Source

1 - What is your understanding of the level of liquidity? Give examples (clear graphs are needed)

liquidity in the market is caused by the buying and selling of the asset this is due to the amount of buying and selling it does every so often depending on how the market interacts liquidity generates various percentages of orders at various price levels in this way some benefit from the current market depending on how liquid the market is.

Depending on the interaction of liquidity is very important to visualize the graphs to see the supports or new resistances that are created according to the movement of buying and selling, the more demand the higher it is and the less demand and more supply the cheaper its liquidity varies according to the orders to buy and sell the asset, in this way many investors place orders at key points where they know it will arrive soon for this way to activate the purchases or sales will generate more liquidity to the market.

We see below a graph where the liquidity level of a market is denoted for example FLM / USDT

we can see that at different points using the temporality of 1 day we visualize that prices fall just when they lack liquidity in this way we can demonstrate a very clear example of liquidity in the market.

Source

2 - Explain the reasons why the tardes got caught in Fakeouts. Provide at least 2 charts showing a clear fakeout.

If this is due to Pund and Dump scams this is because the whales or profiteers buy at very low levels and then try to move them up through liquidity in that then novice investors or those who are full of greed buy at high resistances or supposed fake resistances at very high levels that has not yet had major corrections this is where the potential threat is, what happens is the following the whales or in more technical terms composite man have large amounts of assets invested in these markets.

The real reason that the late are trapped in these markets in very high positions is the movement of the whales as I just mentioned when an investor buys at levels of resistance for reasons of Fomo or some twit without first analyzing the market these whales perform a movement called Dump Where they sell all their assets gradually until you reach a point where they sell all of agolpe which causes a very decreasing movement in the asset the price falls to levels almost start and investors are trapped in fakeouts.

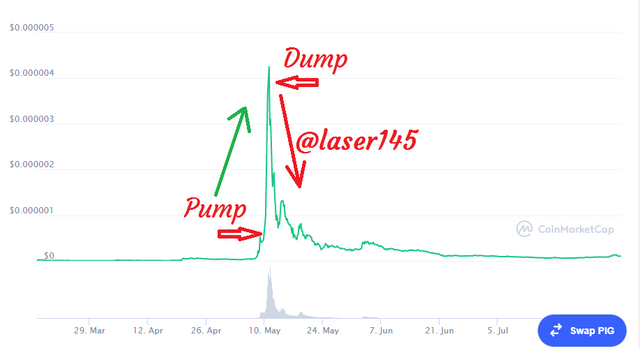

I have a very important chart of what is the layers of these whales in a currency are like black holes ending the trade in them and discrediting the currency in as little as 2 to 4 days. if the currency has no function in general then this currency will end up in the depths of the earth.

The example below is of PIG a token that with the Fomo of Doge and Shib Surgio to super high levels as it was 0.00004 where the whales made the Dump thus being trapped several investors in these levels of resistance manipulated where the liquidity was no longer the subiente at this point the coin touched again the 0.0000001 even currently reaching levels of 0.0000001187 and with a position of #2665

on the coinmarketcap.

Source

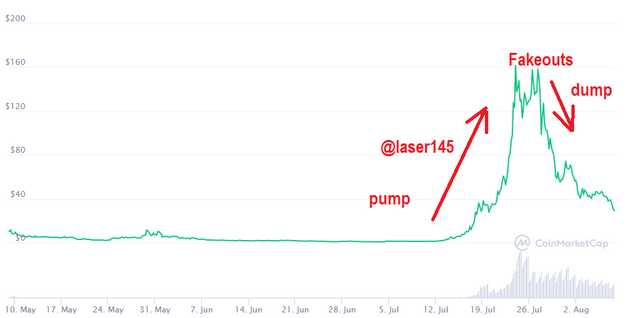

We can see that in Cryptoblade something very similar happened where players who bought the token at prices of $ 130 were trapped in the Fakeouts as the currency by the lack of liquidity and the movement of the whales that was too strategic subtracted large capitals of this project leading to very high levels of up to $ 180 and incredible peaks of up to $ 800 but these were only seconds as the lack of liquidity did not last long for the big drop, we can see that it is currently trading at $ 29 and is expected to fall even more and this project subsequently fails. We can say that it could be a scam.

https://coinmarketcap.com/currencies/cryptoblades/

Source

3 - How you can trade the Liquidity Levels the right way? Write the trade criteria for Liquidity Levels Trading (Clear Charts Needed)

The following is a demonstration of buy and sell criteria with the MSB strategy.

Entry criteria for a buy position

-There must be a correction in the trend, commonly bearish, creating an oscillation.

-We must draw a liquidity line, which will give us the limit point of liquidity that is being generated.

-When the candle exceeds the liquidity line that we have drawn, just after we will place the buy order.

-Apply Stop Loss to trades.

BTC/USDT, 1h .

Source

Exit criteria for buying position.

-Wait until the liquidity reaches a liquidity ceiling.

-When the incoming candle starts to grow below this liquidity limit, we should place the sell order right on the second candle created.

BTC/USDT, 1h.

Source

Trade exit criteria

-We open the trade through take profit with the RR 1:1 using the buy criteria.

-We should not enter the market by fomo or other psychological aspect.

-We activate the Stop Loss.

BTC/USDT, 1h

Source

Trading exit with RR 1:1

BTC/USDT, 1h.

Source

Strategy (BRB)

Entry criteria for buying position.

-Add liquidity limits.

-We wait for the incoming candle to break through that liquidity level.

-If it breaks, we expect it to reach its highest point or swing point, and expect it to move down to touch the previous liquidity line.

-If the candle touches the liquidity line and makes another jump, we expect it to overshoot the swing point.

-When it crosses this line, the order is placed.

BTC/USDT, 1h.

Source

Entry criteria for the sales position

-The liquidity line is drawn

-Wait for the incoming candle to exceed this liquidity level, and generate another peak called swing point.

-The candle goes down to the previous liquidity level, and jumps to exceed the swing point level.

-When the candle exceeds the swing point, we place the Order.

BTC/USDT, 1h

Source

Exit criteria for the purchase position

-The liquidity line is drawn

-We wait for it to take another liquidity limit called Swing point.

-Again the candle will make a reversal and reach the previous liquidity resistance level, and will jump, looking to surpass the swing point.

-Just after passing the Swing point, the order is placed.

-Take Profit order with RR 1:1.

-Stop loss is placed.

BTC/USDT, 1h

Source

Exit criteria for the sales position

-The liquidity line is drawn

-We wait for it to take another liquidity limit called Swing point.

-Again the candle will make a reversal and reach the previous support or liquidity level, and will jump, seeking to surpass the swing point.

-Just after passing the Swing point, the order is placed.

-Take Profit order with RR 1:1.

-Stop loss is placed.

BTC/USDT, 1h.

Source

4 - Draw Liquidity levels trade setups on 4 Crypto Assets (Clear Charts Needed).

Trading setups with liquidity lines, "BUY", strategy (MSB)

XMR/USDT, 1h

Source

Trading setups with liquidity lines, "BUY", strategy (MSB)

BTT/USDT, 1h.

Source

Trading setups with liquidity lines, "BUY", strategy (BRB)

BTC/USDT, 1h

Source

Trading setups with liquidity lines, "BUY", strategy (BRB)

EOS/USDT, 1h.

Source

Conclusion.

In the following research work we learned about too many important points within the decentralized ecosystem the movements of the whales and the processes by which we will avoid this type of movements that can be manipulated for their own benefit leaving trapped investors who ignore this type of markets or ignore the danger of this strategies remain so in Fakeouts also understood that the study and discipline to learn every day a little about financial assets especially in the fields of cryptocurrencies we always have to have plan B the possible exit from the market in time.

If we follow the strategy planned in classes we will not have so many problems we must follow the temporary breakouts (MSB) and the repeated breakouts of Test ( BRB) which leads us to operate very prudently the market and go after those signals that are specific patterns directed by each candle take into account the resistances and supports and always review the levels of liquidity as are our preliminary analysis in each market where we are going to operate.