Namaste 🙏 to all of you. This is Lavanya from India. I hope all is well.

This is my entry post for on going contest Tokenomics in the Crypto Ecosystem by #SteemitCryptoAcademy community.

In the crypto space, there are huge projects. Each project has its own native token. Some projects performed well, some not. There are various reasons for this that determine project growth. In this project, Token economics plays a big role in my opinion. Let's discuss it.

What's You Understanding Of Tokenomics In The Crypto Ecosystem? and highlight its importance. |

|---|

Tokenomics focuses on the design and use of tokens within a blockchain network. It encompasses the various aspects of token creation, distribution, and utilisation within a platform.

So before we invest our money in any project, we need good knowledge of its token economics and real use cases. Based on those details, we can determine its potential strength in the coming years.

Definition of Tokenomics

Tokenomics is a portmanteau of Token and Economics, and it is a holistic approach to understanding how tokens or cryptocurrencies interact with the economy of a blockchain project.

Tokenomics looks at the incentives and economic determinants of a token’s value, the economic models of token distribution, and the economic implications of token ownership. It also encompasses the economic structure of a blockchain network, including the strategy for token distribution, the mining rewards, and the incentives for token holders.

Tokenomics examines how the design of the token incentivizes investor participation and encourages stakeholders to transact, and it explores the use cases of the token and how its value could increase over time.

Tokenomics is an important component of any successful blockchain-based project, as it provides a framework for understanding the economic implications of the blockchain.

What is Tokenomics?

Tokenomics is a term used to describe the economic logic associated with the issuance, circulation, and use of digital tokens.

Tokenomics is a new way of thinking about the economic, financial, and investment opportunities associated with digital assets. Tokenomics aims to provide a framework for analysing and understanding the economic relationships between different stakeholders in the cryptocurrency ecosystem.

In particular, tokenomics is concerned with understanding the impact of the issuance, circulation, and usage of digital tokens on the overall economic system.

By analysing both the supply and demand for digital tokens, tokenomics seeks to create a market system that incentivizes user behaviour and strengthens the network.

Ultimately, tokenomics strives to create an efficient and secure digital ecosystem that allows for the free flow of value and promotes innovation.

Importance of Tokenomics in the Crypto Ecosystem

Token economics is one of the most important aspects of the cryptocurrency ecosystem.

It is a complex system of incentives that are used to create a balanced and efficient marketplace. Token economics is used to create a stable and secure platform where users can safely invest in and trade their digital assets.

Token economics is used to encourage user participation by providing incentives for users to interact with the platform. By creating a token system, the platform incentivizes users to use the services, allowing them to earn rewards in the form of tokens. This helps increase the liquidity of the platform as it encourages more users to join.

Token economics also helps to regulate the supply and demand of tokens. By controlling the number of tokens available, the platform can ensure that the value of the tokens remains stable. This helps to create a more stable market, allowing users to make more informed decisions about their investments.

Finally, token economics helps to promote transparency and trust. By using blockchain technology, the platform is able to provide users with a secure and transparent trading experience. This helps to create trust in the platform, as users are able to view the entire transaction history of the platform.

This helps to ensure that the platform is fair and trustworthy, providing users with greater confidence in their investments.

That's why tokenomics plays a big role in making a successful project in the crypto space.

What are the components of tokenomics? Explain each in detail. |

|---|

Tokenomics is a complex field that has the potential to shape the future of the cryptocurrency market. To understand tokenomics, we must first understand its core components: token supply, token utility, token velocity, token governance, and token stability. Lets discuss each

Token Supply

Token supply is the total number of tokens in a crypto system and is a major component of tokenomics. This supply is typically set at launch and can never increase. It can, however, decrease depending on the system's rules and incentives.

When it comes to token supply, there are two important factors to consider: the total supply and the circulating supply.

The total supply is the amount of tokens created at launch and can never be changed.

The circulating supply is the amount of tokens actively available on the market and can be adjusted through burning and other means.

By controlling token supply, token issuers can determine the price of tokens and how scarce they are compared to other tokens.

Many projects also use token supply to incentivize certain behaviors, such as early adoption, or to create scarcity and control inflation.

Token Distribution

Token distribution refers to the process of allocating tokens to different users. This allocation may be through a presale, an ICO, or airdrops.

It is important to note that the distribution of tokens must be done in accordance with the set regulations of the local jurisdictions.

The two main methods of token distribution are through an ICO or an airdrop.

An ICO, or initial coin offering, is a form of crowdfunding that allows startups to raise money for their project by offering tokens that represent a stake in the project.

An airdrop is a more cost-effective way to distribute tokens since it typically involves dropping the tokens into multiple wallets, typically held by registered users.

When it comes to token distribution, it is important to keep in mind any local laws and regulations that must be adhered to in order to remain compliant.

It is also important to make sure that the distribution of tokens is fair and equitable, allowing all users to access the tokens based on their level of contribution or involvement in the project.

Finally, any tokens that are distributed must have a secure and reliable platform for storage and trading.

Token Velocity

Token velocity is a metric that measures the frequency at which a particular token or currency is exchanged or transferred within a certain period of time. It is a measure of the liquidity of a token.

Token velocity is important to consider when evaluating the market potential of a particular token or currency. Token velocity can be seen as a measure of the rate at which tokens are used in transactions. It is important to consider token velocity when looking at tokenomics because it affects the supply and demand of a token, which impacts its price.

A high token velocity can indicate that there is a lot of activity surrounding the token and that it is being used more often than others in its class.

On the other hand, a low token velocity can indicate that the token is not being used as much and that its market value may suffer as a result.

Therefore, when evaluating the potential of a token, it is important to consider token velocity as one of many metrics.

Token Utility

Token utility refers to the specific use cases of a token, and it is an important component of tokenomics.

Token utility helps to identify the purpose and function of a token and is a major factor influencing its value in the crypto market.

Token utilities can either be used to provide access to certain services or products or to give users the right to participate in certain activities or voting processes.

Token utilities can also be used to incentivize and reward users for engaging in certain behaviours or activities that help achieve the goals of a project.

In addition, token utility often involves assigning certain privileges or rights to its holders.

For example, tokens can be used to pay for certain services or products, receive discounts on certain products, or gain privilege access to certain features or activities that are exclusive to token holders.

Token Sustainability

Token sustainability is a vital component of any tokenomics system. It is the ability of a token to remain valuable and usable over an extended period of time.

Sustainability is achieved through a combination of factors such as marketing, community support, technical innovations, and other aspects of token design.

By considering token sustainability, projects can ensure that their token will serve its purpose over the long term, as well as create a viable incentive system that encourages users to hold and use the token in the future.

To achieve token sustainability, projects should focus on providing value to users. This can be done through the offering of products and services that users can obtain with the token or through the use of the token to access certain features.

Additionally, projects can ensure that their tokens are secure, liquid, and readily accessible. This will help foster a positive sentiment among users and strengthen the long-term value of the token.

Finally, projects should also consider how the token supply will be managed over time. Supplying too much of a token too quickly can lead to deflationary pressures, while supplying too few can create an artificial scarcity.

Therefore, the planned supply of tokens over the long-term should be carefully considered in order to maintain the token’s value and usability.

Those are the core components of tokenomics. We must understand those before choosing any project for our investment needs.

Choose a token and discuss its tokenomics. From the information deduced about the tokenomics of the asset, do you consider the asset worthy of investing in? Why? |

|---|

For this illustration, I choose the Polygon (Matic) network. For why...

Polygon, formerly known as Matic Network, is a layer-2 scaling platform that uses side chains to provide fast and secure Ethereum transactions.

The token economics of Polygon are built around its native token, MATIC, which is used to pay for transaction fees and provide liquidity.

MATIC tokens are used to secure the network and are rewarded to node operators who provide their computing power to process transactions. The amount of MATIC tokens distributed to validators is based on the amount of computing power they provide, making it a more efficient and fair system.

In addition to MATIC tokens, Polygon also offers a suite of other tokens, such as MATIC/USDT, MATIC/ETH, MATIC/BTC, and more. These tokens are used to facilitate transactions on the platform as well as provide liquidity for its various products and services.

It is built on the concept of blockchain matics, which are sidechains that run alongside the main Ethereum blockchain. With the help of Polygon, users can move their assets from the main Ethereum blockchain to the sidechain in order to conduct transactions faster and at a lower cost.

Additionally, the network offers an incentive for users to stake their Polygon (matic) tokens, enabling them to earn rewards for providing liquidity and security to the network. Polygon(matic)’s token economics are designed to incentivize users to join and use the network.

Polygon(matic) tokens are used to pay the fees associated with transactions and smart contract executions, and users that stake the tokens receive rewards for providing liquidity.

By incentivizing users to stake their tokens and providing them with rewards, Polygon (matic) helps to secure and grow the network.

The network also has a wide range of real-world use cases, ranging from DeFI applications to gaming and more.

Polygonal (matic) tokens can be used to pay for transactions and smart contract executions, which can be used to facilitate virtually any type of transaction.

Additionally, Polygon(matic)’s layer-two scaling solution enables developers to build applications on the network, allowing them to take advantage of the network’s low transaction costs and fast transaction speeds.

Overall, Polygon (matic) is a layer-two scaling solution for Ethereum that enables faster, cheaper, and more secure transactions.

Its token economics incentivize users to join and use the network, and its real-world use cases offer a wide variety of potential applications. Polygon(matic) is a great choice for anyone looking to take advantage of Ethereum’s decentralised network while also benefiting from increased speeds and lower costs.

It all shows the strength and use cases of its token compared to other projects. Its faster transactions at a lower fee attract many users to invest in this project.

Coming to Matic Token Economics

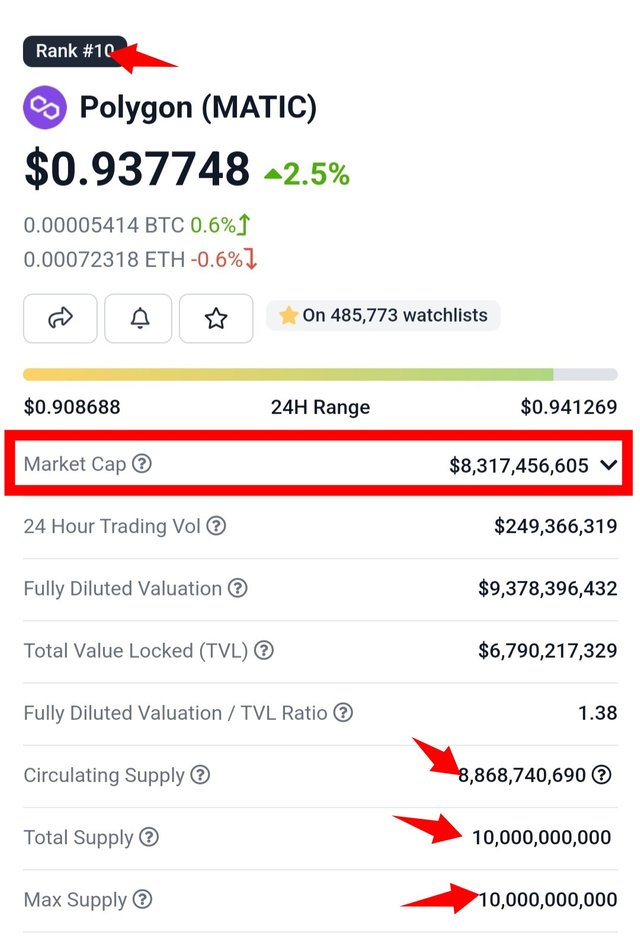

As per Coingeko, at present, the $Matic Total and Maximum Supply are around 10 billion tokens. From this, around 8.73 billion tokens are already circulating in the market, which means 87% of tokens are already in circulation. So the remaining 13% of tokens need to be released into the market based on their lockup duration.

From this, we understand that it doesn't have an unlimited supply, only a limited one, like Bitcoin. Also, further dumps due to token unlocks are very minimal. Because of this maximum supply, we already have 87% of the market. There are only 13% left.

But in this market condition, it is also trending at the 10th rank with a $8,199,343,602 market cap.

At first, this token Introduction on April 3, 2019, through the Binance launchpad(IEO) at a cost of $0.00263 per Matic. Presently, it is trading around $0.96. You may calculate how much, returns it give with in 3 years.

Before IEO on Binance, there were 2 more previous rounds, like the seed round and the early support round they conduct. Here they raised $0.17 million and $0.44 million in funding at a cost of $0.00079 and $0.0026 per Matic. Those details may be checked below.

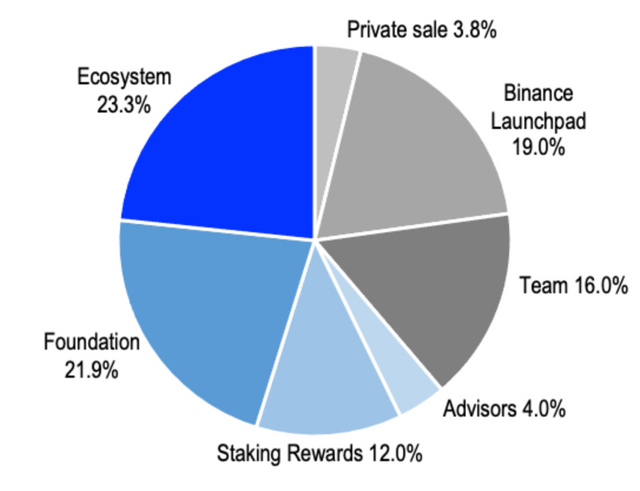

From this we know the IEO and seed round token price ,now we need to check their allocation size and distribution duration on each stage.

source

Based on this, we may understand that the Matic team gives good priority to ecosystem, foundation, and stakeholders too. It shows their priority for consumers and community members.

In my opinion, those projects that give priority to the community always have the best success compared to others. That's why I choose Matic for my investment needs.

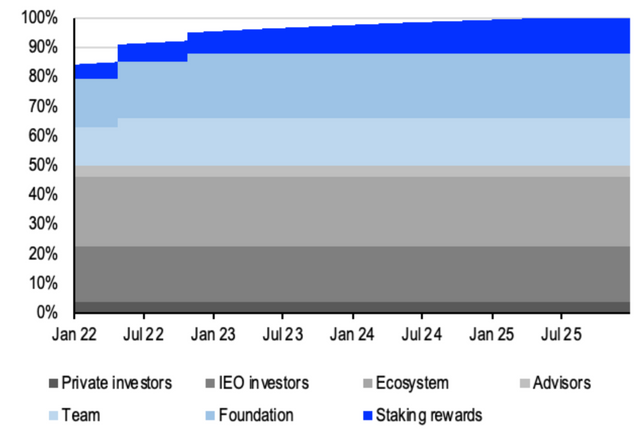

source

As per the above data, for reselling all investors' tokens, including team tokens, in a timely manner (once every six months), To complete all unlocks, it took another 3 years. That means on July 25th, 2025,all investors' tokens will be unlocked 100%.

All we know is that,on token unlock days, we see major volatility in the market. We get those tokens at a cheaper rate during that crucial time because investors book their profit.

But here, the team only releases tokens every six months, not every month. Due to this, the team will gather the needed money and push the price on unlock days very easily. For this reason, investors don't lose their investments.

This is another reason for choosing Polygon for my investment needs.

Most of the project releases its tokens on a monthly or yearly basis, or sometimes with a 2-year cutoff, then on a monthly basis. Like those token releases projects, did not attract investors. Because they need to wait for a longer period, they also have no income at the beginning of the month due to cutoffs. If they release it at least once every 3 or 6 months, it will provide some returns for investors.

But the polygon team is well acquainted with it. That's why they plan to do it every six months.

From this, they keep their investors happy and, at the same time, regulate the circulation supply at an early stage.

By considering all those things, I choose Polygon for my long-term investment needs.Here, polygon team follows good Tokenomics with real use cases of its native Token Matic. also adopting each upcoming new technology and having good partnerships with major projects.

All those show its upcoming strength in the crypto market. That's why I started investing my money in this project.

Note: I am not a financial advisor, so do your research before investing.

Give a few points on why you think tokenomics is important to investors or traders. |

|---|

Tokenomics, or the study of the economic implications of token issuance, is an important concept for investors and traders to understand.

Tokenomics can provide insight into the potential value of different tokens as well as the overall market sentiment.

Here are a few reasons why tokenomics is important to investors and traders:

- First, tokenomics can help investors and traders better understand the value of the tokens they are interested in. By examining the tokenomics of a project, investors and traders can identify which tokens have the most potential for appreciation as well as which tokens have the most associated risk.

This information can be invaluable when making decisions about which tokens to invest in.

Second, tokenomics can provide insight into the liquidity of different tokens. By studying tokenomics, investors and traders can identify which tokens are more likely to be quickly bought and sold. This can be beneficial for traders, as it can be easier to make a profit when trading tokens with high liquidity.

Finally, tokenomics can provide insight into the overall market sentiment. By studying the tokenomics of a project, investors and traders can identify which projects are currently being discussed and supported by the market.

This can be important for investors, as it can provide an indication of which projects have the most potential for growth.

That's why you must check out that project, Token Economics, before you invest or trade. It gives an overall sense of market sentiment and the potential of the project. By using that data, we may make our decision very accurately.

If you are to be the creator of a token, what aspect of tokenomics would you consider most important to drive investors to the project? Give reasons. |

|---|

When creating a token and its associated tokenomics, the most important aspect to consider when it comes to driving investors to a project is the Utility of the token.

Investors want to see that the token they are investing in has a purpose and can be used for something. This means that the token must be able to be used to purchase goods and services on the associated blockchain or platform.

In addition, the token should have some kind of incentive structure in place that encourages users to hold onto the token and use it in the future.

The utility of the token is also important in terms of liquidity. Investors want to know that they can easily and quickly buy and sell the token when they choose. This requires the token to have an active and liquid market. If the token does not have an active and liquid market, investors will not be interested.

In addition, token creators should consider the potential for growth when creating a token. Investors want to invest in tokens that have potential for growth in the future.

This means that the token should be designed to be future-proof as well as have the potential to increase in value over time.

Finally, token creators should also consider the tokenomics of the token.

Tokenomics refers to the economic principles behind the token and how it will be used in the future.

Tokenomics should include things like inflation, deflation, and other economic elements. The tokenomics should be designed to maintain the value of the token as well as provide users with incentives to hold onto the token for the long term.

By keeping all those in mind, I designed my project token economics. Along this , I must choose limited supply tokens for my project instead of unlimited supply. Also, I focus on providing good liquidity and real use cases for my project token.

I only raise 20% of tokens on an IEO or ICO: 10% for the team, 15% for the community, 15% for staking, 2% for promotions, and the remaining 38% for further project growth needs. Also, I release tokens at liner vesting of,once every six months . This vesting continues for up to 5 years after the token launch.

I focus my token release on decentralized platforms as well as centralized platforms too.

Not only those, I also focus token price on the IEO/ICO sale too. Only conduct 10% of tokens at seed rounds; the remaining 10% are on public rounds. Seed round token price is 5X cheaper than IEO round, but it has a 5-year lockup along with team allocation.

But in the public round, investors unlock 80% of their tokens at listing time. remaining at linear vesting up to 5 years.Means 80% of public round token with team, intensive, mining , airdrop of tokens also unlock at listing time based on vesting schedule.

At listing time, around 40% of tokens must be add into present market circulation.. The remaining 60% of coins release slowly into the market with a 5-year linear vesting.

Those are my token economics, along with launch plans for my dream project.I must focus my project, token economics along with its use cases. Both are very important for getting success in the crypto space.

I would like to invite my friends to participate in this contest: @msdbitco, @shohana1, @simonnwigwe, @chiabertrand, @nevlu123, and @harferri.

Thank you so much for reading my article!

Your posts are always top notch dear friend, and I love reading from you.

Tokenomics is a set of rules and regulations that govern the functioning of a cryptocurrency network. It looks at how these rules affect the value of a token, how they can be used to create new markets, and what kind of security measures are needed to ensure that transactions remain safe and secure.

By understanding the dynamics of tokenomics, you can make informed decisions when investing in cryptocurrency and better anticipate price movements.

Thanks for sharing friend, and goodluck in this contest. #steem-on.

I will appreciate if you equally engage on Mine

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for lovely feed back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Utility of a token is one of the major factors that drives investors into any token project more easily. As you have clearly said, every investor wants a project where there is enough liquidity and they can trade their asset at anytime they have chosen. More also, the growth of any token is also a key factor that drives investors as well. When a project has a potential to grow then more people will invest in it. I wish you success in this contest mam.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for lovely feed back my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow dear, you have explained each and every point that is necessary for this post.

Your presentation of the ideas about the Tokenomics are showing that you have a great understanding about it.

Tokenomics is one of the most important things that are much needed for the fundamental analysis of a token before investing in it.

This is completely right that the utility of a token helps in understanding the liquid amount of the tokens that are present in the market for making effecient trades in the market.

The projects that have large liquidity are providing good speed of the transactions processing and hence they are gaining the attention of many scalp traders.

Thanks a lot for sharing your Quality post with us. I wish you a very good luck for the contest 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for lovely feed back. Its giving more energy to me. Thanks a lot.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We support quality posts anywhere and any tags.

Curated by : @sduttaskitchen

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your analysis was quiet sublime, you have used a good alignment trust me you are doing very well i have learnt a lot from you, keep steeming

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for your compliment.Take care of you my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @lavanyalakshman,

Your post is one of the best posts about this week topic in the crypto academy.

I guess that you are a wonderful analyst of the crypto market and I have learnt many things from you in this post that will help me in the future.

This definition of the token economics is very much better for me to understand it well. If all these factors are combined and studied completely then we can make a good decision in the market for yielding profit.

I wish you much success in this week of the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for your compliment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have explained the entire matter with excellently. And I like it a lot.Thank you so much for mentioning me. stay well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for stopping my post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article keep it up boss please visit my post with upvote thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit