Hi friends, From this @sapwood I learn a new concept of On-chain Metrics, based on this how we took positions, where we exit from it. Like those details, I learn.

Thanks for making it like a wonderful lecture to us.

What is the difference between Realized Cap & Market Cap, How do you calculate Realized Cap in UTXO accounting structures? Explain with examples?

Before knowing the Difference between Marketcap and Realized Cap first we need to understand properly, then only possible to identify its differences.

On understanding this we getting a lot of confused, so I try to explain with Examples.

Marketcap:-

Marketcap means simply equal to total supply times the current price.

Means Total supply multiplied with the current price we get its Total Market cap. This amount is always in volatile accord to price move, so it's having huge volatility in each time frame.

This Market cap also shows the project strength in Total Marketcap in Crypto Industries. But that particular coin Total Marketcap always get fluctuation based on coin price change.

Here that coin supply is fixed in some sort of time but its price is not fixed. Because based on Supply and Demand, its price always fluctuated so its Total Market cap also fluctuated always according to price.

so it's a bad reflection of the value of the asset.

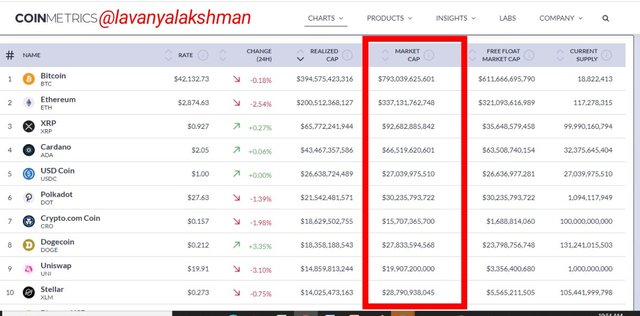

This Screen Shot Taken on 22-09-2021,Around 10 am as per Indian Time

Now it will change may be due to price fluctuations.

Using Realized Cap we can judge its value correctly.

Realized Cap:-

The realised cap means the sum of the most recent purchase prices of all the assets or closing price of that day that the native unit last moved.

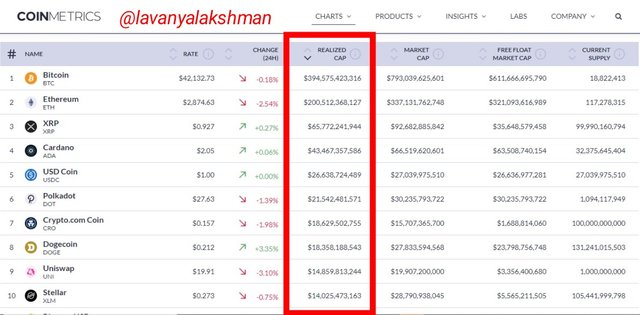

This Screen Shot Taken on 22-09-2021,Around 10 am as per Indian Time

This data gives us the actual value of that asset in that specific time frame. Because it gives exact details about the total sum of investment into the asset.

If its value increasing then we see good growth in the price of a coin, if it decreasing then we can expect Investors to slowly start selling their coins, which means the price starts dumping soon.

Now we understand the meaning of Market cap and Realized Cap.

Difference between Realized Cap & Market Cap:-

Both Realized Cap and Market Cap Looking the same but they are different, their calculations are different.

Here we see some key differences between those.

Calculation of Realized Cap in UTXO accounting structures.

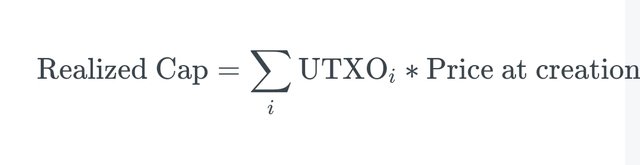

The realised cap we get is based on the UTXO move. Here UTXO means Unspent Transaction Output.

Here users buy and hold that particular coin for future needs. From this, he indirectly controlling that coin Price Move also.

Realized Cap Calculation:-

Realized cap is calculated by valuing each UTXO based on the price when it was last moved.

Means

Source

Simply sum of each UTXO * Last moving price.

From this calculation of asset, we get Realized Cap of that asset.

For Example Dot coin having 10 UTXOs from 2000 to 2021. Those UTXOs values are 3 Coins bought for $5 in 2000,2 coins bought at t price of $7 in 2009,3 coins buy for $20 in 2010 and the final purchase of 2 coins he buys for $22 in 2021.

Here

Realised Cap =

(35) +(27)+(320)+(222)

= 133

So here Realized cap is around $133.

But Present Market cap based on the current price of Dot is

= 10*28

=280

Its value is around $280.

Here we can understand the difference between a Market cap and Realised Market cap. Why we choose Realised cap as the realistic value of on asset also now we understand clearly.

Taken from santiment

Without calculation, we can view Realised cap on this platform. On checking here we can assume the upcoming move of that assets price.

Consider the on-chain metrics-- Realized Cap, Market Cap, MVRV Ratio, etc, from any reliable source(Santiment, Glassnode, etc), and create a fundamental analysis model for any UTXO based crypto.

For on-chain Metric analysis santiment platform providing good tools for our needs.

So for this illustration I using santiment.On using these on-chain Metrics traders and investors can choose the correct decision at the correct time.

Market Cap:-

The market cap we get on total supply multiplied with the current price. It is the Total Market cap of one asset.

In indirectly refer the with of that asset in Total Crypto Mart cap. By using this information we can easily identify that asset further growth.

On using santiment platform we can do short term and long term on-chain analysis very easily here.

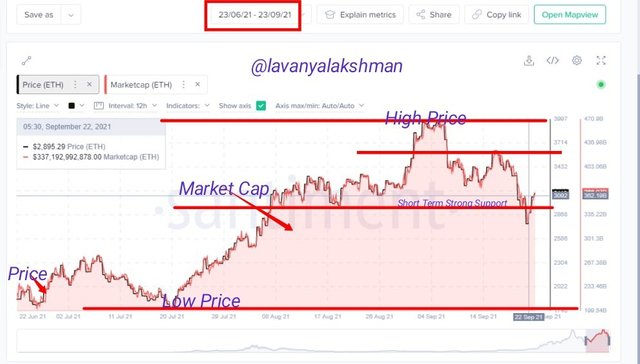

Short-Term Analysis of Market Cap:-

Short term analysis means around 3 months. It means 90 days approximately.

In the above chart Block colour line is the Price Movement line, Pink Colour Filling Area is the Market cap.

On checking the above chart we clearly understood Marketcap going along with Price Move. If Price dump, the Market cap also dumping, If Price moving up Market cap also moving up.

So Market cap completely following Price Move. Here I taking the June 21 to Se 21 of this year graph. It's approximately 90 days. So it's short term analysis chart.

On checking short term price with ETH market cap. Its All-time Low in the last 3 months is $1738 with a $203029054602 Market cap, and Its All-time High is around $3895.35 with $457194093071.00.

It's having Strong support of around $2900 to $30100. That's why BTC last dump also don't dump more, again it starts pushing upward direction. In my opinion, it again reaches its previous high if it breaks the $3300 to $3500 range resistance as per the Market cap and Price Action chart.

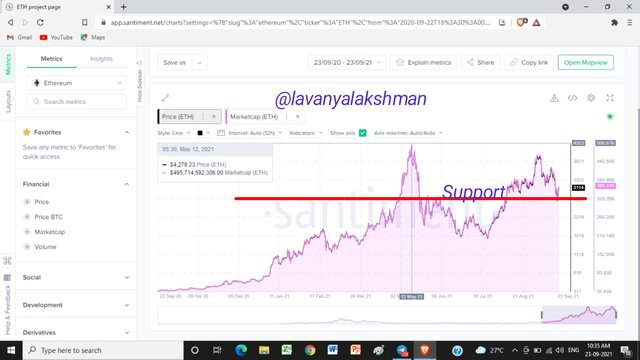

Long-Term Analysis of Market Cap:-

Long term means more than one year we consider them as long term.

If you wish to invest in any assets always a better choice for the long term. Long term holders always earn good returns than short term traders.

For analysing the Market cap in long term here I choosing Ethereum.

For ETH long term Market cap analysis needs I choose on-chain metrics to provide a platform santiment for my needs.

Here I taking a chart from Sep 20, 2020, to Sep 20, 2021. Its approximately one year chart.

In the above chart Block colour line is the Price Movement line, Pink Colour Filling Area is the Market cap.

In this chart also Markep moving along with Price. When the price gets dump, the Market cap also gets a dump. When the price Moving Up, the Market cap also moving g an Upward direction.

As per the long term Market cap with the Price chart, ETH having support at $2844 with a 329.1Billion Market cap, If It goes good there is a high chance to reach its all-time high.

Long Term Price with the Market cap also giving the sign for Uptrend Price move of ETH.

Realized Cap:-

Realized Cap is the Realistic value of an asset. It's don't get that's much volatile based on price, only based on the Trading value it can change.

So Realized cap is the real value of an asset.

Short-Term Analysis of Realized Cap:-

Short term analysis means around 3 months. It means 90 days approximately.

In the above chart Block colour line is the Price Movement line, Pink Colour Filling Area is the Realized cap.

Here last Realised Cap recorded on 25th August 2021 for $3172.46 with $131.63 Billion. Then after we don't get any Realized cap data in ETH.

After 15 th August 2021, Realized Cap increased above the Price. It is a good sign for Investment.

Here is one more thing we can also observe Realized cap not following Price action, whenever price drop there we see the huge Realized cap whenever the price goes high where we see less Realized cap.

So Realized cap is the complete opposite of Price action.

Long-Term Analysis of Realized Cap:-

Long term means more than one year we consider them as long term.

For analysing the Market cap in long term here I choosing Ethereum.

For ETH long term Realized cap analysis needs I choose on-chain metrics to provide a platform santiment for my needs.

Here I taking a chart from Sep 20, 2020, to Sep 20, 2021. Its approximately one year chart.

In the long term chart, the Realized cap is above the price, which means a lot of Investments going on in this range. So in future, we see Uptrend In ETH.

It is a good sign for long term investment needs.

Market Value to Realized Value (MVRV Ratio)

MVRV means Market Value To Realized Value. The ratio between Market and Realized cap we get MVRV.

MVRV = Market Cap/Realized Cap

From this MVRV analysis, we can tell the price of an asset is fair or not. So easy we can judge the future trend of assets easily based on MVRV.

Using MVRV we can easily identify tops and bottoms, along with we can identify buying pressure and selling pressure in the market.

If Buying pressure is high means we expect an uptrend in price, if the selling price is high then we expect a Downtrend then after. These details give good buying investment opportunities and also give a good sign for booking our profit also.

Here we get two types of senior one is an uptrend, another one is a downtrend.

If the MVRV line is above the price line means, it showing selling pressure in future, so this trend does not continue then after, soon we see some downtrend.

If the MVRV line below the price action means, it showing buying pressure in future. So we expect a good uptrend in that assets. So it is a good sign for investing in that coin.

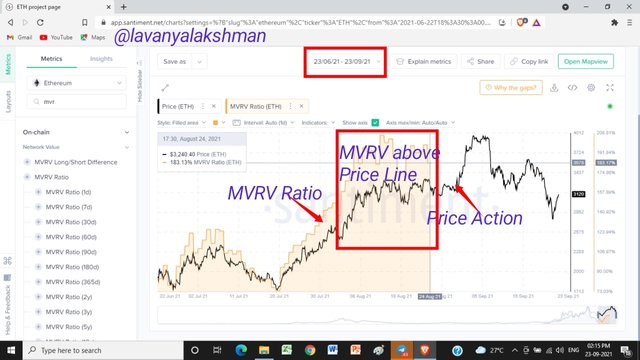

Short-Term Analysis of MVRV Ratio:-

Short term analysis means around 3 months.It means 90 days approximately.

In the above chart Block colour line is the Price Movement line, Pink Colour Filling Area is the MVRV Ratio.

In the above chart MVRV ratio showing above the price line. Means it showing selling pressure in future. So it is not a good time to invest.

Long-Term Analysis of MVRV Ratio:-

Long term means more than one year we consider them as long term.

For analysing the Market cap in long term here I choosing Ethereum.

For ETH long term MVRV Ratio analysis needs I choose on-chain metrics to provide a platform santiment for my needs.

Here I taking a chart from Sep 20, 2020, to Sep 20, 2021. Its approximately one year chart.

On checking one year chart of ETH, Here MVRV ratio is below the price action. So showing buying pressure in future. So it's a good sign for investment in ETH for a long time holding needs.

ETH analysis in Short Term on Applying Market Cap, Realised Cap And MVRV Ratio.

Here I analyse ETH in short term do I taking 3 months chart. Then apply Market cap, Realized cap and MVRV Ratio on Chart.

On observing the above chart, we see Realized cap and a Market cap going good but the MVRV Ratio showing selling pressure in future in short term.

For Short Term needs, In my opinion, it's not a good time to invest. We need to wait till getting confirmation with MVRV Ration for short term purposes Investment needs.

ETH analysis in Long Term on Applying Market Cap, Realised Cap And MVRV Ratio.

Long term means more than one year we consider as long term.

For ETH long term analysis needs on applying Market Cap, Realized Cap and MVRV Ratio, I choose on-chain metrics to provide a platform santiment for my needs.

Here I taking a chart from Sep 20, 2020, to Sep 20, 2021. Its approximately one year chart.

On checking one year chart Realized Cap above price action and MVRV Ratio Below Price Action, And Market cap also looking good. All showing the good sign to invest now for long term holding needs.

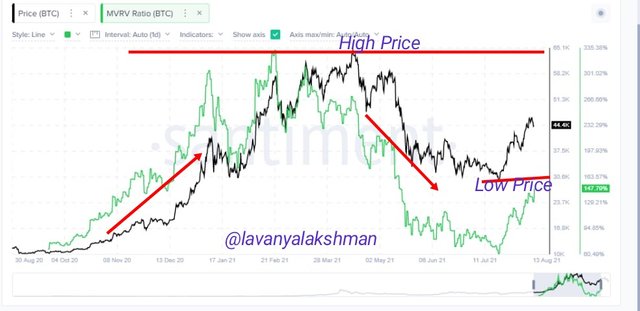

Is the MVRV ratio useful in predict a trend and take a position? How reliable are the upper threshold and lower threshold of the MVRV ratio and what does it signify? Under what condition the Realized cap will produce a steep downtrend? Explain with Examples/Screenshot?

We know Ratio Between Market Cap and Realized cap we get the MVRV Ratio. So it shows the fair value of an asset.

On Using the MVRV ratio we can identify Buyers Pressure or Sellers Pressure in Future. But based on this not possible to identify our Entry and Exit Price, date those details using this.

Because MVRV only shows future trends but does not give any signal for taking our positions.

For Example in the above chart, we see MVRV in the above Price chart, so it showing selling pressure in future. But no one knows after reaching which price sellers start selling their coin. If they sell their coins then the market move in a Downward Direction.

Here we know soon that asset price drop, but don't know in which pints ts start dumping. So not possible to take our position based on it.

After some days, again MVRV Start moving below the Price chart. It means MVRV showing buying price in future.

But from which point asset start moving no one knows, But we know soon its price may go uptrend, but don't know from which range it starts moving.

In my opinion, based on the MVRV Ratio we not possible to take our positions but the further trend we can identify easily using it.

upper threshold and lower threshold of the MVRV ratio and what does it signify.

Using the MVRV Ratio we can identify the Support and Resistance levels of a coin very easily.

Here Upper Threshold means the Resistance of assets. If the price broke this level, and go upward direction, then we need to wait for good rice to sell our assets. Because then after that assets price starts moving in Downtrend because it's an overbought position. So sooner or later it must go Downtrend.

Here Lower Threshold means the Support Area of assets. If the price broke this area moving sideways, then we can take our positions here is a good choice. Because it is an oversold position, so then after it must go in the upward direction. That's why we say this Lower Threshold area is a good sign for taking our positions.

In the above chart ETH having Resistance 1 around the $3300 area, along with it having support around $1900 area. If it breaks first resistance then we can see ETH around $4300, Then after it may go up or again took correction. The exact Target price is not possible to give anyone. Because all are assumptions we are given based on past data.

So it showing a buy signal to us, But not showing the exact price to take our positions.

Under what condition the Realized cap will produce a steep downtrend? Explain with Examples/Screenshot?

The realised cap is a variation of market capitalization that values each UTXO based on the price when it was last moved.

On calculating the last moved UTXOs we get Realized cap. It is quite opposite of Market cap calculation.

Investors always try to buy coins at their lower price in the dumping market and try to sell it's the higher point in raising market. For grab good profits. This also avoids loss on investment.

I do this process oppositely we can have huge losses, which means buying coins at a higher price, selling those at a cheaper price. From the type of investments, we must face loss on our investments.

The same concept is applied to calculating in Realized Cap also. If the Buyer buys the coin at a cheaper price, then sell those at the present price, then here Increased Realized cap we get respectively.

If the buyer buys its coins at a higher price, then sell at the present cheaper price, here we get decreasing Realised cap along with it.

Changes in realized cap:-

We get changes in Realised cap based on the lost move of UTXO and their re-prices in the current price. Here we get three types of changes in Realized cap based on it.

Increases in realized cap

An increase in the Realized cap will occur when the coins lost moved at cheaper prices are spent.

Then users re-price those in the current price, here we get an Increased Realised cap. So here Realized cap will produce a steep Uptrend.

Decreases in realized cap

A Decrease in the Realized cap will occur when the coins lost moved at higher prices are spent.

Then users re-price those in the current price, here we get a Decreased Realised cap. So here Realized cap will produce a steep Downtrend.

Magnitude of change in realised cap

In this situation, it's directly related to different prices and coins that last moved. Then again re - prices those in the most sophisticated price. In this case, we don't see any big changes in the Realized cap. That's why we get Magnitude change in the realised cap, not many differences we get here.

For Example, as per the above chart, we see ups and Downs in the Realized cap.

All we know is Realized cap above the Price line means Buy Signal, Below means low signal.

In the above chart, we getting a lot of Buy signals and Sell signals from Realized Cap.

If the investor invests their money in Accumulation won't, again re-spent in the current price, then Realized cap will produce a steep Uptrend.

Otherwise, if user Buyer spent at a higher price, then re-prices those in the current price,

The realized cap will produce a steep Downtrend.

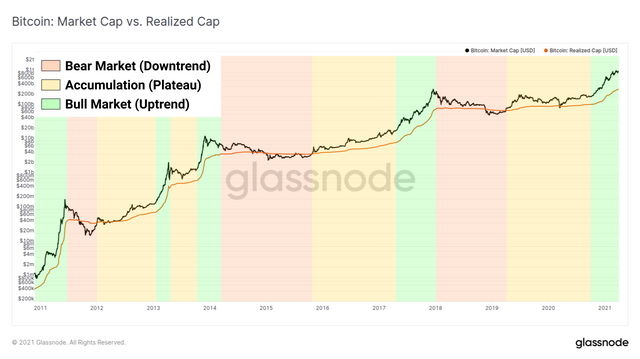

Based on Realized Cap we can identify Market Phases very easily.

Identifying Market Phases:-

The prevailing trend and gradient of the realized cap can also give help to identify Market Phases.

Bull markets

Bull markets occur when we see a steep uptrend of the realized cap. Because here huge accumulation going in a cheaper price, then the re-prices in the current price we see big growth in the Realized cap. Here possible to see Bull Market.

Bear Market

Bear markets occur when we see a steep Downtrend of the realized cap. Because here huge accumulation going in a higher price, then the re-prices in the current price we see a decrease in the Realized cap. Here possible to get Bear Market.

Accumulation phases

After the end of the Bear Market, we see accumulations in the Realized cap. In this phase Market go in Sideways on producing small Ups and Downs. Don't see major Ups and Downs in the Market. Because here accumulation going on. Once accumulation finish then again we see Bull Market.

Like that based on Realized Cap, we can identify Market Phases.

Conclusion:-

On using On-chain metrics we can identify further Market Move for the short term at the same time long term also.

Those give Market Future Move but do not give the exact sign for taking our positions.

Realized Cap gives the exact value of Assets in the Total Market. Its value does not give that's much volatility.

Market cap is not the real value of an asset, Because its value always changes according to price change.

MVRV is the Ratio of Market cap and Realized cap. It gives exact details about the further market movement.

Based on the Realized cap produce a steep downtrend or steep Uptrend we can identify the upcoming Market Phase very easily.

On-chain analysis always helps us with huge losses, possible to get good profits on our investment.

Thanks For Reading My Post