Hello, Steemians. I am very happy to learn at the Steemit crypto academy and also learning from @fendit our crypto professor on the topic “Don’t get lost in the fuzz”.

Question 1: place yourself in the following situation. You bought BTC a couple of days ago at USDT 62k. Suddenly, you see that this situation is going on:

i)What I would have done in the situation above before reading this lecture.

Having little Know-how in the crypto world, patience would have been my best movement across the market. This is because rushing might cost you a huge amount of loss whiles you could have waited to avoid it.

In this case, I would have had the patience for some while to a glance in the market to see and be sure the behavior before any decision could be made.

Example as sited in the Question: I bought USDT 62K per bitcoin, I would wait for some period of time to be triggered by market volatility for longer hours and then put my stop loss in place to avoid massive loss.

ii) What I will do now after reading this lecture?

This lecture has really taught me a lot about the safety precautions needed to be put in place for a safe trade. The stop loss feature is really a great considerable feature that needs to be considered.

Assuming I got myself busy and for that matter with no laudable reason to justify myself, I was unable to keep track of the price behavior of my asset having the market gone dipper before getting to know of it, would be a great loss on my path and in other not to incur such loss, I have utilized the stop-loss feature on my market as taught in today's lecture to avoid loss and rather wait for another convenient time that the market would be optimistic and buy the asset.

Question 2

Share your own experience when it comes to making mistakes in trading.

i) The costly mistake I have made in trading.

I have got to admit that I always fall a victim to FOMO. I had jumped onto several Doge bull run at an inappropriate time with studying the market which has really caused to loss of almost $100. I bought my first DOGE tokens on 2021-02-17, 08:14:43 for 0.0535 for $10.96 which earned me 205 DOGE tokens upon recommendation from a friend.

I was anxious for what I got to know as price mooning and didn't really understand the essence of HODL. I eventually sold my 205 DOGE token for only a $1.472 profit on 2021-04-80 21:28:10 for a price of 0.6095.

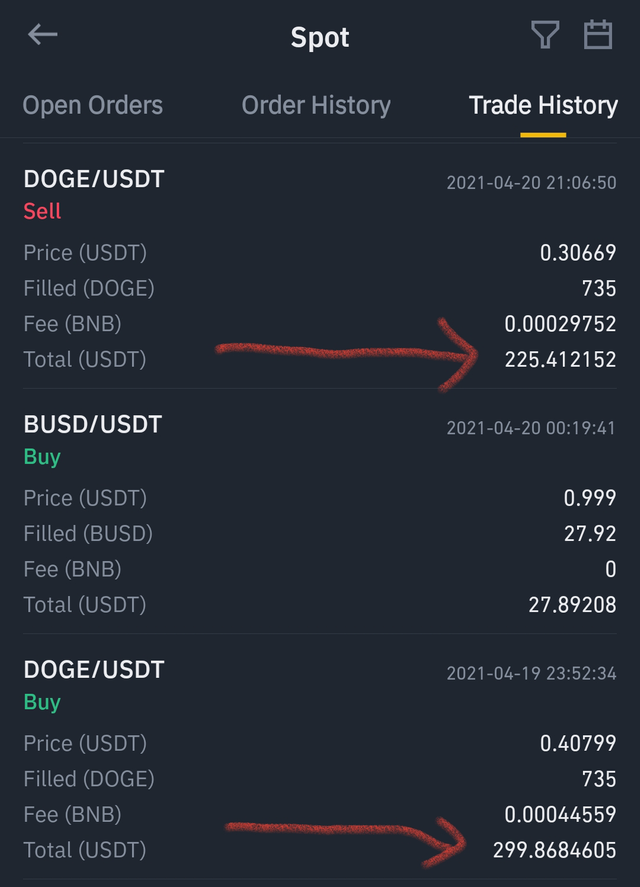

I eventually bought $299.868 worth 735 DOGE tokens on 2021-04-19 at 23:52:34 due to the fear of missing out. DOGE experienced a bear run not long after.

I panic-sold my 735 DOGE tokens for fear of losing much for 0.30669 for only $225.412. I ended up losing about $74.39 off my initial $299.868.

I have made subsequent FOMO trades trade which has caused me money but I believed I'm adapting to the trade market and now with the knowledge of Stop Limit, I can vindicate myself before there is much loss incurred.

ii) Which of the strategies discussed in this class you find the most useful for you? Why.

I am quite fascinated by the Stop Loss feature thanks to this lecture. I have tried my hands on it and I'm in love with it now. It is definitely going to be my favorite in a long time now that I know of it.

My previous trade loss has taught me a valuable lesson to take time to analyze the market trend before I make a decision either to buy or sell an asset. I find the strategy to never invest money that I'm unwilling to lose also useful. Henceforth, I'll only be willing to trade money I can spare in markets that are highly volatile. I also intend to avoid overtrading so I can focus on the specific few markets to make profits.

Question C) Place yourself in the following situation:

Before this lecture, I would definitely not hesitate to jump on the train as such tweets result in the mooning of the mentioned token. I would only watch the market periodically and set alerts for market price drops so I wouldn't miss out on bearish runs. But this method wasn't always effective as I tend to miss notifications of the price alerts and still end up losing my assets.

This lecture has taught me not to jump on any trade-in FOMO. Rather, I will only enter the trade when I have money to spare without the pain of losing it. Subsequently, I will set a stop loss to minimize the amount of loss in case the market turns downside in a bearish run,

Conclusion.

This is a lovely class and it has helped me remember and notice my mistakes and it is going to go a long way for me. Such mistakes won’t be repeated twice. Thank you @fendit for this wonderful lecture.

cc:

@fendit

Thank you for being part of my lecture and completing the task!

My comments:

Nice work, a bit too brief in some parts, but still you managed to show that you understood all concepts!

Overall score:

5,5/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @fendit for having read my work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit