Good is my pleasure once again to participate on my professor @allbert Home work which he has done Noble in explaining the "Trading with Contractile Diagonals," and as well my regards goes to the my noble steemian. I welcome every one i hope you will find my article interesting.

QUESTION ONE

1- Define in your own words what a contractile diagonal is and why it is important to study it. Explain what happens in the market for this chart pattern to occur. (screenshot required / Bitcoin not allowed)

Wedge in spanish is known as contractile diagonal pattern .

Therefore this is known as a signal either in a bullish or bearish pattern in it's price reversal, is also converge trend line of a chart to connect the respective high and low of series of price over the course of period. Of which the line are known as the high and the low which are either rising or falling in their respective pattern and in different rates which appear to form the wedge as the converge.

Therefore this is known as wedges has three characteristics of which it was known of, which are the converging trend line, a pattern of declining volume as respect to the price progress in it's patterns, lastly the two kinds rising wedge pattern which are the the rising wedge pattern known as bearish reversal or the falling wedges known as the bullish reversals.

The important to study contractile diagonal

Base on technical analysis, it is used depict price movement and as well the trends in the market below are also some reasons to study wedge which is know as the contractile diagonal;

• It shows the a general outlook of the market conditions.

• It show the point of reversal which forms a convergence in price trend which gave birth to wedge.

• it is important because the investors can derive a cogent market through the depicted wedge.

• it depicts the bearish and the bullish in the market.

• Also the upper and that of the lower trendline are very important to investors in terms of making investment decision.

Explain what happens in the market for this chart pattern to occur. (screenshot required / Bitcoin not allowed)

They are two kinds of Contractile Diagonal pattern which occurs in the market either as ( The rising Contractile Diagonal or as the falling Contractile Diagonal, therefore this two is opposite to each others

Therefore the falling and rising of the wedge are said to be predominantly said to be reversable pattern depending on the direction of the trend.

Meanwhile wedge is known as the market consolidation zone which bound at two respective points known as the sloping support and resistance line which converge at it progress. This lead to the formation of the high and then low.

Therefore the rising Contractile Diagonal is known as the price action zone which have connection between the support and the resistance lines.

The formation of this boundaries are based in the support line and the resistance line which requires two or three highs to get it formed of which each proceeding high is geater than the others.

Therefore Price movement forms the support and the resistance line in sloping manner or pattern which eventually converge as the pattern gets mature and form a wedge.

Rules For Contractile Diagonal

For this to be formed the there must be rule attach to it of which it operate on, therefore the wave are numbered from one to five waves with the following principle.

•The second (2) wave never ends beyond the starting point of wave one (1).

•The third wave (3) always breaks the ending point of wave One (1).

• The wave four (4) usually breaks beyond the ending point of wave one (1).

•The fifth wave (5) in the absolute majority of cases breaks the ending point of third.

• The third wave (3) can't be the shortest.

•The second wave 2 can't be a triangle or a triple three structure.

•Therefore the first, second and third waves 1, 3 and 5 form like zigzags.

QUESTION THREE

2- Give an example of a Contractile Diagonal that meets the criteria of operability and an example of a Contractile Diagonal that does NOT meet the criteria. (screenshot required / Bitcoin not allowed)

For a complete Contractile Diagonal to be achieved the following have to be fulfiled in it, which are as follows.

•The wave (1) have to be greater than that of the wave (3).

•The wave (3) have to be greater and larger than wave (5).

•The second wave (2) have to be larger than that of the wave (4).

•The trace of the impulse have to be in a diagonal of (1,3,5) and (2,4) respectively.

•The diagonal line have to start converging at a point towards the bullish or the bearish trend.

Therefore all this show a complete Contractile Diagonal that meets the criteria while the other does not as it is shown on the screenshot below.

QUESTION FOUR

3- Through your Verified exchange account, perform one REAL buy operation (15 USD minimum), through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Your purchase data must match your analysis data: such as cryptocurrency and entry price.

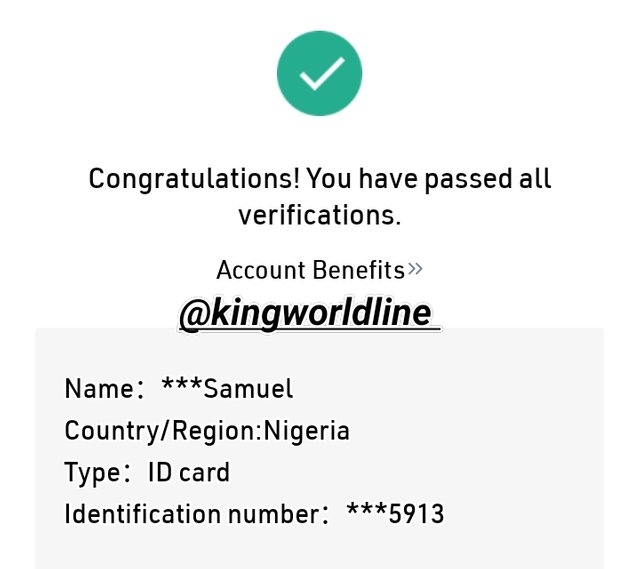

As regards to the Question demands i will be using a varified KUCOIN account for this real buy, mean while below is my proof of varified kucoin.

Therefore i proceed in the real buy with the contratile diagonal method.

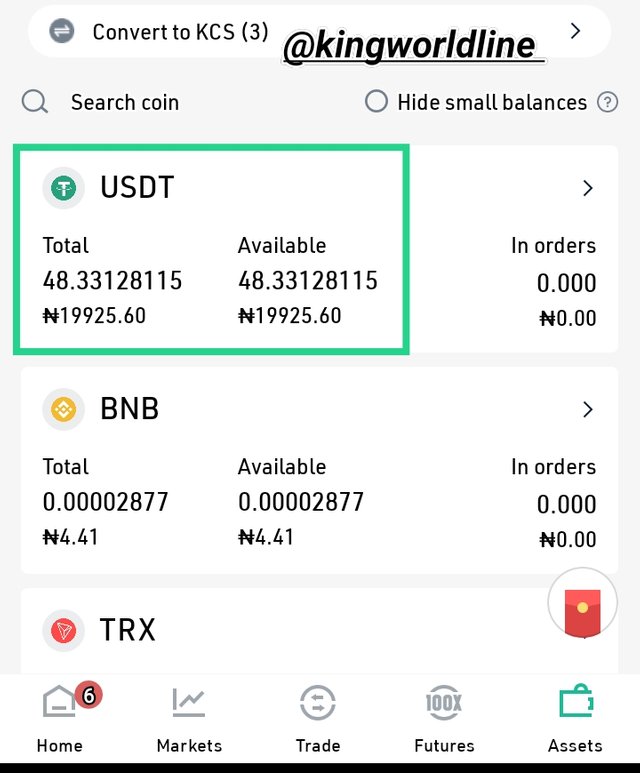

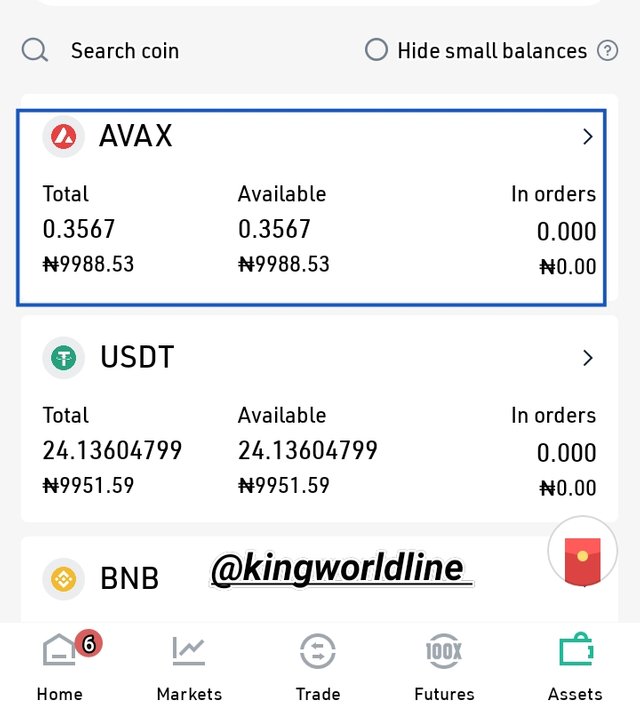

Although i have more than 15 USDT in my account which i use to place for the real buy according to the contractile diagonal. Screenshot shown below.

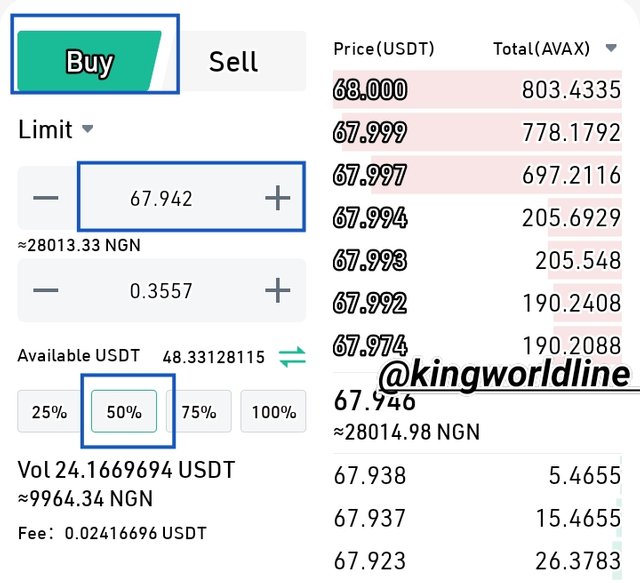

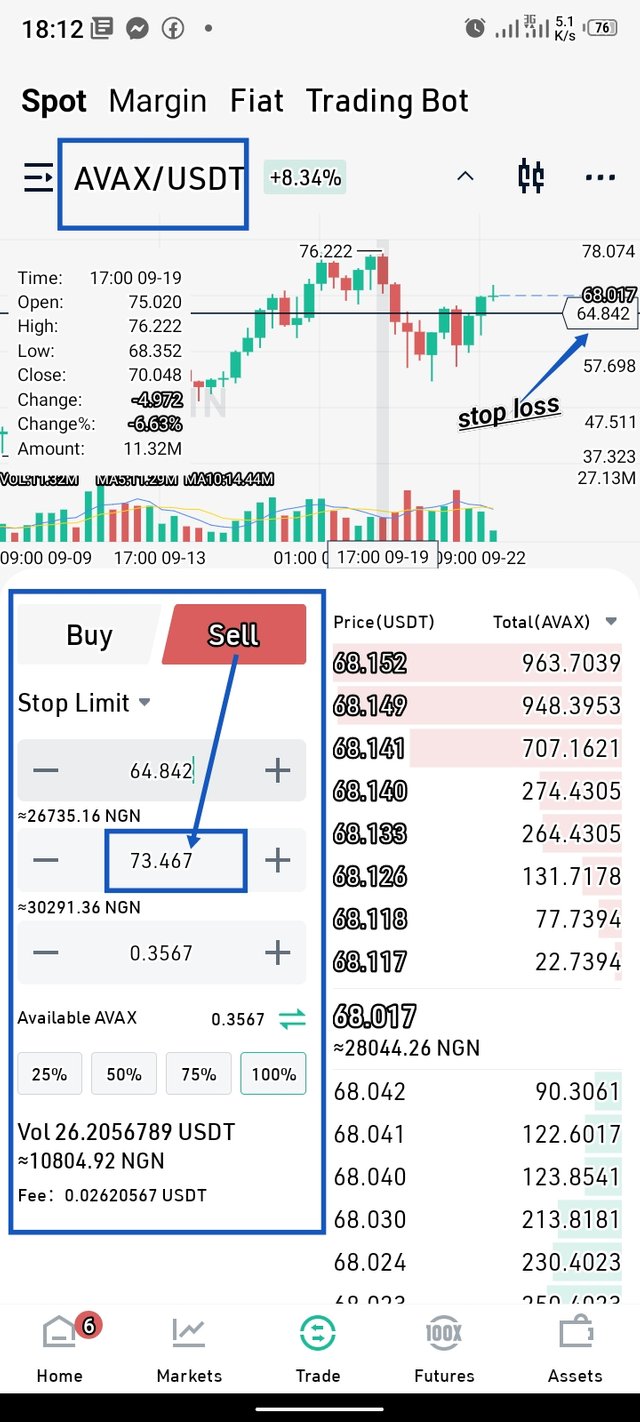

Am using AVAX/USDT under 8 hours in the chart i was able to get a forming diagonal with (1,3,5) with (2,4)

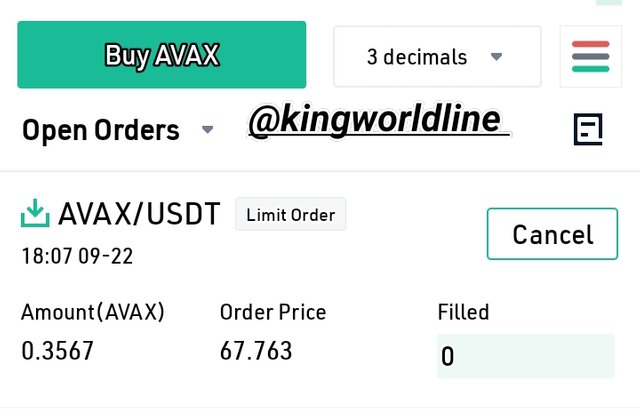

I have to buy at the bullish trend point of formimg the 5th wave with 50% of my trading account whot which is more than the 15 USDT required, i bought at price of 67.942 as shown on the screenshot below.

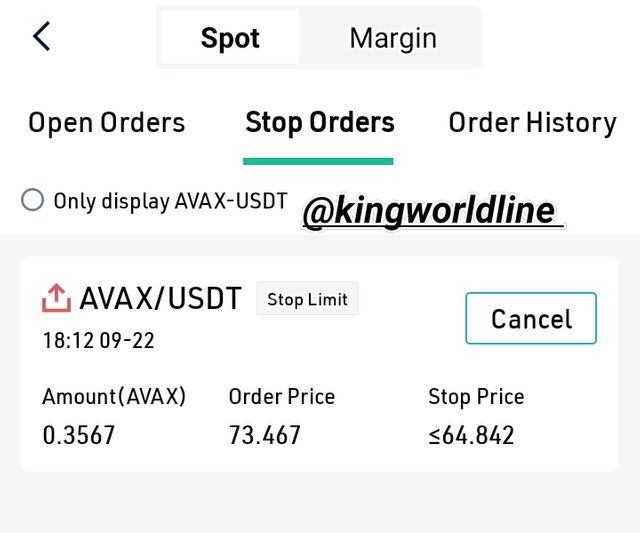

Therefore for me to sell, i place i place sell at the price point of 73.467 with my stop lost at 64.842 with 100% sell. Screenshot shown below.

Therefore i was able to complete the buy and sell with the following value and criteria.

Account : Varified Kucoin

Signal : contractile diagonal

Pairing : 8 hours

Buying price: 67.942

Selling price: 73467 (Stoplost: 64.842)

Chart result: After not less less than 20 hours under 8 hours, the below chart was forming the last wave for the contractile chart screenshot below.

4- Through a DEMO account, perform one sell operation, through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Bitcoin is not allowed.

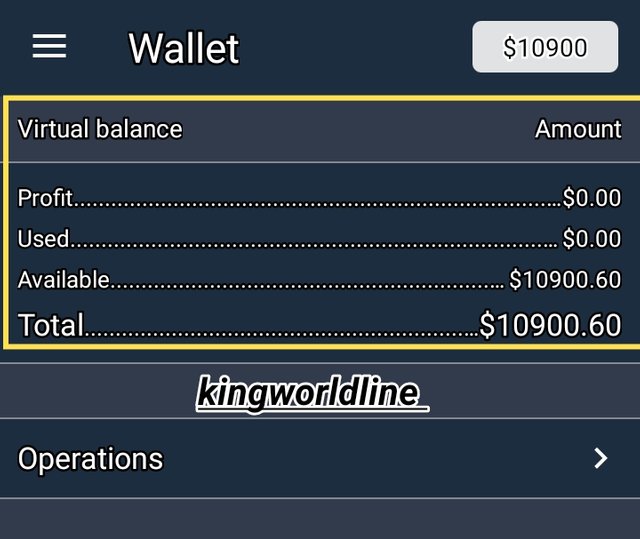

Therefore to justify the question given i used a demo application known as crytomania to perform the operation.

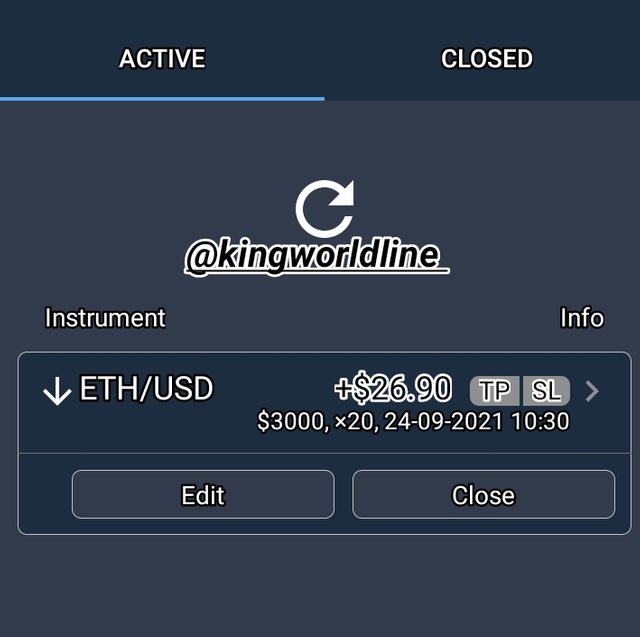

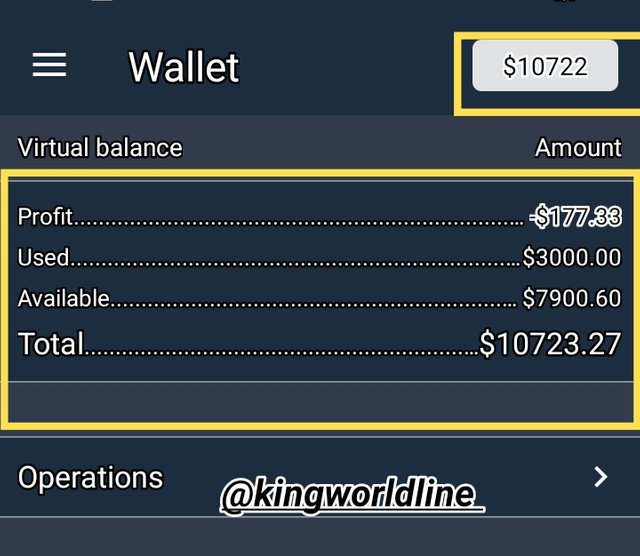

Therefore with respect with contractile diagonal as the question demands am going to perform sell operation, meawhile am going to use ETH/USDT as the currency pair in order of sell operation.

As indicates in the below screenshot on ETH/USDT pairs i uses a day timeframe to achieve this with compliance with contractile diagonal with entry price at and exite shown in the screenshot with profit indicated in the screenshot below.

Therefore below is the screenshot of the out come (Result) of the the sell operation of the paired currrency after technical analysis

5- Explain and develop why not all contractile diagonals are operative from a practical point of view.

Regards to the above question, is expected that for a successful Contractile diagonal to be formed a certain requirement have to be fulfilled.

• Based on the wave (1) must be greater than the previous wave for the bullish while for the bearish the wave gets smaller as it gets down the bearish.

• The must not be a sign of equality in respective wave along the diagonal.

• It is expected that the diagonal line goes towards the the end, they should be a sign of converging between the two diagonal line.

• They must be touch of retracements of the diagonal between (1,3,5) and (2,4) respectively.

Therefore to fulfill all this essential prove for a complete contractile diagonal all this listed above have to be fulfiled, therefore in the absence one of this is regarded is regarded as not being opeartive.

CONCLUSION

In conclusion the contractile diagonal wave are pattern in chart which signifies market changes which are common in the market, meanwhile they are used by the traders in determining the market situation at a point in time or period and as well in determing entries and exists of the market, with the entry and exit a trader can easily spot the market in order to take profit and as well set his stop loss in order to minimize risk of lost on assets on stake.

Therefore contravctile is a zizag formed in a chart which count in the order of 1,3,5 above and 2, 4 below in showing the high and lower in order of signifying oversold and overbought in the market.

SPECIAL REGARDS

@allbert

#allbert-s4week3 #cryptoacademy #diagonal #wedge #nigeria #pattern

.jpeg)