Welcome to my home work assigned to me to fulfull by my dear prrofessor @reddileep

On [Cryptocurrency Triangular Arbitrage], i hope you will get my homework interesting. Thanks Alot am

@kingworldline

1-Define Arbitrage Trading in your own words.

Arbitrage can be define as a strategy of taking advantage in price increase in different markets for an asset or price instability. Meanwhile for this to happen, they should be at least two equivalent assets which differs on prices.

Therefore Arbitrage is a state where by a trader can profit from the the imbalance of an asset price in terms of their individual difference in the market, meanwhile the simplest means of this is to purchase a particular asset in the market which the price is lower and as selling the asset out in the market with a higher price tag.

Arbitrage is strategy been used widely in trading which may probably one of the oldest trading strategy to exist. Meanwhile trader who engage in this ae called arbitrageurs.

2-Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

CURRENCY ARBITRAGE

This is a two point arbitrage and as well known as trading Strategy which actually takes advantage of price difference when ever there is spread of various currency, mean while the difference in spread is the difference between the bid and asking price

for acurrency pair at different exchange.

Is known to every trader that all broker offers different rates for each currency pair, Meanwhile a trader can buy and as well sell currency pairs at different brokers simultaneously and as well take the price difference which is the known as the price difference.

TIME ARBITRAGE

This is the difference in the short-term price and that of the long term price of a stock with respect time interval.

Meanwhile this is due to the mispricing of short-term horizon for the long-term and vise-visa in assets, which now creates a vacuum for traders to take advantage for time arbitrage.

RETAIL ARBITRAGE

In this type of arbitrage is very simple concept whereby a product bought from a loacal retailer with lesser price and store for a certain period of time and sell it at a higher price, therefore the basic difference between the buy and sell is the profit. which actually define the difference between the two.

INFORMATION ARBITRAGE

This a techniques of using more information, better understood information and better used information to figure out trends and as well opportunities in order to capitalize on them which focused in predicting the future requirement.

Information arbitrage is a technical means of using more well understood information and better used information to identify the trends and opportunities and capitalizing on them. Information arbitrage can be used to make accurate predictions about the future requirements of customers.

RISKLESS ARBITRAGE

This is the buying and selling of an asset immediately as well generating the profit from the price different of the assets. Meanwhile this does not need any investment and not does not have any rate of return as is been sold immediately.

NEGATIVE ARBITRAGE

This observed when ever there is lost of opportunity due to higher borrowing cost and lower lending cost. Mean while this occurs when ever there is lower returns on investments and require to finance debt with a higher rates.

3-Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

TRIANGULAR ARBITRAGE

Triangular Arbitrage is a type of trading Strategy which make some interesting or which take advantage of prices fluctuation in three Cryptocurrencies market which is as well known as three-point arbitrage or cross arbitrage, Meanwhile the the price discrepancies is cause by the undervalued of one or more currency or and over valuation of the other within the angle of three currencies.

Therefore this can be done by convertion of the first Cryptocurrency to the second and to the third with the aim of earning devident for any trade of convertion done, Meanwhile all this transaction is done by trading algorithms in seconds.

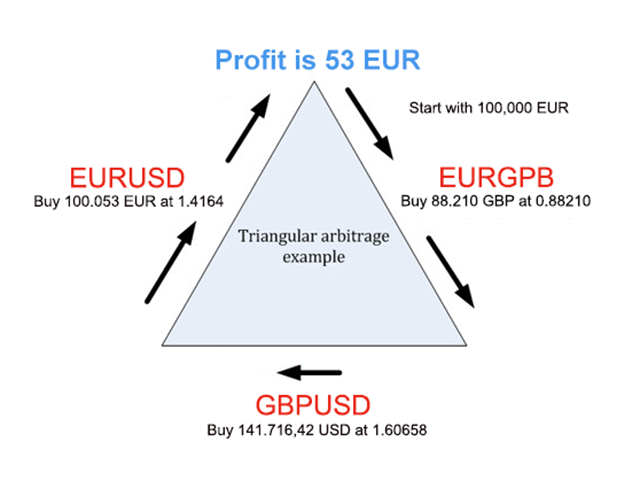

Then based on illustration of triangular arbitrage Strategy, this is based on the illustration of three trade of which the initial currency exchange for the second and the second exchange to that of the third currency and finally the third is brought back to the initial.

Base on the diagram above i was able to picture out the movement and the formation of the triangular arbitrage strategy.

Based on the practical analysis, three currency was involved which are ( EUR, GBD and EUR) the strategy, behind this is it all started with 10,000 whot of EUR to buy 0.88.210 what of GDB.

Again they used the GBD balance to buy USD at 1.60658 and lastly they used 2.4164 what of USD to buy back my EUR.

Therefore after the three trade, it yielded 53 EUR as profit.

4-Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

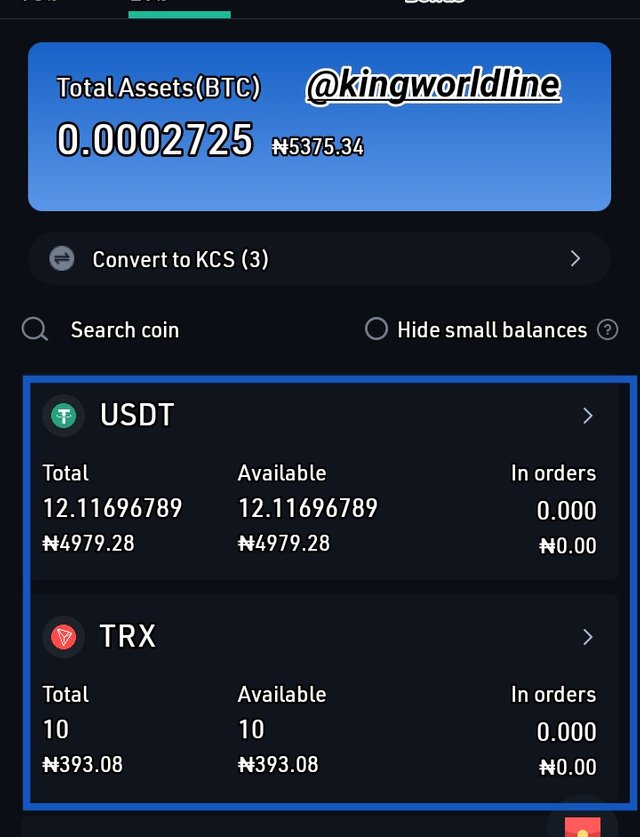

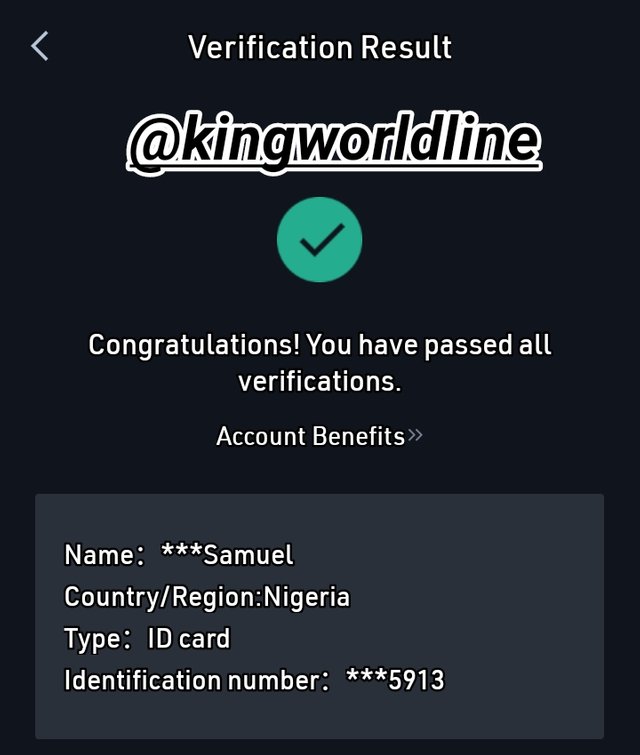

Firstly I was asked to used a verified account below are the screenshot of the both verified account on KUCOIN and Roqqu.

KUCOIN

ROQQU

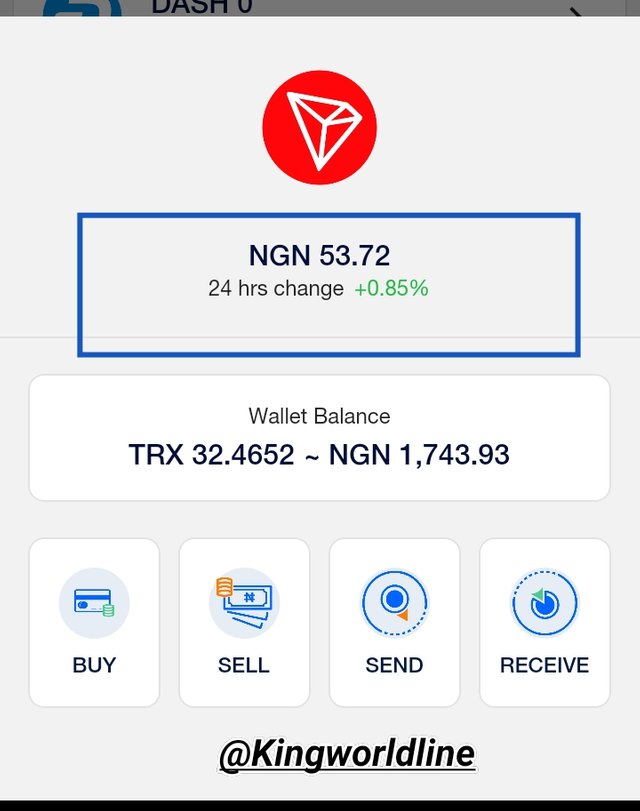

To start with the transaction below are the price of Tron on the two exchange platform as of the time I collected the screenshot, The price Tron on KUCOIN=39.3

The price of Tron on Roqqu=53.72

Therefore I discover that the price of Tron on Roqque is higher compared to the price at Kucoin with a difference of 39.3. Screenshot shown below.

KUCOIN

ROQQU

Therefore I paired TRX/USDT in order to use my available USDT to buy 10 Tron on my kucoin exchange platform below is the screenshot of the transaction.

KUCOIN

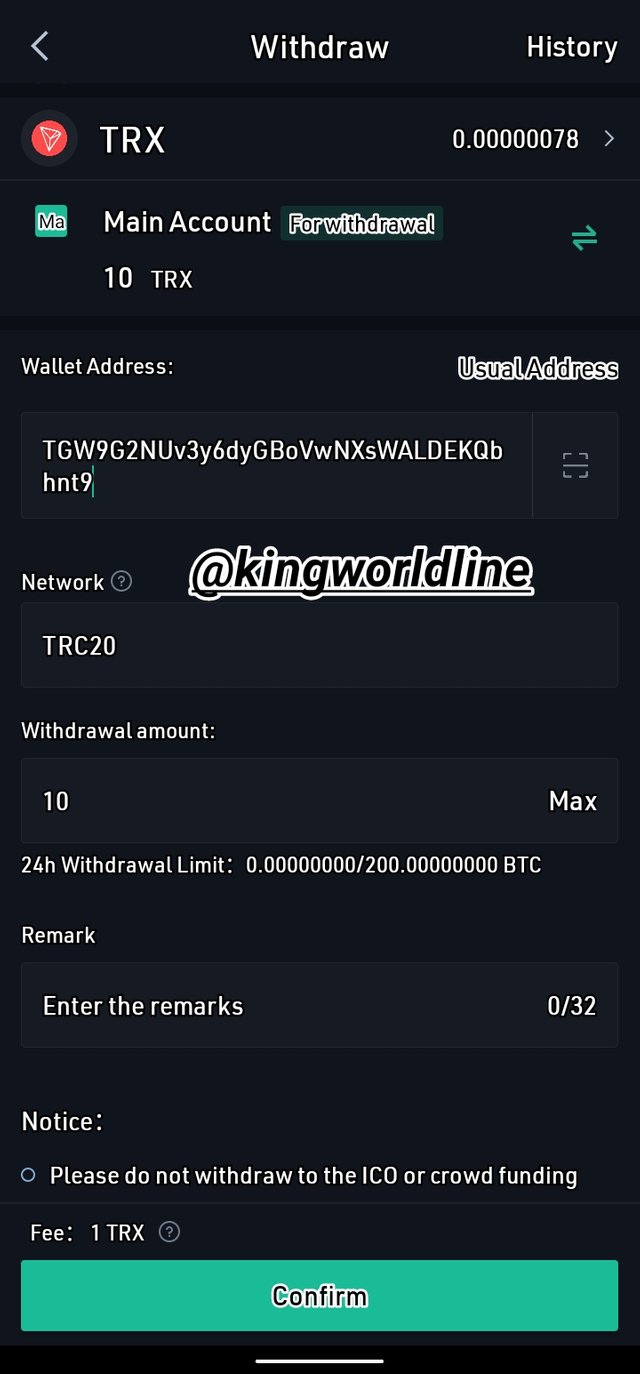

Then I open my Tron wallet at Roqqu and collect the seed phrase which is the Tron link receiving address, although at the course of this transaction i was charged 1 Tron as fee remaining 9 Tron. Screenshot shown below.

Then I proceeded by clicking WITHDRAWAL and CONFIRM of 9Tron from my Kucoin account. screenshot is shown below.

More than 5 hour now and at the point of posting my Home work at my Roqqu I haven't seen the reflection of the 9 Tron due to their poor management in their service, below is my balance at Roqqu.

I promise to update the screenshot once my walllet is updated with the 9Trons.

Below are the screenshot of the Tron transaction proof

5-Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

•First I was asked to to use a verified account, meanwhile i will be using my varified KUCOIN exchange platform for this, below is the screenshot of proof of my verified exchange account.

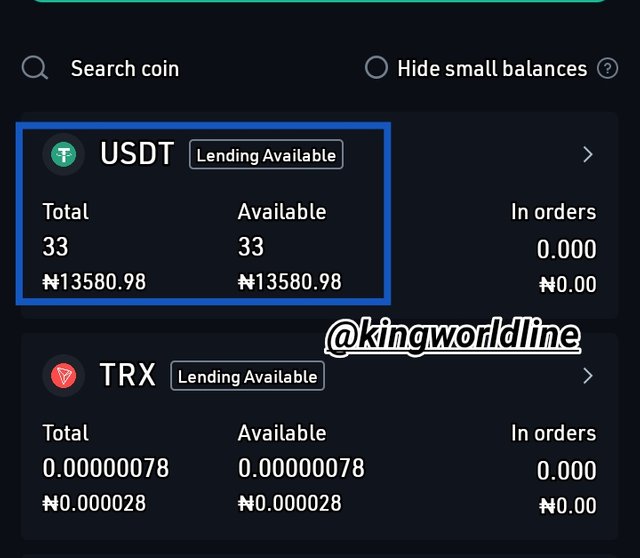

•As regards to the question, it required an investment of minimum of $15 of which I make the investment with 33 USDT, below is the screenshot of proof.

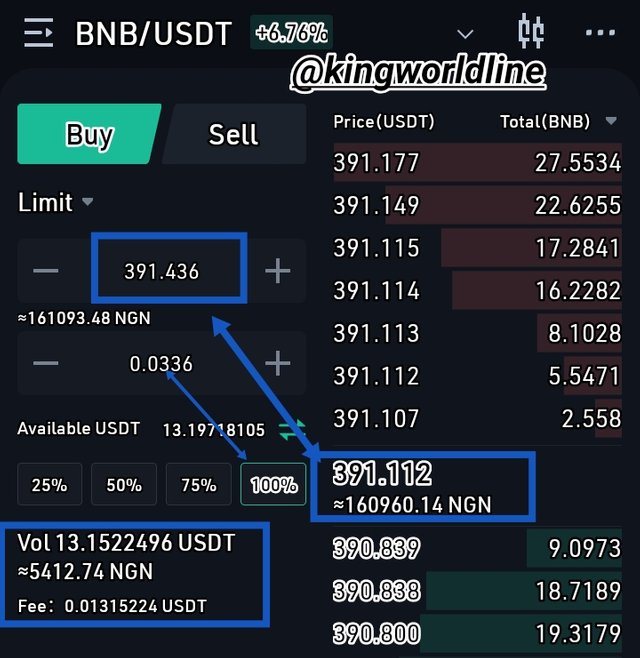

• In order to fullfil the Triangular arbitrage strategy, I have USDT already on my account, then I proceeded in buying BNB with my USDT of which the screenshot is shown below.

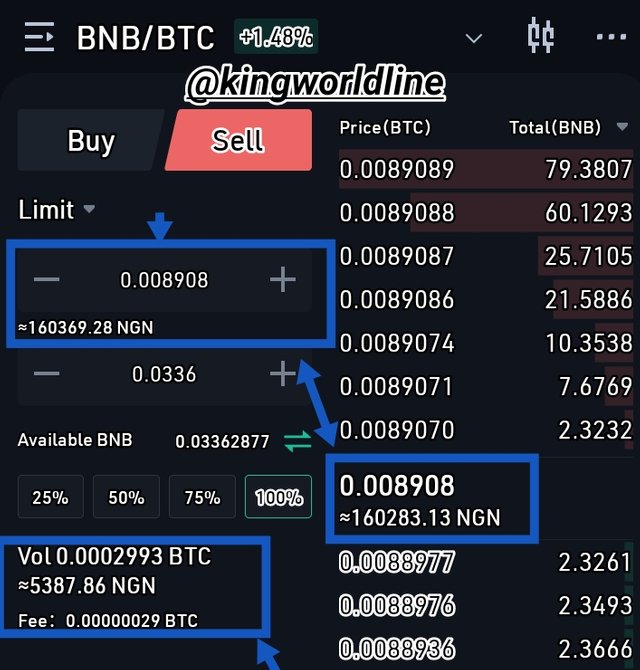

• Then after I got the BMB, I proceeded again to sell my BNB with latest price in order to Buy BTC of which i did as it been shown on the screenshot below.

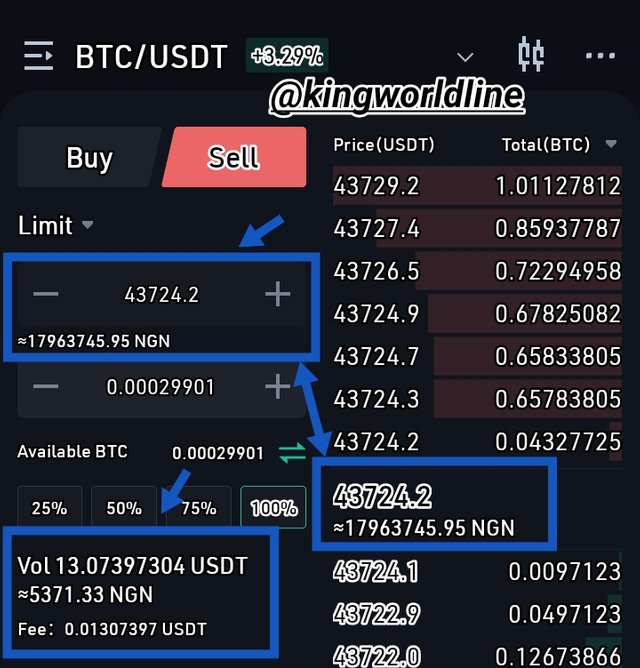

•Then lastly I have to complete the angle of three which forms the Triangular Arbitrage strategy by selling my BTC in order to buy back my USDT

In conclusion I wasn't able to make resonable devident rather I encure some lost of my coin during the Triangular arbitrage due the lack of liquidity in the market.

6-Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

As regards to arbitrage, this actually has advantage and disadvantage of it's own, meanwhile which is known to be have good and bad side of it. Below is the advantage followed by the diadvantage of arbitrage.

ADVANTAGES

•Triangular arbitrage This actually allow traders to earn and gain from the discrepancies in price or unstable market

• Trangular arbitrage can have a relative low risk when ever is implimented well compared to the other strategy.

• It helps in maintaining the price of the securities in the market, and as well it help to stop price variance in securities across different markets.

•Triangular Arbitrage makes the market more efficient, take a look if there is no arbitrageurs than stock it could have situate the market trading in different price in different market which could leads to speculation by some individual, and which can go a long way by damaging the confident of the investors and as well stock market.

It has a minimized risk profit profit in terms of buying and sell the currency within it's axis

DISADVANTAGES

Although Arbitrage trading strategy is not completely risk free it have some basic challenge in terms of risk where a broker can delay in filling one legs of truagular arbitrage strategy which could now lead to failure in strategy since the market is known to be fast .

•It actually require sophisticated and as well advance programe in order to automate, which may be highly expensive or no longer available.

•The cost of transaction is some thing else which actually reduces the price gotten from

triangular arbitrage strategy.

•Since discrepancies can lead to exchange rate to triangular arbitrage opportunities which occur in infraction of cents. This now can lead a trader to plan a strategy that will forced to use huge lot size in order make a reasonable amount of profit. Which implies that the Strategy is only profitable to those with deep pockets.

Arbitrage as the the name defines taking advantage over unstable development, it actually operates in many forms which encompasses many other strategies which tends to take advantges of increased in chances of success. Meanwhile many of the risk free form of pure arbitrage are unavailable retailer traders.

Therefore they are many other forms of Arbitrage which tends to take out opportunity where ever there is instability such as Triangular, negative, riskless, RETAIL arbitrage and many other.

Arbitrage tend to make profit from different currencies and as well in different exchange platform in of place of instability in price of an assets, meanwhile it has shown us means to make some devident in cross exchange trading and as well with a single exchange.

Thanks for reading my home work

My Regards To

@reddileep

#reddileep-s4week4 #cryptoacademy #arbitrage-trading #cryptocurrency-triangular #trading-strategytriangular