Source

A big greeting today I will perform the task of Professor @allbert, in this way try that all steemit users and new members of the academy that come and read this rea can understand it in the best possible way and is very understandable.

1- Explain graphically the difference between weak and strong levels. (Screenshots are required) Explain what happens in the market for these differences to occur.

Strong levels:

The strong levels are those that are at a certain price on the chart which makes the price comes and get a rebound in this way can not pass or will break a support or resistance since in that area is a buyer or a very important seller, When we analyze the graphs we observe that the levels of resistance or support respect that level in this way the price can retestiar several times that area and bounce immediately which indicates a retreat to the moving average line, this can be observed by the indicators of support and resistance in this way to use the right tools for technical analysis.

Source

In the following chart I explain that there are two strong level for both resistance and support the price remains on the line respecting the levels and thus you can see a range or consolidation process and then make its next market move according to our technical analysis will take the trend, we see how the price rises to touch the strong level line then bounces and down to the supports maintaining that predictive cycle this is due to the supply and demand generated by large investors or whales at the time which makes the price down to a lower level of strong resistance and when it touches this point other investors are willing to buy what makes the price rises again where they get profits and leave the market thus creating these levels of resistance and strong support.

Weak levels:

It is the opposite of the strong levels so we can say that resistance and weak support are not 100% reliable and are quite misleading because the price has tested two or three times the previous support or resistance and when it is going to test again it breaks it regardless of the direction of the trend.

As we can see we can speculate that prices will take a strong direction after 2 to 3 tests to the strong level zone occur so we can see the breakout of the support or resistance almost imminent.

Source

Looking at the FLM/USDT chart in 4 hours time frame we can clearly see the weak level of rupture and we can see that it broke the resistance that it had been respecting from behind so we can call this weak level, thus overcoming the previous resistance levels, this means that there is a formation of a weak level in that area, the buying levels were higher than the selling levels in the market which caused the rise just at that point marked the level of rupture.

Explain what a gap is

when an asset jumps the price both bullish and bearish it is called a gap jump, this indicates that the price jumped the level to a higher or lower price depending on where the trend is heading, thus creating a level without going through the previous one. the market will show that opened a new price level above the price this indicates that opened a price gap between these two levels. you can see in the following graph as the price passes after the close of a candle to another but leaving a gap between them.

Source

In the Flm/Usdt chart we see how there is or was created a Gap in temporality of 3m this means that there is a jump in the price in the process of transactions when several investors buy at a time at prices higher than those marked by the market then creates a demand for assets higher than you want buyers try to buy more expensive and create a gap which is called Gap a gap in the market which causes a rapid rise the market will try to fill this gap over time can be used as support or resistance depending on the case in which it is found.

Explains the types of breaches

Rupture gap:

It is a gap that indicates a break in the market structure, the formation of this gap indicates a change of trend in the market It can indicate a strong uptrend in the market or bearish given the case we are talking about we can use it as a support or resistance and this is usually respected as it is a very strong support or resistance.

Source

Monero/Usdt looking at the above chart we can visualize how a breakout gap was created coming from a downtrend as the theory tells us, when the gap is formed at these levels it creates a breakout in the levels and indicates a potentially strong trend change. thus changing us from bearish to bullish.

Gap out of control:

This gap tells us the continuation of the trend usually appears when in the middle of an important level of buying or selling depending on the trend of this and so generate tells us an important continuation of the trend, when a large number of users try to buy or sell at a specific point or almost equal prices this gap runaway Gap is formed. we can also use them as a resistance or very important supports at the time.

Source

We see that in XME/USDT a rupture (Runaway Gap) in the middle zone that indicates a continuation of uptrend so after this rupture that is formed by the large orders that exist in the market at the same time creates a gap and therefore generate a very strong resistance that ultimately ends in the continuation of an uptrend of a very important volume.

Exhaustion gap:

the exhaustion gap indicates us in the diagram a change in the movement of the trend this means that the price will change if they were bearish to bullish or the opposite, the market to show this gap indicates that it is exhausted and the change is imminent will give the last gasp or final movement so that then the market is responsible for filling the gap that left the exhaustion gap. the following example will show how it looks on the chart.

Source

Monero/USDT has an exhaustion gap, the price is in decline and in a downtrend, and we see a long red bearish candle which indicates after this is that the market has managed to fill the gap that was in that position and then resume an uptrend.

Perform (buy/sell) through strong support and resistance.

Source

As we see the Chart Of XMR/USDT I will use the strategy Breeak Retest Break (BRB) this shows a break of support level or resistance of the selected currency, seeing the downtrend of the market then I perform my technical analysis where it indicates a small revote to the previous support level become resistances which indicate me that at that exact point will reach the price to then fall using this method we can understand the market and its repetitive trends with the past times, in this way I applied a purchase of TP 1: 1 for this exercise since I am starting I saw a breakout at the pivot point and in this way I could enter into operation, I got very good profits at the completion of the operation the operation was won and continue to analyze other markets.

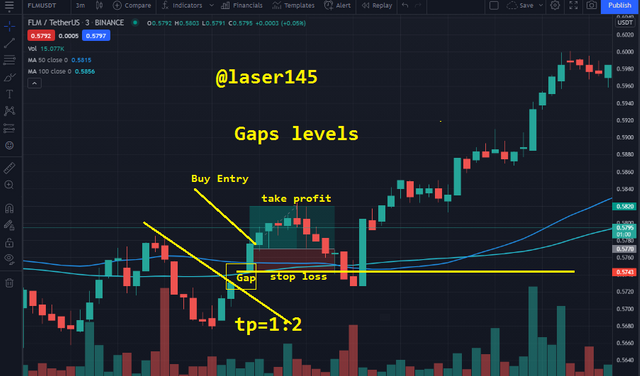

Perform levels (Buy / Sell) through gaps

Source

In the following operation Chart of FLM7USDT, the purchase entry was at 1:2 which I liked a lot because I recovered the investment with profits I used several indicators and the moving average Ma, in addition to the ADX that indicated the strength of the movement or trend, I saw a strong bullish movement then I also saw the breach of gaps which indicated an entry for that operation then I went to 1:2 because I was somewhat sure of the movement the strategy discussed above indicated a change of trend from bearish to bullish so I entered and it was a total success.

Conclusión:

Traders and students use different methods to analyze the charts we also perform fundamental analysis and psychological analysis, for this we must always have a cold mind the gap breakers indicate us important points to enter the market and with the help of the other appropriate tools which can be the moving averages , the RSI, ADX indicator etc and with the help of the interpretation of various patterns and now with this new strategy of studies of the gaps and all its functions we can have a very safe tool to enter into operation and thus have more % of profits and increase our capital.

Thank you very much

By @laser145

.png)