What a wonderful lecture you have delivered @Professor, i have really learnt enough, so let me get into the assignment

1a.DEFINE IN YOUR OWN WORDS WHAT A CONTRACTILE DIAGONAL IS IN YOUR OWN WORD

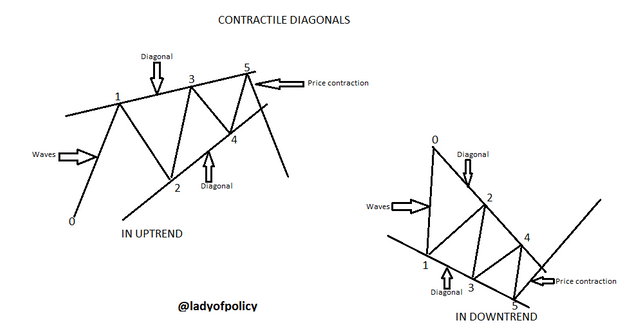

Image created by me with paint.

Contractile Diagonal is a pure price action pattern that uses the wave nature of price to ascertain price/market turning point. It is involves the use of trendline line to mark out areas where price contracted to formed a 1,2,3,4,5 wave pattern. Where wave 1,2,3 are in the direction of the current trend while wave 4 and 5 are price retracementFor this wave pattern to be valid, the five waves must meet some requirements which are as followsa.The 3rd wave must be shorter than the 1st wave b.The 5th wave must be shorter than the 3rd wavec.The 4th wave must be shorter than the 2nd wave.This wave patterns are seen as already mentioned above at the end of a bullish or bearish trend and when all the requirement are met, price moves with much momentum in the opposite direction of the current trend breaking out of the diagonal line.

1b.WHY IS IT IMPORTANT TO STUDY IT

A proper understanding of how contractile diagonal works helps a trader to know where price is about to change it's current trend and begin a new one hence studying contractile diagonal increases one's knowledge about price reversal.

1c. EXPLAIN WHAT HAPPENS IN THE CHART FOR THIS CHART PATTERN TO OCCUR

Due to lack of momentum for price to continue in it's current trend, price starts to contract with each new wave shorter than the previous giving rise to a wedge formation which indicates that the current market trend is most likely going to reverse after the last wave. Towards the end of a trend the big institution accumulates a lot of position to move price against the current trend which becomes evident in the chart in the form of a contractile diagonals.

2.GIVE AN EXAMPLE OF CONTRACTILE DIAGONAL THAT MEET THE REQUIREMENT AND THE ONE THAT DOESN'T MEET THE REQUIREMENT( SCREENSHOT REQUIRED)

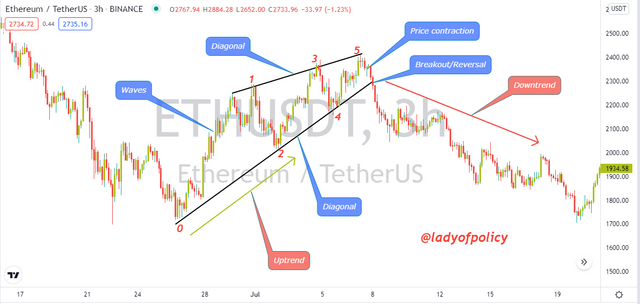

From the screenshot of ETH/USDT 3HRS Chart above, the 3rd wave is shorter than the 1st, the 5th is shorter than the 3rd wave, the 1st wave being the longest wave in the direction of the current market trend. Also the 4th wave is shorter than the 2nd wave both are price retracement. The above image met all the requirement, after which price broke the diagonal and moves opposite the price trend and is now in a downtrend.

From the above screenshot, we can see that wave5 is longer than wave3, which kind of violate one of the requirements of the contractile diagonal pattern, that wave5 must be shorter than wave3. So as we can see the contractile diagonal pattern was violated, instead of a change of trend after wave5, price continued in it's current trend because all the requirements were not met which i mentioned earlier.

3.THROUGH YOUR VERIFIED EXCHANGE ACCOUNT PERFORM ONE REAL BUY OPERATION(15 MINIMUM USD),THROUGH CONTRACTILE DIAGONAL METHODEXPLAIN THE PROCESS AND DEMONSTRATE THE RESULTS AND GRAPHICAL ANALYSIS THROUGH SCREENSHOTS. YOUR PURCHASE DATA MUST MATCH YOUR ANALYSIS: SUCH AS CRYPTOCURRENCY AND ENTRY PRICE

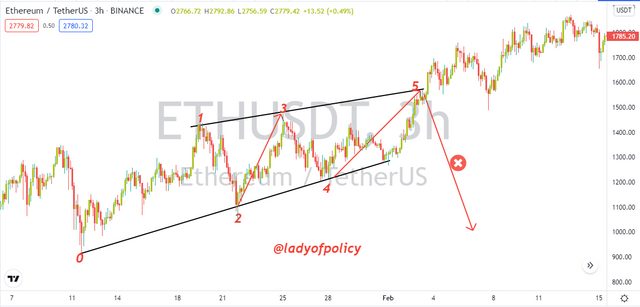

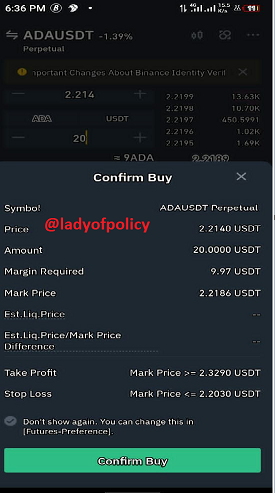

From the image above, all the 5 waves met the requirement of a contractile diagonal pattern, after the 5th wave, i went to my verified exchange(Binance) and made a purchase of ADAUSDT with $20 after the 5th wave at an entry price of 2.214 using the 5mins timeframe .Below are the evidence of my purchase

The screenshot above shows evidence of my verified binance account

The screenshot above shows evidence of my verified binance account

Screenshot before i confirmed the buy, with my Entry price at 2.214, stoploss at 2.203 and Take profit at 2.329

The screenshot was taken after the buy order was placed.

The screenshot above shows the outcome of the buy position on ADAUSDT

The screenshot above shows the outcome of the buy position on ADAUSDT

4.THROUGH A DEMO ACCOUNT, PERFORM ONE SELL OPERATION THROUGH THE CONTRACTILE DIAGONAL METHOD, EXPLAIN THE PROCESS AND DEMONSTRATE THE RESULT AND GRAPHICAL ANALYSIS THROUGH SCREEENSHOT

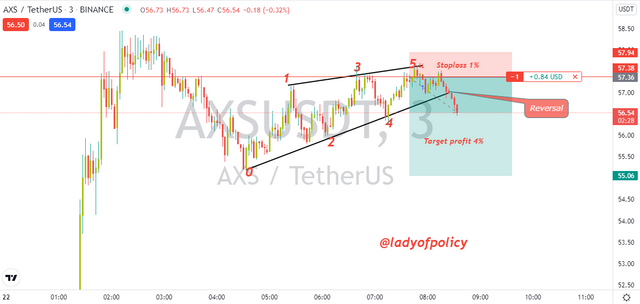

From the above screenshot of AVSUSDT 3mins chart, the 1-2-3-4-5 wave pattern met all the requirement, i took a sell after the 5th wave which is a very high risk trade but with a very High risk to reward of 4:1, waiting for a reversal in the current price trend

The screenshot above shows the result of the trade taken earlier, after the 5th wave price dropped and broke out of the diagonal showing reversal in the current trend.

5.EXPLAIN AND DEVELOP WHY NOT ALL CONTRACTILE DIAGONALS ARE OPERATIVE FROM A PRACTICAL POINT OF VIEW.(SCREENSHOT REQUIRED AND BTC NOT ALLOWED)

Just like all other strategies and patterns that exist, contractile diagonal pattern is not a holy grail strategy and cannot give us a 100% efficiency, why because a contractile diagonal formed in the middle a current trend is most likely to continue in that same trend, this becomes a false signal for traders that doesn't understand this exception. Even if all the requirement of contractile diagonal are met, this pattern is most likely to fail when it is seen in the middle of a trend, as this indicates accumulation of orders for price to continue in the same trend.

CONCLUSION

Contractile diagonal pattern is a very powerful strategy which when combined with other reversal pattern such as the Sharkfin pattern give more confluence and provides a high probability edge for traders to capitalize on. It is important to ensure that all the requirements are in place before a trade is taken using contractile diagonal in order to eliminate false signals