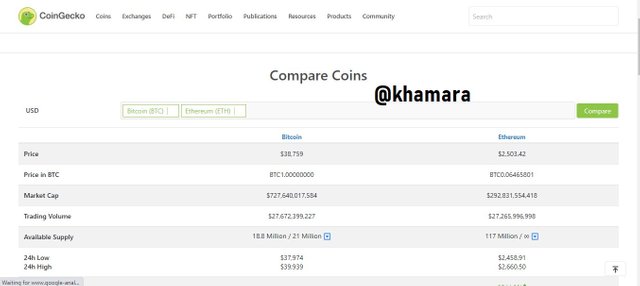

Finally, another very useful feature I found on the CoinGecko platform was, still under the resources tab, a section to compare coins. This is very useful for long term investors and traders alike, in order to select which coins they choose to invest in or trade.

Question 2

a) Give a brief explanation of Tradingview platform.

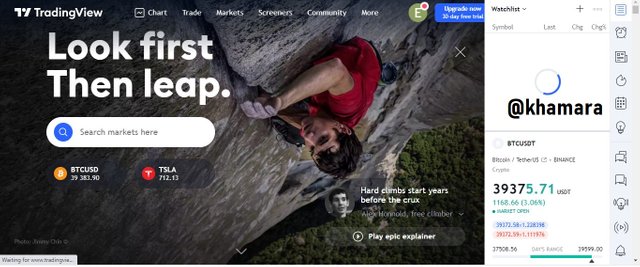

TradingView is a cross between a social platform and a charting tool. It has a space for traders and investors alike to socialize and interact and to exchange ideas and information, as well as provides tools for well-customized charting and technical analysis by traders/investors.

Their charting tool is very well-equipped and has a wide variety of tools that enables traders to fully analyze their selected assets, ranging from stocks, currencies, and cryptocurrency. You can view the price charts and edit them as you please, by adding technical indicators, drawing patterns, trendlines, and many other technical analysis tools.

b) Explain the steps involved in adding indicators on Tradingview chart. You can add any indicator of your choice except moving average. (Screenshots required)

Within your chart you can add technical indicators, and here’s how to do so:

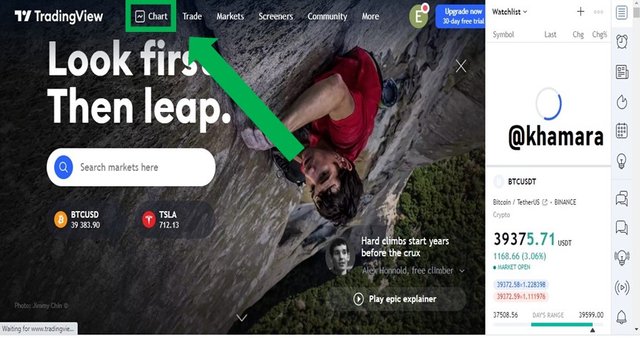

From the landing page, towards the top left corner, you click the Chart link and it would take you to the charting interface.

Towards the top left corner again, you will see a symbol like this:

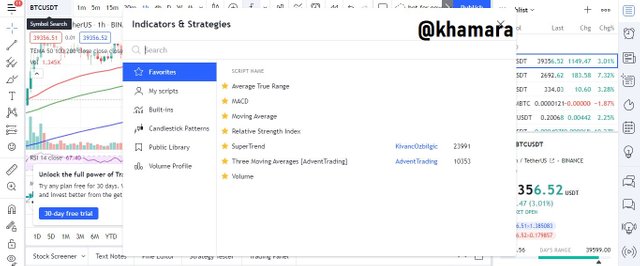

That symbol represents the technical indicators and clicking on it displays a pop-up window titled “Indicators & Strategies”.

To add an indicator to my chart I will simply type in the name of the technical indicator I want to add. For example, now I want to add the Indicator known as Bollinger bands, which is a very useful cryptocurrency analysis tool.

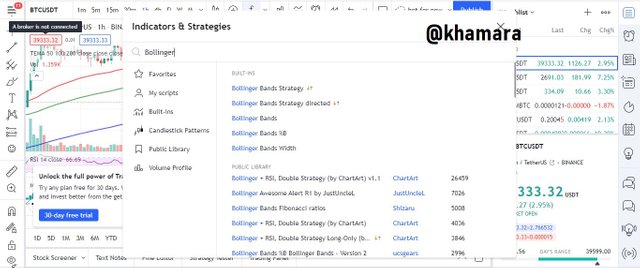

So I type in “Bollinger” and the indicator is shown in the list.

After clicking on it, it is successfully added to my chart.

c) With relevant screenshots, illustrate how to modify the indicator you have added to your chart.

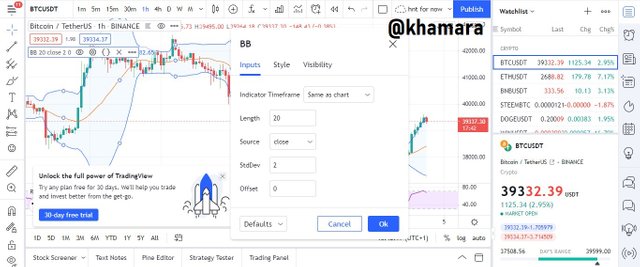

In order to modify my chosen indicator, which is the Bollinger bands indicator, I click on the indicator bar at the top left corner which gives me different options of what to do with the indicator.

I then click on the settings icon within those options.

After clicking on that a pop-up window appears which shows the current settings the indicator is running with.

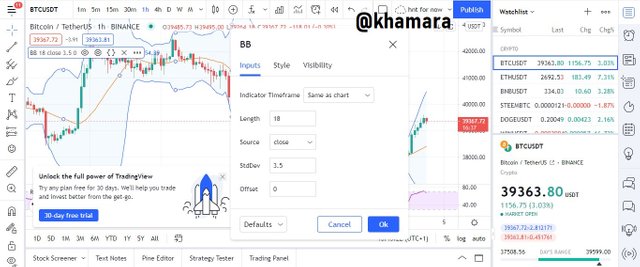

I can then modify this to my taste.

As you can see, I have suited the indicator to my preferences.

Question 3

a) In your own words, explain cryptocurrency Portfolio and Watchlist.

Cryptocurrency Portfolio: A Cryptocurrency portfolio is basically a comprehensive and complete list of all the cryptocurrency assets an investor/trader has put their capital into. It is the collection of all of an individual’s cryptocurrency.

Cryptocurrency Watchlist: A Cryptocurrency Watchlist is a list of Cryptocurrency assets which and individual is keeping tabs on or observing.

There are a very large number of cryptocurrencies available in the cryptocurrency market. Due to this large number, no single person can single-handedly watch all the available cryptocurrencies at the same time. Therefore, one must carefully analyze some of the available cryptocurrencies, either through technical or fundamental analysis, and if the individual sees a potential upside to the cryptocurrency asset, they can choose to add it to their Watchlist, and eventually to their portfolio.

b) Explain the need for Portfolio management.

One of the efficient ways of managing one's risk is by diversification of investment, and as such, an individual should never fully invest their capital into only one cryptocurrency. This exposes their capital to very high risk. An investor/trader may not be correct in their analysis of a cryptocurrency asset, and a cryptocurrency which they thought to have potential for upside ends up going down.

If the price of a cryptocurrency asset goes down by 40%, and a trader/investor invested their entire capital, their capital takes a net loss of 40%, however, if they diversified their portfolio, some assets may see an upside in price and others see a downside, then they have managed their risk and minimized their net loss. It is also important for an investor/trader to have some free capital in order to take opportunities that may present themselves.

For example, an investor should never have all their capital in Bitcoin. A better strategy would be to have maybe 40% in Bitcoin, 20% in Ether, 20% divided among other altcoins of their choice and another 20% of their capital free in order to take opportunities that may come.

c) Select 5 cryptocurrency assets you wish to add to your Watchlist and explain your reason for selecting each of them. (Show screenshot of your Watchlist. It can be any platform).

Bitcoin(BTC): Of course, we all know that bitcoin is the granddaddy of all cryptocurrencies. Being the first cryptocurrency, it is also the major and most dominant cryptocurrency with the highest market cap till date and is definitely one that any investor/trader should put on their watchlist.

Ether(ETH): The second biggest cryptocurrency till date, this is the cryptocurrency for the Ethereum blockchain, which was created to enforce smart contracts. This cryptocurrency is well-known for following after bitcoin and is very well worth investing in.

Binance Coin(BNB): Binance is one of the top cryptocurrency exchanges in the world currently, and is also the exchange I use. They have made many advancements and one of them was creating their own cryptocurrency which can help one reduce fees on their exchange. Due to their many advancements as well, their coin continues to see an upside in the market, having the fourth highest market cap according to coinmarketcap.com. Definitely one to have on my watchlist.

Steem(STEEM): This is the cryptocurrency of the Steemit website, which we are currently posting on and the token of the Steemit blockchain. Since I earn in steem, as well as being interested in the Steem project, it's very important to have this on my watchlist.

Dogecoin(DOGE): Another very interesting coin, Dogecoin is a meme coin that has gained a lot of traction over the space of a couple of months, due to tweets by Tech-made Billionaire, Elon Musk. This is one I personally consider worth watching due to the heavy influence of fundamentals on the price.

Heres a view of my Watchlist from TradingView:

CONCLUSION

CoinGecko and TradingView are very important and interesting platforms that really help any cryptocurrency enthusiast or investor/trader understand the market better and enable the individual to enter into the market. CoinGecko helps one do more of fundamental analysis, with being able to analyze a coin by market cap, circulating supply, website, and other important factors. TradingView is more concerned with Technical Analysis and being able to analyze the price chart of a given cryptocurrency with technical indicators, drawing tools and much more, and finally being able to share those ideas with fellow traders, investors or enthusiasts. Thanks to @reminiscence01 for the very informative lecture.

All pictures were taken from TradingView or CoinGecko by me, or were designed with the help of Canva

Hello @khamara , I’m glad you participated in the 6th Week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit