Hi all, In this Today lecture from @cryptokraze, I learn about the new concept of Trading With Sharkfin Pattern with help of the RSI indicator.

Thanks for making it like a wonderful lecture to us.

What is your understanding of Sharkfin Patterns. Give Examples.

Due to volatility in the Market we see charts in different patterns. From this finding good opportunity for our trading needs is not so easy.

In this situation, if you see V Shape or Inverted V Shape patterns on the chart those are the best opportunities for us for taking our positions in that specific Time frame. Those Patterns is known as Sharkfin Pattern

Like those patterns occurs very quickly because the market goes downside or upside suddenly it took a reversal, in that situation it forms Sharkfin Patterns on the chart.

In this situation, we get a good opportunity for taking Buy/Sell positions. For day trading needs this is a good opportunity for us.

Example of Sharkfin Pattern on Chart:-

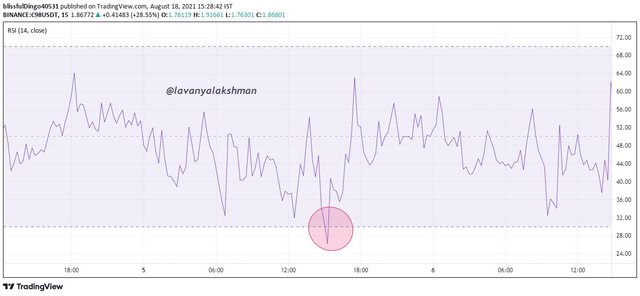

Just observe below BNB/USDT chart in 30 minutes Time frame. In one is it farm V Shape pattern them after we see which reversal in the market.

In this situation, it is a good opportunity for placing Buy Long Positions rather than Short positions.

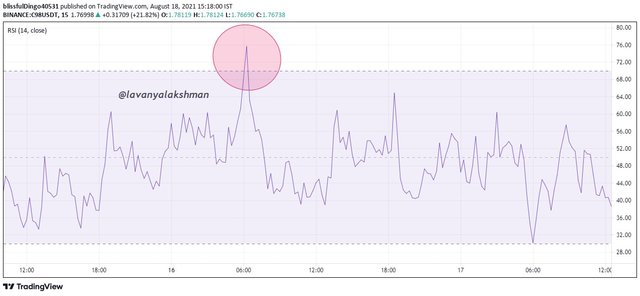

In another Example here I am giving, Just observe the below chart of the DOT/USDT chart. After farming Reversal V shape(Downtrend Sharkfin) market start dumping hard.

In this situation, we need to place sell short positions rather than long positions. Because it indicating then after we see a strong downtrend in this specific Time frame.

Like that on identifying Sharkfin Patterns on the chart, we can do profitable Trade on this specific Time frame.

Implement RSI indicator to spot sharkfin patterns.

Identifying Sharkfin Patterns on the chart is not an easy thing. For solving this use on Using RSI with its default settings of 14, upper and lower band with 30 and 70, we can find those patterns very easily.

Here RSI helps us to find strong Sharkfin Patterns on the chart.

Because on checking the chart, we get a lot of Sharkfin Patterns but all are not a good opportunity for taking our positions.

For avoiding those traps on using RSI we find good and best opportunities for us.

For Identifying Downtrend Reversal with RSI. RSI must go below 30 level line, then after it bounces back to above 30 levels very quickly. In this case, it forms Sharkfin Pattern on the chart.

In this situation it forms V Shape on the chart, this is a good opportunity to Took Buy Long Position for quick profit needs.

In the above Example of the BNB/USDT chart, in one place it farms the Sharkfin pattern.

For confirmation, I check RSI alone. On observing I identify market go below 30 levels then after it gets a quick bounce back to above 30 levels again.

It is a good opportunity for taking Buy long position.

For Identifying Uptrend Reversal with RSI. RSI must go above 70 level line, then after it bounces back below 70 levels very quickly. In this case, it forms Sharkfin Pattern on the chart.

In this situation it forms Inverted V Shape on the chart, this is a good opportunity to Took Sell Shot Position for quick profit needs.

In the above Example of the DOT/USDT chart, in one place it farms the Sharkfin pattern.

For confirmation, I check RSI alone. On observing I identify market go above 70 levels then after it gets a quick bounce back to below 70 levels again.

It is a good opportunity for taking Sell Shot position.

Like that on using RSI we possible to identify Strong Trend Reversal Sharkfin Patterns very easily. So possible to Trade profitable Trades with help of those very easily.

Write the trade entry and exit criteria to trade sharkfin pattern.

With help of Sharkfin and RSI, we learn how to Trade, But still, we don't know our Entry and Exit Strategy based on those. Now I try to illustrate with help of an Example chart.

For doing Future Trading we must learn where we give entry where is our Exit point too. Then only possible to do profitable trade.

Entry Criteria for Buy Position

For Buy long Positions we need Downtrend Reversal assets for taking our positions.

First, we need to select which assets we need to go for the trade.

Next, add RSI to our chart.

Now wait and observe that chart in each time frame, wait until in farm V Shape

Then confirm it with help of RSI. Here for taking buy long position, the market must go below 30 levels then after it must get a quick bounce back again above 30 levels, only we need to take our positions. Otherwise, we need to wait until we get the opportunity.

Our Buying bid we must place above 30 levels only, don't be hurry here, we need patience then only we get a good opportunity.

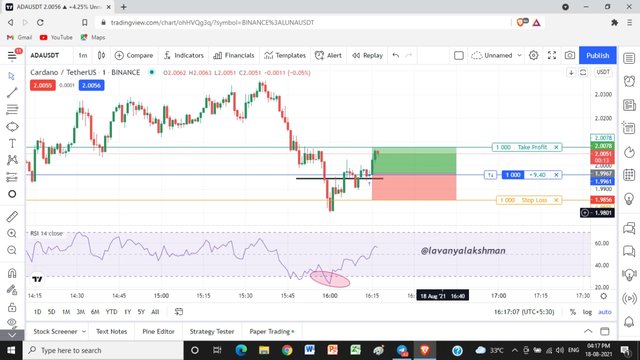

In the above chart, I took C98/USDT 15 minutes chart for identifying Upgrend Sharkfin Pattern for Taking My Position.

On checking the chart I got a lot of Sharkfin Patterns on the chart but all are not good opportunities for taking positions. Only some are valid, some or Invalid.

For Identifying valid opportunities I analyze RSI alone. Here I got some valid Opportunities for taking our Buy Long Positions.

Here I got one good opportunity, so here we can Take our Buy Long Position.

Exit Criteria for Buy Position

Now we learn where is our Entry point but still our Trade not yet finished. We need to Exit from it with profit then only it becomes profitable trade. So we also learn how and where we set our Stop loss and Exit Point also for getting profitable risk free Trading needs.

For any open position we must set Stop Loss for our Trades. It gives protection from further huge losses.

Here Our Stop loss must be the Swing Low point of Sharkfin Pattern.

Along With we also set our Take Profit Point.

For beginners always use the 1:1 Risk and Reward Ratio strategy to good choices. After getting experience in trading we can do 1:2 or 1:3 Risk and Reward Ratio trades using Trailing Stop Loss.

If the price crosses the Stop loss means our entry is Invalid, so here we need to exit from trade and wait for another good opportunity.

If it crosses our Target Price means we give valid entry and exit with profit from that trade.

In trading don't be greedy, always try to book profits. Otherwise at any time Trend get a reversal, there is a chance to close our trade with loss also.

In Crypto, we get plenty of opportunities each day so always try to book your profits and wait for good opportunities.

In the above example, I took my position after farming the Uptrend Sharkfin pattern, and also get confirmation with RSI Indicator.

Here I apply the 1:1 Risk and Reward strategy, so I exit my trade with profit.

Entry Criteria for Sell Position:-

For Sell Short Positions we need Uptrend Reversal assets for taking our positions.

First, we need to select which assets we need to go for the trade.

Next, add RSI to our chart.

Now wait and observe that chart in each time frame, wait until in farm Inverted V Shape

Then confirm it with help of RSI. Here for taking Sell Short position. So market must go above 70 levels then after it must get a quick bounce back again below 70 levels, only we need to take our positions. Otherwise, we need to wait until we get the opportunity.

Our Selling bid we must place below 70 levels only, don't be hurry here, we need patience then only we get a good opportunity.

In the above chart, I took C98/USDT 15 minutes chart for identifying Downtrend Sharkfin Pattern on Taking My Position.

On checking the chart I got a lot of Sharkfin Patterns on the chart but all are not good opportunities for taking positions. Only some are valid, some or Invalid.

For Identifying valid opportunities I analyze RSI alone. Here I got some valid Opportunities for taking our Sell Short Positions.

Here I got one good opportunity, so here we can Take our Sell Short Position.

Exit Criteria for Sell Short Position

Now we learn where is our Entry point but still our Trade not yet finished. We need to Exit from it with profit then only it becomes profitable trade. So we also learn how and where we set our Stop loss and Exit Point also for getting profitable risk free Trading needs.

For any open position we must set Stop Loss for our Trades. It gives protection from further huge losses.

Here Our Stop loss must be the Swing high point of Sharkfin Pattern.

Along With we also set our Take Profit Point.

For beginners always use the 1:1 Risk and Reward Ratio strategy to good choices. After getting experience in trading we can do 1:2 or 1:3 Risk and Reward Ratio trades using Trailing Stop Loss.

If the price crosses the Stop loss means our entry is Invalid, so here we need to exit from trade and wait for another good opportunity.

If it crosses our Target Price means we give valid entry and exit with profit from that trade.

In trading don't be greedy, always try to book profits. Otherwise at any time Trend get a reversal, there is a chance to close our trade with loss also.

In the above example, I took my position after farming the Downtrend Sharkfin pattern, and also get confirmation with RSI Indicator.

Here I apply the 1:1 Risk and Reward strategy, so I exit my trade with profit.

Like that we can give Entry with help of Shakfin Pattern and RSI, then we exit with it Profitable.

Demo Trades

For taking my position with the Sharkfin pattern signal, I check a lot of charts in different time frames. Finally in ADA/USDT 1 Minute chart, I get an opportunity.

For getting confirmation again I check RSI alone. On checking RSI I notice ADA fall 30 levels then after it bounces back above 30 levels, and start moving upward direction.

After getting confirmation, I immediately place my Buy long Position at that Market price.

Here I use the 1:1 Risk and Reward Ratio strategy, that's why I don't place my Stop loss below the previous Swing Low Point.

Finally, I exit My Trade with profit.

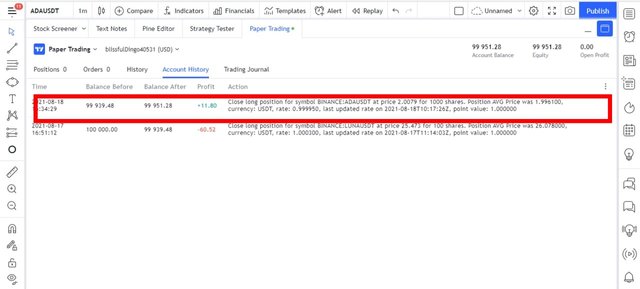

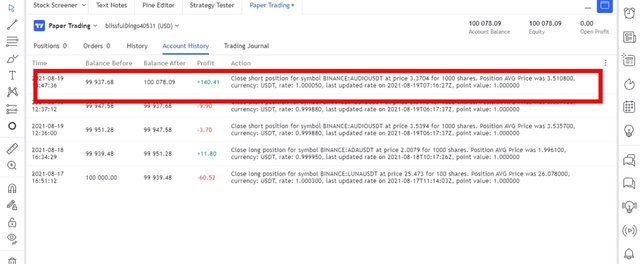

And here is My Trade History.

Demo Trade 2:-

For this Illustration, I took the AUDIO/USDT 5 Minutes chart.

On checking the chart I identify Downtrend Sharkfin Pattern on the chart.

For getting confirmation I check RSI alone. Here I get confirmation. On crossing the 70 level line, it starts to bounce back immediately, then after it starts dumping.

On getting all those conformations, I immediately place my Sell Short Position in that price.

Finally, it reaches my Target, so I exit my Trade with Profit. Here I use the 1:1 Risk and Reward strategy for my trade.

Here is My Trade History.

Like that, I do two profitable trade withheld of Sharkfin Pattern and RSI confirmation.

Conclusion

On using Sharkfin with help of RSI we can possible to identify good opportunities for taking our position.

But always keep Stop loss and Target Points also after taking your position.

Always try to set 1:1 Risk and Reward Ration at the beginning. Then after getting experience go for 1:2 or 1:4 also on maintaining Trailing Stop loss.

On checking the chart, we get a lot of Sharkfin Patterns on the chart but all are not good opportunities for taking our position.

Always give your entry after getting confirmation with RSI. Then only possible to get a profitable trade.

In trading for getting good opportunities we need patience and observation skills, then only possible to get profitable trades.

In crypto, we get a lot of opportunities so don't be hurry on taking your position. And also try to book your profits always, don't be greedy about seeing profits.

Thanks For Treading My Post

You have been upvoted by @sapwood, a Country Representative from INDIA. We are voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into Steemit.

Engagement is essential to foster a sense of community. Therefore we would request our members to visit each other's posts and make insightful comments.

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit