Short squeeze happens in a time period when we see an increase in price of stock or an asset that has been shorted to a greater extent. When investors borrow shares of any stock and are also willing to sell them by keeping in mind that they would buy them back at low price after sometime then this is called short selling and they also bet sometimes that prices of the stock would go towards a decline but sometimes things becomes opposite of that.

Short squeeze occurs when price of stock starts to raise instead of going to decline so there could be different reasons due to which it can happen.

- If there is a positive news surrounding the stock then it could rise the price and can cause short squeeze because it leads to more buying of stock and it drives up the price.

When price of a stock price then those who have already shorted that stock get panic in response because they think that there is a need to buying back the shares that they borrowed for the purpose of returning them to lender. When we see rush of people buying the stock then demands increases which leads to price increase. A feedback loop is created in this way because rising price forces more to short sellers for covering their positions which further leads to price increase.

My opinion about short squeeze

If I talk about my opinion related to short squeeze then it is really exciting for me because it create volatile nature in market so in this way it leads to provide both opportunities either they are profit and loss but short squeeze could also be risky especially for those people who are shorting their stock so thorough research is important before getting involved in any of the strategy.

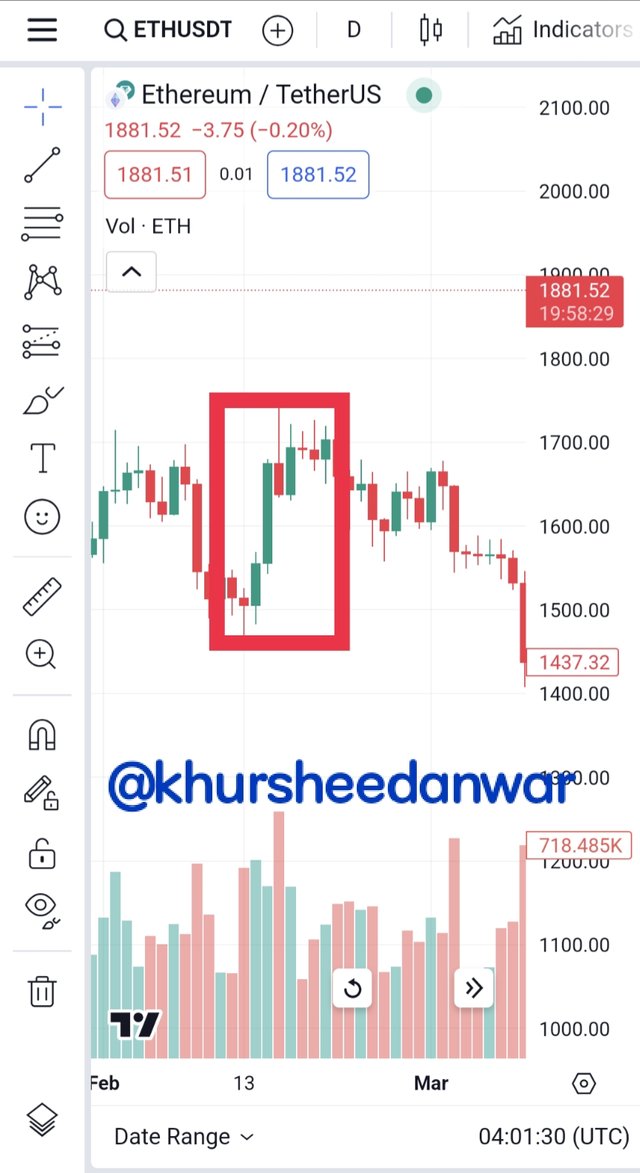

I am here with you with an example of short squeeze of Bitcoin and Ethereum.

In the screenshot that I have shared here you can see a short squeeze of Bitcoin which is a cryptocurrency and this is a screenshot of 10-15 February 2022 when this short squeeze occurs. At that time there was a positive news everywhere about Bitcoin that's why many investors borrowed and sold their Bitcoin by keeping in mind that they would buy them back at little price. Due to that positive news prices of Bitcoin increases suddenly so at that time short sellers was very nervous due to increase in the price of Bitcoin and they buy Bitcoin back because at that time they want to close their short positions.

As the demand of Bitcoin continues to increase at that time so short squeeze occurs as a result as I have shared in the screenshot. Now let's move towards another cryptocurrency which is Ethereum coin.

Ethereum short squeeze that I am sharing below in the screenshot is also of the same date from 10th to 15th of February 2022 so same scenario happens to Ethereum that time there was a positive news about Ethereum that's why many investors borrowed and sold their Ethereum by keeping in mind that they would buy them back at low price.

Due to that positive news prices of Ethereum coin increases suddenly so at that time short sellers was very nervous due to increase in the price of Ethereum coin and they buy Ethereum back because at that time they want to close their short positions.

Short squeeze is formed by a series of step I am explaining below.

1. Short Selling:

When investor borrows are cryptocurrency and sell it in market by considering that price of that cryptocurrency would decrease then it is called short selling strategy which is a trading strategy.

2. Short Interest:

When different number of investors becomes greater and they start short selling of a particular cryptocurrency then it leads to high short interest so it becomes clear then there are many investors that have borrowed and sell a particular currency which creates large number of open short positions

3. Positive News or Catalyst:

When positive news spread then at that time it becomes very clear that there could be a short squeeze because it boost the confidence and demand for a particular cryptocurrency so this positive news and sentiment leads to increase in cryptocurrency price.

4. Price Increase:

Short sellers becomes more concerned about incurrence losses if prize continues to increase so for prevention of losses short sellers close their short positions by buying back particular cryptocurrencies.

5. Increased Buying Pressure:

If a short seller buy a particular cryptocurrency back then this activity of buying eggs to the over all demand so due to increase in buying pressure then available supply it can also leads to scarcity of this particular cryptocurrency in overall market.

6. Feedback Loop:

Feedback loop is created due to scarcity of a particular cryptocurrency because when price continue to increase continuously then short sellers feel compelled to cover their positions due to a fear of high loss. This Rush of people that becomes due to buying back of particular cryptocurrency further drive up the price of asset.

7. Cascade Effect:

Cascade effect can be triggered by continues increase in price and urgency of short sellers for covering their positions. Other traders and investors may also start to buy a particular currency that anticipate for the price increase so additional buying pressure can also amplify short squeeze.

8. Short Squeeze Peaks:

When significant number of short sellers cover their positions then short squeeze occurs to its peak due to increase in buying pressure,normally at that time buying pressure subside itself and it leads to stabilization of the price.

There are different advantages and disadvantages of short squeeze.

Advantages of the short squeeze strategy:

1. Profit potential:

Short squeeze can create very sudden and significant profit opportunities for those who are involved in trading and if there is someone who is on right side of trading then you can make substantial gains when the price of a particular cryptocurrency increase due to squeeze.

2. Market inefficiencies:

Due to market inefficiency short squeeze can also occur so people who are involved in trading can exploit these in efficiencies and potentially gain profit from them by considering it advantageous.

3. Increased liquidity:

Due to short squeeze liquidity can also rise in market which leads to increase trading activities so trader can get benefit from them by having more opportunities for entering and exiting positions at favourable prices.

Disadvantages of the short squeeze strategy:

1. High risk:

Short squeeze can give you sudden benefits but on the other hand it can be very risky because it is very volatile and unpredictable so if timing misjudged aur fail to properly managing risk then you can face great losses also so essential understanding of market dynamics and management of risks is important when you are engaging in short squeeze.

2. Limited availability:

Short squeeze have limited availability because they are not very easy to find in market as they don't occur more frequently so careful analysis and proper research is required for the identification of potential candidate for short squeeze and short squeeze are more prevalent in stocks with high short interest.

3. Timing challenges:

Timing is very important to understand when you are engaging in short squeeze because it is important to predict in a correct way that when short squeeze would occur and when it would end. It is a need to monitor market conditions and to combat with time challanges.

Here I'm explaining short squeeze strategy on a steem/USDT pair. This is I'm explaning and showing screenshot of short squeeze from 30 October to 2 December 2022.

At that time traders who shorted steems are borrowing and selling them by keeping in mind that they would buy it back at little price somewhere in future for covering up positions and making essential profits.

At that time there was a positive news and there was a surge in buying interest for steems and due to this price increase suddenly which was problematic for traders that have shorted the steem asset because they want to buy it again at high price for closing their positions.

At that time price of steem continuous to rise and short sellers get panic in this way for covering their positions which leads to driving up the price of steems and it creates short squeeze in return.

Traders that truly identify the timing of short squeeze occurrence gain profit from that short squeeze by buying steems before and after the squeeze and as price increase they sell their positions at higher price and capture profit from short squeeze.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Aapane topic ko bahut acchi Tarah se cover karne ki koshish ki hai aur apni maximum efforts ko hamare Sath show kiya hai aur hamesha ki Tarah mujhe aapki post ki presentation bahut jyada Pasand I hai kyunki aapane har point ko bahut acchi Tarah se highlight Kiya aur ISI ki vajah se har chij jyada elaborative lag rahi hai.

Main aapki baat se bilkul Karti hun ki jaise Hi ek positive news kisi ke deputy currency ke around surround karti hai To iski vajah se automatically ek particular currency ki price increase hoti hai aur price ki increase hone ki vajah se buying pressure increase hota hai jiske vajah se Ham ek short squeeze dekhte hain lekin yah yad rakhna bahut jaruri hai ki hamen Kisi bhi short stories mein engage hone se pahle uske bare mein acchi Tarah se research kar leni chahie Taki bad mein Jo bhi profit ya losses ho uske Zimmedaar Ham Khud ho.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing a comprehensive explanation of short squeezes, @khursheedanwar.

Your examples with Btc and Ethereum short squeezes provide a clear understanding. The detailed breakdown of the short squeeze strategy on the Steem/USDT chart adds valuable insights.

Well-done analysis!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey Friend

I must say your post is of high quality I really do get you all thanks to you I have learnt of features and details about short squeeze and I believe I know this time I will be able to implement it while placing trade in the crypto market to ensure enhanced mobility to make profit from every state in the market

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Soo much @patjewell

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pleasure! 🎕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit