INTRODUCTION

.png)

The lecture taught by @fendit really gave out the basics of the Wyckoff method of trading. she went back to the history of how Richard Demille Wyckoff brought about the theory after a study of the stock market.

She talked about the Fundamental Laws and showed the phases that support the theory on the chart. It was very enlightening.

The homework tasks today will help us understand more about the "Composite Man" and what the theory is really all about. I will be doing research on the theory, and writing down my results and findings, i hope you will be enlightened by my findings.

Question 1

Share your understanding of "Composite Man" and the fundamental laws. What's your point of view on them?

THE COMPOSITE MAN CONCEPT

Demille Wyckoff brought up the composite man idea, he proposed that the stock market would be better analyzed by seeing the market as an identity, a person, "A COMPOSITE MAN" elaborating on the theory that acknowledging this would enable the study of the stock market at that time easier, and traders could go along with the trend easily.

The composite man is a representation of the big whales, it is a term that is an imaginary image of the biggest investors of the market, whatever market it may be, the Composite Man must always act in a way that profits him the most, which mainly consists of buying at a low price and selling at a high price.

The Composite man is a manipulator in my opinion, his mode of work is mostly accumulating a large amount of an asset, owning a really huge quantity, and then he makes transactions with that asset, therefore enlightening other investors about that asset in a way that they would want to buy that asset.

In this format, he has drawn a market to that asset which he holds a huge quantity of, and we all know that demand of an asset raises the price, so at this point where the price has risen to a considerable profit gain for him, he sells off all his assets and watches how the price drops.

Wyckoff was tired of losing so much money to the stock market, so he studied the market movement and imagined a man sitting behind the scenes and pulling the strings to his own advantage and to the disadvantage of all other retail traders who did not understand the movement of the market. He brought up fundamental laws that the market ran by.

One of these laws was that there is always a cause for every movement of price on the market. The market just does not move up and down for fun! the Composite man buys assets slowly to avoid an undesired spike in price before he's able to gather as much of the asset he wants.

He does not want to be discovered, I personally like the angle that Richard Demille Wyckoff has brought to life. He has brought out a whole new perspective, An imaginary man that is representing a small group of very rich investors or market whales that tweaks the market up or down just the way he wants. It sounds so heartless and sinister to me but I like it, reminds me of so many evil godfathers in some novels I read.

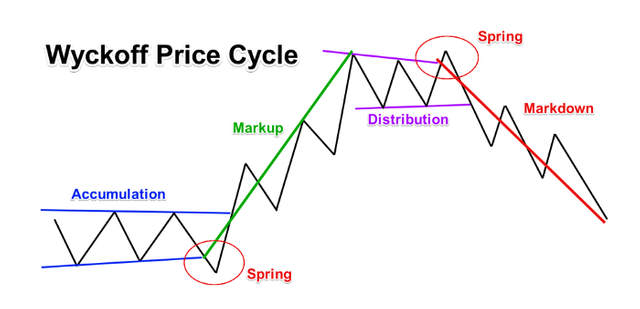

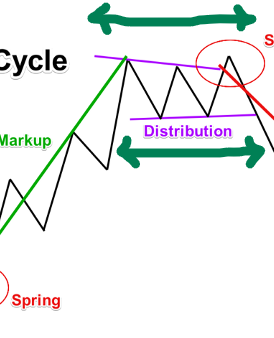

Thankfully, the movement of the market by the Composite Man can be predicted, and Wyckoff divided the chart movements into phases, Which are:

The Accumulation phase

The uptrend Phase

The Distribution Phase

The Downtrend Phase

link

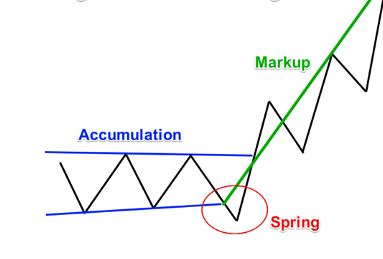

- THE ACCUMULATION PHASE:

link

This is the first phase of the Wyckoff method because this is where we identify the Composite man starting to work silently! He (the composite man) stores up the discussed asset before other investors, in a sneaky way.

He does it slowly so that the price change does not cause a great attraction to the asset before he has enough of the asset accumulated.

As seen on the chart used as an illustration above the spring point is where the Composite Man has had enough stored asset, and decide that now is the time to advertise the asset so that other investors can start demanding the asset. This then leads to the next Phase:

- THE UPTREND:

link

when The Composite Man succeeds in weakening the organization of sellers for that asset, and "He" has most of the assets in the market, this causes a natural attraction for investors, They start seeking the asset, and have to run back to the Composite Man for help.

This means that there is now an increase in demand, and supply is controlled mostly by the composite man as he holds most of the asset or commodity and will now choose the rate of the price increase.

Now it is wise to keep in mind that there could be multiple accumulations during an uptrend, where the price just sits and reforms to come out stronger. They could be labeled as re-accumulation phases.

The Composite man could sell so much at a high price, and seeing that the price of the asset is increasing, the general public of traders become interested, and start placing buy trades, this takes the price of the commodity to even greater heights.

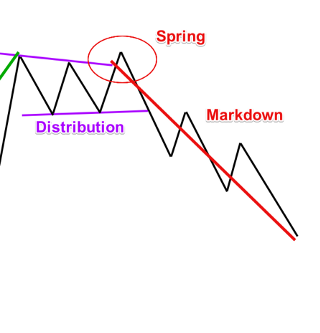

- DISTRIBUTION:

link

This phase is the phase invented by the Composite Man to clear out demand, but not swiftly, in a manner that "He" can profit the most, of course, making the market move in a linear zig-zag motion as seen above.

In this phase, He sells! releasing most of the assets in his possession at a profit rate that suits him to investors and new traders who are attracted to the recent spike in the price of the asset. WHich automatically leads to the final phase:

- THE DOWN TREND:

link

As soon as the Composite man increases supply, and Supply becomes greater than the demand, the price drops, causing the downtrend as seen above.

Seeing that the price of the asset is now dropping, investors are then pushed to also sell whatever of the asset they have to minimize their loss on the trend. This causes an even stronger bearish trend.

let us address the fundamental laws that Wyckoff has acknowledged and stated, and has also imbibed into the Wyckoff method.

FUNDAMENTAL LAWS OF THE WYCKOFF METHOD

- LAW 1: LAW OF SUPPLY AND DEMAND

The law of supply and demand is one of the most basic laws in the world of economics, it is the law that controls everything about price action and direction.

The law states that "Price is directly proportional to demand over supply increase and inversely proportional to supply over demand increase"

The equation for the law can be represented as:

Demand > supply = price increase

supply > Demand = price decrease

In simpler terms, let me explain this. The more people want a commodity or an asset, the higher the price will go, and if the supply or availability of that asset or commodity is nowhere sufficient to satisfy the demands of the customers, the price will keep skyrocketing.

In that same way, when there is way too much availability of a product, commodity, or asset, and the demand of the product does not get to the degree of supply and availability, the price must go lower, so as to get the product or asset sold effectively and avoid loss on the asset by the producer. this is basic economics, and it applies to every market you can think of.

MY POINT OF VIEW ON THE LAW OF SUPPLY AND DEMAND IN REGARDS TO THE WYCKOFF METHOD:

How do we know when the supply is greater than demand, and when the demand is greater than the supply so as to know if the price is about to go up or drop?

I think monitoring the trading volume of the coin pair in this case, or the cryptocurrency or even the currency pair in Forex trading would help us evaluate together with the current movement in price if the supply is looking too outrageous to be bought out by the buying force. I also think that this method did well to bring this law into consideration, so it also involves proper research to see if that coin or currency pair is being bought less or bought more.

- LAW 2: LAW OF CAUSE AND EFFECT

The law of Cause and Effect suggests that the price of the commodity is played between the cause and effect of the price movement. It puts into consideration that there is always a cause of every price movement and the cause or reason of price movement always has an effect directly proportional to it.

Simply put: Cause is directly proportional to effect in the assumption of an ever-present cause.

It suggests that there is always a reason for the always available difference in the supply and demand of a commodity or asset. Wyckoff aggregated that the cause of an "uptrend" is most likely the "accumulation" of the discussed asset by The Composite Man and that a "downtrend" is caused by the "distribution" of the said asset by The Composite Man.

Note that the strength of an "uptrend" is determined by the "accumulation" range, meaning that as accumulation is the cause of the uptrend, the longer the accumulation period. The same goes for the downtrend which is caused by distribution.

MY POINT OF VIEW ON THE LAW OF CAUSE AND EFFECT IN REGARDS TO THE WYCKOFF METHOD:

This law in my opinion comes in handy because if traders keep in mind that there is always a cause for a trend and that at every movement and timeframe, a cause is always present for every candlestick movement and even non-volatility.

It broadens perspective, to look at the range of the cause and predict how much effect the cause would result in eventually. Doing this prevents being caught at the wrong side of the market, and helps us follow the decisions of the composite man effectively.

- LAW 3: THE LAW OF EFFORT VS RESULT

This law finally, brings into consideration the volumes of the commodity and highlights it as the Effort of the market. That being said the law simply states that:

The changes of a commodity are the results of an applied effort. I know, it sounds a bit like Physics, but it still works.

How does it work? well when there is an increase in buy orders of an asset, and there is also an increase in trading volume, the trend is happy to see these two brothers work together, and will most likely move up. This happens when there is harmony between the price movement and the trading volume.

Keep in mind that this also works the other way. The market will move down with a downtrend when there is a disharmony or a disagreement between the two brothers which are the price action and the trading volume.

MY POINT OF VIEW ON THE LAW OF EFFORT VS RESULT IN REGARDS TO THE WYCKOFF METHOD:

In my opinion, this law could be like an imaginary indicator that shows and predict upcoming trends. when you compare the trading volume with the current price movement, one can be able to decipher what trend is brewing.

This will help traders effectively follow up with the Composite Man to buy or sell, whatever the case may be, and then using the two previous laws, the Composite man follow-up is complete.

Question 2

Share a chart of any cryptocurrency of your choice (BTC or ETH won't be taken into account for this work) and analyze it by applying this method. Show clearly the different phases, how the volume changes and give detail of what you're seeing.

For this question, i have chosen TRX/USDT pair to analyze, i don't have a particular reason, but the TRX has actually been through some amount of volatility in the past year so maybe that influenced my choice. Here is my chart analysis below:

screenshots taken from trading view

ACCUMULATION PHASE:

So from the chart above, we can all notice the ranges of the accumulation (in the first green sphere), where The Composite Man managed to accumulate so much TRX over a long period of time. The first accumulation phase was so long, so we should expect a considerably matching uptrend next.

UPTREND PHASE:

As expected, the uptrend is long and steady, as we have already discussed in one of the laws above, "The law of Cause and Effect" we said that the cause is directly proportional to the effect, and this uptrend is clearly the effect of the long accumulated TRX.

DISTRIBUTION PHASE:

I represented the distribution phases by red spheres. Now the differences between these two causes will show us that truly, the cause is directly proportional to the effect.

From the first red sphere, we saw that the distribution period is really small, so we sould expect a down trend, but not a serious one, the down trend that should come after the first distribution phase and red sphere shouldn't be really serious.

on the other hand, the second distribution period was long lasting, and lasted longer than the first, so the effect which is the downtrend should be considerably strong.

DOWNTREND PHASE:

The down trend follows immedately after the distribution perod as labelled above, but is only as strong as the cause, obeying our second law which we have discussed earlier.

HOW THE VOLUME CHANGES

.png)

screenshots taken from trading view

Okay so looking at the chart above, i had to zoom in to properly illustrate the changes in the trading volumes, and the results of the changes as we have formerly discussed in the answer to the previous question.

As we said in the third fundamental law, if the trading volume and the price action are moving in "harmony" the trend will continue, but where ever there is disharmony between the two brothers, the former trend stops and most of the times reverses to go the opposite direction.

In real time analysis, The Wyckoff method of chart analysis has made me understand that in cases where the trading volume pikes up, but the price goes down both in very drastic movements and at the same period, the trend is about to halt or change, so that point could be a sniper entry for following the Composite Man to accumulate or buy long, or sell off, depending on the former trade.

My analysis:

My last observation on the chart above was a disharmony between the trading volume and the price action or price movement, and with the former trend being a downtrend, my analysis would be a slight accumulation period for the Composite Man, followed by an up trend again, so a bullish trend is brewing in my opinion.

conclusion

The Wyckoff method is mindblowing, and is an eye opener to one who is ready to imagine and follow It's rules. Doing research on The Composite man has made me look at trading in a different way, like if you do not acknowledge that there is an entity moving the market, you would lose and conue losing like Wyckoff did to the stock market.

I hope my content has fully explained everything necessary to know and understand about the method, thanks again @fendit for the lecture, and for the homework, i have really learned a lot. Hope you enjoy going through!

ps; all screenshots taken from trading view

and medium.com and self designed with the help of canva

Thank you for being part of my lecture and completing the task!

My comments:

Nice work! Everything was really good explained and precise when it comes to developing concepts. Still, when it comes to your analysis of the composite man there was a slight mistake, it's not representing a group of rich investors, but a way of making the market simpler to understand!

Nice work on your chart and analysis :)

Overall score:

8/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the review, I guess i was misunderstood when i used that line, but i believe that in other explanations, i analyzed the composite man theory as one that gives a new perspective. The "rich investors" explanation was just me trying to put it in it's simplest term, so anyone reading the article would have a ground level understanding.

I wish you'd reconsider your scoring, That is if that was my only flaw. Thank you, i enjoyed doing the research.

@fendit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please ma, is there any other part i missed, so i can learn from it? @fendit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit