.png)

INTRODUCTION

Good day Professor, fellow Steemit Crypto Academy students, crypto enthusiasts, and steemians alike. This post will be the homework task for this week's crypto academy lecture by Professor @reminiscence01 where he taught us some more on Technical indicators.

QUESTION 1.

a) Explain Leading and Lagging indicators in detail. Also, give examples of each of them.

Leading indicators:

These are indicators that forecast price movement of an asset. Leading indicators give a trader an early signal, as to where price might likely go, even before price moves towards that forecasted direction. This early signal enables the trader to enter the market before the forecasted move, and maximize profits, as well as minimize losses, if the forecasted move eventually plays out.

The forecasted move could be the beginning of a new trend, continuation of the current trend, or a trend reversal and a leading indicator can be used to predict or foretell the timing, duration, or even magnitude of the future price movement with a formula or change in some certain variables, and many times, a graph. These indicators (like all others) are not 100% accurate, however, when used wisely, and in confluence with other indicators, can yield a trader good profit.

Leading indicators tend to be favored by traders, although they have their own set of disadvantages and demerits. They mostly are used to predict price movement by showing how "overbought" or "oversold" an asset is. Usually, if an asset is "overbought" or "oversold" for sometime according to the parameters of the indicator, then it will return to the normal area. However, these indicators' accuracy may be dependent on the type of market, and the phase of the market cycle the price is in i.e. some leading indicators work best in ranging markets and others in trending markets. These indicators can also sometimes be manipulated by whales or institutional money to produce "fakeouts" which are signals which are not eventually correct.

Some good examples of leading indicators include:

- Average Directional Index (ADX)

- Random Index (KDJ)

- Ichimoku Kinko Hyo

- Awesome Oscillator

- On Balance Volume (OBV)

Lagging Indicators:

These are somewhat like the reverse/opposite of leading indicators as they are indicators that come after price movement, essentially confirming the price movement. Just as the name indicates, these indicators lag after price action, and authenticate or validate the price movement. This protects traders from the fakeouts of whales and institutional money, however, due to the lateness of the indicator, it reduces the amount of price movement a trader can ride.

Once again, the type of signals, the lagging indicator can produce range from the beginning of a trend, the continuation of the existing trend, or a trend reversal. Because of the late signal, traders tend to need wide stop losses in entering into the market. What the lagging indicator misses size of price movement, and profit margin, it makes up for with accuracy, as lagging indicators tend to be more accurate, and have their signals play out more, than leading indicators, although still not 100% accurate.

Because of their general improved accuracy, this type of indicators are mostly used for long-term/swing trading. Examples of leading indicators include:

- Simple Moving Average (SMA)

- Moving Average Exponential (EMA)

- Moving Average Convergence Divergence

- Bollinger Bands

b) With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question 1a. Do this for both leading and lagging indicators.

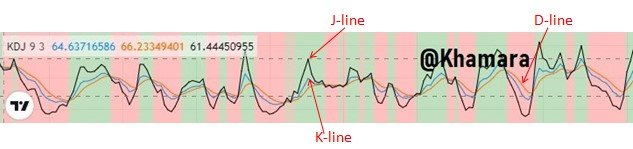

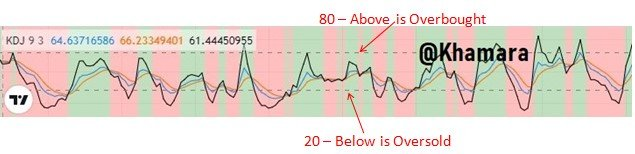

The Random Index (KDJ) Indicator

The Random Index indicator is an oscillating leading indicator, also known as the KDJ indicator. This is because it is made up of three lines. The K, D, and J lines. The K and D lines are similar to the lines of the Stochastic oscillator, so what really makes the KDJ indicator unique is the addition of the third line: the J-line, which outlines the divergence of the K-line from the D-line.

As an oscillator indicator, the random index tells us when a market is overbought or oversold. This is indicated when the lines go outside of the normal range of between figures of 20 to 80 (below 20 for oversold and above 80 for overbought.)

Bollinger Bands

The Bollinger Bands is a lagging indicator that uses a 20-period Simple Moving Average and two outer lines. The two outer lines are the bands, and represent positive and negative standard deviations from the SMA. the usual setting for the bands are 2 standard deviations away from the 20-period SMA, and these are used as a measure of price volatility. With increased volatility, the bands widen, and as volatility reduces, they contract/squeeze together.

Bollinger bands are mostly used thus: When the price reaches one of the outer bands, it usually acts as a trigger for it to return to the SMA, although one must realize that this is dependent on the type of market, as in highly volatile markets, price may go beyond the bands consistently.

Bollinger bands are a lagging indicator because they can not indicate where, how, or when the price will move, they can only signal that a move may potentially happen.

QUESTION 2.

a) What are the factors to consider when using an indicator?

Market Phase

One of the foremost things a trader should consider when entering into a market, and choosing which indicator to use in doing so, is the phase of the market cycle that that particular asset is in. There are essentially two types of asset market phases; the trending market, and the ranging market. Trending markets are also of two types; Uptrending markets, and downtrending markets.

A trader must be able to identify trending (either uptrending or downtrending) markets, and ranging markets before choosing which indicator to use, because different indicators work best in different situations. Some indicators are called trend-following indicators because they work best with trends, while during ranging markets, traders are advised to use momentum or volatility based indicators.

Type of Indicator

After one has identified the market phase or trend, they should consider the type of indicator they intend to use.

Is it a leading or lagging indicator? Is it a momentum-based indicator, or a trend-following indicator? How is the indicator read?

When one has discovered all these about the indicators they want to use, they can then determine whether or not the indicator is fitting for the type of market they wish to trade, and they can begin to consider how best to apply it

Time Frame

The time frame one is trading on, be it the daily, hourly or even the 15 minute time frame, is an important factor to consider when picking an indicator. This is because some indicators work best in some certain time frames, and work poorly in others. The time frame parameter of the indicator is also another important thing to look out for. For example, a 50-period SMA, is better used by Scalpers, and a 200-period SMA is a better gauge of long-term investor sentiment.

Trading Style/Strategy

A traders' style of trading - scalping, swing trading, long-term holding - is also important to consider when picking an indicator. Some indicators give signals for only short term moves and are better suited for scalpers, and some give more long term information, and are better suited for swing traders. Sometimes, even the same indicator can be used differently depending on the trader's style.

Apart from style of trading, one also has to consider what strategies would best work with the current market phase/condition. Is it a breakout & retest? A pattern reversal? The trader has to also consider this.

Indicator Confluence

Another factor to consider when picking an indicator is confluence. Traders are advised to use indicators in confluence with other indicators to generate more potent/valid signals. A trader, in picking an indicator, should also bear in mind what other indicators would work well together with it.

Volatility

Another important thing to consider wold be market volatility. Some markets are more volatile than some others, and because of this some certain indicators do not work well in these markets.

b) Explain confluence in cryptocurrency trading. Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required ).

Confluence is a very important concept in the world of trading that is used by many traders to reduce risk. The word "Confluence" that denotes merging or joining, and it carries that same meaning in the world of trading. Confluence in trading, is the usage of more than one indicator to generate a trading signal, or, the usage of another, or more indicators, to confirm the signal produced by one indicator, because no indicator is 100% accurate every time. This is very useful in making sure a signal is valid, and eliminating investor/trader bias.

QUESTION 3.

a) Explain how you can filter false signals from an indicator.

The entire idea of generating signals is to know when to enter/exit the market to maximize profits, and to minimize losses. False signals are found when rice movement does not correspond with the indicator signal. This is a problem because it can lead to the trader entering into a market that would go against him.

The entire point of filtering out false signals is to be able to know whether one can enter the market with them or not. Therefore, although one can ideally check the corresponding price movement when a signal is seen, that would mean the person didn't filter out the false signal. However, there is a way to filter out the majority of false signals. This is, of course, after one has ensured that all their indicator parameters are correct. This is through confluence.

By ensuring that a signal given by an indicator corresponds with the signals given by other compatible indicators, we reduce the risk of error, and the possibility of the signal being false. This enables a trader to be much more confident when entering into the trade, and maximizes profit, while minimizing loss potential.

b) Explain your understanding of divergences and how they can help in making a good trading decision.

Divergence is a key concept of indicator use. Divergence is observed when there is a significant difference between price movement and indicator movement. Divergences can be used to gain better insight as to what is really happening within the market, and can also be used to filter out false signals. With this information traders can then go on to make the right moves in the market and carry out profitable trades.

c) Using relevant screenshots and an indicator of your choice, explain bullish and bearish divergences on any cryptocurrency pair.

There are two types of divergences seen in indicators; Bullish and Bearish Divergence.

Bullish Divergence

This occurs when price experiences lower lows on the charts, but in the indicator graph, higher lows are spotted instead. This divergence between the chart and the indicator graph is called a bullish divergence, and indicates the slowing down of a downtrend, and a possible upcoming reversal to the upside. This indicates that the Bulls are beginning to take over the market.

Bearish Divergence

This can occur when price experiences higher highs on the chart, but the indicator graph shows lower highs. This is called Bearish divergence and indicates that the Bears are coming into the market, and, as such, there is going to be a slowing of the uptrend and a reversal to the downside.

CONCLUSION

In this lesson we learned some more about Technical indicators and in this task i have discussed leading and lagging indicators, as well as how to make good use of them, what to be wary of, how to select them, filter out false signals, and use them in confluence with one another. I have also spoken on divergences, and how to spot them. I hope you enjoyed reading my assignment. Thanks to Professor @reminiscence01 for the lesson. Till next time.

NB; All pictures used in this post were either taken from the respective websites or designed by me on Canva. Thanks.

Hello @khamara , I’m glad you participated in the 4th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit