Thanks, Professor For an awesome lecture.

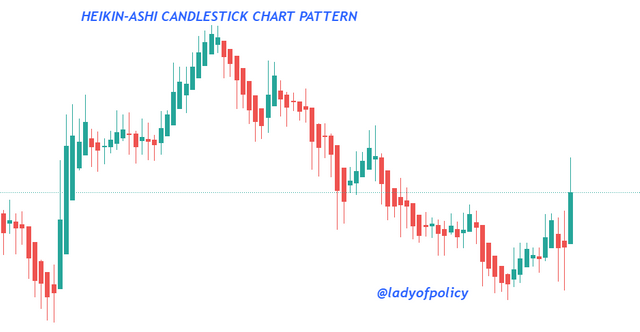

Out of the different chart patterns that exit, the Candlestick chart pattern is the most widely used because of its interpretation of price movement. Apart from the common Japanese Candlestick chart pattern, there's another type of Candlestick pattern called the Heikin-Ashi, in which we are going to discuss its important features, how it works and how you can apply it as one of your trading strategies. So let's get into it.

DEFINE HEIKEN-ASHI TECHNIQUES IN YOUR OWN WORD

Screenshot taken from Tradingview

This strategy was developed by Munehisa Homma a Japanese trader in the 1700s, to analyze and read the chart with ease.

Heikin -ashi simply put, is a type of chart pattern where price trend can be easily identified using the Heikin-Ashi candlesticks which are arranged in an orderly form, it is different from a typical Japanese candlestick pattern because it's open and close are calculated differently. Hence the Heikin-ashi candlestick is more arranged than the typical Japanese candlestick.

It is also called average bar because it is calculated as the average of the previous candles open, close, high, and low

MAKE YOUR RESEARCH AND DIFFERENTIATE BETWEEN THE TRADITIONAL CANDLESTICK AND THE HEIKIN-ASHI CHART

The two candlestick chart patterns even though they originated from Japanese traders they are different from each other.

Lets take a look at the difference between these chart patterns below

| Heikin-ashi candlestick chart | Japanese candlestick chart |

|---|---|

| 1. New candles are formed as an average of previous candles open and close | 1. New candles are independent of the Previous candles |

| 2. It is based on a two-period average | 2. It doesn't involve a two-period average |

| 3. Less used by traders | 3. Commonly used by traders |

| 4. Reduces market noise by creating a clear trend | 4. Different candlesticks are formed in a particular trend creating a lot of noise |

| 5. A clear trend is identified by a color change in candlestick | 5. A new trend is formed when the price starts making higher highs(uptrend) or lower lows(downtrend) |

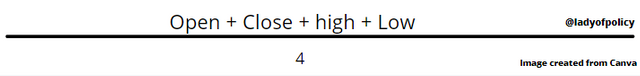

EXPLAIN HEIKIN-ASHI FORMULA

To calculate the next Heikin-ashi candlestick, we need to know the values of the previous candles #High, #Low Open and #Close. These values are calculated using different formulas so let's get into it

How to calculate the High of the new Heikin-ashi candlestick

This is calculated by getting the maximum value of the current candles' high, open or close

How to calculate the Low of the new Heikin-ashi candlestick

This is gotten by identifying the minimum value of the current candles' low, open, or close

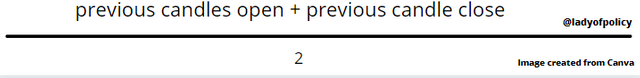

How to calculate the Open of the new Heikin-ashi candlestick

To calculate the Open of a new candlestick, we need to get the values of the previous candles Open and Close, sum them together, and then divide by two(2)

How to calculate the Close of the new Heikin-ashi candlestick

To calculate the Close, the sum of the Open, close, high, and low levels of the current is divided by 4

GRAPHICALLY EXPLAIN TREND AND BUYING OPPORTUNITIES USING HEIKIN-ASHI CANDLES

One of the advantages the Heikin-ashi chart patterns have over typical Japanese chart patterns is that trends (uptrend/downtrend) can be identified easily using this technique, which is pretty amazing since it n gives traders an edge to capitalize on the market.

IDENTIFYING UPTREND USING HEIKIN-ASHI CANDLES

Screenshot Taken From Tradingview

In a clear uptrend, we tend to see Heikin-ashi candles wick above the body of the candle. Also, the color of the candles are uniform(green in this example)

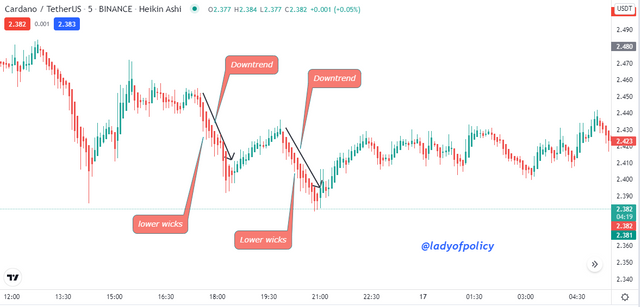

IDENTIFYING DOWNTREND USIND HEIKIN-ASHI CANDLES

Screenshot Taken From Tradingview

When the wicks of the Heikin-Ashi candles are below the body this indicates that we are in a downtrend. Also, the colors of the candles are uniform(Red in this example)

IDENTIFYING A BUY OPPORTUNITIES

Screenshot Taken From Tradingview

After a range or consolidation in the market, the formation of indecision buy candle indicate the beginning of a new uptrend and this generates a buying opportunity for us to capitalize on

IS IT POSSIBLE TO TRANSACT WITH ONLY SIGNAL RECEIVE FROM HEIKIN-ASHI TECHNIQUES?

Yes, it is, the reason being that Heikin-Ashi on its own gives an edge to the trader that understands it properly. And different things work for different traders, it is possible to transact with the only signal received from techniques but it is not guaranteed that all the signals received from Heikin-ashi will be 100% efficient because just like other indicators there's no holy grail. Hence for a high probability signal, it is better to combine the signal from this strategy with other indicators/strategies.

USING A DEMO ACCOUNT PERFORM A BUY AND SELL ORDER USING HEIKIN-ASHI + 55EMA + 21EMA

Screenshot Taken From Tradingview

This buy order above was taken after spotting prices above the 21 and 55EMA indicating that the price is in an uptrend.

Screenshot Taken From Tradingview

After spotting prices below the 21 and 55EMA indicating that the price is in a downtrend, I took the buy position.

Heikin-Ashi Technique is a powerful strategy which when combined with other indicators like the EMAs gives rise to a high probability trade and hence should not be used alone to prevent many false signals.

Cc:

@reddileep