Source

Greetings community today I am going to start my participation for the intermediate assignment with professor @imagen which I carefully read his lecture about decentralized platforms and about Yieds farming.

Describe the differences between Staking and Yield Farming.

Firstly I want to clarify the basic concepts of each of them, in order to better understand the differences between each of them:

Staking:

investors leave blocked funds, through the consensus of Proof of Stake (Pos), this to have benefits later since these blocked funds will increase the security of the entire blockchain that are using the protocol (POS) to avoid being hacked by some organization or hacker, therefore investors get rewards the more funds they leave blocked the more rewards they will get.Yield Farming:

once investors deposit funds in the platform these go directly to the liquidity pool, once the funds are deposited in the lending system we will get rewards while other borrowers will seek to take those loans in exchange for interest that will be coming as rewards to the investor, all assets go directly to the liquidity pool, the rewards given by the platforms come in the form of governance token this by the platform and we will also get rewards for providing liquidity to the ecosystem.Now we will look at the differences of Staking and Yield Farming:

Staking :

Assets are locked to support the blockchain (POS).Yield Farming :

Blocked funds allow to generate liquidity by loan interest.Staking :

Time is too long to get rewards for our blocked funds.Yield Farming:

The time to collect your rewards is much shorter as there are groups that are formed in reward pools.Staking:

The % of rewards for the amount of capital that is locked is usually in the range of 5% to 10% with a rarely seen maximum of 15%.Yield Farming:

governance tokens are obtained with higher profits than staking, so yield farming can generate tokens in a more fluid way.Staking:

It is mandatory that funds are blocked for a certain amount of time.Yield Farming:

There is no mandatory time to lock your capital.

Log in to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process of trading on the platform (wallet connection, funds transfer, available options) and show screenshots.

.To start with the journey through the Yearn Finance platform let's click on the following link:

https://yearn.finance/#/home

We can see if the official page below:

In it we can see the different features and options that allow us to interact on the page.

Source

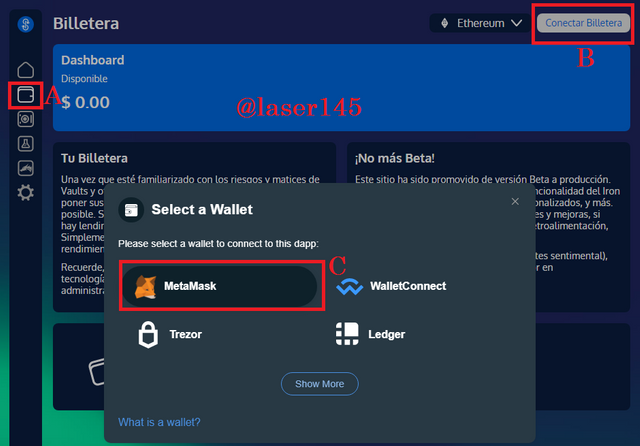

Wallet

let's connect with metamask in the ethereum network:A: Select the Wallet area.

B: Select Connect Wallet area

C: Select MetaMask

Source

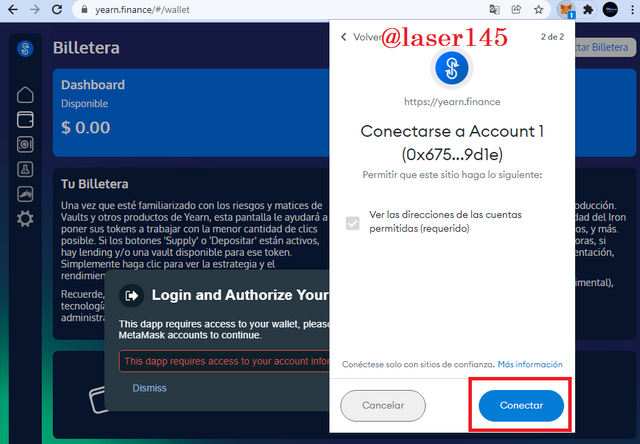

Select Ethereum Network in Metamask

Connect and ready

Source

We are now connected to the Yearn.finance platform.

Source

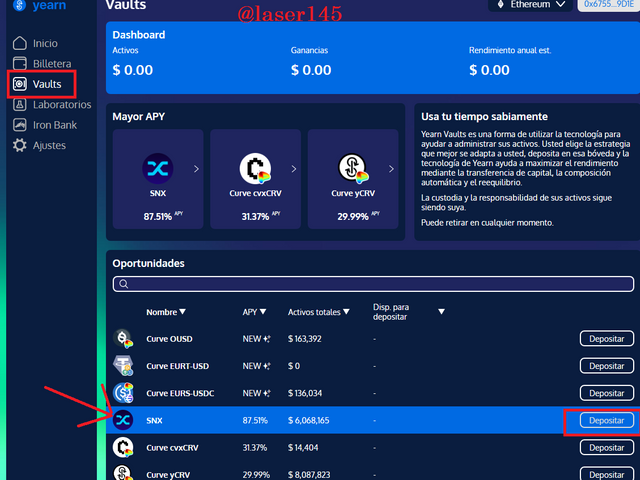

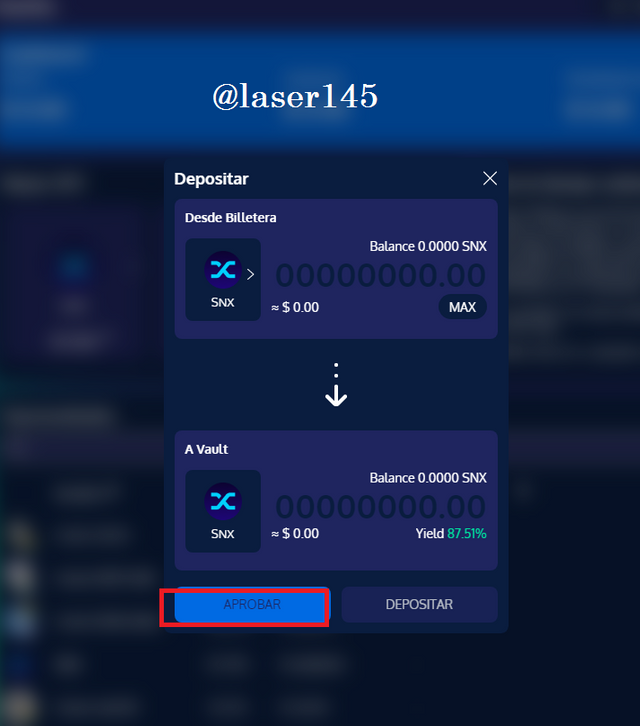

To deposit we only need to go to the Vaults Option, select an asset and then click on Deposit.

Source

After clicking on deposit, this window will open and you just have to APPROVE on the next button,

Source

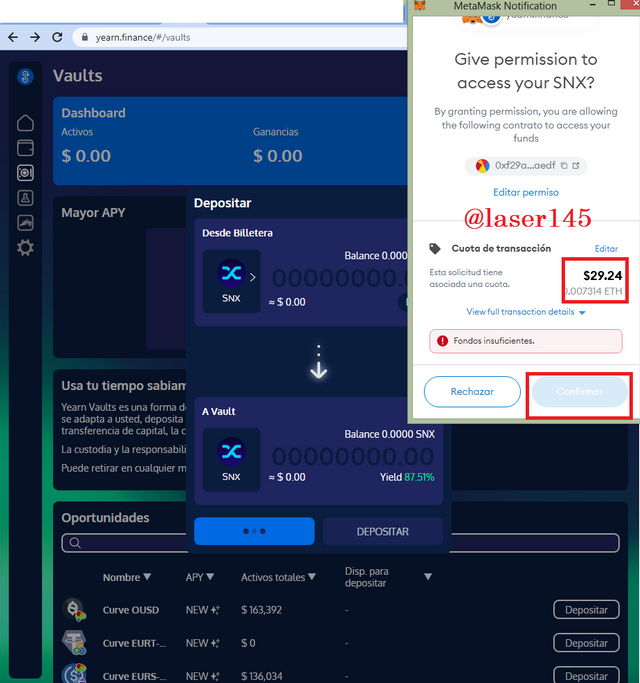

So we can see what we get for approving the transaction in MetaMask

The cost of the gas is $29.24 equivalent to 0.007314ETH.

once the transaction is confirmed you will be Approved.

Source

Vauls:

We can see the amount of assets we have, the earnings and yields all this estimated in an annual range, we can also see the options we have with the best APYs that offer us in addition to the investment opportunity at the time of our first deposit.

Source

Laboratories:

.clearly tell us the risks that may exist on the platform in addition to that we can identify the assets that we can begin to obtain clearly tells us that we must accept the conditions offered to us to be clear about all the risks involved.

Source

Iron Bank:

As it clearly states "Let your Crypto work for you" They explain that we can get simpler models to get a reward once we make our first transaction, there are high risks so we can borrow without selling our assets as collateral for the loan.

Source

What is collateralization in Yield Farming and what is its function?

.In Yield Farming a collateral must be placed in order to access the loans, there is a serious problem with the risk of collateral as these can be liquidated according to market volatility, therefore prices fluctuate rapidly, this leads to the reaction that the collateral is completely liquidated, therefore the collateral must be increased gradually so that the % of risk is lower each time.

All the platforms have a series of requirements that must be fulfilled, it means that each one of these indicates the index of guarantee required to access the loans, we can know a very important term the over guarantee that offers us borrowers who have to raise even more the value of the guarantee to avoid losing the guarantees of the platform.

We must perform these actions to reduce as much as possible the risk of being liquidated and cover themselves from these wild movements that happen in the Digital market, therefore the platforms can observe that the guarantee percentages are very high, so it is required to take additional measures to optimize the risks.

At the time of writing your assignment, what is the LTV of the DeFi ecosystem? what is the LTV of the Yearn Finance protocol? what is the Market Capitalization / LTV ratio of the YFI token? Show screenshots.

We need to open the following link: https://defipulse.com/

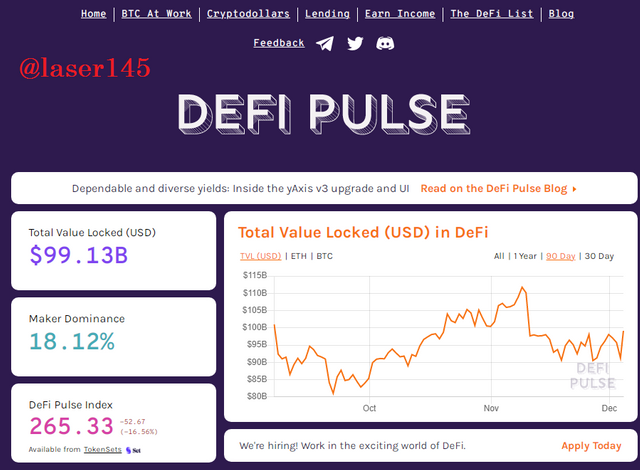

We can see that the current TVL value of Defi ecosystem is: $99.13B at the time of doing my task.

Source

In this illustration we can see the TVL of Yearn Finance at the bottom of the platform we can see that it is in position #8 and has $3.99B TVL.

Source

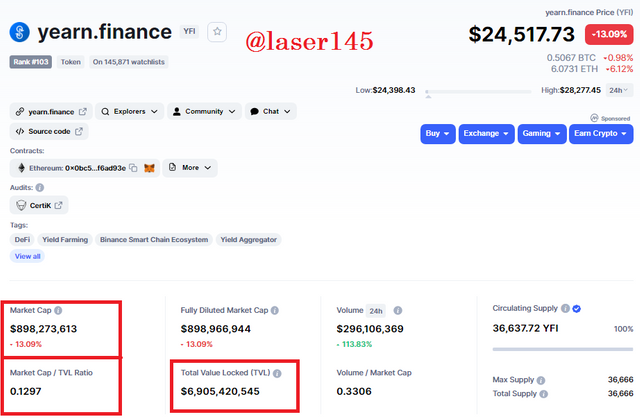

In the coinmarketcap platform yearn.finance we can see the information of the YFI token

Source

Price Token TFI: $24,524.66

Market Rank #103

Total Value Locked (TVL) $6,905,420,545

Market Cap $895,774,748.90

Market Cap / TVL Ratio 0.1297

Circulating Supply 36,638 YFI

Total Supply 36,666 YFI

Max Supply 36,666 YFI

Is the YFI token overvalued or undervalued? Please indicate the reasons.

The token The YFI token is currently Undervalued, if we get the TVL value of the relationship they have with the marketcap and look at theIFY we will see that really this Infravalorad, the platform has a Yearn Finance project which in turn allows users who has very little time and it costs them to understand the movement of the ecosystem, provides the option to generate profits but also demonstrates its transparency by indicating that there is high risk by the same issue of volatility in the market.

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment today? Explain the reasons.

For this I go to the Binance platform with the BTC/USDT pair and go to the date 01/08/21 until the moment 12/04/2021.

Source

Desde la fecha 01/08/21 hasta el momento 12/04/2021 BTC obtubo un crecimiento de 16.05% luego de una caida brusca de un 26-98% la madrugada de hoy aun existen beneficios si fuera comprado el dia 01/08/2021 de un 16.05% como lo dije anteriormente.

Vamos a ver la relacion de precios si fuera invertido en YFI el dia desde la fecha 01/08/21 hasta el momento 12/04/2021

Source

From the date 01/08/21 until the moment 12/04/2021 if invested in YFI would be in losses of -26.20% if not placed stop loss would be trapped in the market and if sold with losses would be really lost -26.20% today of the capital invested in YFI therefore it is required to perform technical and fundamental analysis to this and all markets in which it will enter also recommend placing stop loss at the entry price or a little lower to have a better margin in case the market seeks to liquidate at that price.

Amount invested $500

We calculate the amount of BTC price. 500 x 0.1605 = 80.25$ + 500$ = 580.25$ BTC

We calculate the amount of the YFI price 500* -0.2620 = -131$ + 500$ = 369$ YFI

The funds invested in BTC to date paid off more than those invested in YFI as it is at -26.20% is a significant negative percentage in Crypto trading, right now YFI and BTC are in buy positions.

In your personal opinion, what are the risks of Yield Farming? Reason your answer.

One of the most important risks of Yield Farming is on the collateral that can be liquidated in its entirety, by some sharp drop in the market like what happened early this morning, it is a risk that has to be taken very seriously and pay close attention as to the collateral of the borrowers.

As to whether it is easy or not to operate the market is relative but it is more inclined to the difficult, since the project generates a great attraction for the benefits that can be obtained, I can not say that it is completely easy you can lose all the capital if you do not have the right experience, those who have more funds are those who benefit the most from tield farming.

It is a decentralized system with a lot of security but smart contracts can have some flaws if the platforms do not have adequate capital to operate the risks are quite serious and if there is any failure in the could lose the funds allocated quickly.

Therefore we have to understand perfectly how is the process to operate in the Yield Farming platform before entering to investigate even the smallest thing in it and be very clear about the risks that I mentioned above as this is extremely delicate especially with the settlements for high volatility in the Crypto market.

Conclusion

we talked in the following Yield Farming research paper how to enter how to connect the benefits and disadvantages, and the different important features of the ecosystem, the risks to invest in the YFI ecosystem, we can also appreciate the under valuation of the market where the token is currently located, on the other hand we have to take very much into account the collateralization of YFI that would be the guarantees very attentive to this as it requires a requirements by the lenders that are accessed just the borrowers.

Cc: For @imagen

by @laser145