Hello everyone, I hope you all are doing great today. This happens to be the first lecture that I will be participating in from @nane15 , A lot of emphasis and justice have been done by the professor on Algorand and the blockchain Trilemma.

The lesson have given a detailed explanation of the above mentioned topic and I will be giving answers to the questions asked in the homework task from the lesson.

(1) WHAT IS ALGORAND BLOCKCHAIN?

Algorand is an open-source blockchain technology network that is built to support DeFi and dApps on it’s secured and pre-organized blockchain. It’s native currency is known to be ALGO and it was launched in June 2019 by a computer scientist and MIT professor known as Silvio Micali, a well reputable and recognized man.

The sole aim of this awesome project is to create a decentralization based consensus protocol called the "Pure proof of stake (PPoS) and a Byzantine Agreement protocol. Algorand is an open source block chain in the sense that there are no permissions required thereby anyone can build on the blockchain. It’s high throughput enables the management of its widespread global usage.

Algorand has been designed to be fast and efficient in making payments and transaction with a speed of executing more than a thousand transaction per second while finalizing every transaction in a space of 5 seconds. The Proof-of-stake consensus mechanism creates an enablement for all this swift actions and transactions to occur and also aids in the distribution of validators rewards to all holders of the native ALGO cryptocurrency.

Algorand relies on staking thereby making it a public smart contract Blockchain that enables the development for decentralized application (dApps) and decentralized finance (DeFi). Many dApp developers and decentralized finance traders have turned to Algorand due to high gas fee from other Blockchain technology.

Algorand Standard Asset (ASA) protocol is used by developers in creating new Token on the Algorand blockchain and also transfer tokens from a different blockchain to the Alogrand ecosystem. Algorand Standard Asset (ASA) are fungible and non-fungible which makes sure that all ASA’s adhere to the laid down parameters and also allow some customization for developers and some examples ASA’s are USDC, USDT etc.

It is quite notable to also add that Algorand also engages in the distribution of its ALGO crypto token to every holder of its asset in its wallet which in turn helps the stability and buoyancy of the project. Algorand has gone against the impossible notion placed on the decentralized database network making it possible to create a fast, secure and completely decentralized system.

(2) WHAT IS PPoS?

The Pure Proof of Stake is an improvement of the popularly known Proof-of-Stake (PoS)consensus algorithm which was introduced back in 2011 on the Bitcointalk forum and was created to solve profound challenges faced by the Proof-of-Work. The Alogrand blockchain became the world’s first Pure Proof of Stake providing security, scalability and decentralization in an eco-friendly viable and feasible way.

The Pure Proof of Stake (PPoS) is a consensus protocol used by Algorand in enabling transaction validation and processing of its blocks based on the number of Token held by users. It’s validation protocol creates an enablement for users to validate transactions proportional to the quantity of token being held.

A Randomized Block Selection and Coin Age Selection are widely used in the selection of the next validator to forge the next block. So a holder who intends to participate in the forging is expected to lock a certain amount of token into the system as a stake. Though the size of the stake can give you a better influence on the system but just so that the highest nodes doesn’t always get the selection, the protocol thereby was programmed to randomly pick nodes/users irrespective of the amount they of their stake.

The Pure Proof of stake (PPoS) allows blocks to be created and validated in three vital phases which are the block Proposal, soft vote and certify vote.

(3) EXPLAIN THE ADVANTAGES AND DISADVANTAGES OF PPoS?

There are various advantages and disadvantages of the Pure Proof of Stake so below I will be listing them in a tabular form.

| S/N | ADVANTAGES |

|---|---|

| 1. | Every online user can get lucky in the random nodes selection process which in turn increases the decentralization and security of the system. |

| 2. | Transaction speed have greatly increased and the high cost of transaction fee have been greatly reduced in the system. |

| 3. | Users are not required to lockup any amount of token before becoming eligible to participate in the block creation. |

| 4. | High transaction throughput can be handled on demand without any congestion. |

| 5. | The block creation are finalized within seconds making it compete in speed with other global payments and financial networks. |

| S/N | DISADVANTAGES |

|---|---|

| 1. | In the pure Proof of Stake, stake holders might have a malignant intention while staking their holdings on altcoins. For example, they can decide to place their vote on both forks in the blockchain. The absence of a validation mechanism will be of great obscurity to the system causing a setback for other sets of users having lesser holdings and who have only voted for single forks. In essence, there is a massive waste of energy and resources that comes from mining both sides of a fork. Hence, it might make the implementation of the Pure proof of stake not to be a hundred percent reliable. |

| 2. | The vesting period of the Pure Proof of Stake and the founders having a huge stake even though with a good intention can make the system to become less decentralized and more under the control of a central authority which are the founders with the huge stake making the implementations. A blockchain technology is all about decentralization but it is as though that the project may loose the intentions if the implementation of the pure proof of stake is carried out. |

| 3. | In a blockchain ecosystem, holding of tokens by stake holders fosters the growth and balance in the system and also proves that holders have faith on the project but in a case of implementing such a concept in Pure Proof of Stake mechanism, the idea is therefore seen as an act of “hoarding” and can negatively affect the system. |

(4) DO YOU THINK ALOGRAND REALLY SOLVED THE BLOCKCHAIN TRILEMMA? EXPLAIN YOUR ANSWER

To begin with, we should know that the blockchain trilemma is the inability of developers blockchain to attain a complete decentralized, secured and scalable ecosystem without one having to suffer. It has been discovered that blockchains are usually forced to create tradeoff which prevents them from attaining the three concepts:

Decentralization: This is the ability of the ecosystem in a blockchain to be non reliant or dependent on a central authority or body.

Security: This is the ability of the ecosystem in a blockchain to defend its self against attacks, fraudulent activities bugs and other unforeseen circumstances.

Scalability: This is the ability of the ecosystem in a blockchain to carry out an increasing and numerous amount of incoming / outgoing transaction speedily and effectively.

The mutual attainment of the above mentioned concept have been far fetched until Alogrand brought about an approach which for the very first time solved the problem of the blockchain trilemma without anyone of the three concept having to suffer. The solution was brought about by the popularly know MIT Professor and Alogrand founder “Silvio Micali” known for his outstanding knowledge in computer science and cryptography.

Algorand used a simple technique called “RANDOMNESS” to solve blockchain Trilemma while maintaining scalability, decentralization and security.

All these where achieved by simply identifying the focus point in the system which was found out to be the Validators. Their jobs are to add new transaction in form of blocks to the system. Now since the main aim of a blockchain is to commission the validators in other to preserve decentralization and scalability in the system.

The solution therefore was achieved by randomly selecting validators from all token holders through an algorithmic process that automatically choose the next set of nodes that will become worthy of adding the next set of blocks to the system. This approach as simple as it sounds solves the problem of the blockchain Trilemma by maintaining decentralization since it is a random selection process and anyone can be selected in the system. Hence, no one is able to predict the validators and this is a major part of the security measures and together the blockchain Trilemma is solved.

(5) DO YOU THINK PPoS IS BETTER THAN PoW? EXPLAIN YOUR ANSWER

The Pure Proof of Stake (PPoS) is better than the Poof-of-work (PoW)mechanism, this notion is coming from the aspect of the blockchain Trilemma that has greatly been an issue in blockchain technology even today. Algorand, using the PPoS mechanism have solved the blockchain Trilemma making the PPoS system to a more reliable option for building a blockchain in recent times than the PoW.

| S/N | PROOF OF WORK | PURE PROOF OF STAKE |

|---|---|---|

| 1. | In the Proof of Work, the amount of computing work determines the probability of mining a block which is a less scalable system. | While PPoS randomly selects validators from all token holders through an algorithmic process that automatically choose the next set of nodes that will become worthy of adding the next set of blocks to the system which is a more scalable and decentralized method. |

| 2. | In the Proof of work miners must compete to solve complex puzzles using the computer power to win or be chosen as the next validator | while in the proof of work anyone can be selected randomly not withstanding the amount of your stake and this makes it a more decentralized system. |

| 3. | The Proof of Work can not meet up the demand for a faster means of performing transaction in and out of the system requiring a greater scalability and higher transaction speed. | But the Pure Proof of work can handle an enormous amount of transaction flowing in and out of the system in matter of seconds. It competes even with the global payment and financial network in terms of speed. |

(6) DO YOU THINK PPoS IS BETTER THAN PoS? EXPLAIN YOUR ANSWER

The Pure Proof of Stake (PPoS) is better than the Poof-of-stake (PoS) mechanism even though the PoS has achieved a lot of success in the addressing scalability issues in the system, but due to the fact that the system can still undergo a form a monopoly by stakeholders in the system with a significant amount of token, the aim of decentralization thereby becomes far-fetched. So in order to avoid the “rich get richer” syndrome, Algorand came about with a solution called the Pure proof of Stake. This is a more democratic and systematic process achieved by a random selection of online users by certain mechanisms in the system irrespective their stake.

| S/N | PROOF OF STAKE | PURE PROOF OF STAKE |

|---|---|---|

| 1. | In the Proof of Stake, the amount of stake or amount of token is a determinant factor for the validation of a new block in the system. | While PPoS randomly selects validators from all token holders through an algorithmic process that automatically choose the next set of nodes that will become worthy of adding the next set of blocks to the system which is a more scalable and decentralized method. |

| 2. | In the Proof of Stake an algorithm is a determinant factor for a winner to be chosen based on the size of their stake in the system. | while in the proof of work anyone can be selected randomly not withstanding the amount of your stake and this makes it a more decentralized system. |

| 3. | The Proof of Work are far more cost and energy efficient and are also less reliable in transaction speed | But the Pure Proof of work can handle an enormous amount of transaction flowing in and out of the system in matter of seconds. It competes even with the global payment and financial network in terms of speed. |

(7) EXPLORE AND EXPLAIN AN ALGO TRANSACTION USING algoexplorer.io ( SCREENSHOTS REQUIRED)

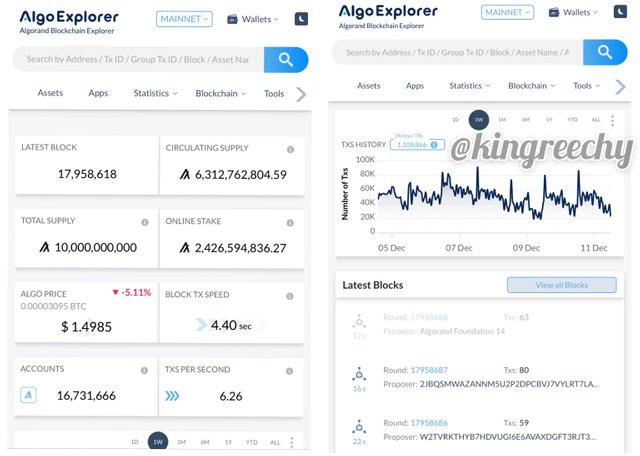

To Explore the Algo transaction platform, we begin by visiting the page algoexplorer.io , we will see the below image on the first page display.

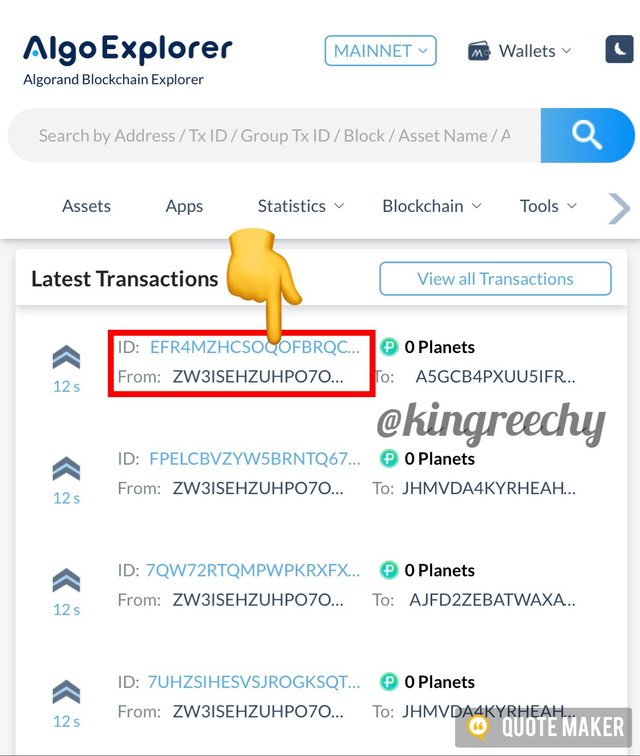

Scrolling downwards we will see a “Latest transaction” page. To Explore further, We can follow the steps as indicated below

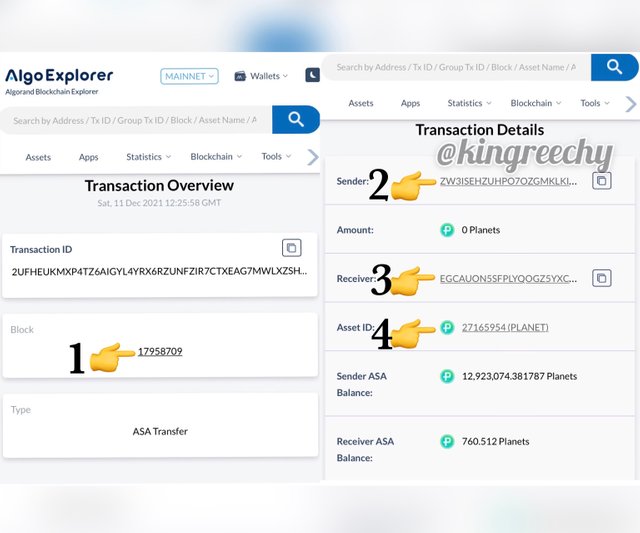

Through this page we can access the transaction block overview, sender transaction also the receiver transaction and more.

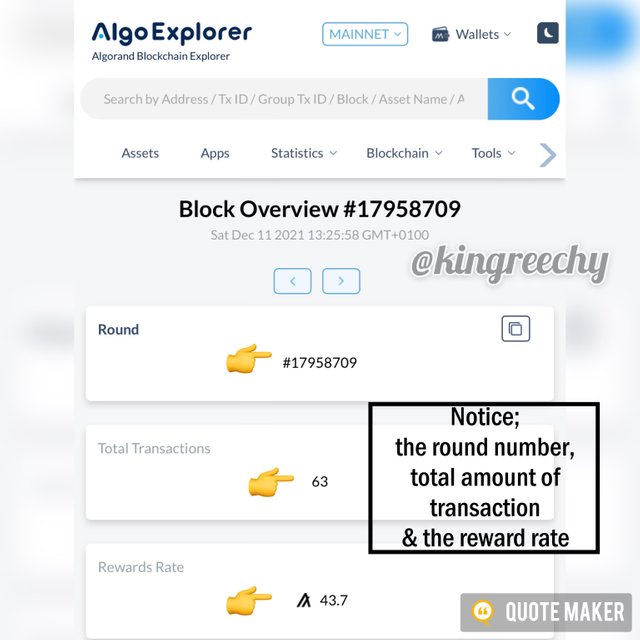

By clicking on the transaction block number as shown below we will be directed to the block overview page.

We can also access the sender transaction details by following the process as shown below.

And we can also access the receiver transaction details by following the process as shown below.

(8) CARRY OUT AN ANALYSIS OF THE PRICE OF ALGO FROM THE BEGINNING OF THE YEAR TO THE PRESENT. Via GRAPHICS (SCREENSHOTS REQUIRED.)

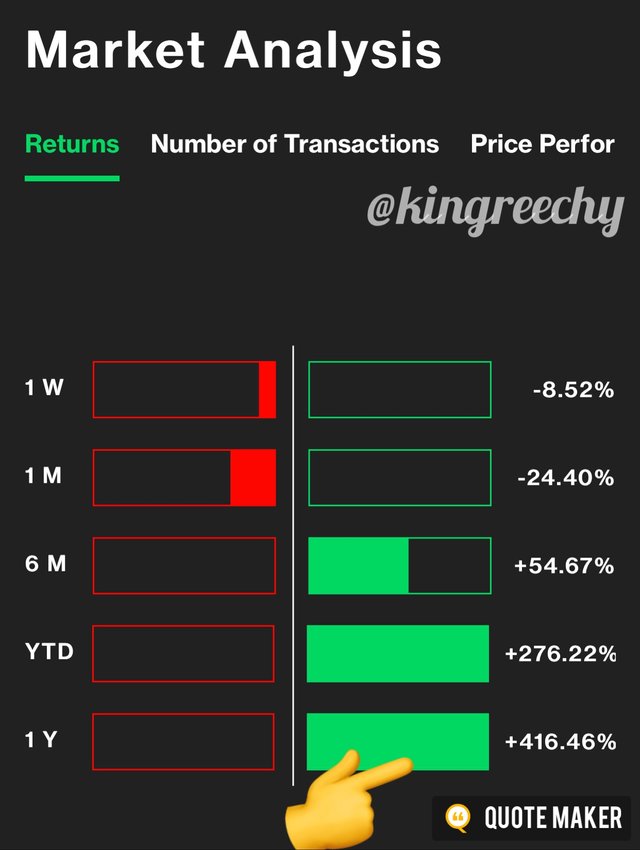

To carry out my analysis of the price of Algo from the beginning of the year till present, I will be using Coindesk.com and below are the result of my analysis.

Looking at the first page below we will notice the current market price of Algo is currently at $1.5 as at the moments of this post.

From the below screenshot we can see the price of Algo from the beginning of the year 2021. So as at 1st of January 2021, the price of Algo was at $0.324385

The market Analysis below shows that the market has been up by +416.46% in this year. This is why the price rose from $0.32438 at the beginning of the year to $1.5 currently. Below is the proof of my analysis.

This lesson has really impacted me so much on the various approach that has been used in the develop blockchains, I now understand what Alogrand and the blockchain Trilemma is truly about, I have learn the difference between the Pure Proof-of -Stake, Proof-of -Stake and Proof-of -work and how it affects the decentralization, security and scalability of the blockchain system. All thank you @nane15 for this wonderful lesson and the knowledge I now possess.

Thanks for reading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit