Hi all, In this today lecture from @fredquantum, I learn another new topic Dark Pools in Cryptocurrency.

This Topic is very new to me, but now I am so happy about knowing something new. Like that knowledge always helps in our Crypto Journey.

Thank you very much for making it a wonderful lecture for us.

Discuss Dark Pools in Cryptocurrency in your own words. How does the dark pool works?

In the crypto market, we know how manipulation is accrued by whales. Those whales doing like those trades only for manipulating assets price. But Investors are different from Whales.

Investors always think to invest huge money without manipulating present market assets price. That's why they want to hide their investments from the public. By hiding large transactions from Public Blockchain we can easily eliminate Market Manipulation.

For doing like those trades they need a Private Trading Place with full security features. Which platform offers like those Trading opportunities are known as Dark Pools.

Dark Pools are simply a private venue for Trading Large amounts of assets without exploring any details to the Public. Like those Dark Pools mainly used by Institutional Investors. Because they invest Millions of Dollars at a time, that's why they choose those private Trading platforms. From this, they also hide their details from the outside market.

For doing like those Tradings, we don't get any effect on Traditional Market too.

It is quite opposite to Traditional Exchanges. Because here we don't see any order books. Just we need to place our bids for our needs. If any order matches our orders executes automatically. Here orders also not visible by others those are only visible after completing orders only.

Like those Transactions did not occur immediately, it took some time. Those all managed by Dark pool Tradings provided Platforms.

Here orders execute based on available liquidity. That's why that liquidity is called Dark Pool Liquidity. Here all almost every order execute through Block Trades.

Block Trades means transaction of larger quantity orders at predefined Prices. Here small quantity is not possible to execute. So who wants to invest more than $500000+ will join like those Tradings.

At first Dark Pools were introduced in the 1980s for institutional investors to buy/sell large quantities of assets.

With help of Dark Pools, Institutional investors may do a large quantity of trading very easily without manipulating the present market price. At the same time, they can hide their complete Transaction from the public. Due to they avoid creating unnecessary fear/greedy in the market too.

How Does Dark Pools Works

We already learned what is Dark Pools, here we don't have any order book for placing our bids. But who place their bid for buying or selling a large number of orders will see their orders.

But those orders are not visible to the public. From this, they can anonymously place a large quantity of Buy/Sell orders without realising their interest to other traders.

%20(1).jpeg)

In Dark Pools Trading we have Two things. One is Limit Order another one is Market Order only. Here we con't do any Margin or Future tradings. Only buy/Sell will do through Limit /Market bids. No other choice.

Limit Orders

Limit Orders used by most of the Institutional traders for buying or selling large quantities of assets through Block Trading in Dark Pools at their desired price. From this can easily eliminateHigher Slippage here.

From this, they eliminate unnecessary Fear/Greedy in the market. Like those large orders do not give any impact on present assets price. So from this, normal trades and Retailer Investors not get any effect.

Here limit orders execute when the potential relevant others buy/sell bids met only. After execution, that money is added to the opposite maker/taker wallet automatically.

Market Orders

In limit orders, we set our buy/sell price as per our wish. But in Market Order we need to sell/buy our assets based on another trader Predetermine Price.

For this tradings, we need to bear higher slippage too. Here our orders execute instantly without any delay but need to pay additional slippage and trading fees compared to limit order tradings.

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

At present, in the crypto market lot of Exchanges offer Dark Pools. But from this Kraken Exchange is most popular like those tradings.

Through Kraken Exchange any verified Institutional investor can do Dark Pools Trading.

In Kraken Exchange, we get only Limit Orders, not possible to do Market Orders. So from this feature Investors may get free from higher slippage and their limit orders execute only execute when they met relevant orders.

Here Traders may watch their placed orders but not possible to show order books like the general market. Because here all orders are anonymous, so no one is not possible to visit.

That's why in Kraken Exchange orders also execute through Block Trades only when they met a specific predefined price.

So in Kraken Dark Pools, Any Institutional Investor may place their Buy/sell limit orders. After placing their bids, Only the system matches the relevant limit order for completing open Block Trades as per predefined price. Here no one doesn't know, are you a Market Maker or Taker. All details hide here.Here all orders execute privately, without exposing any details to others.

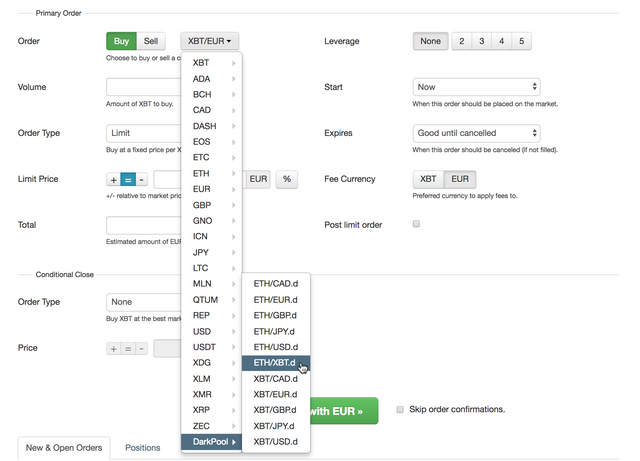

Supported Assets On The Kraken Dark Pools

When I wrote this post, Kraken Exchange only offered major Two Top Assets of Bitcoin and Ethereum curries only in their Dark Pools.

But it offers different pairs for BTC and ETH.

Ethereum pairs:

ETH/CAD

ETH/EUR

ETH/GBP

ETH/JPY

ETH/USD

Bitcoin pairs:

BTC/CAD

BTC/EUR

BTC/GBP

BTC/JPY

BTC/USD

Along with BTC/ETH Pair also available.

Requirements For Trading Dark Pools in Kraken Exchange.

Before participating in Dark Pools Through Kraken Exchange we need some requirements and need to follow some conditions, then only it allows participating in Dark Pools.

Firstly we need a Pro Level verified Kraken Account.

Here only Possible to Place Limit Orders only.No Market-Orders.

The minimum order size for BTC Pair must be greater than or equal to 100k USD. Below this volume not possible to participate.

The minimum order size for ETH Pair must be greater than or equal to 50k USD. Below this volume not possible to participate.

If we meet those rules then we can participate in Block Trades in Kraken Exchange.

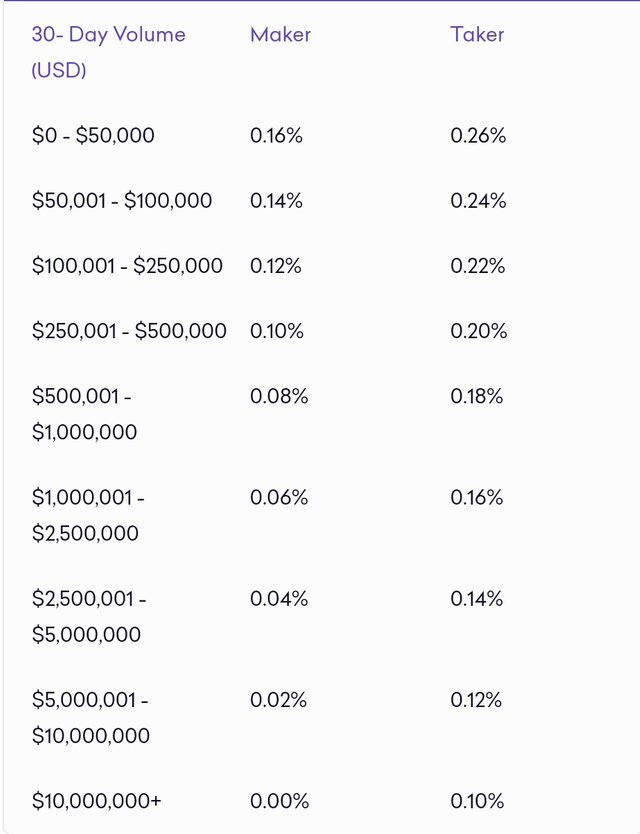

Fees For Dark Pools in Kraken Exchange

In general trading, we have nearly 0 to 0.16% trading fee in Kraken. But for doing Dark Pools we need to bear nearly 0.20 to 0.30% on every block trade.

This is a little bit higher compared to general tradings. But reasonable.

But those fees also we can reduce based on our trading volumes.

If we do regular Dark Pools trading with higher volume then a trading fee may reduce based on 30 days Dark Pools complete Trading Volume.

This is another feature we have in Kraken Exchange.

Block Trading On Kraken Exchange

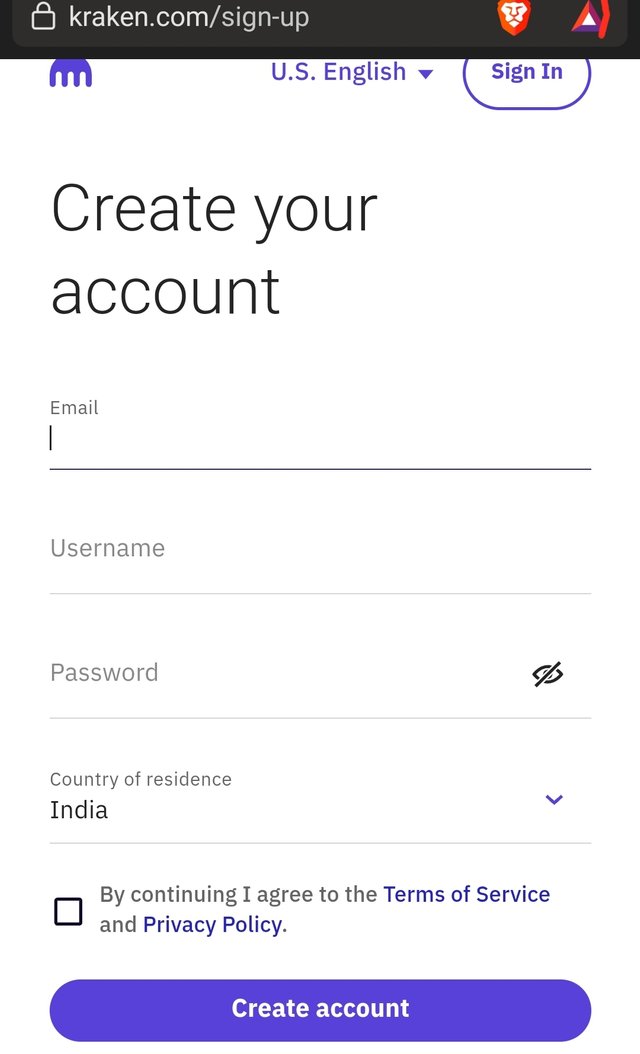

For doing Block Trading In kraken Exchange. First, we need to create an account here with our email.

Then verify the email. For participating Block Trading we must reach Pro Level verification. Without pro-level verification, we cont possible to participate in Block Trading.

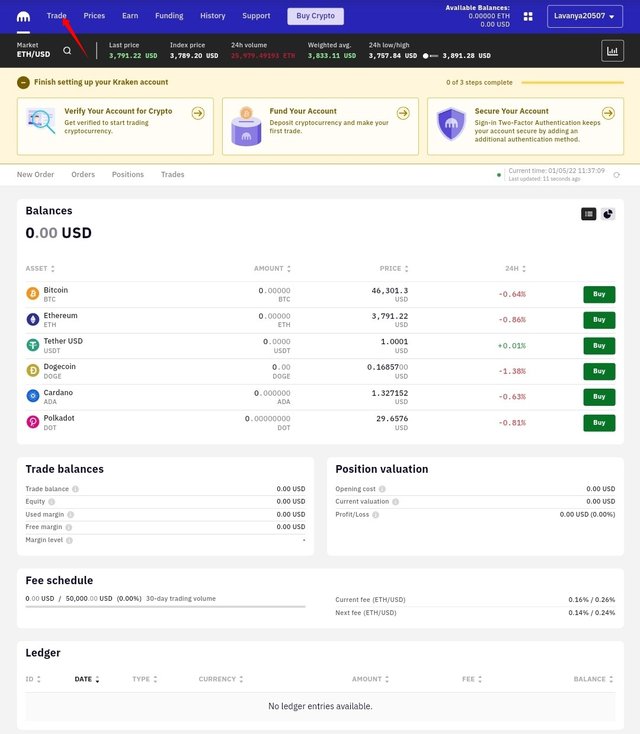

After reaching pro-level verification, then select the Trade tab. From this Switch to Advance, Then it redirects the new order page.

Here you see a list of Dark Pool support assets with their pair. From this select which you need, and place your bids as per your wish.

After placing our orders we can watch those but others not possible to see.

When our limit order match by the opponent limit order, our order get executed and the equivalent value is added by our wallets automatically.

Here Dark Pools assets also look like regular assets pair but those are designed with extension .d. From this difference only we can easily identify Dark Pool assets from regular assets.

Those we can easily view in our Kraken Exchange buy open

Trade->Advance Trade ->Order Page

by refreshing the window after placing our orders.

After execution of our orders, those details are also we can check.

Trade->Advance Trade ->Trades Page.

In Dark Pools, we are only possible to watch our placing orders and our completing orders after execution only. Not possible to watch open order Positions of other Traders.

One more thing here not possible to do Margin Trading. We having some limitations and rules to participate in Dark Pools.

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Now we understand how to do Dark Pool through Kraken Exchange. Kraken Exchange is one of the Centralized Exchange, so it operates our Dark Pool Bids. So here we getting third party involvement for the execution of our Trades. Along with participation, we need to meet a lot of requirements like Pro Level KYC Verification and many more.

Those looking for something inconvenience to Institutional Investors. Here Tradings hide by the public but they need to verify their KYC for Participations. That's why here Instructional Investors not getting 100% Anonymous.

Decentralized Dark Pools are also one type of Dark Pool venue for cryptocurrencies. Here for doing large transactions no need for any KYC, all orders execute in a Decentralized way. So here Institutional Investors getting 100% anonymous from the outside market.

At first like those Decentralized Dark Pools Trading offered by Singapore-based Republic Protocol in 2018.

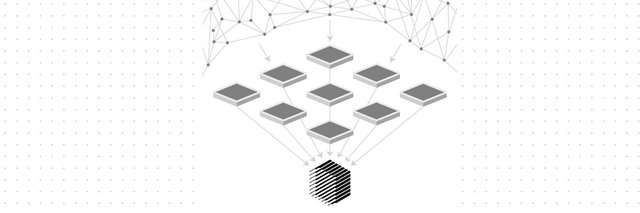

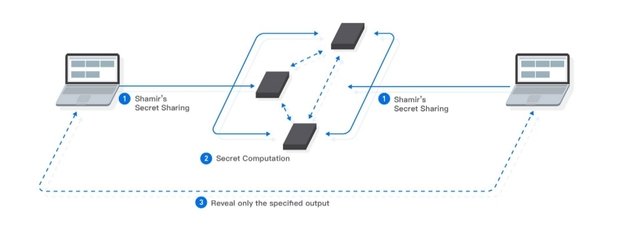

In Kraken Exchange, Dark Pools execute just like peer to peer under Kraken. But coming to Decentralized Dark Pools, here our order divided it into multiple Fragments and match them back again using zero-knowledge proofs.

From this Decentralized Dark Pool Tradings giving very limited impact on Traditional Market. Due to slippage, we get a very little bit of volatility in the market, nothing more effect we get.

At the same time, Institutional Investors can do their tradings with 100% security and anonymous.

How Do Decentralized Dark Pool Trades Work?

After receiving the order by Platform. First, it broke our order into multiple Fragments. The next process is similar to the Bitcoin Mining process.

Then those Fragments store in each separate node, and search for another matching node, if it met our criteria then orders get executed. Like those processes repeated until execution of all nodes, then it gives final execution transactions to us.

Here also miners get a reward and fee for each match. Here zero-knowledge proof is used to verify the integrity of the transactions.

Once orders get matched those details are recorded into the system then send notifications to other nodes regarding the match. Unmatched fragments are reused in matching the next set of orders. Those are done repeatedly until getting matched nodes.

Like that Dark Pools orders execute in Decentralized Dark Pool Platforms.

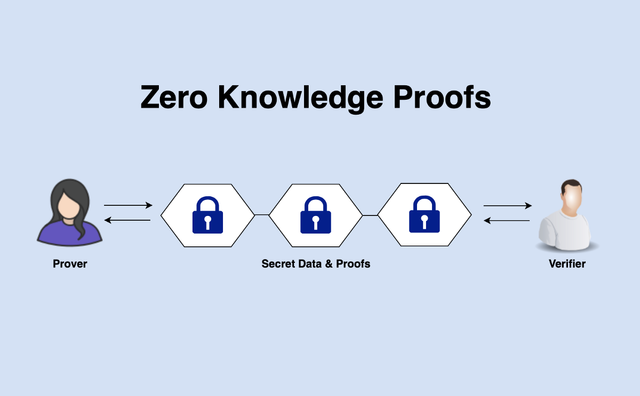

zero-knowledge proof:-

We know Blockchain Technology offers a lot of advantages like transparency, immutability, and decentralisation. But coming to privacy it does not meet 100% anonymous. Those issues we solve with help of Zero-Knowledge Proof.

On Combining Zero-Knowledge Proof With Blockchain Technology, we can give users powerful immutability and security.

Here Zero- Knowledge Proof(ZPKs)means is an encryption scheme whereby one party can prove the specific information to others without showing any additional details.

Means here for the execution of Transactions no need any personal data and other details, all transactions execute complete anonymously, that's why Institutional Investors showing a lot of interest for doing Decentralized Dark Pool Tradings.

Here each transaction contains Verifier and Prover.

In Zero-Knowledge Protocol traders can do trading by revealing their price, volume like those details. That's why Nodes take part to confirm the trade. In this transaction, even nodes also don't know exact information but they finish the transaction perfectly.

Here we get three criteria Completeness, Soundness and Zero-Knowledge.

Completeness:

If the prover knows the information then he needs to convince the verifier.

Soundness:

If Prover doesn't know information then he un convince the verifier.

Zero-Knowledge:

If Verifier doesn't know exact information about prover know or not.

Simple we can explain with an example how the Zero-Knowledge protocol works in the execution of orders.

For example, Bob and Alliance get a surprise gift of candies bar 🍭 due to the Halloween Festival.

Now they want to know whether they get an equal number of bars or not without revealing how much they hold to each other.

Like those issues, we solve with help of Zero-Knowledge Protocol very easily.

For this ZKP using nodes transaction, from this, it solves this issue without having additions details and revealing any details to others.

Like that here transactions execute without revealing any personal data.

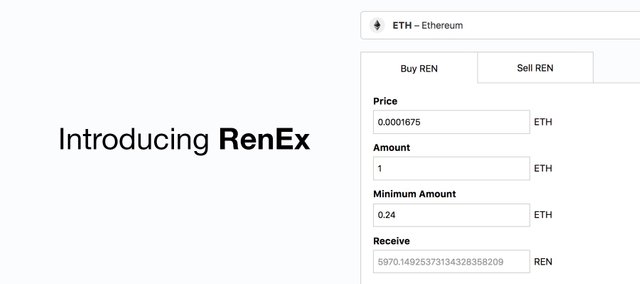

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

After increasing Centralized Dark Pool Trading, slowly Decentralized Dark Pool provided platforms also start into the mainstream.

World's first Decentralized Dark Pool Launched by Republic Protocol on 2018 with name of RenEx.

It's a Singapore based company. It's officially launched as RenEx. This platform is very popular on Wall Street, that's why major Institutional Investors like

JP Morgan Chase, Goldman Sachs and many more investors use this platform for investing their huge money in crypto without revealing their details.

It a simply we can say a private platform for trading Crypto assets for Institutional Investors only.

In this platform, we have nearly 10 to 15% volume compared to complete crypto volume, so institutional Investors without having any liquidity issues can do their tradings.

Here any institutional investor can place their bids in Dark Pool like this.

Then after those order is recorded in Darknodes with the ability to match orders. From this, they earn a fee for providing liquidity here.

Like that hear, Transactions execute without revealing any data from outside.

At the same time for doing Transactions by Institutional Investors no need to do any KYC.

Here all transactions execute based on Zero-Knowledge Protocol.

What I give details those I get from their Social Media only. I am not sure about which crypto assets they offer, fee-related details like those because this platform is restricted in my country.

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Before we discuss Centralized Dark pools along with Decentralized Dark Pool platforms too.

Now we try to learn major differences between those.

| Centralized Darkpool | Decentrlized Darkpool |

|---|---|

| Here we need to provide our KYC Details for participation in Dark Pools | No need to provide any KYC Documents For Participation |

| Orders Not Broken into Fragments | Orders Broke Does into Multiple Fragments |

| Need to wait to meet until our needed volume and Predefined Price | Our order Volume is not an important criterion but predefined price play a role for execution |

| Here Nodes not involved in settlement | Nodes play a big role in execution settlement |

| For execution orders third party get involved | Here no third party involvement |

| Not get any Smart Contract Related Transactions for the execution of our orders | Here through Smart Contracts our orders execute |

| Our Ordes can visible by Dark Pools offering Exchanges | Here no one not possible to watch our orders |

| Orders Execute on Private Blochchain | Orders Execute on Zero-Knowledge Protocal |

Like that key difference, we get between Centralized Dark Pools and Decentralized Dark Pools.

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

For this illustration, I chose on November 3rd 2021,coinbase whales dump incident.

On that day,one unknown coinbase whale place Market sell Order of 246 BTC at the price of $62,500. Its value is nearly 15 million dollars.

Due to this, we get scam wick in the chart. For this action BTC price drop suddenly to $60000.

Like those activities always makes a lot of fear in the market, so a lot of Traders also start selling their assets at market price, so we see huge volatility in the market.

This order we can see based on order book thickness also.

Here he placed Market Sell not Limit sell, if he place limit sell that's much volume, all will catch his order so there is a high chance to market react opposite to him. Due to this, his orders are not possible to execute.

That's why he goes with market sell, due to this we get a few minutes of huge volatility in the market, then, after all, becomes normal.

If he uses any Dark pools platforms for this huge BTC sell-off, then we don't get that's much scam wick in the market. Because here he places limit sell orders, so those execute slowly so we don't get any that's many effects on assets price.

But he does sell in open Exchange through Market order, that's why we see BTC from $62500 to $60000 within a fraction of seconds.

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset.

In Exchanges, if you see any big orders in the order book, Traders act regarding it. All most every trader try to buy that's assets due to this they increase its Market Cap and assets Price.

Similarly, if they see any big sell orders in the Order book, Retail Investors and small traders also join with them, then start selling that asset due to this they decrease its Market cap and Price.

Along with if any assets demand increase, supply decrease then also we see some price surge in that price.

Whether if Supply Increase, Demand decrease we see a correction in that assets price too.

So here Sentiments, Demand and supply play a big role in pumping or dumping assets price.

Coming to Dark Pools, here we don't have any order books, at the same time not possible to watch other orders. As per Institutional Investors needs they place their bids, if any matching bid met their conditions their order is executed otherwise it is open to them.

Here other traders are not possible to see that's much huge volume orders so no sentiments play a role here along with supply and demands also does not give any effect because Traders place their wished limit orders as per their needs.

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

St present Dark pool Tradings increasing day by day. Due to this, we have some benefits along with some disadvantages too.

Now we discuss those.

Advantages

Through Dark Pool Tradings, Traders can prevent huge slippage. Because here Traders place limit orders as per their wish.

Here we can get good liquidity for executing huge volume orders.

Dark Pool orders are not possible to visible so here they reduce market sentiments and high volatility on assets price from their huge investments.

Dark pools act as private exchange platforms for Institutional investors. So a lot of big players can involve in crypto very easily without revealing their details to others.

Disadvantages

- Here whales place their orders based on their wish. Due to this, we can see some unknown losses on Retail Investor's investments.

For example, if all whales talk to the dump market about using Dark Pools. Then they place their sell orders below the present price, then we see a sudden dump in the market. But we don't know the reason why market dumping is because here orders are hidden from the outside market.

We cont possible to protect our orders here, so normal investors can lose their investments.

If all whales start using Dark Pools for their needs, then we don't get that's much liquidity on Traditional Market. So normal traders are not possible to execute their orders due to liquidity issues.

In Dark pool, we don't get any order book so we cont trust those. we can say there is a lack of transparency in Dark Pools.

Like the Advantages and Disadvantages, we have in Dark Pools.

Conclusion

Dark Pools are very useful for doing huge volume trades without revealing those details to the outside market. But still, there is a Transparency issue here, if we overcome this, then we see a more functional market in crypto.

Thanks once again professor @fredquantum for giving such a wonderful lecture to us.

Thanks For Reading My Post

You have submitted a very good homework task, I appreciate your effort behind the homework. All the best!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for compliment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit