Source

Greetings to all the steemit community after reading the lecture of Professor @kouba01 I have understood the importance and operation of the ZigZag indicator, I will begin to make my contribution to this class today.

1. Show your understanding of the ZigZag as a trading indicator and how it is calculated.

The ZigZag indicator lets us know in which direction a trend is going in trading, it also tells us reversals, support and resistances this process occurs by a line that goes along with the direction of the trend according to a percentage of the price scale it can be configured in such a way that it ignores misleading signals that may occur on the chart at the given temporality.

The theory indicates the following the lines are viewed as follows

•higher highs

•lower lows

•lower highs

•higher lows

We must pay attention to the timing because all this is intertwined creating patterns of bullish or bearish trends, we must configure the most optimal way possible. When the price fluctuates by a certain percentage then it sends us a signal that creates a pattern which we can observe patterns that are formed according to the previous candles it is recommended not to use as signals indicators of entry and exit points as these present variations in the signals therefore we must pay close attention to the configuration, can also be used with other indicators to increase the magnitude of the analysis and to better speculate the next market movement in this way to have clear points of entries and exits in different operations.

Source

How it is calculated:

First of all we must establish the type of reading of a chart using the ZigZag indicator this we determine by the ratio of the calculation on the closing price and by the candlestick readings, and by the following parameters of values such as high high highs, low highs, low lows and high lows.

We must visualize the percentage of prices according to the movement of the price of the asset, the following is to eliminate the false fluctuations by a large percentage of the movements of the graph this we can notice by the sudden change of price then we will take the first measure in 5 and we are going to give a depth of minimum and maximum distance in 10.

We should pay attention to the following characteristics to represent the lines of a ZigZag indicator

The percentage of the asset's movement must be established.

The highest maximum and lowest minimum starting points should be determined.

A new point should be determined by the highest highs and lowest lows.

Determine the trend by drawing a reference line to the trend point.

Repeat the process by going to the current high or low swing point.

The following formula is used for the indicator.

ZigZag (HL, % Change = X, retracement = False, last extreme = true).

legend:

HL = Highest high Highest low Lowest low.

% = Minimum percentage price movement

Last extreme = is the price change in different periods.

The ZigZag line is drawn if the % change is greater than or equal to X.

2. What are the main parameters of the Zig Zag indicator and how to configure them and is it advisable to change their default settings? (Screenshot required).

The necessary parameters for the indicator are as follows :

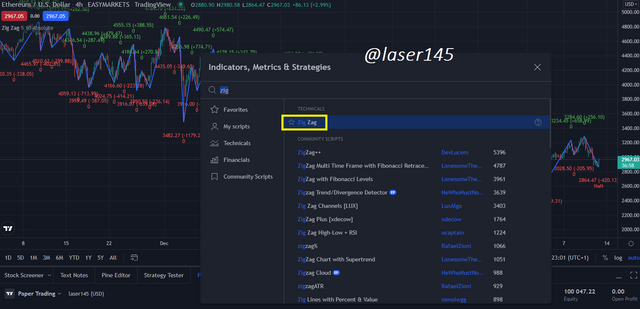

We open Tradingview and we go to the chart of the pair of your preference in this case we go to ETH/ USD we click on indicators we write ZigZag and we click on the first option as I show in the following illustration.

Source

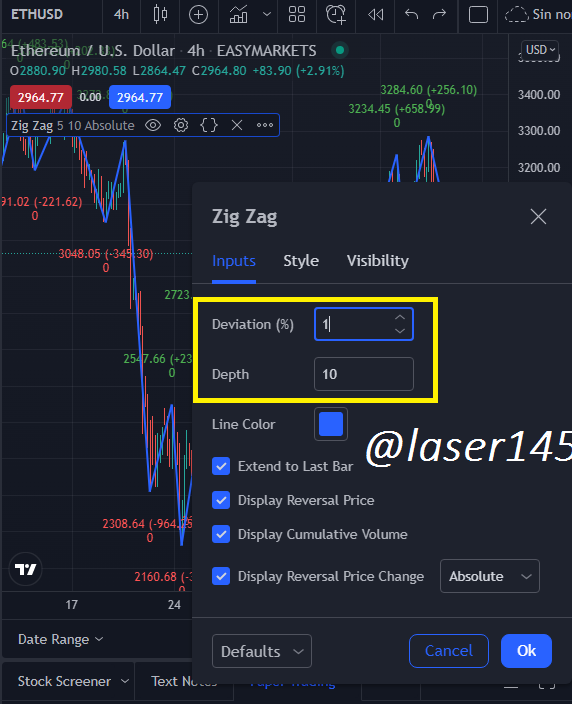

We must configure the necessary parameters for this we go to the next option "configuration" and follow the illustration below.

Source

We must select in the first deviation that comes out as default in a percentage of 5 we will change it to 1

and the depth we will leave it in 10 as it is indicated by default.

Source

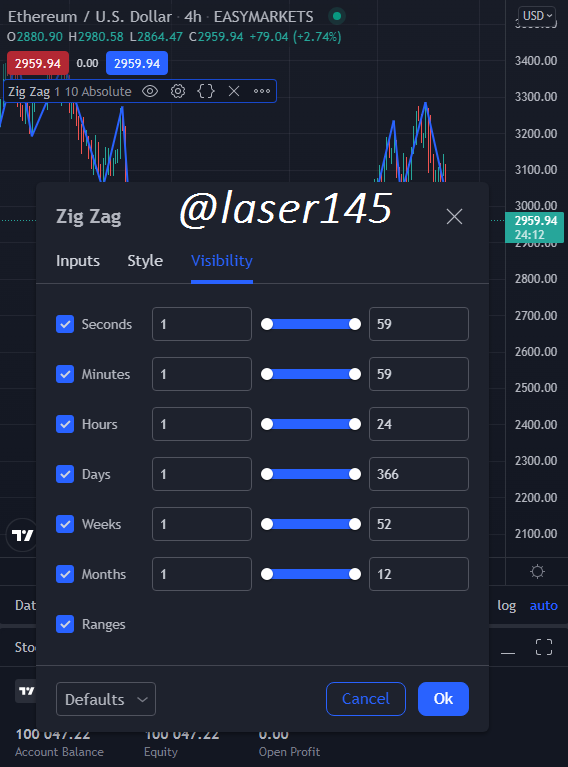

Now let's give a style to our ZigZag line for this we are going to style it we remove the labels these show us the price of gains and losses related to the previous point, therefore we are not going to want to use it at this time we remove it.

Source

We will leave the last predetermined part which would be the visibility in this way we can work with better comfort. usually traders use the setting between 5 and 10 to avoid false signals because if it is less than this causes a misreading or causes interference in the most sensitive signals as these can cause false reversals and thus can misread the signals to identify the patterns on the chart.

Source

For long trades you can set the default settings in this case it is very important to know the indicator because it can be used in different parameters both for holding a position and for scalping you can set a different configuration, i.e. for each trading mode you can set a configuration that suits your needs.

3. Based on the use of the ZigZag indicator, how can one predict whether the trend will be bullish or bearish and determine the buy/sell points (screenshot required)?

To distinguish whether the trend is up or down we must first understand the parameters of the ZigZag indicator

uptrend: Clearly visualize the uptrend in this case the highs must be strictly higher than the previous highs, and take care that the lows are higher than the previous lows.

the downtrend: We must see that the highs are lower and the lows are lower so we will know that the trend is downward.

Source

Buy and sell points.

To determine the points of purchase and sale we must first look at the directionality and strength of the asset, the temporality, I will make the example of a long or buy operation, first we have to see that the trend is bearish and look for the pattern when the last minimum is higher than the previous one at that point we look at the second candle is green or bullish in that is our entry signal to operate by placing a stop loss at the previous minimum that would be our most important previous support to exit in case of emergency operation due to the high volatility of the market. I manage my risk management at 1:2 according to the percentage of my total balance.

Source

4. Explain how the Zig Zag indicator is also used to understand support/resistance levels by analyzing their different movements. (screen shot required)

Support and resistance levels can be visualized by the peaks of the candlestick highs and lows let's first define each of these with a visual example on a real chart.

For the resistance

We can visualize the peaks that are formed at the highest maximum levels therefore when this happens we can see that the asset is in high demand this means that the investor is buying more and more of the asset for a certain purpose this peak or point is also formed when there is a purchase order which reaches a certain value or maximum then the price corrects which forms a peak in the uptrends we will see that a peak is formed each time higher than the previous one but for the downtrend we will see that this peak is much lower than the previous one.

For the support

We have in mind that the support levels is where the falling price for some reason of interest by the trader the asset falls into oversold and the user arrives and buys because he sees it at a point where he can make profits and the price begins to rise again which forms a peak of support when the peaks are each time higher than the previous ones we can say that the asset has a certain interest in the user or investor therefore its trend is upward but when we see the peaks each time lower we can say that we are in a downtrend and the asset has little appeal to the investor.

Source

5. How can we determine different points using the Zig Zag and CCI indicators in the entry trading strategy? Explain this based on clear examples. (Screenshot required)

We are going to use a chart where we can visualize the ZigZag indicator and we can use the entry trading strategy this can be done with a temporality of between 15min to 1hour , for further analysis we must complement with other indicators such as for example the RSI and ADX the MA averages in this way we will have a better analysis of the trade that we are going to explore.

First of all to understand better we go to the chart and configuration of the ZigZag indicator for this strategy we will use the configuration of 5 and 10 followed by this we will see on the chart that there is a very important resistance at the upper level so we will use a well known strategy such as BRB which tells us theoretically that we must enter into operation just after the break of the most important resistance when the green candle starts, followed by a stop loss at the lowest support of the most important resistance that level is critical for the operation to be successful. let's look at the illustration below:

Source

In the following illustration we can see the CCI indicator in conjunction with the ZigZag indicator a powerful tool that tells us the commodity channel index, and can be used with the following features 100 bands for buying and -100 bands for selling to trade accurately with the CCI indicator you have to form patterns of breakout of support and resistance this influences the type of operation we are doing.

So let's see the breakout pattern above the resistance where we enter into operation, let's look at the illustration and see in the CCI indicator the breakout above the 100 band, then it tells us that it is a good time to buy, therefore at that same point we place our operation and also setting a stop loss to protect us from any negative movement.

Source

For sell operations we can see that the CCI pattern gives us an alert below the -100 line which indicates a strong fall, thus we see the break of the previous support through the ZigZag indicator, therefore we will place a sell order at the same point as we will see in the following illustration.

Source

6. Is it necessary to pair another indicator to make it work better as a filter and help eliminate false signals? Give more than one example (indicator) to support your answer. (screen shot required)

It is very necessary and almost indispensable to pair other indicators for this to work better with respect to filters and help eliminate false signals the example I am going to give below is of the CCI indicator or commodity channel index and we are also going to use the RSI indicator which tells us the overbought or oversold market as well as the ranges depending on its position in the band. for the following example we are going to use the illustration below:

Source

In the previous chart we can visualize a break in the are of the important resistances and the CCI indicator confirms it leaving its 100 band at the top so it is a good time to go long or buy in the market and operate with the strategy that best suits our needs and the appropriate risk factor now let's see the RSI indicator which tells us that if the band is above 70 then we would be in overbought and if we are below 30 then we would be in oversold. we will see how to validate this data below:

Source

In the analysis with the RSI indicates me the following when the line goes below the 30 band then the operation begins then we say that the risk factor in this case I will leave it in 1:2 so that 1% is the factor of losses and 2% of profits to take profits if I am very sure I can raise it to 3% the total value of profits for the stop profit.

7.List the advantages and disadvantages of the Zig Zag indicator:

| Advantages | Disadvantages |

|---|---|

| It is very easy to understand as it is a single zigzag line | if you do not have the required parameters for each operation it could give interference or false data in the analysis. |

| provides us with information to enter and exit the operation without so much protocol | additional indicators have to be used to complement the required information. |

| It provides very good information on both supports and resistances in a pre-defined timeframe | the longest time frame must be taken for the operations to have the best results. |

Conclusion:

As we saw in the research work the Zigzag indicator leads us to valuable information that is easy to interpret easy to analyze and very accurate in longer temporalities we must also pay close attention to the default values which we must change depending on which temporality we work, identify patterns correctly is an advantage over other users as we can and speculate the next movements in advance. The system gives us the position of the supports and resistances as we saw in the past instructions, that is to say we can differentiate important supports from supports with less volume as well as resistances, in this way we can eliminate those false signals that can lead us to make mistakes that are paid with assets something we do not want to happen. therefore always operate in temporalities of 1h to 4h in values of 1.10.

Cc: @kouba01

by @laser145