The cryptocurrency world has been experiencing a great form of evolution since the integration of artificial intelligence (AI) and machine learning (ML). This innovation has achieved a great improvement in their accuracy, adaptability, and run-time making them helpful for analyzing the crypto market and making prediction easier when the market is volatile. In this post, I will talk about how AI and ML technologies are applied to Steem/USDT trading, build a predictive model, apply sentiment analysis, and address the challenges faced in AI-driven trading.

1: Exploring AI and ML in Cryptocurrency Trading

AI and ML have been of great help in enhancing cryptocurrency trading by automating data analysis and providing actionable insights. Here's how they are applied:

Market Sentiment Analysis

Social media platforms like Twitter and news articles use AI tools to analyze and gain AI-driven insights on public sentiment about cryptocurrencies. For instance, an ML model trained on Twitter data can predict whether sentiment surrounding Steem is bullish or bearish.Algorithmic Trading

Traders leverages on AI tools and predefined criteria like price thresholds, and sentiment scores to enhance their decision making and automate trading processes.Risk Management

AI enhances risk management by evaluating the volatility and correlation between assets of a trader and assist the trader in making informed decisions, navigating the volatile market and reducing losses.Price Prediction Models

ML models analyze historical price datasets, trading volumes, and macroeconomic indicators, enabling traders to make informed decisions. These predictions are suitable for short-term trading strategies.

Advantages of AI and ML Over Traditional Methods

AI and ML have shown significant advantage over traditional methods and some of these advantages are improved accuracy, speed and emotional-free decision making. They enable the trader navigate the complex and volatile market very effectively.

Example

Steem’s historical price data used to train a machine learning model successfully identified a potential breakout when trading volumes surged and sentiment turned positive, ensuring that traders make a profit from the price movement.

2: Building a Predictive Trading Model

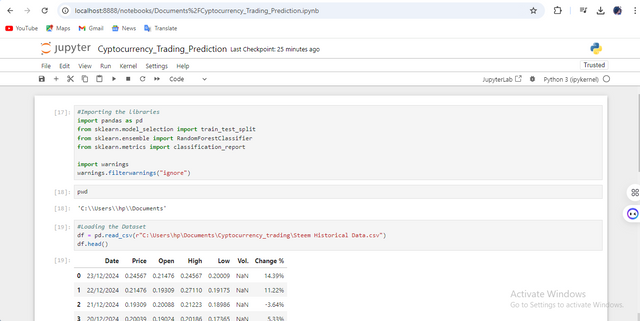

To predict the Steem/USDT price direction for the next 24 hours, I used Python’s Scikit-learn library.

The first step involves Data Collection and Preprocessing. Here, I downloaded historical Steem/USDT price data from a trusted source called investing.com.

Step 1, I imported the necessary libraries and loaded the dataset as a CSV file.

Step 2, I did the Preprocessing process which involves cleaning the dataset, checking the shape of the dataset, and removing the NaN Valves and the irrelevant columns.

.png)

I also calculated moving averages, RSI (Relative Strength Index), and price change percentages.

Label the data: so that If the price increases in the next 24 hours, I assign a label of 1 (up), otherwise 0 (down).

.png)

.png)

Lastly, I went on with Algorithm Selection: Here I Used a Random Forest Classifier because it has the robustness and ability to handle non-linear relationships.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Interpretation

The model didn't perform well because the dataset is imbalanced and it needs to be fed with more data, also it predicts a downward trend, so traders can buy Steem/USDT, potentially profiting from a price decrease.

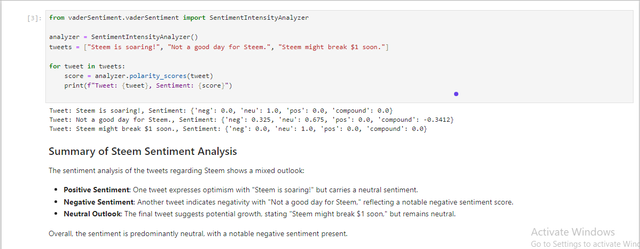

3: Implementing Sentiment Analysis for Trading Decisions.

To attempt this question, I will be using the VADER sentiment analysis tool to analyze Twitter and Steemit posts that mention Steem.

This analysis shows that there is a neutral sentiment among users, This mixed sentiment could influence traders' confidence and trading decisions regarding Steem coins, emphasizing the need for traders to monitor the market trends.

Using Sentiment Trends: Sentiment trends act as a secondary signal. If sentiment aligns with technical analysis (e.g., RSI and moving averages), confidence in the trade increases.

4: Designing an Automated Trading Strategy

To design an Automated Trading Strategy, the automated trading system executes trades using a predefined logic created with the help of an AI tool.

Here is a simple logic for Triggering Trades:

When the price goes above the 15-day moving average and the sentiment is positive, this gives a Buy Signal, but once the RSI exceeds 70 and the price goes below the 15-day moving average, then its a Sell Signal.

Furthermore, the Stop-loss has to be set 5% below the entry price so that the losses can be limited and the Take-Profit should end the trade when the trade is at a 10% profit and the sentiment is negative.

For instance, an AI bot can monitor live Steem/USDT prices and sentiment scores and If a buy signal is triggered, it places an order for the trader, when the price hits the take-profit level, the bot sells automatically for the trader making it easy for the trader not to loss.

5: Addressing Challenges and Improving Reliability

Below are some of the challenges faced by AI and ML-driven trading and solutions to these challenges are as follows:

Overfitting: this is when the model is been trained on the noise in the training data to the point where there is a negative impact on the model's performance on unseen data.

Solution: This can be solved by using cross-validation and regularization techniques to improve the generalization of the model.Limited Data: this is a result of limited or insufficient data for smaller tokens like Steem.

Solution: to solve this challenge, we can use data augmentation to increase the dataset or integrate external sources like sentiment analysis.Run Time: Slow data processing can lead to poor decision-making.

Solution: A high-performance server that is close to other exchange APIs can be used to deploy the trading system.Market Volatility: This is when the outcome is not steady leading to sudden price swings.

Solution: we can incorporate real-time risk management algorithms that can help adjust positions dynamically.

Practical Example

A machine learning model trained on Steem/USDT data and integrated with sentiment analysis and volatility filters would give a good prediction and also avoid losses by putting the trades on pause when the market was at an extreme condition.

Finally,

The integration of artificial intelligence into the cryptocurrency world, particularly within the Steem/USDT market, has marked a significant transformative shift. This advancement demonstrates that traders can effectively navigate the volatility of the market. By embracing these innovations, traders can gain an advantage over traditional methods. Although there are few challenges faced with these technologies, but continuous upgrades and consistent research on current trends can enhance the accuracy and effectiveness of AI-driven trading strategies.

All attached images are screenshots done by me.

Thanks.