Source

1. Discuss your understanding of the ADX indicator and how it is calculated. Give an example of calculation. (Screenshot required)

It is an indicator created in the 70's by Wells Wilder, whose purpose is to provide data on the strength of the trend of the financial markets of the time, this indicator can only be used to provide data on the strength of the trend but not its direction, to calculate the prediction of the direction of the trend is advisable to use other indicators, the ADX indicator or average directional index, can be used to analyze and discuss a possible purchase and sale according to the directionality of the trend, as it gives us good data on the strength of the trend.

This indicator can be found in any trading program or exchange platform, and it can be observed that many times it brings 1 single line called ADX and other times it can be accompanied by two more lines called D and DI - which are secondary moving lines that help us to see the directionality of the trend for a period of 14 cycles, this indicator is called DMI for bringing these two lines accompanied, and it is the most used by investors today.

The indicator has an indicator strip that goes from 0 to 100 and is divided into 4 cycles and if the ADX line tip is at that point, we can read it very easily, the 4 cycles of trend strength that make up the indicator are:

0/25 = No or very weak force

25/50 = Mild and initiating force

50/75 = pronounced and strong strength

75/100 = Very strong force

Source

In the image above we see the meaning of each line that makes up the ADX indicator and make the division of cubicles from 0 to 100 to show how you can read the ADX line of the indicator, in this case the ADX line is in the cubicle 25/50 ie the strength of the trend is starting and is very slight this shows that it has more strength to the upside and can continue to rise more its value.

How to calculate. Give an example calculation.

Data:

Maximum of the day= 75

Minimum of the day= 63

High of the previous day= 57

Previous day's low=52

Formulas and results to calculate ADX

Calculation of DMI+ and DMI-.

DMI+ = day high - previous high

DMI- = previous day's low - previous day's low

DMI+ =75 - 57 = 18

DMI- = 52 - 63= -11 = 0

Calculation of TR max.

TR = MAX (|PH - PB|; |PH - C|; |PB - C|)

PH= maximum of the day = 75

PB= low of the day = 63

C= close of the previous day = 57

TR = (PH - PB) = (75-63) =12

TR= (PH - C) = (75-57) = 18

TR= (PB - C) = (63-57) = 6

TR= MAX 18

Calculation of DI+ AND DI-.

DI+ = (DMI+/TR)

DI- = (DMII-/TR)

DI+ = 18/18 = 1

DI- = 0/18 = 0

Calculation of DX.

DX = 100 * ((DI +) - (DI-)) / ((DI +) + (DI-))

DX = 100 * ((1) - (0)) / ((1) + (0))

DX = 100 * (-1) / (1)= 100

Calculation of ADX.

ADX = Sum of n [((DI +) - (DI-)) / ((DI +) + (DI-))] / n

ADX = 100*[(((1) - (0)) / ((1) + (0))] / 14

ADX = 7.14

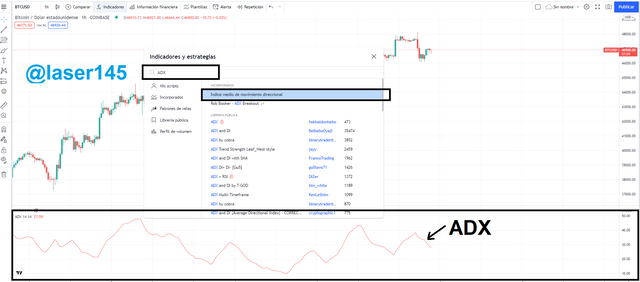

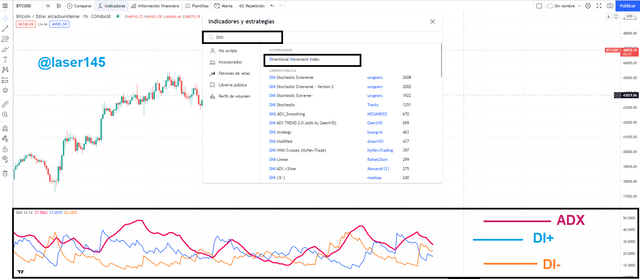

2 How to add ADX, DI+ and DI- indicators to the chart, what are their best settings and why? (Screenshot required)

We click on "indicators", use Tradingview to add it.

Source

We can use the ADX indicator which has only one ADX line that allows us to see the strength of the trend and there are no other data such as the DI+ and DI- lines for a trend direction.

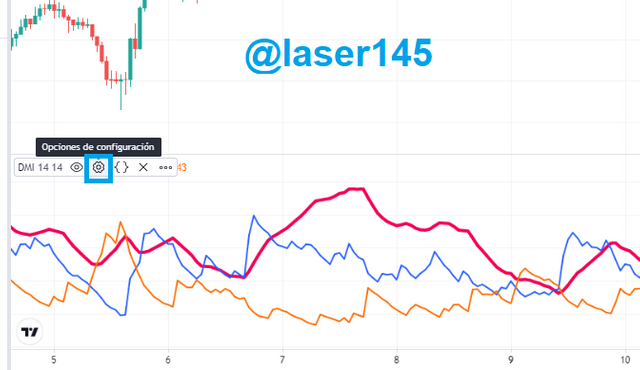

Source

In this case we will use the most complete ADX indicator called DMI, where we can find the ADX line, DI+ and DI- line.

Source

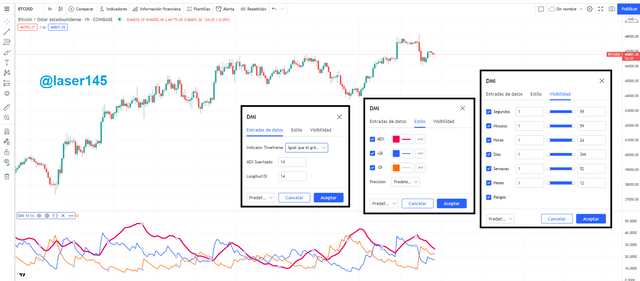

To view your configuration or add a new configuration, go to the indicator configuration.

Source

Here we can see 3 different configurations, both for x reading periods or colors of your lines and various types of visual time reading.

Source

With this indicator we can see the strength of the trend by discussing the ADX line of 0 and 100, there are 4 cycles that can be found to define its out of trend, we can see that the lower of 25 is found, the trend will be less strong and the further away the stronger it is, it has two lines DI+ and DI- both give us information about the trend, if DI+ is below the ADX line but above DI- it is an uptrend, if DI- is below ADX but above DI+, it is a bearish trend, also if there are crosses suffered by DI+ and DI-, for a change of trend, its reading includes 14 previous periods but it can be modified, the smaller the periods, the faster the signal and more prone to misreadings, the higher it is much more difficult to get its reading speed right.

Source

Here we have an example of a wave type with a period of 5, look at its fast oscillation flow, something that creates many false signals and very abrupt change, that is why for long operations this type of configuration is not advisable.

Source

3Do you need to add DI+ and DI- indicators in order to trade with ADX? How can we take advantage of this indicator? (Screenshot required)

It is not necessary to add DI+ and DI-, ADX indicator is very useful alone, because its purpose is to provide information about the strength of the trend, for the direction we can use other type of indicator, in the following chart we will look that ADX line is in a zone of 25 and it is falling and weakening.

Source

To enter a trading zone, we will look at the previous peaks that were generated in the ADX line, if we see a constant cycle zone between DI+ and DI-, we will wait for the ADX line to surpass its previous peaks with directionality DI+ below the ADX line and above DI-, here we will enter a buy zone.

Source

4What are the different trends detected using the ADX? And how does it filter out false signals? (Screenshot required)

The different trends using ADX are:

Value of 0/25, no trend or very low trend, can be found in sideways range zone, where the price collides between resistance and supports.

Source

Value of 25/50, the ADX line has an upward strength, this is the zone where the trend is considered to be real and is a point to enter the market.

Source

Value of 50/75, in this zone the strength of the trend is very strong, in this zone it is advisable to be attentive to stay or leave the market, because many times it breaks resistances and supports.

Source

Value of 75/100,

It is not common to see the line in this zone, it is very rare, if the ADX indicator is in this zone it is because of a very rare movement, the common thing is to see a cryptocurrency enter this zone when it is just entering an Exchange, or it has provided a very favorable news for investors.

How to filter false signals

In addition to properly select the periods to work it is advisable to work by operation, short and long operations, for long operations are short periods such as 4 to 8 periods, and long from 8 to 30, no more than 30 to avoid errors and false signals.

In addition we must work in trend zones higher than 25 so that the trend is taken into account, if the holding is below this zone it is better not to consider it.

If the DI+ line is above the DI- line and below ADX, it is because there is a trend, and if it crosses the Di+ above DI- there is also a trend change.

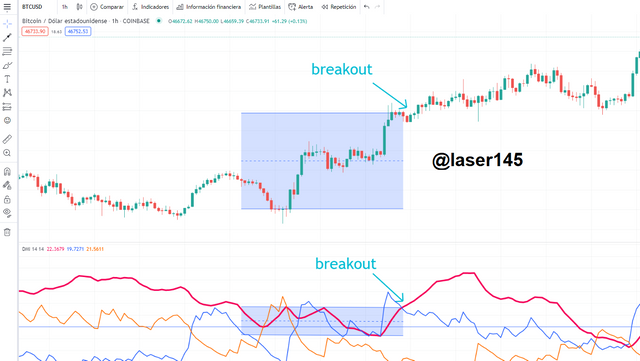

5 Explain what a breakout is. And how is the ADX filter used to determine a valid breakout? (Screenshot required)

A breakout determines if the price is going up or down, as we have said before, for a trend to be accepted, it has to be above the 25 zone, for this reason, a breakout is when the trend is in a range from 0 to 100, and this does not go out of there, then we must take into account the peaks generated, and if the peak breaks beyond the last peak, it is a breakout, just as I show in the chart, breakouts are used as a buy point.

Source

As we can see, for there to be a valid breakout, the ADX indicator must be above 25, have been in range, then we mark the highest point reached by the ADX line and wait for the range to continue between the 25/50 zones, for a breakout to occur the previous high point must be broken and here is a buy zone.

6What is the difference between using the ADX indicator for scalping and swing trading? What do you prefer between them and why?

Fortunately this indicator has a configuration to change the time periods, for scalping is necessary an extremely short period of 1 min, scalping is a fast operation, so you must be very focused on our market strategy, the ideal is to use only the ADX indicator and use another more useful indicator such as RSI.

In addition the ADX indicator has to be configured for long periods, between 8 and 30, to be used in Swing trading, because this is a long operation and with more time to enter and exit an operation, here we must consider much technical analysis using an indicator such as ichimoku and ADX to see the strength of the trend.

I recommend it for Swing Trading because I like the holding and I like to go deeper with the technical analysis and the news that may be there to be very sure of what I do with my investments.

Conclusion:

It is advisable to use only the ADX indicator without the DI+ and DI- lines, because these often provide many trend errors, you can use other softer indicators that are more useful for our operations, also that for short operations should be used with short periods and for long operations with long periods, taking into account that to be a valid breakout the strength of the trend must break the 25 zone.

Hello @laser145,

Thank you for participating in the 7th Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve a 6/10 rating, according to the following scale:

My review :

Acceptable work in which you tried to answer the questions in your own way and I have a few points I want to note:

A clear explanation of the ADX indicator with a great effort to interpret its complex method of calculation.

To get the correct ADX result, you need to calculate DX values for at least n periods then smooth the results.

In the third question, your answer was short as you did not go into details.

The last question lacks depth in the analysis, especially in the topic of your choice in which type of trading you prefer to use the ADX indicator.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit