Good evening everyone and welcome to my homework post for week 2of season 2. I'm very very delighted to do this assignment and am grateful to professor @kouba1 for this amazing and self explanatory lecture.

Prior to now,I love everything about crypto but have a very little knowledge of it but but following this lecture and some other lectures in @crytoacademy,gradually my knowledge on cryptocurrency is upgrading.

Thank you professor @kouba01

Below is the answer to my homework.

• WHAT IS CRYTPO CFDs?

Before I proceed,i will like to define CRYPTOCURRENCY and CFDs differently.

Cryptocurrency can be defined as a digital currency or asset which doesn't exist in physical form like paper money nor issued by any central bank authority but can also be used as a medium of exchange to transact through the internet while;

CFDs is an abbreviation for Contract For Differences.CDFs can be done without possessing any crypto asset in ones account and only only trading can be done on the price of crypto asset.

Therefore,Crypto CFDs can be defined as a trading process which involves the individual going into a contract with a broker in order to trade and invest an an asset without going directly on a particular market to open a position.

To further explain,In crypto CFDs both the trader and the broker goes into agreement which enables them to copy the market conditions and also settle the differences between themselves when the position closes.

Cryptocurrency is not fixed,it can fluctuate at any point in time ,so as a trader,if you expect the value of an asset to increase or decrease,then you have to open a position which can either be BUY or SELL.In crypto CFDs,trading,a trade can earn in any direction the asset move whether the price increase or decreases.

• HOW DO I KNOW IF CRYPTOCURRENCY CFDs ARE SUITABLE FOR MY TRADING STRATEGY?

In other to know if cryptocurrency CFDs is suitable for my trading strategy ,I have to engage myself in series of research and proper investigation. So in order to know,the following points should be considered;

• Cryptocurrency trading has no guarantee of loss or gain,its very risky and as such should be traded with a capital that can be risked.

• One need proper and adequate knowledge of margin and leverage trading before considering trading crypto CFDs.

• CFDs trading enables users to trade with a very low capital,so considering the fact that cryptocurrencies are very expensive and not everyone can affordvto purchase it,CFDs trading is suitable for me here.

• If you wish to trade,make sure you do that in a safe environment through brokees who are regulated.

• Considering the volatile nature of cryprtocurrencies,it is very easy for a trader to lose all his capital so to avoid this,it is best to invest only with the money you can afford to loose.

• ARE CRYPTO CFDs RISKY FINANCIAL PRODUCTS?

The answer to this question is yes. CFDs are an extremely high risky financial products because of the fact that cryptocurrencies are not fixed and they can easily fluctuate and also the value of CFDs linked to them is also not fixed and for that,they are vulnurable to any change in price due to unexpected changes in the market price. So before investing,one should really consider the risks involved like the price votalitu,leveeage and margin,The charges and funding costs and also the price transparency. Therefore because of the high risk,it is advisibly to invest with a capital that can be risked and which loss one can endure.

• DO ALL BROKERS OFFER CRYPTOCURRENCY CFDs?

The answer to the question is no,not all brokers offer cryptocurrency CFDs. Since it involves a little capital and high risk,not all brokers offers this opportunity.

From my research,these are few brokers that offer crypto CFDs.

• Oinvest.

• eToro

• Plus 500

• XTB

• FXCM.

• EXPLAIN HOW YOU CAN TRADE WITH CRYPTOCURRENCY CFDs ON ONE OF THE BROKERS USING A DEMO ACCOUNT.

Using eToro to illustrate.

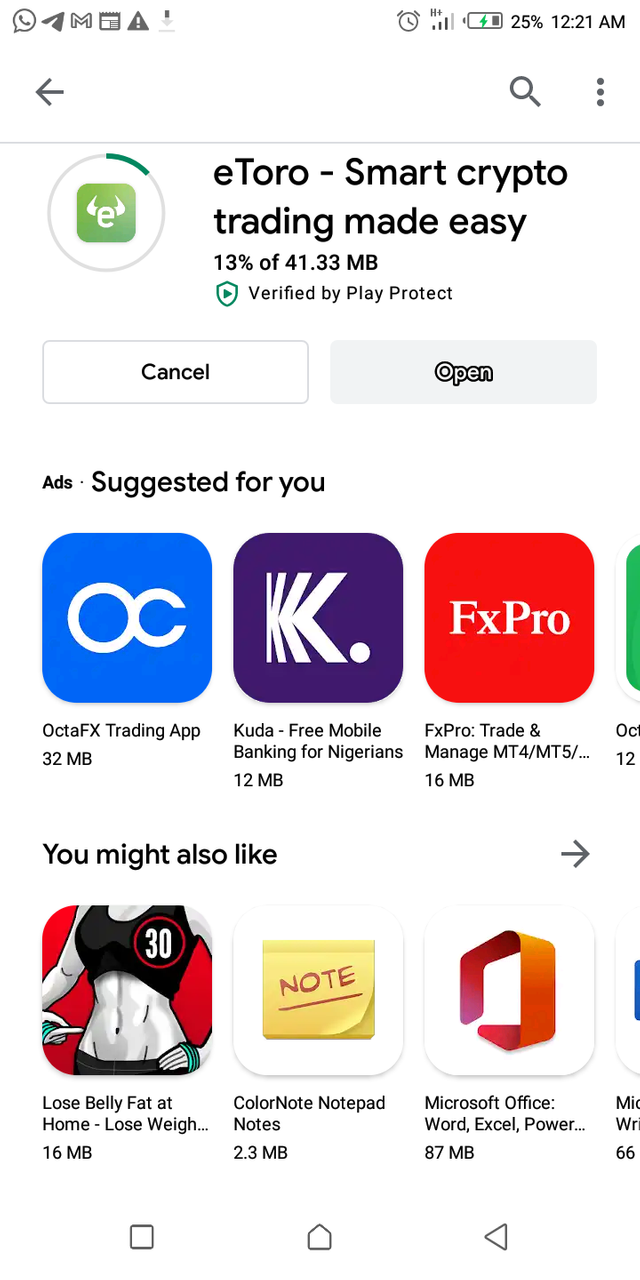

• First thing to do is to login to the site and download the app through google play store as shown in the screenshot below.

Downloading the app from play store.

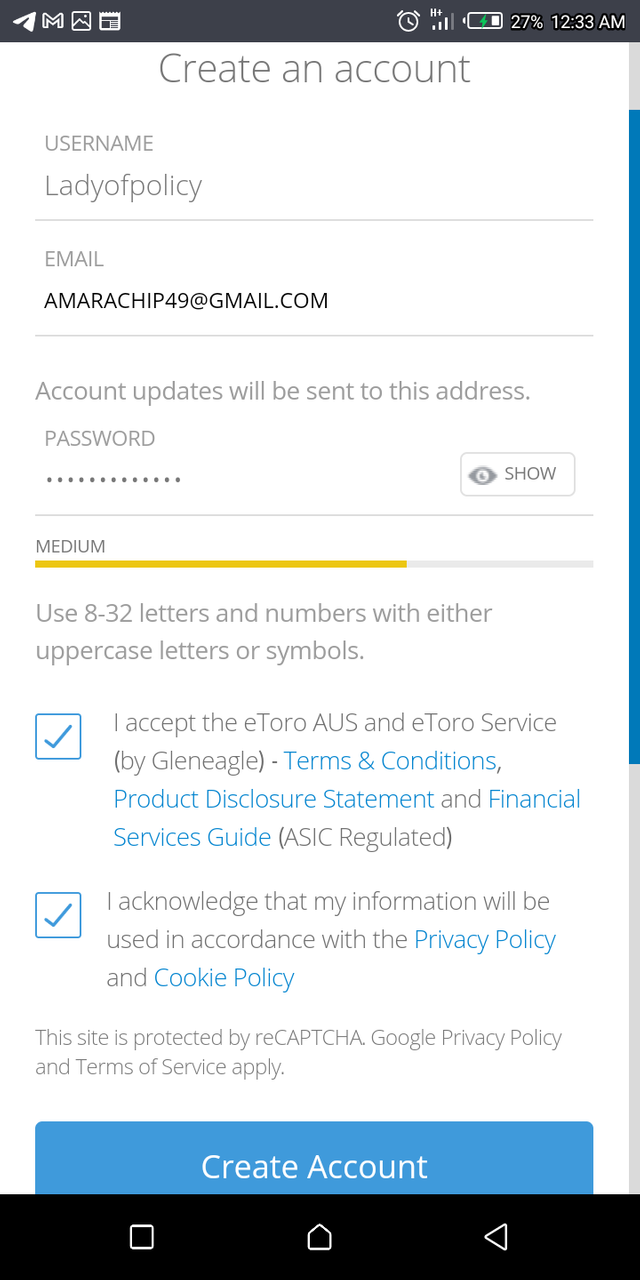

• After downloading the app,click on it and sign up,after signing up i updated all my profile which is very important.

Creating my account.

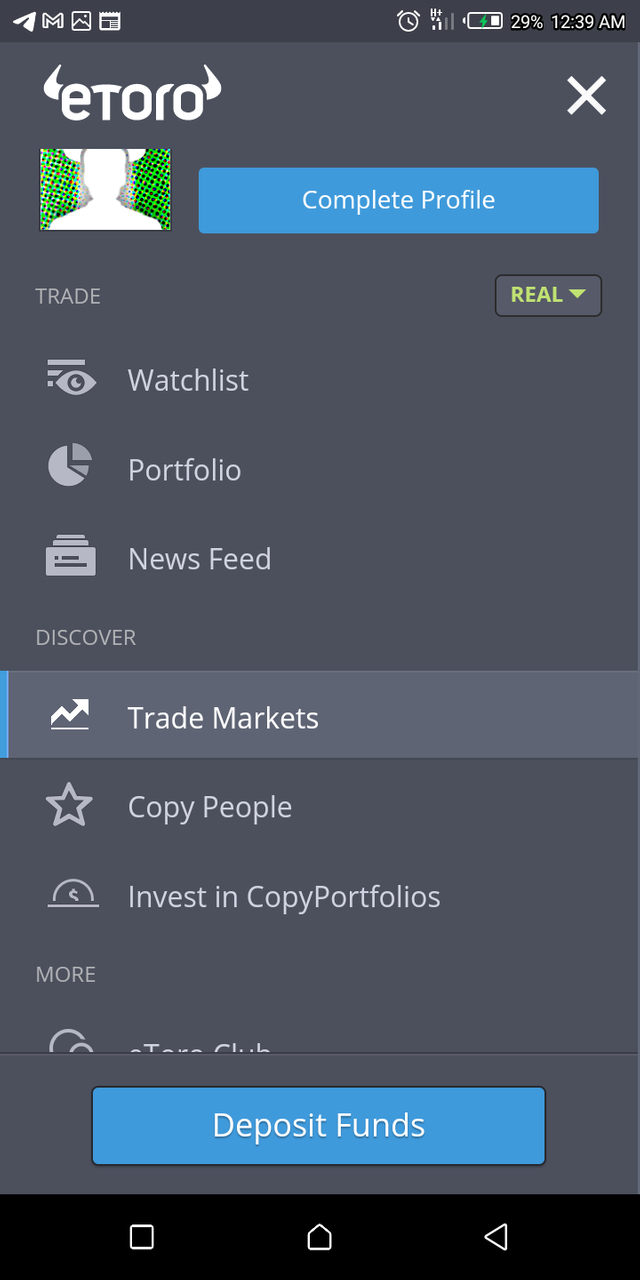

• After creating my account and logging in,i will click on trade market since I'm using a demo account without making any deposit yet.

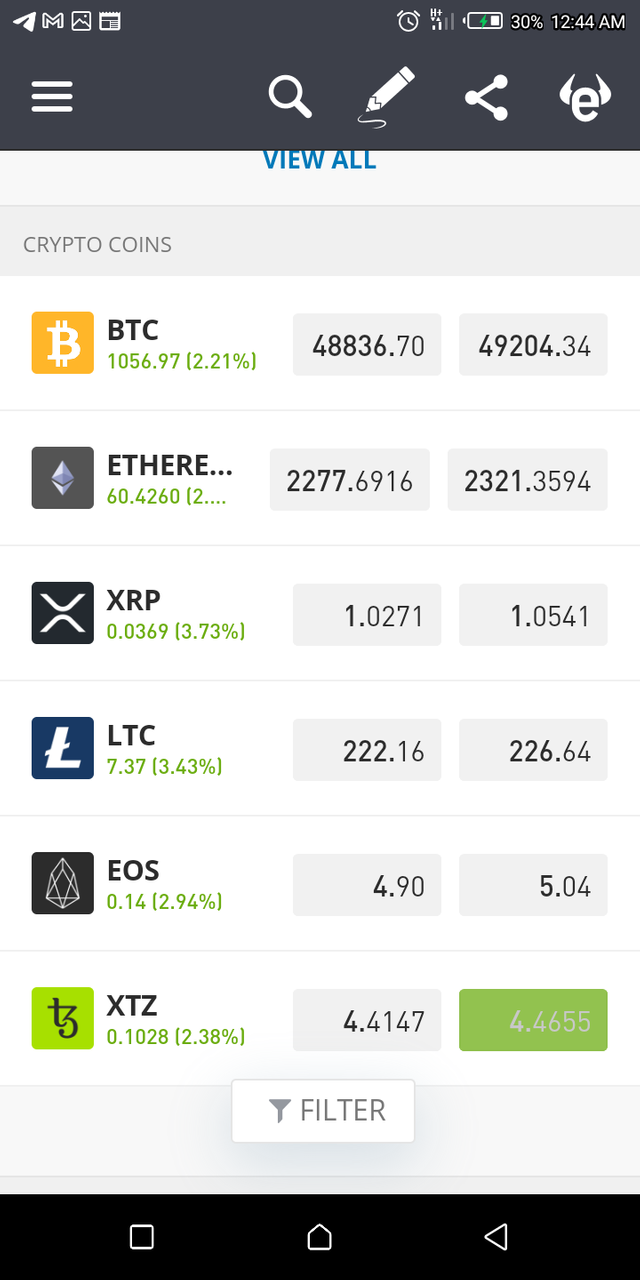

• When i clicked on trade market,a wide variety of markets assets were opened for trading, so since my main interest is crypto,I scroll down to where I see crypto and select BTC.

Note: My phone cannot highlight or make emphasis so my focus from the screenshot above is BTC

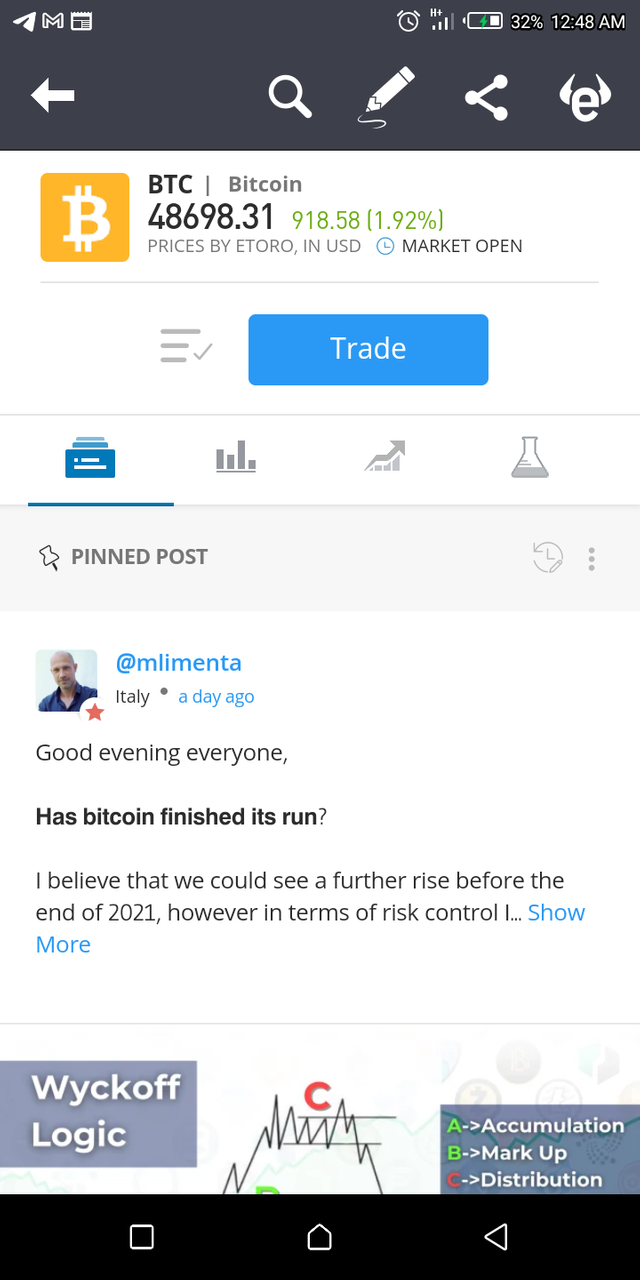

• Then click on BTC and it will take you to this slide.

Click on trade and input your desired amount and click either on buy or sell depending on your choice.

CONCLUSION

I will conclude by saying that crypto CFDs is suitable for trading strategy for traders with low capital,however the risk of losing is high because of the volatile nature of cryptocurrencies and as such,its not advisible to trade with money which you cant afford to bear the loss.

Thanks fir checking my work in advance.

@kouba01.

.jpg)

Hello @ladyofpolicy,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 5/10 rating, according to the following scale:

My review :

Medium content article. you have managed to answer the questions to an extent, but the analysis is missing the ideas that you have provided.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you sir @kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit