At the end of the fifth week of this interesting third season, I would like to thank all of the teachers for their continued efforts in preparing useful lessons and correcting this huge amount of articles throughout the week, which is not an easy job, one thing that I confirm because I live this experience daily. I also want to thank all the students for their interest in the field of blockchain and cryptocurrency and their desire to develop their knowledge, including 55 who participated in writing articles related to the lesson that I have presented as a second part to explain how to trade using the Ichimoku indicator, where I focused this time on the Kumo cloud and explained and analyzed several elements related to it. After that, I asked the students some questions to evaluate the extent to which they understand the topic and evaluate the cognitive gains they have achieved from reading the lesson.

The questions to be answered are :

1. Discuss your understanding of Kumo, as well as its two lines. (Screenshot required)

2. What is the relationship between this cloud and the price movement? And how do you determine resistance and support levels using Kumo? (Screenshot required)

3. How and why is the twist formed? And once we've "seen" the twist, how do we use it in our trading? (Screenshot required)

4. What is the Ichimoku trend confirmation strategy with the cloud (Kumo)? And what are the signals that detect a trend reversal? (Screenshot required)

5. Explain the trading strategy using the cloud and the chikou span together. (Screenshot required)

6. Explain the use of the Ichimoku indicator for the scalping trading strategy. (Screenshot required)

7. Conclusion:

Homework correction :

Discuss your understanding of Kumo, as well as its two lines.

The Ichimoku Cloud is an indicator designed to detect a price trend, its strength, supports and resistance levels, and even trading signals.

Generally speaking, when prices are above the cloud, as can be seen in the chart above, the latter acts as support and this indicates that we are in an uptrend.

Conversely, when prices are below the cloud then we speak of resistance and this indicates that we are in a downtrend.

As the chart below shows, the green cloud on the chart is perfectly trending upward.

This indicates that the trend is unmistakably bullish.

Based on this information, the Ichimoku scalper will look for opportunities to position himself for the purchase.

Senkou span A (SSA) is the average of Tenkan and Kijun projected 26 periods ahead, senkou span B (SSB) is the average of the highest and lowest of the last 52 periods, projected 26 periods ahead.

In other words, the present price action determines the future cloud. The space between these two lines forms the cloud (Kumo).

Forget the notions of colors (bullish blue, bearish orange) indeed as we saw earlier in the course, everything is relative depending on whether we are in a clear trend or in lateral drift. (In range, the color of the cloud has no interest)

How and why is the twist formed? And once we've "seen" the twist, how do we use it in our trading?

When we witness the crossing of the SSA curve and the SSB line, the cloud turns on itself as shown in the graph above going from green to red and goes from bullish to bearish or vice versa, we then speaks of "twist" or torsion in English.

However, when the cloud evolves in successive "twists", this indicates that the market is moving in a "range" and no longer has a clear trend.

Understanding how and why the twist is formed is great, but what interests us more is knowing how to use it. Once we have "seen" the twist, how do we use it in our trading?

Very often when the cloud twists after a period of trend, prices enter a range (in 75% of cases). The twist indicates a weakening of the trend and in no way a change in the trend to come.

As shown in the image below, after a nice and long trend, the lines of the cloud (SSA and SSB) intersect and form a "twist". Immediately after this twist, the trend clearly falters and prices enter a period of sideways drift (in range).

As you will see later in the chapter devoted to Senkou span A and Senkou span B, this information is given to us in advance, leaving time for the trader to act and consider taking his profits. The trader can also prepare to trade the probable range to come. By watching the twist, we will know faster than others that the trend is likely to run out of steam and we will be ready to trade the range before everyone else.

IMPORTANT:

The twist of the cloud is often mistakenly seen as a weak place in the cloud that prices and chikou would like to rush into. This is absolutely false since it cannot be demonstrated!

It is very common to see the price or chikou span cross the cloud outside the twists. Just as there are many examples of prices and chikou, unable to cross the twist.

Explain the trading strategy using the cloud and the chikou span together.

The Chikou Span a line which follows the same variations as the price of the underlying with a delay of 26 periods. To get off to a good start in trading with Ichimoku Kinko Hyo, you need to keep a close eye on this line because it is what will confirm or not the current trend to you, and therefore your future investment decisions. At the technical level:

- If the Chikou Span is above the cloud and the prices, the uptrend is probably validated.

- If the Chikou Span is below the cloud and the prices, the downtrend is probably validated.

- If the Chikou Span is above the cloud and the prices and the price of the underlying does not meet technical constraints such as major resistance or a chart pattern to be validated, taking a long position is possible.

- If the Chikou Span is below the cloud and the price and the price of the underlying does not meet technical constraints such as major support or a chart pattern to be validated, taking a short position is possible.

- If the Chikou Span does not meet the four previous cases, the investor should abstain if he is looking for the trend.

Explain the use of the Ichimoku indicator for the scalping trading strategy.

This scalping strategy is based on an Ichimoku analysis over several periods, namely 30mn, 5mn, 1mn.

It consists first of all in deciphering the Ichimoku chart in 30 min to have a medium long-term underlying trend and key levels of support and resistance.

Then, we display a new Ichimoku graph in 5 minutes in order to ensure that the short-term 5 min trend corresponds with that of 30 min. Then, we display the last Ichimoku graph in 1 minute for its positions in scalping.

The higher time units, therefore, make it possible to identify the trend of the Forex pair in question as well as the important supports and resistances.

A longer periodicity will have more impact on the price evolution, which is why the Ichimoku M30 and M5 analysis is important.

Results, Observations and Suggestions:

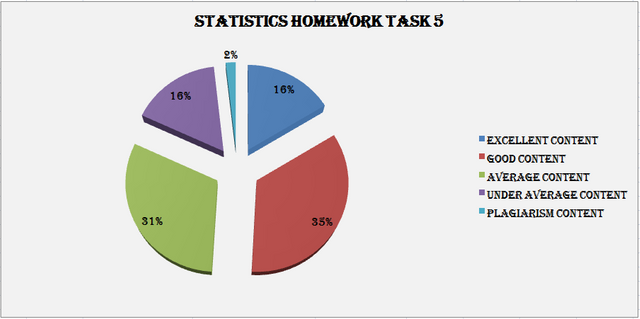

During this week, results saw a decrease in excellent work to represent 16% of the total writing, versus an increase in good content articles to reach 35%, as well as articles with medium content that rated as high as it is. 31%, bringing the total homework successful and rewarded to 82% versus 16% who couldn't get grades above average, and if that's anything to be said, the seriousness with which students get what they are asked and how eager they are to learn And do their best to get the highest ratings.

We also note that unfortunately an increase in the percentage of articles with plagiarism to reach 2%, I said unfortunately, although it is a small percentage because it was zero percent in the previous week, but it remains our great hope that students will continue to write articles without these practices, which remain the first enemy most important towards improving their level and progress with their knowledge.

We also mention that there are conditions to participate in response to the homework that I submitted required a reputation 60 and 500SP, so I invite all the participants to respect these conditions so as not to waste preparation effort without getting an evaluation. and reward.

TOP 3 Homework week 5 season 3.

We would like to first thank all the participants for their challenges and inspiring achievements, and we hope that the spirit of this competition will continue for as long as possible, and we hope that the culture of challenge and facing obstacles will spread in all communities.

We are pleased to announce the names of the three winners of the first week of the third season competition, which was held from 24th July to 31st July 2021.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

thankyou so much professor for selecting my post....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will be failing if I do not acknowledge with grateful thanks for honouring me by selecting my post as one of the best. I really appreciate that Prof. @kouba01.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much professor. The fact that my post has been selected for this honor inspires me to continue striving in the academy to write quality articles. Thanks again and regards!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Respected Professor: please verify my post I shall be very thankful to you

https://steemit.com/hive-108451/@naveed15125/crypto-academy-season-3-beginners-course-homework-post-for-task-4-blockchain-consensus-mechanism

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit