.png)

INTRODUCTION

Good day Professor, fellow Steemit Crypto Academy students, crypto enthusiasts, and steemians alike. This post will be the homework task for this week's crypto academy lecture by Professor @pelon53 on the Solana Blockchain. In the lecture, he taught a lot about the Solana blockchain, including its origin, use, method of operation, and its native token - SOL. I will try to give a brief overview of the Solana Blockchain before i proceed to answer the task questions.

The Solana blockchain is a third-generation blockchain, which implies that its intent is to solve problems and make up for limitations discovered in the Bitcoin and Ethereum blockchains. These issues are majorly, the scalability issue, and the consensus algorithm/governance issue, and the Solana blockchain, solves these two problems very nicely.

The mainnet of this blockchain was launched in 2020, although it had run a number of tests prior to that in 2018 and 2019, and the idea behind it was born from the mind of Anatoly Yakovenko, the founder of Solana Labs, in 2017.

The Solana blockchain employs a Proof of History (PoH) consensus mechanism with the well known Proof of Stake (PoS) consensus algorithm to drastically upregulate the scalability of the blockchain, allowing it to achieve a sustained performance of over 50,000 transactions/second on their testnet network of 200 nodes.

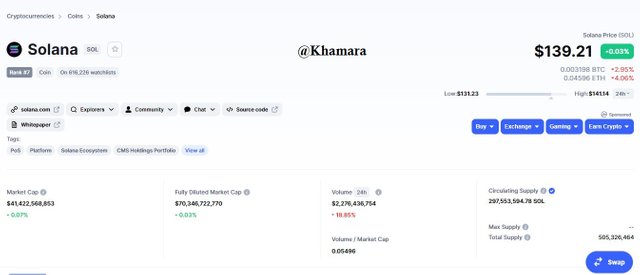

Solana seems to be one of the key figures in the ongoing cryptocurrency revolution, with its token having risen to be ranked #7 on Coinmarketcap.com at the time of writing this, going from a price of about $19 on April 1st 2021, to a price of about $139 at the time of making this post.

I will now go ahead to answer the questions given to us by professor @pelon53 for this task.

1. Explain in detail the PoH of Solana.

The Solana Blockchain is currently the fastest blockchain in the world with the ability to process over 50,000 tps. This is amazing, and when compared to the original blockchain models - Bitcoin, with a transaction speed of 4.6 transactions per second, and Ethereum, with a transaction speed of 30 transactions per second - definitely beats them hands down.

The question is, how does Solana manage to carry out so many transactions in such little time?

And the answer to that is the combined/hybrid consensus algorithm of Proof of History (PoH), and Proof of Stake (PoS).

Now, what exactly is Proof of History (PoH)?

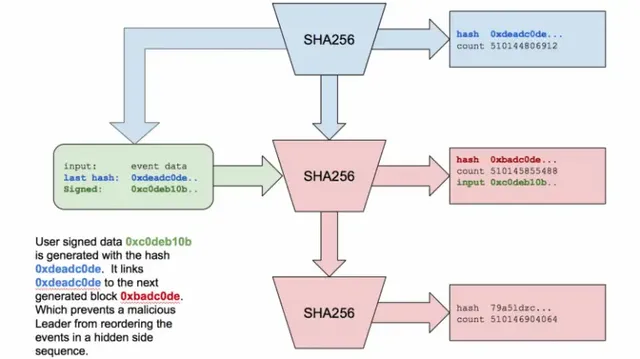

Proof of History is, not a consensus algorithm in and of itself, rather, it is a tactic for speeding up consensus on the blockchain. How does it work?

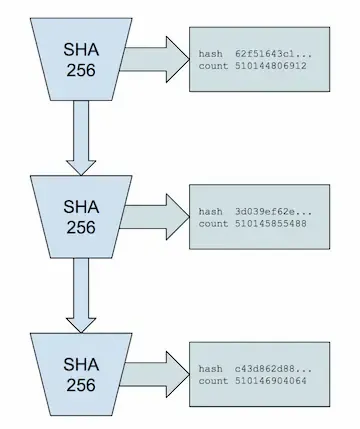

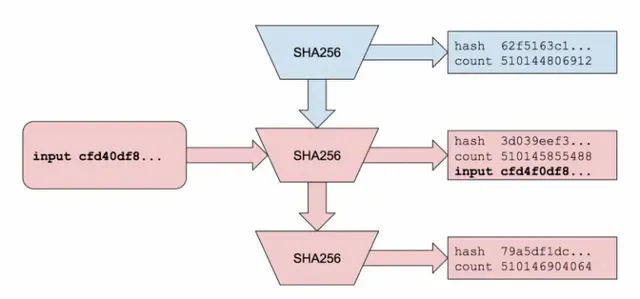

Proof of History creates an order of transactions, by incorporating timestamps into the hashes of transactions, but not just timestamps, Proof of History uses a new cryptographic concept called Verifiable Delay Function (VDF) to prove that an event occurred at a specific time. This VDF, rather than just using a timestamp, uses cryptography to encode into the transaction's hash that the event occurred before and after other events i.e. it verifies passage of time between two events.

Proof of History uses a set of sequential steps to produce a unique, verifiable, output. This is because the function is written such that the output is unpredictable without complete execution. The VDF can be solved with a single CPU core and the sequential steps.

The Proof of History works like this:

A value is taken as the input, and put through those sequential steps to generate the output (remember that the output cannot be predicted without complete execution of the steps) and when that output is generated, it is then used as the input to run through those sequential steps again, and this process is repeated again, and again, as many times as is needed.

To give a clearer understanding, assuming we take our first input to be "2" it is then hashed through the set of sequential steps to give the unpredictable output 5. 5 is then used as the input for the next step. The output may then be 7, it is used as the input again.

Now, instead of just a random number, each PoH transaction/event is given a unique SHA256 hash function based on this model, where the input hash for one transaction is the output hash of the transaction before it.

Because the output is unpredictable, one has to use the first input to go through the first step to get the output, which is then used as the second input to go through the second step. This proves that there was a passage of time between the two steps, and consequently, the events that triggered them.

In most blockchains, reaching consensus over the time of mining of a particular block is a huge task, and is just as important as reaching consensus over transactions within the block. However, with the time problem solved with the PoH function, this reduces the processing weight for the validating nodes of the blockchain, thereby making processing much faster, and lighter.

Combining this with the Tower Byzantine Fault Tolerance security protocol which lets participants on the blockchain vote on the validity of a PoH hash, the Solana blockchain has, to a large extent, been able to solve the cryptocurrency blockchain trilemma, achieving decentralization, scalability, and security.

2. Explain at least 2 cases of use of Solana.

With all the amazing features that the third-generation, acclaimed fastest blockchain brings to the table, it is no wonder that many developers are flocking to Solana to build and execute their projects/Dapps on. As of the time of writing this post, the blockchain claims to have over 400 projects currently up and running on it, including but not limited to NFTs, DeFi, Web3 and more.1 For this post we'll only be examining two out of these projects, and these are:

Raydium

Raydium is one of the leading projects on the Solana blockchain. Founded by AlphaRay, XRay, and GammaRay, with its mainnet launched sometime in February 2021, it has quickly risen to prominence as Solana's #1 Automated Market Maker (AMM), and liquidity provider.

Built for, and in collaboration with, Serum, a DEX also built on Solana, Raydium is able to provide on-chain liquidity to a central orderbook, which places it above most other AMMs. This partnership implies that Raydium LPs get access to Serum's entire orderflow and liquidity. This also means that funds deposited into Raydium become limit orders on Serum's orderbooks.

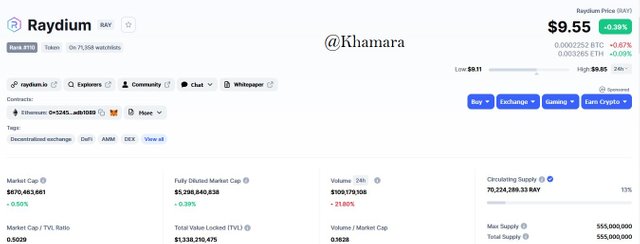

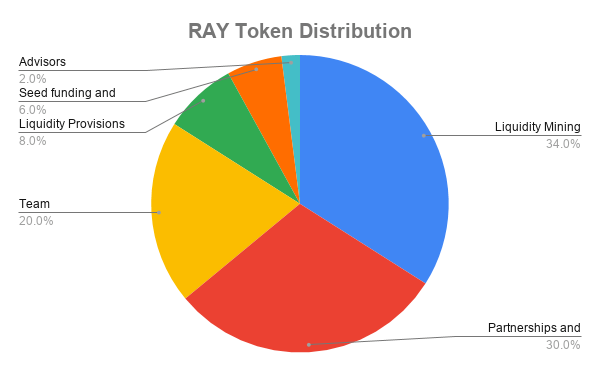

The utility token for the Raydium project is RAY. It is used for staking and governance on the platform, and is currently ranked #110 on coinmarketcap.com.

Source

Source

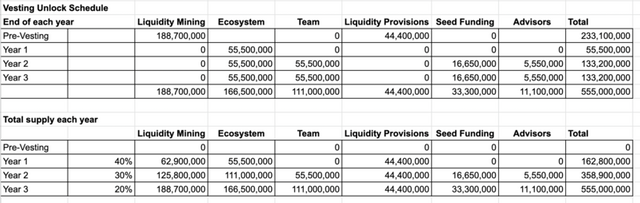

Here's a link to RAY Tokenomics

Raydium aims to become an integral part of introducing new projects into the Solana ecosystem

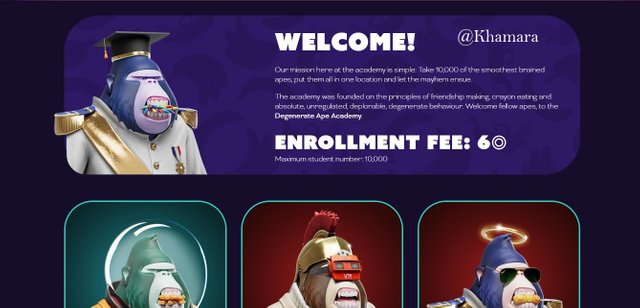

Degenerate Ape

With the recent increase in interest in NFTs (Non-Fungible Tokens), a lot of collectors and investors ran to the Ethereum blockchain, and its Dapps, hoping to purchase some, in order to make profit or just to secure heir slot in the NFT revolution. However, with this surge of participants to the network, Ethereum gas fees skyrocketed, and purchasing and making transactions on the Ethereum blockchain became even more costly. Because of this, many individuals began to look for other options, and the Solana blockchain looked to be the best among these options.

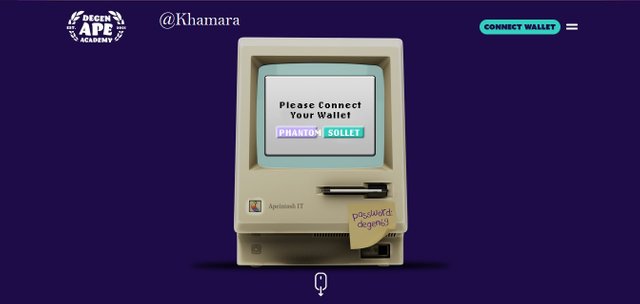

Degenerate Apes is an NFT project on the Solana blockchain where one can mint an NFT Ape, in order to join the Ape academy on the Solana blockchain. These apes have traits that are ranked in the order: Common, Uncommon, Rare, Super Rare, and Mythic, with each trait type having a corresponding % chance of being minted. This project bears some similarity with the Bored Ape Yacht Club project on the Ethereum blockchain.

The curret Minting price for minting a Degenerate Ape is 6 SOL, and in order to mint an ape, one would need to connect their Phantom or Sollet wallets. The NFT drop date was on August 13th, after which it was listed on Solanart to enable secondary trading of the ape NFTs.

On Saturday, the 11th of September, the 13th rarest Degenerate Ape, Degen Ape #7225 sold for 5,980 SOL, which was roughly $1.1 million, making it Solana's first million-dollar NFT sale.

Here's a link to the Degenerate Ape Roadmap

3. Detail and explain the SOLA token.

The SOLA token is the native utillity token of SOLA, a DeFi project built on the Solana blockchain. SOLA is a market maker that uses both CEX and DEX features to distribute liquidity automatically, thereby imroving asset management efficiency.

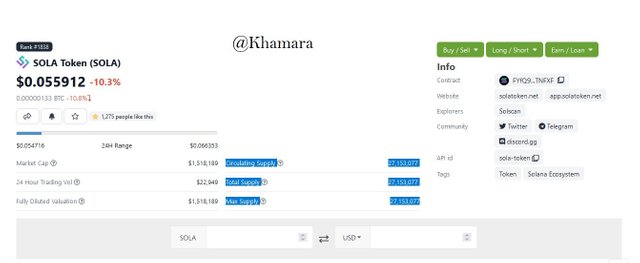

The SOLA token has been listed on CoinGecko and ranks #1838 currently, but is not yet on CoinMarketCap.com. It was issued on the 9th of August, 2021, and, with a price of $0.055912, currently has a market cap of about $1,518,189 with a circulating supply of 27,153,077 SOLA. The full tokenomics of the SOLA token are given below:

- Circulating Supply - 27,153,077 SOLA

- Total Supply - 27,153,077 SOLA

- Max Supply - 27,153,077 SOLA

- Distribution: Of the initial circulating supply of 27,153,071 SOLA,

- 6,153,077 SOLA goes to the Liquidity Providers

- 1,000,000 SOLA goes to Community Development

- 10,000,000 SOLA goes to Investors

- 1,000,000 SOLA goes to Advisors

- 5,000,000 SOLA goes to the Team

- 4,000,000 SOLA goes to the Marketing

The SOLA team plans to conduct token burns from the proceeds from the API and transaction fees till the circulating supply gets to 21 million.

4. When did Solana Blockchain see its operations interrupted? Why? Explain.

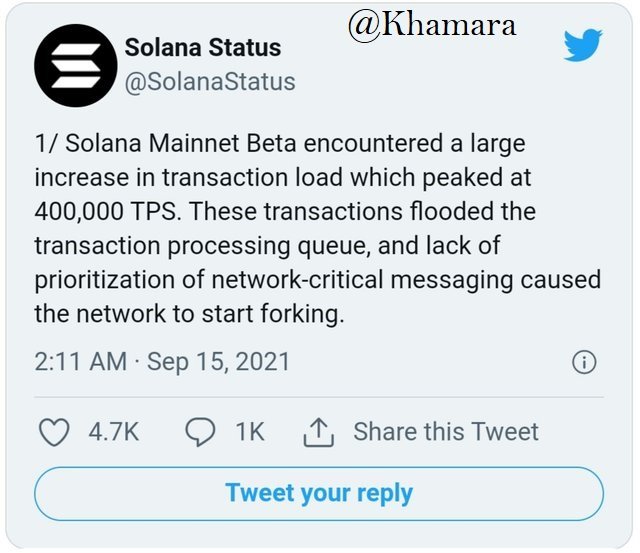

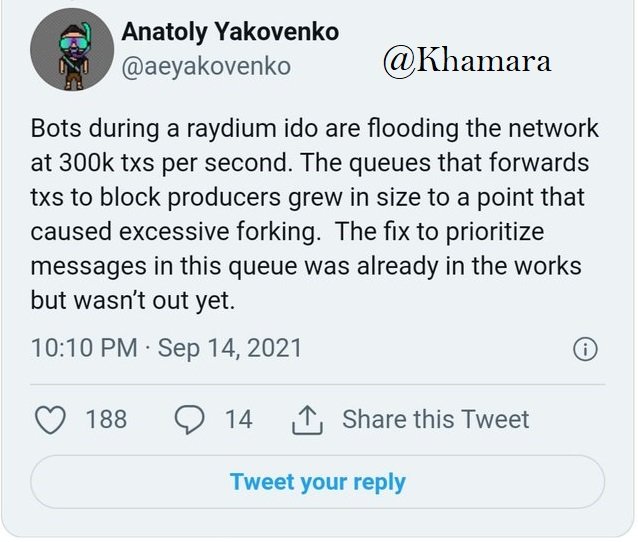

On the 14th of September, 2021, at 12:00pm UTC, the entire Solana blockchain mainnet experienced some downtime which lasted for about 17 hours, entering into the next day.

The Solana team announced on Twitter the reason for the system failure, which was a tremendous increase in transaction amount per second, up to 400,000 tps. This increase in transaction load was caused by a bot-generated transaction from Grape Protocol, a social networking company that had launched their IDO on Raydium.

The hefty increase flooded the transaction queue and initiated forks in the system, which caused some network nodes to be forced offline due to excessive memory consumption, and although attempts were made by the ecosystem's engineers to stabilize the network, it was not successful. Because of this, the validator community, with an 80% vote from token holders, decided a restart of the network with a hard fork would be in order.

In order to restart the network, and to ensure that the issues were fixed, the engineers and validators of the ecosystem worked on the network to update it to "increase network resiliency during periods of extreme transaction load."source

The system was eventually restarted at 5:30am UTC, on September 15th, 2021, with the SOL token having seen a significant about 5% drop in price.

5. Check the last block generated in Solana and make an approximate calculation of How many blocks per second have been generated in Solana, taking into account from the initial block to the current one? Justify your answer and show screenshots.

To perform this task, I would need to use the Solana Blockchain Explorer

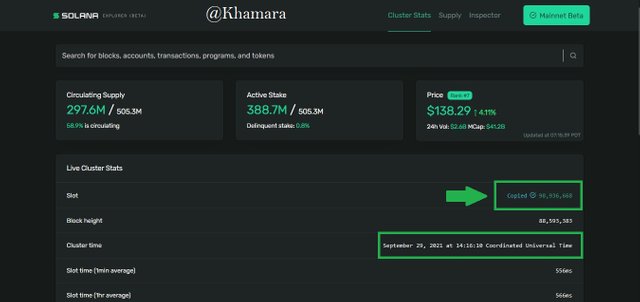

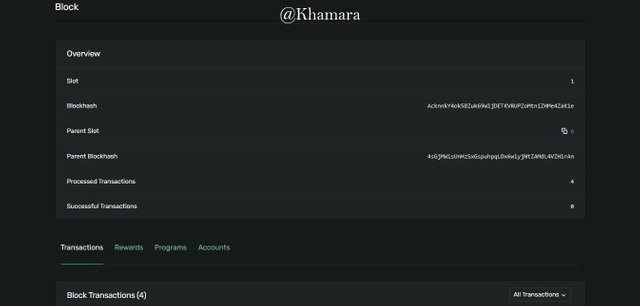

On opening the Solana Blockchain Explorer, we can see on the homepage that the last block at the time of viewing is Block 98,936,668.

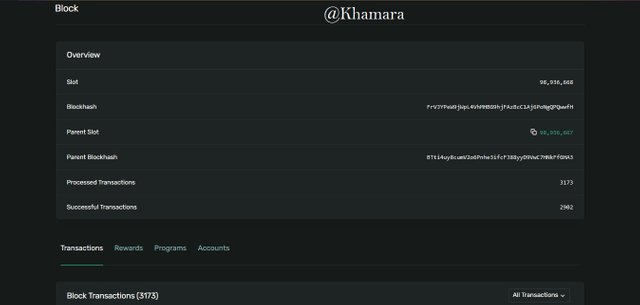

This is the Block Information for Block 98,936,668.

We can see that there was a total of 3173 transactions for this block.

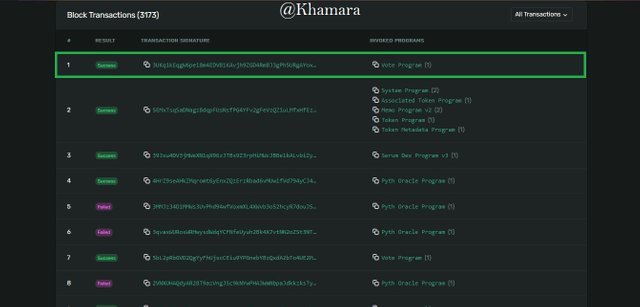

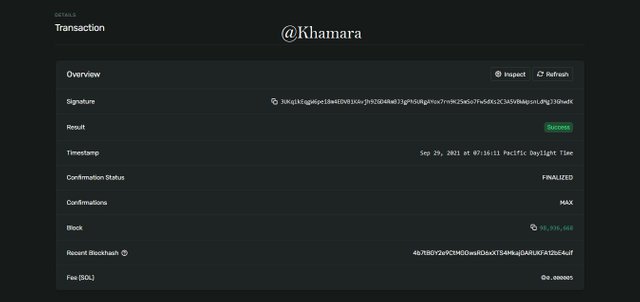

If we click on the first transaction, we can see the details of that transaction.

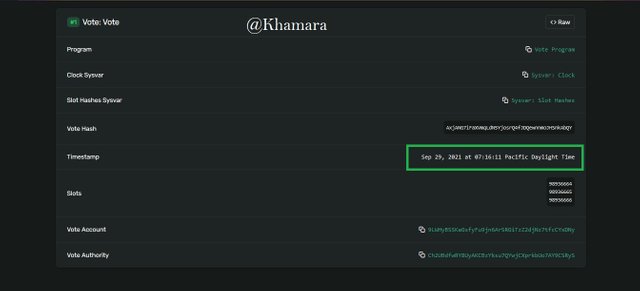

Scrolling down, we can see the transaction's timestamp. This will be useful in our calculation.

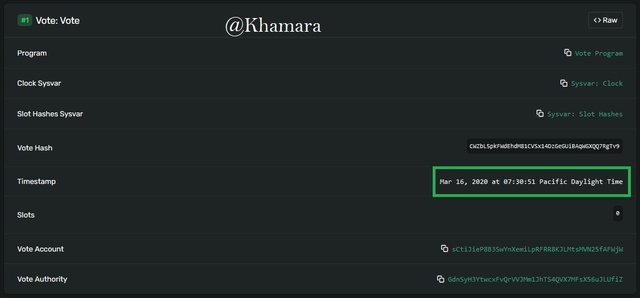

The next thing to do is to find out the timestamp for the transactions in the Genesis Block, Block #1.

Here's Block 1's information.

There were a total of 4 transactions in the Genesis Block.

Viewing the first transaction's details, we can also get the transaction's timestamp.

Now, with these two transaction timestamps, we are going to calculate, how many seconds have passed between the two timestamp. To do this, we take into account that there are 86,400s in a day.

Firstly, we calculate how many seconds remained in the day of the first timestamp. To do this, we must find out how many seconds had occurred before the Block 1 transaction.

- The transaction took place at 07:30:51.

1 hour = 60 minutes, 1 minute = 60 seconds.

7 hours = 60x7 minutes = 420 minutes, 420 minutes = 25,200 seconds.

30 minutes = 1,800 seconds.

Then we add up all the seconds and minus it from 86,400.

25,200 + 1,800 + 51 = 27,051.

86,400-27,051=59,349 seconds.

So, 59,349 seconds remained on that day.

Next, we find out how many seconds had occured on the day of the second timestamp.

- The transaction took place at 07:16:11.

1 hour = 60 minutes, 1 minute = 60 seconds.

7 hours = 60x7 minutes = 420 minutes, 420 minutes = 25,200 seconds.

16 minutes = 16x60 seconds = 960 seconds

Then we add up all the seconds

25,200+960+11 = 26,171 seconds.

So, 26,171 seconds had elapsed on that day before the transaction on the latest block.

Then we find out all the time in between.

- Between March 16, the date of the 1st tranaction, and September 29th, there are a total of 560 days.

1 day = 86,400 seconds

560 days = 560x86,400 = 48,384,000 seconds.

So there were 48,384,000 seconds between those two days.

Now, we add up all the seconds, to get the total number of seconds between the first block and the current block in question, block 98,936,668.

- 59,349+48,384,000+26,171 = 48,469,520 seconds.

In order to get the number of blocks per second, we can then divide the current number of blocks - 98,936,668 blocks, by the total number of seconds it took to produce those blocks - 48,469,520s.

- The number of blocks per second = 98,936,668 blocks/48,469,520s

= 2.041 (rounded to 3s.f)

So the total number of blocks per second is approximately 2. Meaning that it takes roughly 0.5s to create one block.

CONCLUSION

The Solana blockchain is one of the most important blockchains now due to its solving of the blockchain trilemma. Being able to achieve decentralization, security, and scalability is not an easy feat, especially when combined with low transaction fees, and the entire blockchain and cryptocurrency community has begun to put its eye on Solana. We expect much more from the developers, and its exciting to see where this blockchain can get to. Thanks again to Professor @pelon53 for this wonderful eye opening lecture, and i hope you enjoyed reading.

NB; All pictures used in this post were either taken from the respective websites or designed by me on Canva. Thanks.

Gracias por participar en Steemit Crypto Academy Season 4, Semana 4:

Excelente trabajo, felicitaciones. Muy bien llevado.

Cuando hablas de los 2 Casos de Uso, están unidos que se puede confundir cualquier persona.

Recomendaciones:

Mayor separación entre un punto y otro.

Espero seguir leyendo tus publicaciones.

Calificación: 9.9

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You very much Professor. Will take your corrections and I'm thankful for the high score. I hope to be in the top 3 too🥰

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit