Thanks to @yohan2on professor for this topic and the lecture. My entry is below;

Define the following trading terminologies and include illustrations on the first four.

• Buy stop

source

Here a trader is instructed to make a purchase when the strike price is above the current market price. When the investor ales his purchase, it remains on pending not until the strike price reaches the buy stop and then after it is implemented. It is similar to the price floor concept where prices are set above the market price.

• Sell stop

source

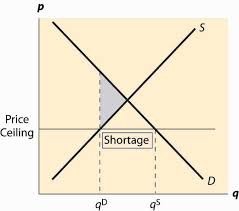

Is an order that is placed when the strike price is below the current market price. In your trade, you have to identify the sell stop when you see the support level and then wait for it to build at that level then place your order when it is slightly below that support level.

You have to place your order when the price drops below the current market price. This one is similar to the price ceiling where prices are set below the market price.

• Buy limit

sourced

This is an order that is placed to purchase a security below its specified price. This gives traders a chance to control their payments for securities.

If the price fails to reach the limit price or moves very quickly through the price, a buy limit order is placed by investors who want to purchase when prices have dropped. And if the stock falls, the buy limit order is then triggered and executed at that price or below it.

• Sell limit

source

A sell order is placed by an investor who wants the price to rise up to a certain level, break below the support line and the short trade signal will be formed. The investor is guaranteed to make a purchase at the price or above that price.

• Trailing stop loss

This trading order let’s you set a maximum value of loss that you may incur on a trade. In this case, if the stock’s price rises or falls in your favor, the stop price moves along with it . But, if the price rises or falls against the investor, the stop price stays in on place. It can be automatically set or manually set by the trader to monitor trades. It’s main purpose is to lock profits while safeguarding investors from any significant losses that may arise.

• Margin call

This occurs when an investor’s margin account falls below the broker’s required amount. Here, an investor has to deposit money on his account when the margin call occurs.

Some traders are forced by their brokers to sell their assets regardless the market price so that they can be able to meet the margin call at a time when the trader fails to deposit funds on his account.

Practically potray your understanding on Risk management in trading

Risk management are strategic plans put in place to control trading activities so as to minimize losses. It is a central pillar in trading because without it, there can never be successful trading due to the usual uncertainties that occur. Therefore, it is very important to keep trades under control through setting up risk management tools which include;

• The one percent rule

This shows traders that it is very risky to put more than 2% of your capital in a single trade. You should atleast put 1% and also invest in other trades because when one fails, you have a possibility of benefiting in the other.

• Expected return ratio

It is very important to calculate the risk reward so that traders can rationalize their trades and be able to select the most profitable ones.

Formula for calculating the expected return is;

[(Profitability of Gain) X (Take Profit] + [(Probability of loss) X ( Stop loss)

• Diversification of capital

Make sure you do it put all your capital in one trade because you may incur heavy losses. Always diversify your investments so that you can manage your risks.

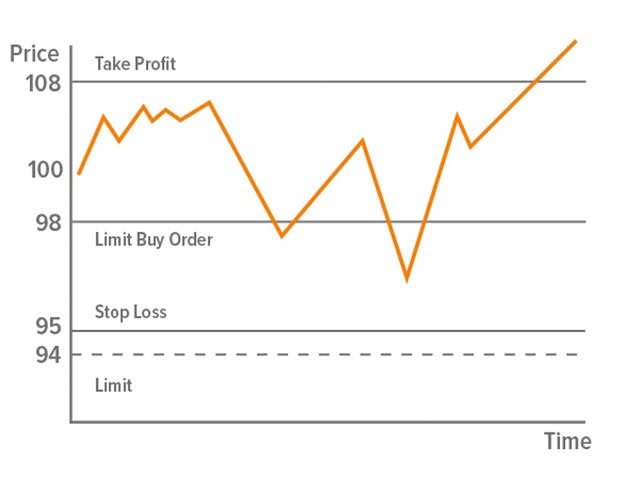

• Stop loss and take Profit

source

Using stop loss, a trader decides how much risk they are prepared to take which also helps them know the profit they are to get and the loss they may make in the future.

Take Profit closes a trade at Profit time. For long term traders, a limit order is placed above the trade price, then for short term traders the order is placed below the trade price.

Conclusion

In Conclusion, every trade needs a risk management strategy so as to minimize losses. No one knows whether they will make profits or losses but the losses can be minimized if the strategies are put in place and executed well.

Thank you @yohan2on professor. I am not a trader so I have failed to do the second number. I kindly ask for marks on my first part so that I can know if I am learning.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

Since this is a Crypto Academy, you are meant to provide only crypto-related examples and NOT stocks, securities

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wawooo well explained work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It was a tag of war dia

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit