Introduction

The finger-trap scalp trading strategy is a scalping strategy where we use two exponential moving averages (E.M.A) most likely period 8 and period 34 to snipe out entries and where we take profit, and minimize our stop loss space, making it tight, in order to lessen the effect of loss.

.png)

Demonstration of scalping, using the finger-trap scalp trading strategy on ethusd pair and btcusd pair.

Well, scalping in tales trading with small-time graphs, like the 5-minutes graph or even as small as the 1-minute graph, depending on the preference of the trader. so in the following posts, i will show with screenshots how i scalp traded ethusd and btcusd pairs.

ETHUSD finger-trap scalp trading

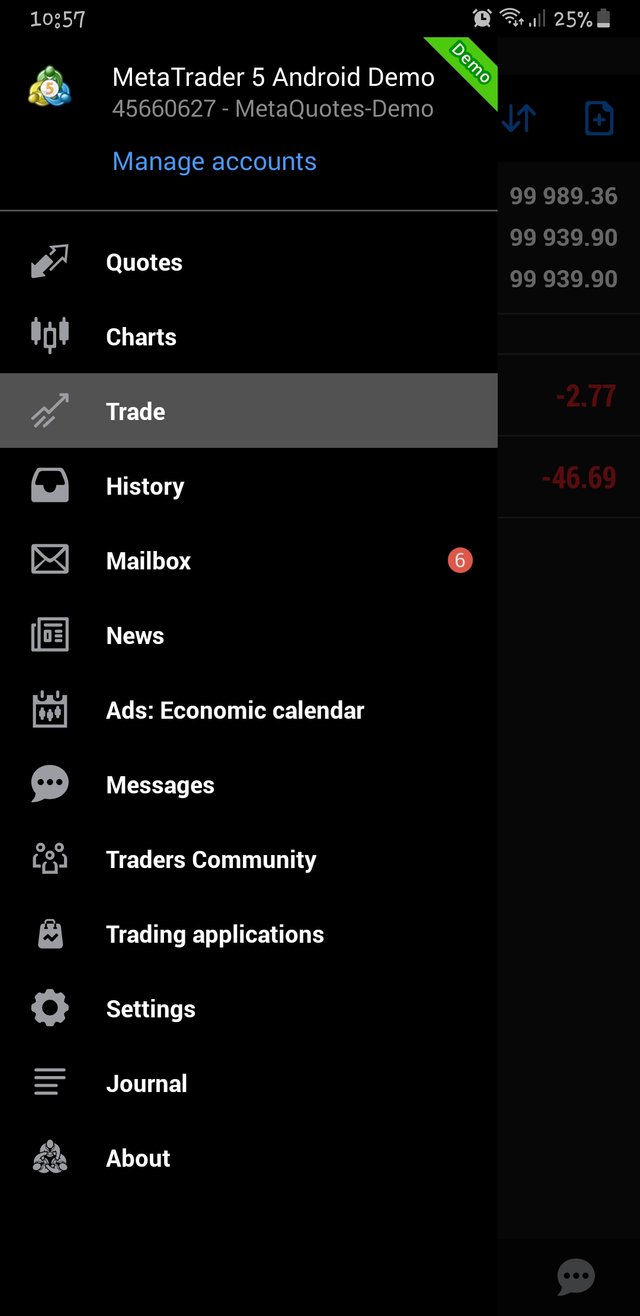

i am using the mt5 platform for this assignment, and a MetaTrader quote demo account has already been automatically prepared for me upon installing the application.

now to demonstrate how to use the finger trap scalp trading method I divided it into some steps below:

Steps

- use E.M.A 8 and 34 with different colors to show line crossing

- choose and open one large time frame for a chart to determine the trend direction.

- open a small time frame for the same chart to determine when to enter and when to leave and set stop loss

- place the trade, and set a tight stop loss to ensure better risk management.

- make sure to close the trade within a satisfactory but not too buoyant level.

E.M.A

Exponential Moving average is the moving average, that deals with the most recent price changes, and behavior. it is ideal for scalping since in scalping, we trade very swiftly, and even though we trade sometimes in the direction of the trend of the market, we don't always put the trend into consideration, the E.M.A helps to pin point to a scalper trader, what and what could come next and guide the trader to pace the right trades. We use 8 and 34 in the finger-trap strategy to show adequately, the market's movements, it's highs and its lows. And traders, (like i might show you) often decide on their trades when the two lines cross, either to go long or short.

checking trend by opening a large time frame graph

the finger-trap is originally a toy where the child gets her two fingers stuck and doesn't know that the way to get herself free from the toy is by pushing and not even by pulling hard, catching the toy very quickly dead in it's tracks. the same thing should be imitated in the trading strategy, and to do that, the trader has to determine the trend and place trades according to the trend sometimes, depending on her reading from the two selected E.M.A indicators. to check the trend, the trader has to use bigger time frames and look for higher lows or lower highs, like i found above.

opening and trading with small time frame graph

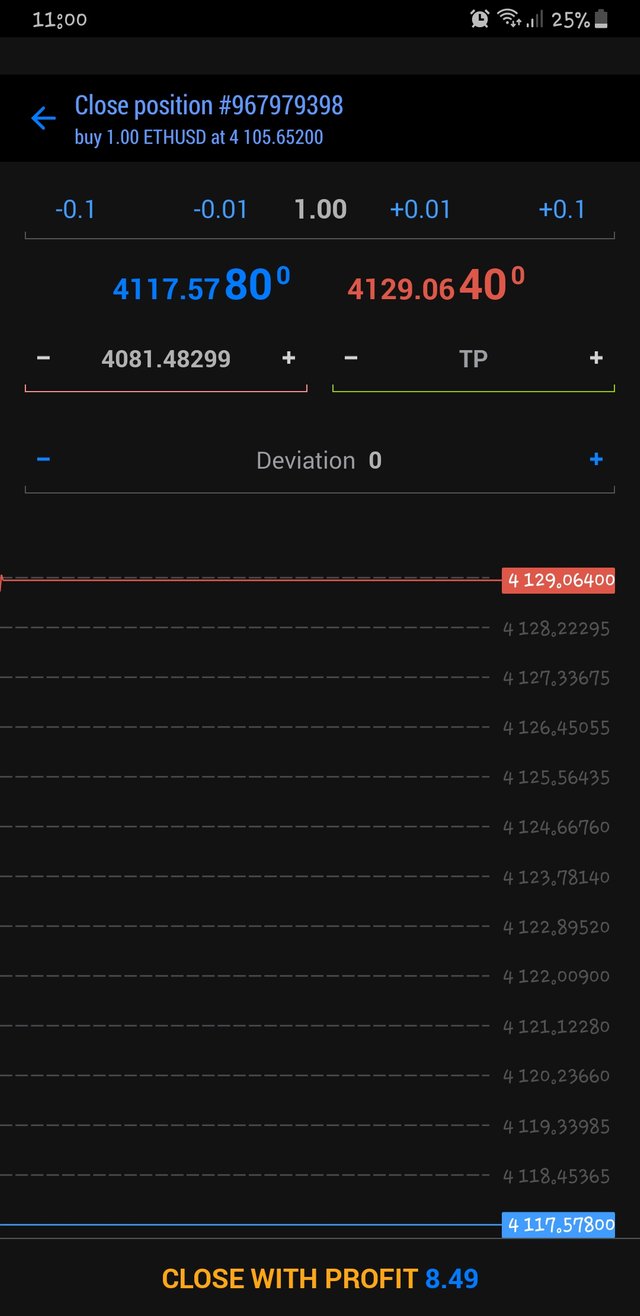

a seen above on the 1-minute graph, wherever the two E.M.A lines crossed, there seemed to be an increase in price, until the last recent dip, where the lines are abandoned by the graph. here, since i am scalp trading, i know that this dip is already too steep, so i decide to go long. now to decide on my stop loss in case something goes wrong.

i use the pinpoint tracer tool, to check at what level I'd like to place my stop loss, and I decide it to be on the very tight 4081.48299 price point. and then I placed my trade. i watched as the money quickly entered into a little profit, and then closed the trade at about $8. Just like a trap!!!

BTCUSD finger-trap scalp trading

vital elements used:

- E.M.A of 8 and 34 blue and red respectively

- trend indicating strategy

- tight stop loss

- quick profit retrieval.

- The E.M.A has been set already in the 1-hour btcusd graph above, and the next thing i looked for to go on with my finger-trap scalping method/ strategy is the trend. I realized that the trend was currently a downtrend, as I noticed:

- A head and shoulder.

- lower highs from the graph.

- After determining the trend, I then go on to scalp and find an entry point with a more suitable graph, i use the 5-minutes graph to decide my entry and stop-loss as seen below;

- here, the downtrend is more prominent, and I then decide where I place my stop loss at. I decided to place it at a tight point at the time of my lacing, which was at 5244.610 price and monitored as the price quickly also changed from loss to a profit of about $57, and then I closed my trade. these both trades happened in a matter of minutes and I was able to finger-trap so much profit in such little time using this strategy.

Benefits of finger-trap scalp trading

easy to learn and use:

I only just had to study the strategy for a while, and used it to make profit on my demo account in no time! that's super awesome.quick money:

even as i know trades do not always go well, this strategy ensures quick entries and withdrawals in the market, as profit is not allowed to linger too far in a way that greed sets in and allows the price to reverse into a loss.safer:

with the use of the tight stop loss, the strategy also enures that even if the trade goes all wrong, too much capital is not lost to the market, which facilitates safer trading habits.

conclusion

Finger-trap scalp trading is a new technique of trading currency pairs, be it crypto pairs too, where we use an indicator known as the Exponential Moving average, to determine via two of its lines where price could be heading towards, and how to place short-timed profitable trades by using these indicators and still maintaining a tight stop loss to reduce liquidation effect on the trader's total capital. it is a very nice scalp trading strategy, that is easy to learn and safer for beginners or newbies to crypto and forex trading. thank you @yohan2on for the awesome lecture, see you next time.

all pictures are either designed by me or screenshots from my mt5 mobile demo account.

Hi @khamara

Thanks for participating in the Steemit Crypto Academy

Feedback

This is very good work. Well done with your research and practical demonstration of scalp trading style using the finger trap strategy.

Suggestions

You should note that the stop loss is placed 5 or 10 pips above the previous swing high or swing low depending on the trend you are following in the 1-hour time frame and whether you are going short or long in the 5 -minute time frame. That is purposely to give room to the up and downward price movements that might hit your stop very early.

You will also have to wait for the price to re-load. Once it recrosses the 8 EMA then that acts as a trigger for your entry.

Homework task

9

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you sir for the correction, i've taken note of how to place the stop loss properly for future purposes.

thank you for the correction.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow excellent explanation from you with real screen shots.

#affable #india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!, I really studied and stayed up all night for this homework, thank you for appreciating me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You did grat work because you work hard.

#affable #india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit