Source

Express your understanding of the RSI + Ichimoku strategy

There are thousands of technical indicators currently in the market, they are indispensable tools to perform technical analysis this helps us to better understand each fluctuation that is precente in trading, these indicators are not 100$ reliable as they may present intermittency in the signals, therefore it is recommended the combination of two or more indicators to have a correct signal as these will filter the intermittency that are produscan in the chart of the asset.

To understand the strategy of the RSI + Ichimoku as they combine to form an optimal strategy for trading.

RSI Indicator:

It is an indicator that is used to see the overbought and oversold signals by measuring price impulses of the asset. using only the RSI in an analysis is a serious mistake because it can generate some intermittent false signals when the market follows a trend so we will use in combination the Ichimoku indicator.

The Ichimoku indicator:

The Ichimoku indicator helps us to visualize trends through the dynamic supports and resistances, therefore the indicator goes along with the price as it gives us as a result the signal after the price moves.

If we mix the RSI + Ichimoku indicator and use this trading strategy so that it can tell us the direction of the future price then our analysis will be very strong and we can make profit in the trade and therefore it would be very successful in a large percentage. as we could understand the next move in advance and this would be a good entry point for the trade.

RSI and Ichimoku effects

It is an indicator that works under impulses that tells us through ranges that come between 0 - 100 that tell us if the digital asset is in overbought or oversold therefore the trader can perform a price analysis in terms of certain patterns that are as follows when the RSI touches the range of 30 is said to be on sale the trader usually expects the price to drop below 30 and touch the 30 again that would be an entry point for a long. However, there are intermittencies in this indicator if the reading range is between 70 and above it is said that the price is overbought and possibly in a delicate position or soon to turn trend.

Then one of the biggest flaws it has is that it can not tell us how much strength has the overbought or oversold so it only supports trends every time the rsi is above 70 means that it is likely to fall more in a correction but not a change of trend so there is where confusion is created for traders who are starting. Similarly for the oversold if it is in the 30's range then we would ask to speculate that the next move would be up, therefore it could generate a false pattern or correction which we look at as a trend change but this would follow the bearish path.

Source

As we can see in the last chart we can observe that the price range is above 70 in the RSI therefore we can say that it is an overbought point therefore we have in mind what I said before it is a point that traders look at as a point to sell assets or go in a leveraged short position. but in this case we can observe that the trend did not change I just got a correction and the trend continued its upward path.

Ichimoku Cloud Indicator Effects

It is an indicator developed to identify trends by calculating prices, which we will measure supports, resistances and impulses average trends consists of 5 lines that serve us as an average to identify accurate data points of previous prices, you are generating us movement both above and below the price which gives us signals to enter or exit a trade of some digital asset.

The Ichimoku indicator helps us to define future levels of support and resistance to detect trend reversals, the positions of the nine with respect to the price give us important information to identify trends, for example if the price is above the cloud gives us an indication of a downtrend, ie the breaks of the cloud with respect to the price indicate trend changes and opportunities to enter into operation in an early position according to the directionality of the trend with respect to the rupture.

As we well know the Ichimoku indicator goes at par with the past price which tells us that the price has already moved when we see the signal on the chart, the problem with the indicator is that it gives us that delay and this is a problem for the trader who is performing the analysis also does not show us the beginning of a new trend in a real time let's look at the illustration as they are defined.

Source

The above example shown with the chart tells us that the price broke the Ichimoku cloud at the top with a move of 17.6% before indicating the trend or bullish trade in this case we can see that it makes it difficult to identify a trend move in time so it usually gives signals when a trend is exhausted.

Trend identification using the RSI+Ichimoku strategy

next we will see how we can use the RSI+ Ichimoku strategy let's talk about the RSI we say if the is around the range above 70 then there is a strong overbought if the trend is bullish with a long lasting temporality then the RSI will be around the 70 zone staying the trend in that range of values, when we see new highs forming and higher lows every time we can say that we are in a strong uptrend.

But as the RSI can not show high volumes of buying then Ichimoku comes into action, that is if we see that the price is above the Ichimoku cloud then the trend will be bullish and will reveal the momentum of the uptrend. by expanding the clouds of Ichimoku we will see the following thanks.

Source

Bearish trend using RSI + Ichimoku

when the RSI is below 30 shows that it is in an oversold region shows us both a downtrend or the beginning of a downtrend for some reason may be because of fear or some social invention that induced investors to sell the asset, then comes into play the Ichimoku identifier where it tells us that the price is below the Ichimoku cloud which confirms us the downtrend, we can differentiate by the size of the cloud the volume of trades at those corresponding points.

Source

Source

Use of MA with RSI+Ichimoku strategy

I am going to use a moving average of 85MA in combination with RSI+Ichimoku in this way we can filter out the noise that exists on the chart as these false signals can appear if few indicators are used in wrong time frames, then the MA will help us to better identify trends, reversals, supports important resistances.

According to the strategy we looked at in the conference we will use the 85MA period together with the RSI+Ichimoku in this way we will have a better reading for the analysis of the chart below:

Source

SourceWe look at how the 85MA moving average confirms the trend reversal is shown in white so we can confirm with this moving average the trend reversal in that relative temporality, together the Ichimoku cloud is above the price signaling the trend reversal and the relative volume. then we already see a trend confirmation with the correct use of MA + RSI+Ichimoku.

Support and Resistance with RSI + Ichimoku Strategy

We must analyze the most important supports and resistances to get better support data on the chart therefore we will see these supports to establish entry and exit points for each trade using the RSI E Ichimoku strategy.

Uptrend market identifying supports and resistances:

The Ichimoku strategy gives us a reference by the color of its clouds of support and resistance when the cloud is in green tells us that there is an uptrend and the price is at support levels when the cloud changes to red serves us to identify resistance during a downtrend, but if the price approaches either cloud tells us that the trend is exhausted and if the price moves away from the cloud will indicate a strong trend. when there is a break of the cloud with the price will indicate a change of trend.

Source

SourceIn the chart we can see the strategy where we identify the supports and resistances also the trend exhaustion and the strong buy on the RSI therefore this method is very important for the corresponding technical analysis.

Downtrend market identifying supports and resistances:

Source

SourceAs we can see in this downtrend we can observe the resistance below the Ichimoku cloud and with an RSI below the 30 point which indicates an oversold RSI, and when the price is getting closer to the Ichimoku cloud it indicates an exhaustion of the trend.

Use of this strategy for intraday trading:

The trading strategy that is used for each trade is very important to master it therefore each trader has his technique that he has developed over time, if the strategy that he uses is effective then he will continue to use it therefore it will depend on each trader, those who trade Intradia can use these strategies that we are naming in the past, If they master it in a good way will be successful in operations this strategy is very effective in trending markets or tangos, in this way intraday traders can establish patterns of entries and exits of operations combined with the moving average can filter anomalies in the graph therefore have more chance of success and thus have more possible benefits.

Demo trade with RSI + Ichimoku strategy

let's perform the trade using the strategy from the class using tradingview.com

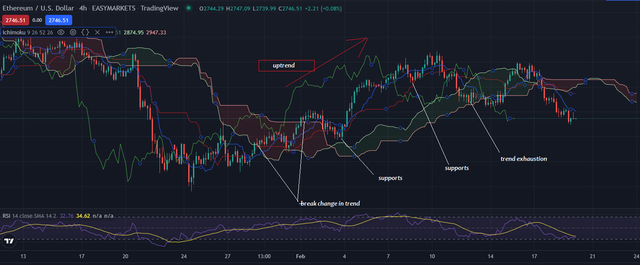

For this we go to the ETH/USDT

chart. Source

SourceIn a demo trade with a 4H time frame in ETH/USDT I looked at the chart and saw a buying opportunity in a downtrend that is making a rebound to the mean to continue down then we operate that rebound to profit by placing a stake profit right at the previous resistance and a stop at the previous support and a certain entry point for this operation I could successfully exit the purchase operation. as we see in the illustration. to perform operations we must know the movement and determine strategic entry and exit points as dictated by the technical analysis.

Trading in ETH/USDT

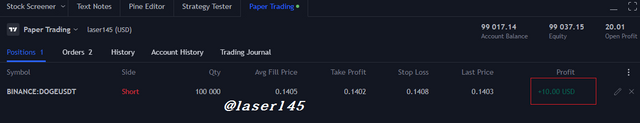

Source

SourceIn the previous chart where we see the Doge/Usdt pairs in 3m to perform the operation successfully we see that the Ichimoku cloud is above the price which indicates a downtrend with an RSI in low ranges reaching almost 30, we place a stop los at the previous resistance and a stop profit just before the previous support we ensure the entry and operation in the digital market.

Source

Source

Conclusion:

The combination of MA + RSI + Ichimoku indicators is a correct and very powerful strategy to determine trend take out false signals and optimally trade the market for users who are learning trading is spectacular signals can be obtained from both a range and a trending market.

We must understand that each of us adapts to a style of strategy therefore these indicators will be a complement to your strategy in the future, success comes from practice and continuous study of the activities.

Thank you very much professor

Cc: @abdu.navi03

by: @laser145