Hello every one am happy and is my pleasure to get in touch with you through this medium with my home work assigned by my noble professor @awesononso for his lecture and teaching on The Bid-Ask Spread (Part II).

Am @Kingworldline

I hope you will enjoy my homework.

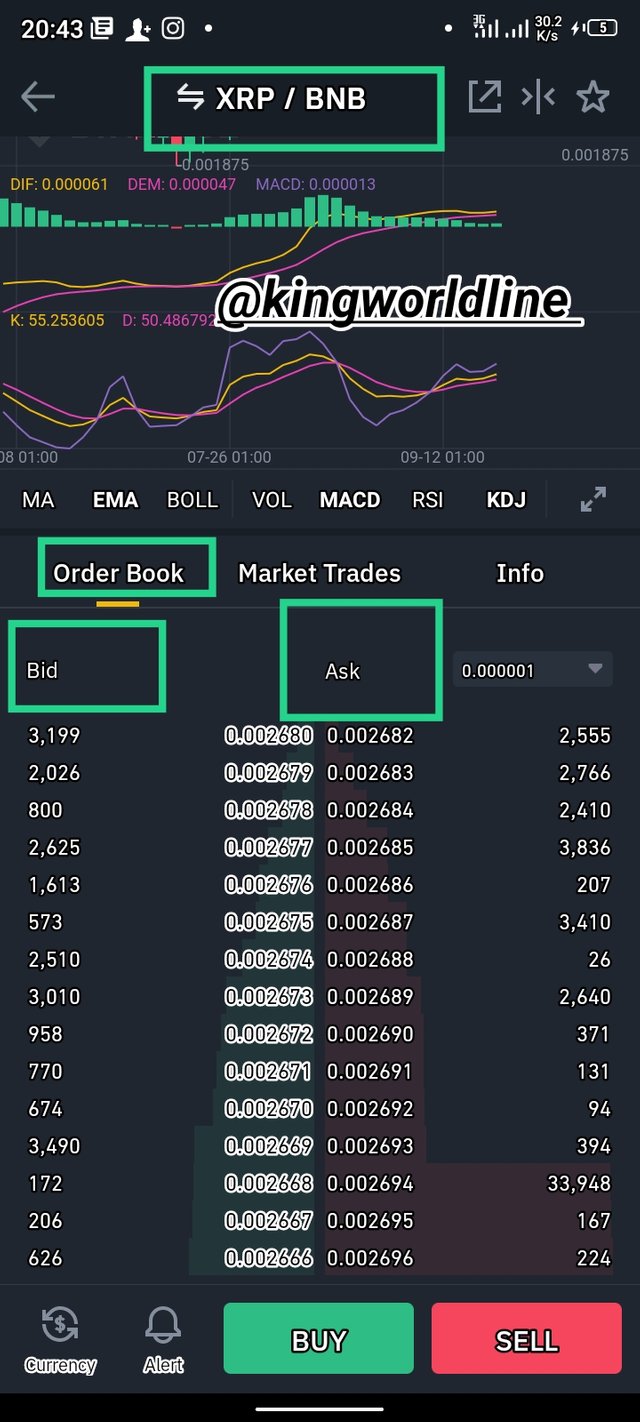

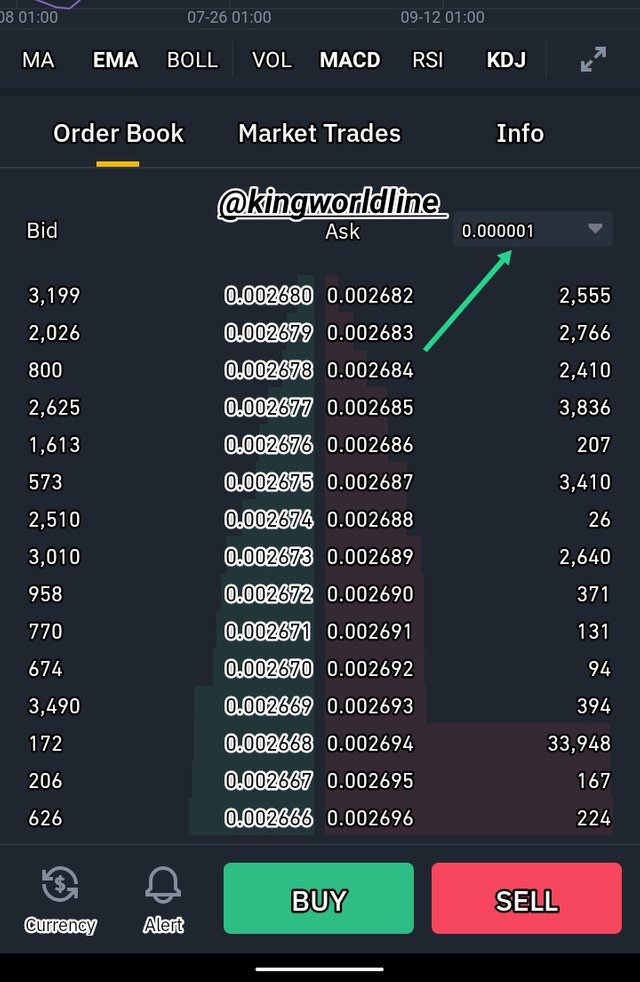

1.Define the Order Book and explain its components with Screenshots from Binance.

Order book is an electronic documentation of assets on a trading platform show casing it value and entries of buy and sell on a cryptocurrency exchange platform, therefore an order book shows compressive order of asset according to buy and sell orders, meanwhile exchange platforms employed a automated engine which help in matching all entry of buy and sell orders accordingly.

Further more an order book have diffeent key information as regards to assets. In the first part it have a dedicated part for buyers and as well the sellers, of which "ask" is dedicated for sell order and "bid" is dedicated for buy order

On varioue exchanges like Binance, Kucoin the Bid are always at the right hand side of the book containing the buy and sell orders, meanwhile the Green color signifies the Bid and the ask is signifies with Red color.

The table, the linechart, the bar charts, and many others actually vitualize the interaction between the buyers and the sellers. Further more the Japanese candlesticks has a common relationship with the order book which shows the current and past statues of the market which send message across to the trader about the condition of the market. In many cases the orders books are made of unfulfilled order which are set to be fulfilled at when due at a specified price.

Orders which are waiting to be fulfilled are known as the limit orders which are fixed at a particular price in order to fulfill it, mean while the orders which are stipulated or fixed at current prices are market orders. Highest bid prices and the lowest ask price shows up at the top of the orderbook. Therefore the differnce between this two is known as the bid-ask spread. therefore it shows the supply and demand strength in the market.

2.Who are Market Makers and Market Takers?

THE MARKET MAKERS

The market makers are those who expect to get paid through premium from the market taker in order to flood constant liquidity. Therefore the premium is known as the edge, which stringly differnciate the bid and the offer.

Therefore the market maker tend to turn over their positions rapidly, without observing whether is the long or short. Meanwhile their aim is to position at the market due to the fact when ever they are buying and selling with edge it give them alot of profits with low risk, therefore at any point in time in the market impose an oppportunity cost. Thus the market markers works in different dimentions in the markets simultaneously.

THE MARKET TAKER

The market taker needs liquidity and also immediacy to ensure a substantial price exists when ever they want to trade or close an already existing position. Meanwhile the market taker always accept the edge in return to the service ushered by the market maker. Also the market takers are not order frequent compared to the market makers and therefore they are less concern about the trading costs.

3.What is a Market Order and a Limit order?

A market order is actually an instruments use in buying and selling of asset immediatly which guarantee an order that will be excuted. But in the other way round it does not guarantee a specific price since the price is dynamic, the asset price fluctuate at its time.

Further more the market order to purchase or buy will execute at the current bid while the the market sell will excute near or close to the current ask or at the price fixed to sell price.

PROS

• Orders are excuted immidiately.

• Usually excuted at the most recent point.

• less fees.

CONS

• They are surprice price suprise.

LIMIT ORDER

This is a type of order that let's a trader or investor to set a cap (known as limit) per share willing to pay for security.

A limit is order of a trade of an asset or stock for a specific price. For example if you intend to buy at a share of $200 whot of asset or stock at $200 or less then you can set up a limit order that won't filled unless the asking price settled.

A limit order is a type of order to buy and sell an asset a specified price which is known to be the "limit price" meanwhile a limit order to buy can only be excuted at the specified limit price or lower, while limit order to sell can be excuted at the limit price or high.

PROS

• Offers controls the Price.

• Can be used to buy or sell order.

• You can add conditional orders for more control over your execution.

CONS

•Your order cannot be executed if target price isn't met.

•May be complicated and fees are attached.

•Oders can be filled partially.

4.Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

To start with, one thing that have to be known is that market makers place a limit order while market takers place the orders. Meanwhile the marketaker provides the liquidity to the market while the market takers takes out the liquidity from the market.

Therefore to have buyer there should be a seller as well to compliment the market, therefore when ever a buyer makes place an order there in the other way round his counter part is selling the asset. As the orders gets accomplished or excuted.

Therefore when a order is placed, there is

addition liquidity in the market until the time limit order is accomplished.

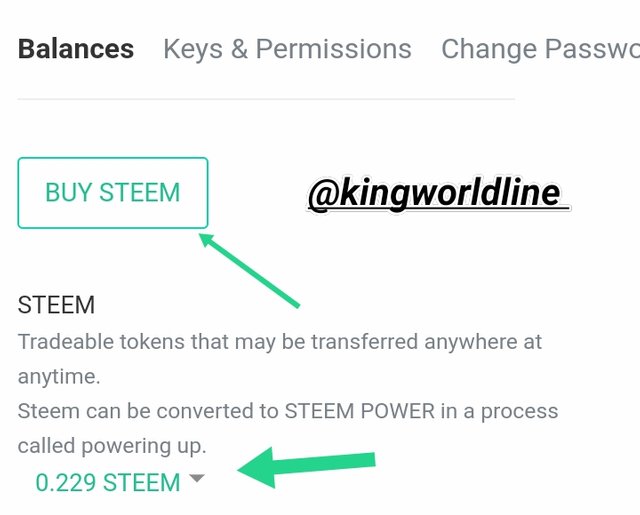

5.Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?33xs

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

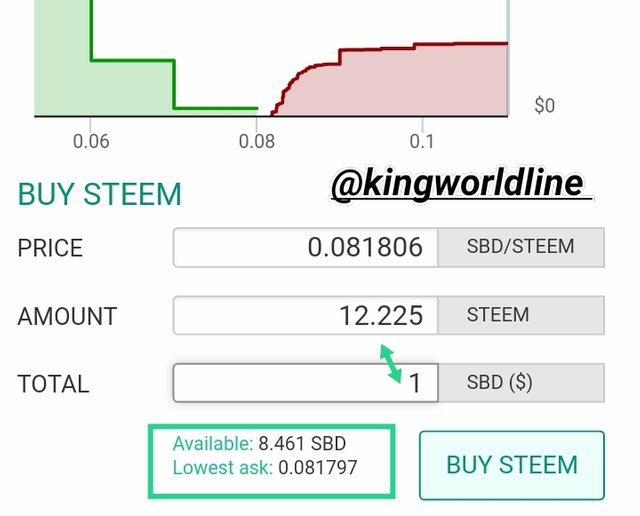

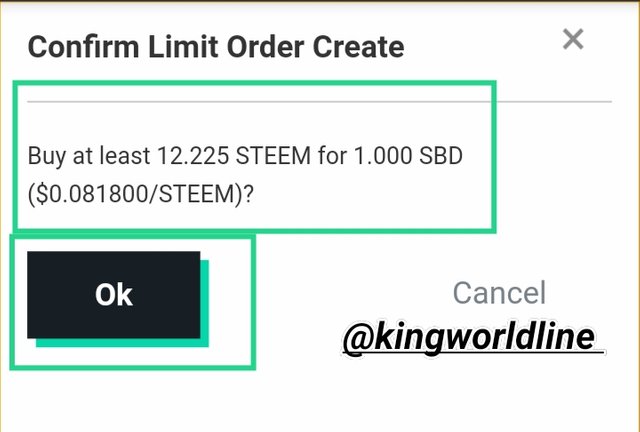

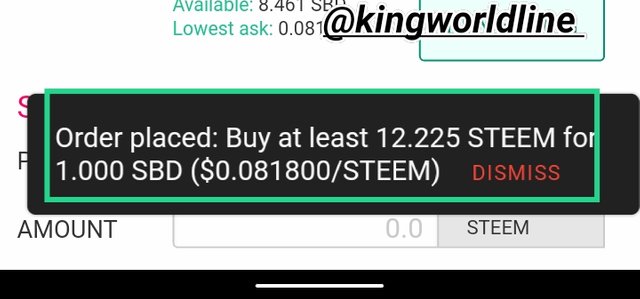

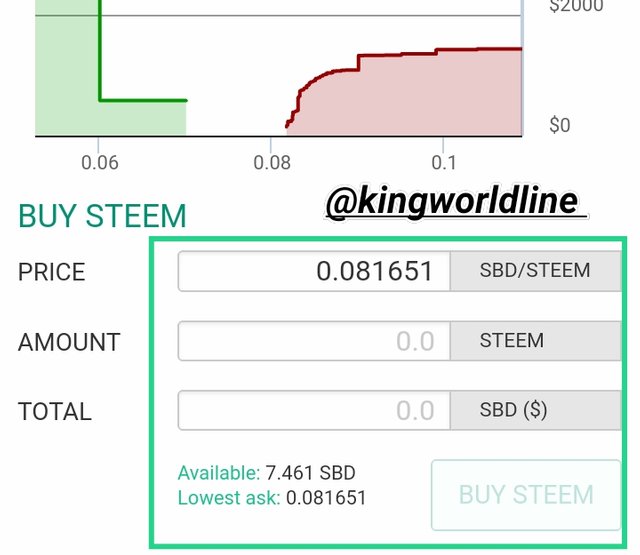

I logged into my wallet. From the next platform showing market, i moved on to click on market where i was loged to a platform made for the order and exchange where i have option to buy and as well sell steem.

Meanwhile on the buy and sell section i input the amount of 1 SBD with fixed price. Then i click to proceed to buy steem. Next the transaction was completed with the help of my active key login.

After some seconds the order was placed and was excuted "INSTANTLY, this did not take time due to it was placed at price at which some one is will to sell. But due to low liquidity in steemit of the internal market caused a brief delay in second in order to achieve the transaction.

CHANGE OF LOWEST ASK

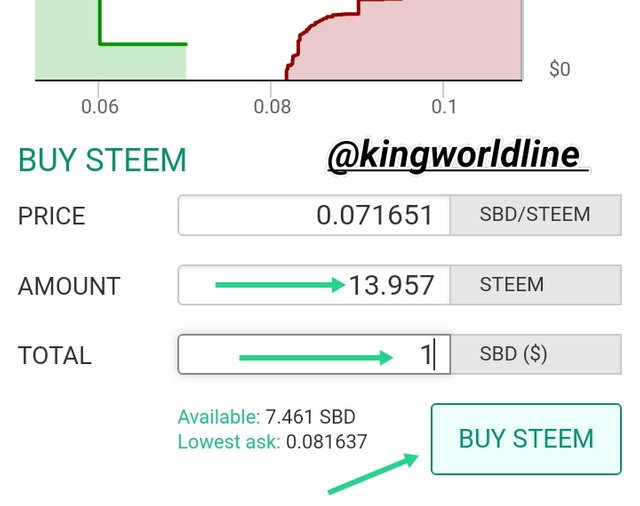

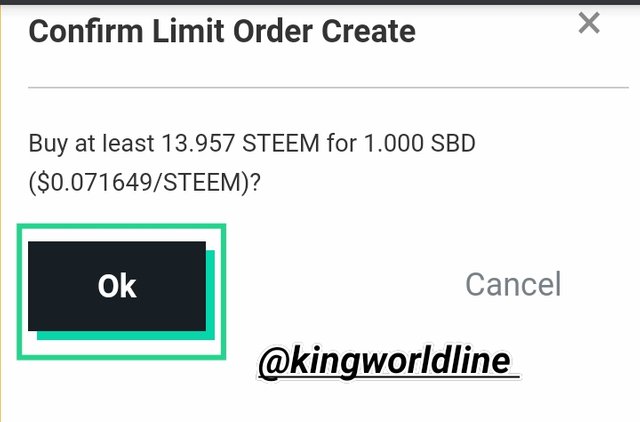

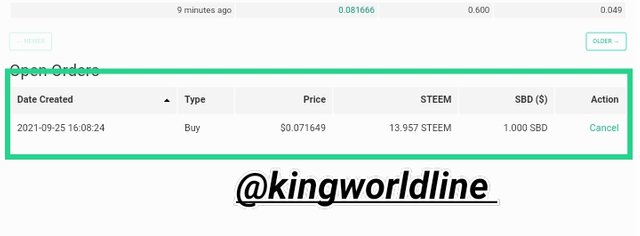

As i did in buying steem, the same here but i have to place my order at a specified price in other to sell.

As i have to purchase steem. I now change my price from 0.081651 fixed price to 0.071651

•Using one USDT

•I will get 13.947steems for 1 SBD

•Then then order was placed until until when it will be fulfilled, still pending.

A

B

6.Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

BUY LIMIT ORDER

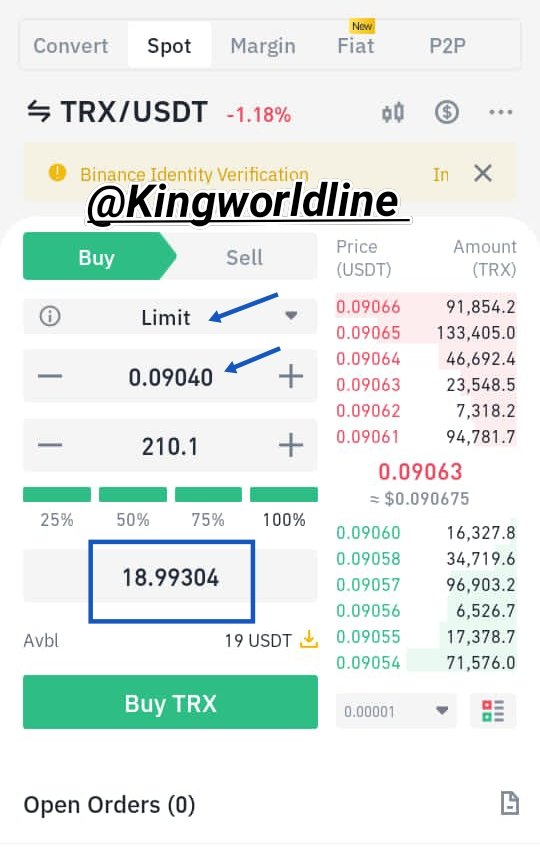

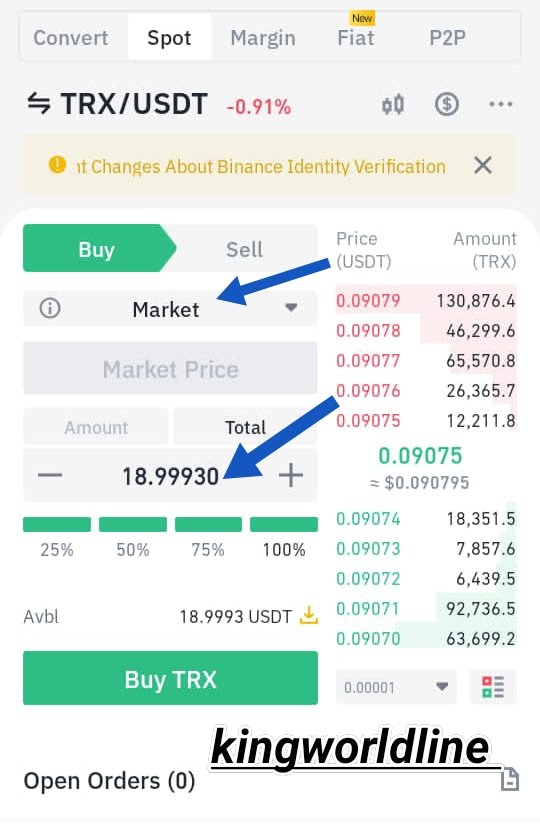

I procced to anwser as demanded I open my Binance account application from the display i click on markets. Then i select trading pair containing one cryptocoin that is on Binance wallet with a another coin i want to buy as stated i wannted to purchase TRX with my USDT, therefore i proceeded to search of TRX/USDT pair and click for my order book to display, then i clicked buy.

On the next phase i change the the market to that of Limit, and fill in all my details required. Then i change the price of TRX at the market to and then i place my order.

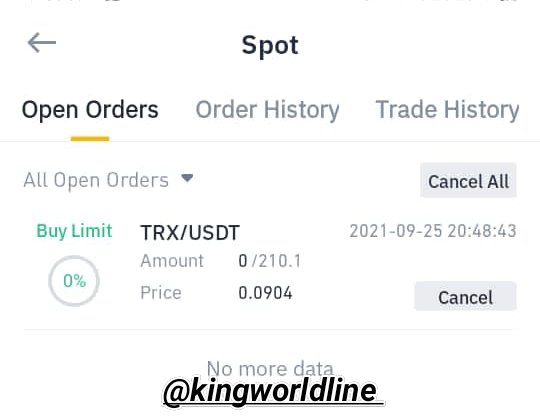

Then at the limit price, i choose to purchase TRX that worth USDT which i got TRX and then i proceed place the order meanwhile it was pending.

Then the limit order for TRX was shortlisted in the order book waiting for the Price to merged and executed which means i acted as the market maker because i was able to provide liquidity to the market.

7.Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

BUY MARKET ORDER.

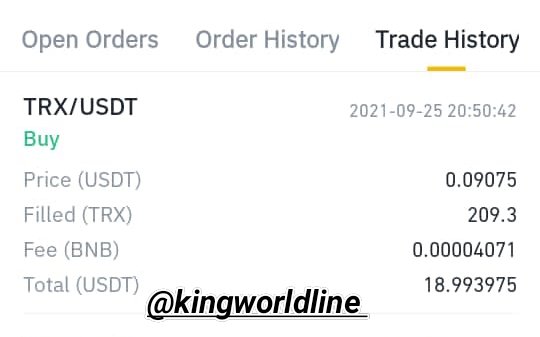

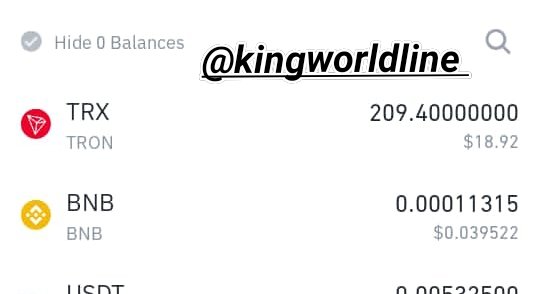

Again i have to open my Binance Application. From the display at the botton there is option then i click on markets. Then i select my currency have founds in the exchange wallet and another currency i want to purchase. For an example, i bought TRX with my USDT my sarching for TRX/ USDT pairs and click on on it a platform shows up.

Open Binance app. From bottom panel of options , click on markets. Select a trading pair containing one cryptocoin that we have on the exchange wallet and the other coin that we want to purchase. Example, i waited to buy TRX from USDT. So i search for TRX/USDT pair and order book will load. Next we click on Buy.

Next i filled allthe required details required like the amount, amount of TRX, then i clicked, to to excute it instantly.

Screenshot shown below

After that my order was excuted instantly where i acted as market taker due to the fact i consumed liquidity from the system.

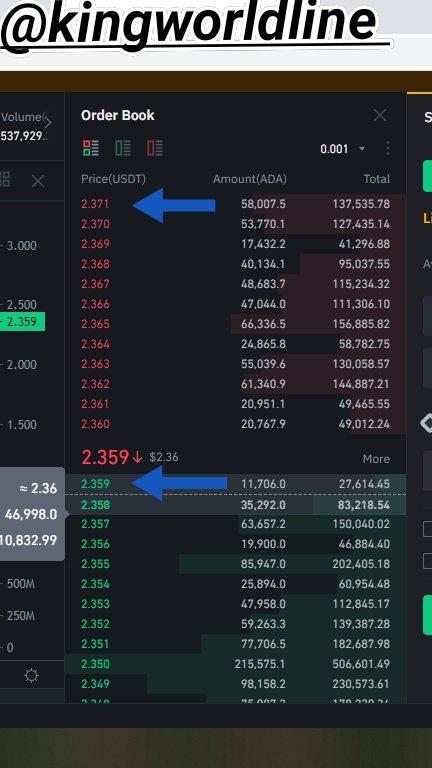

8.Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

FOR ASK PRICE

Bid price=2.359

Ask price= 2.371

For bid price= 2.359-2.371= 0.012

For Ask price= 2.359+2.371= 4.73

Order books is a comprehensive orders, placed accordily as the the update continue coming in, meanwhile it actually help us in knowing the parameters and trennding at a particular point in time.

Hello @kingworldline,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit