Thanks for Making it a wonderful lecture for us.

What is Liquidity in PancakeSwap Explain with examples? and add Liquidity in PancakeSwap and explain all the steps with a screenshot.

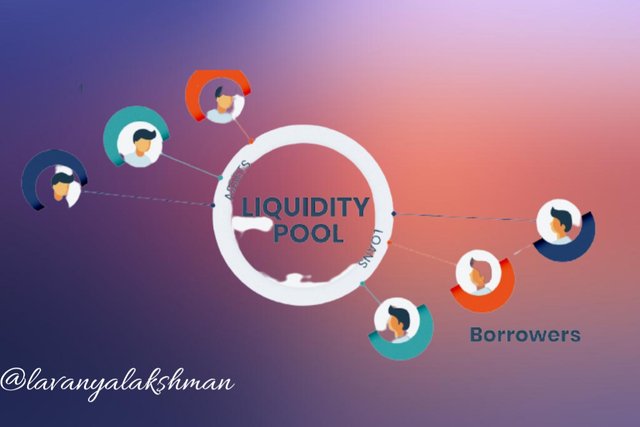

In Centralized Exchanges, the Exchange admin take care of providing needed liquidity for traders needs. That's why without having any liquidity issues we doing our tradings as per our wish.

Coming to Decentralized Exchanges like Pancakeswap, Uniswap, Sushi swap, and many more platforms need sufficient liquidity for getting successful Swaps. But that liquidity who provide??

That's why they offering different liquidity pools at good APY, So holders just providing their holdings in the liquidity pool and earn some good returns on it.

Here team pay some interest to us for providing liquidity. Those interests are collected as trading fees from others users who swap their needs.

Here trader and liquidity provider both get benefited. Trader successfully finishes his trade without any liquidity issue, at the same time liquidity provider earn some extra money for providing liquidity.

Here we can unstake our liquidity when we need. Then we convert our needed coin as per our wish.

Like that liquidity, pools work in Decentralized Exchanges.

Providing Liquidity in Pancakeswap

Before providing liquidity be sure on selecting coins. Because here we need to provide liquidity in 50-50 with two coins combination.

In Pancakeswap there is a lot of pools available with different found with high yield. But those are very risky, not recommend for the long term. Because in those coins we to get impermeable loss, so be careful.

That's why I always recommended Stable coins for the long term, For the short term, I use which give a high yield. After providing liquidity we get LP tokens, Those Tokens we can stake and earn some additional interest on it.

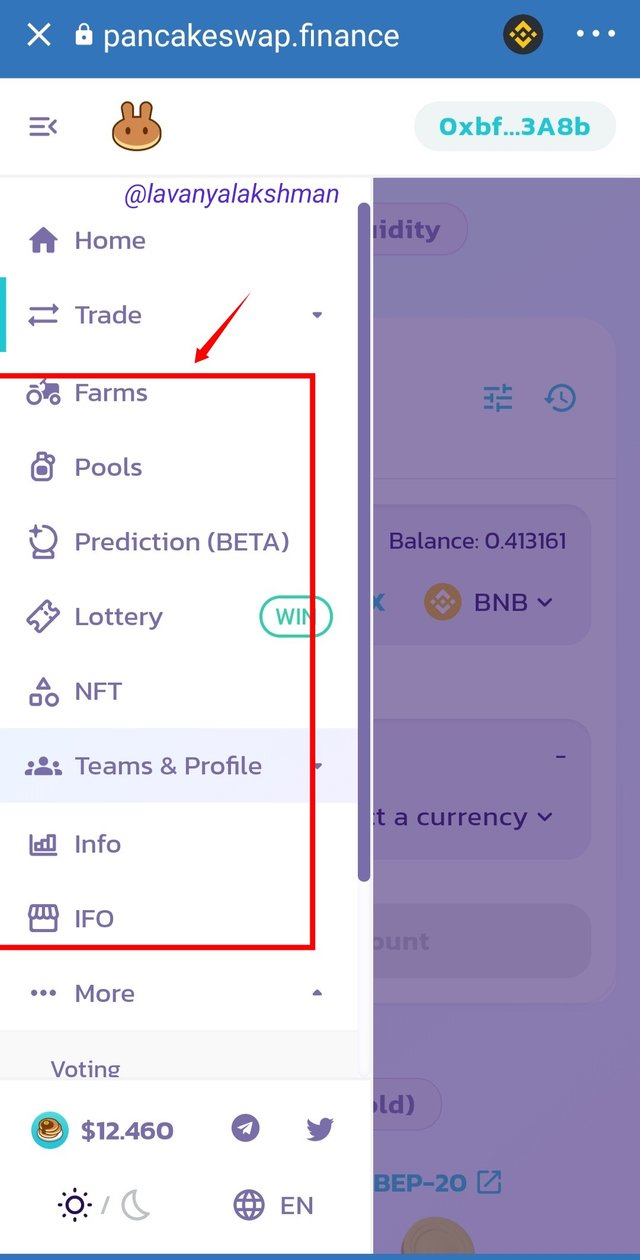

For providing liquidity, First I go Pancakeswap and Check all liquidity pools and choose one for my needs.

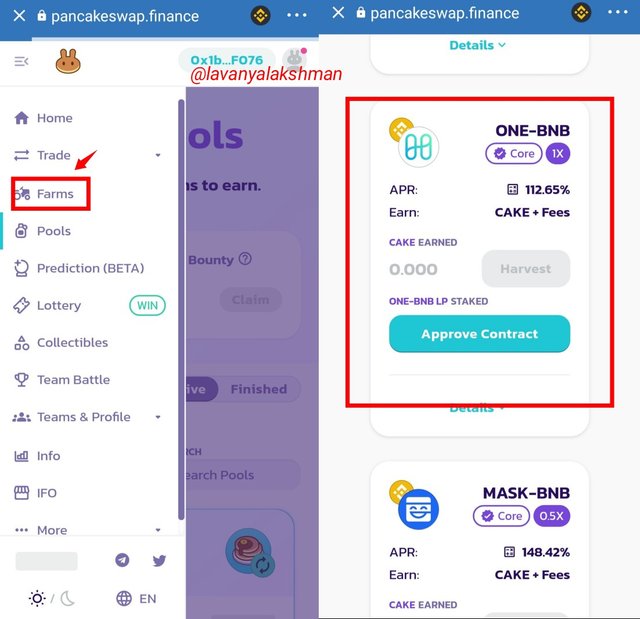

For this, I just go Pancakeswap, Select Farms.

Here we can see a lot of available Farms, from this I chose the BNB combination pool. Because I having BNB in my wallet, On buying another coin I provide Liquidity.

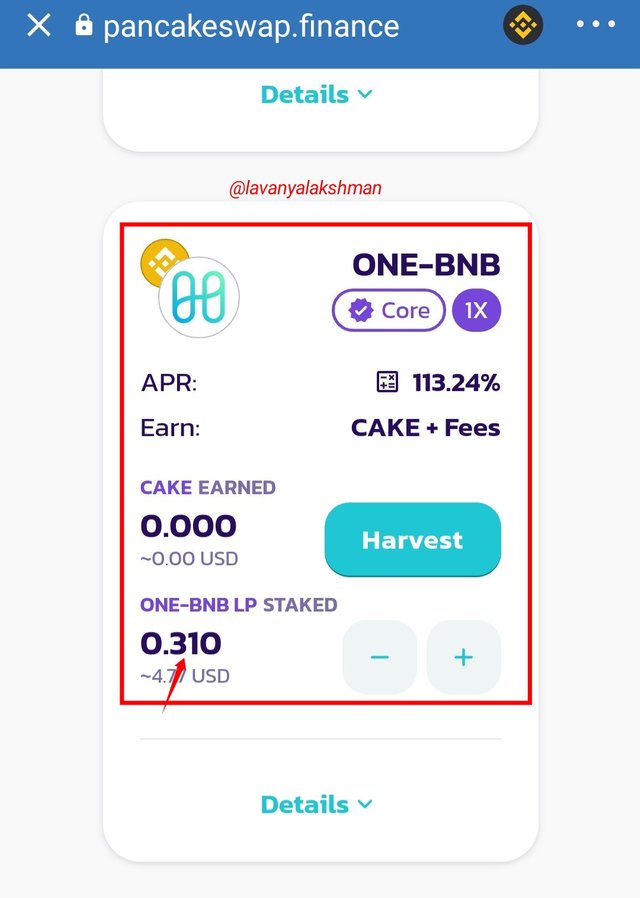

On checking all I choose ONE-BNB Pool for providing liquidity.

For providing liquidity to this pool, first I need LP Tokens of BNB and ONE combination.

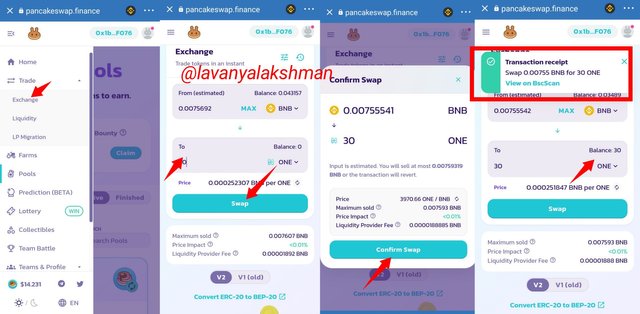

For getting it, first I swap the required BNB to ONE coin.

For this First go Trade Tab, Then Select Exchange.

Here I buying 30 ONE tokens, Using my BNB.

Now I finish my swap successfully. Now required ONE token added to my wallet.

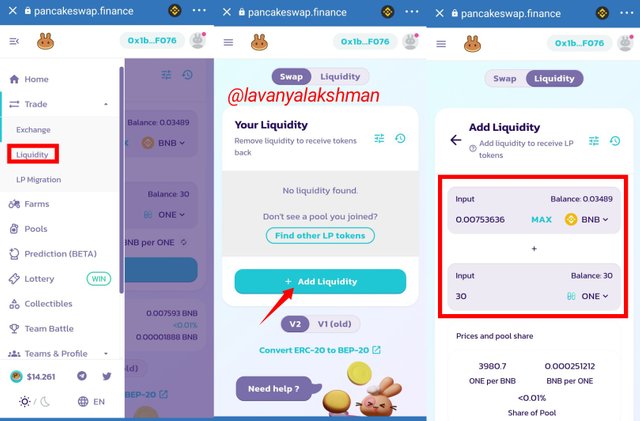

Now I go for providing liquidity in Pancake swap, On providing Liquidity I get LP tokens.

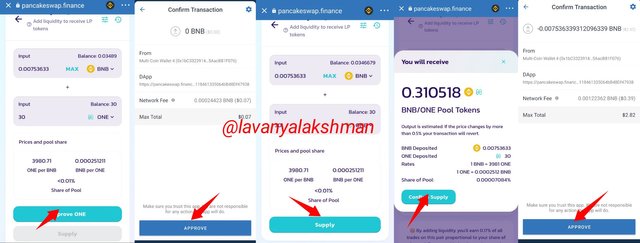

For Providing liquidity I go Trade tab from this select liquidity tab.Then Select Add liquidity tab. Now we get this screen.

Here I selecting BNB and ONE because I holding those coins in my wallet.

After selecting coins now select the Approve ONE tab.

After paying Approve Fee, Now select the Supply tab.

In Dex for any new activity, first, we need to approve, then swap. So two times we need to pay a gas fee.

Now I successfully supply my BNB-ONE in BNB - ONE pool.

Those combination LP tokens were added to my wallet.

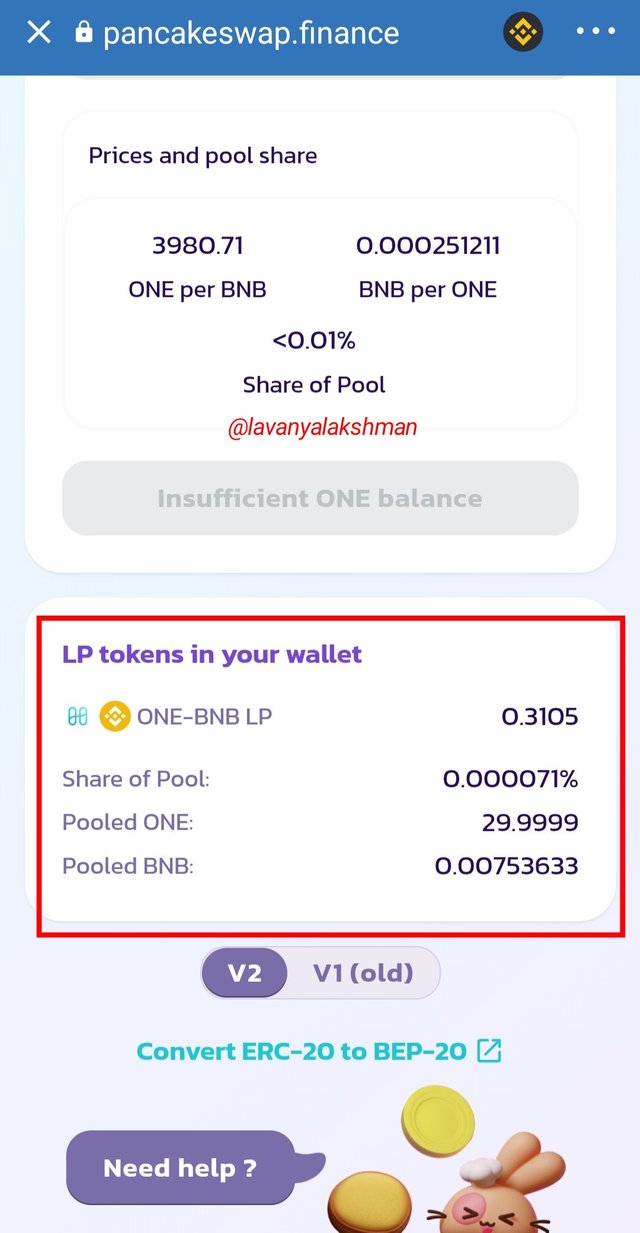

Here you can see My LP Tokens in My wallet.

Now I go for staking those LP Tokens for additional income.

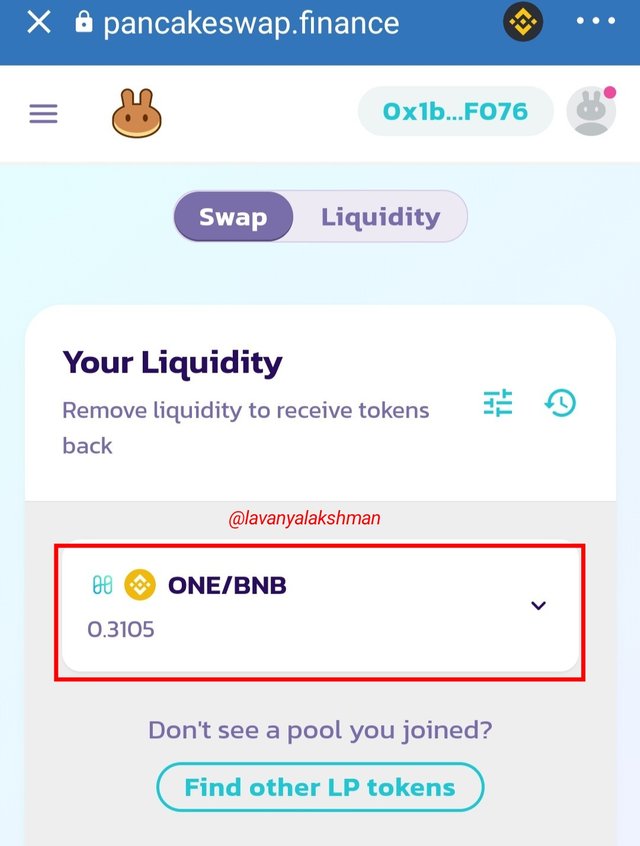

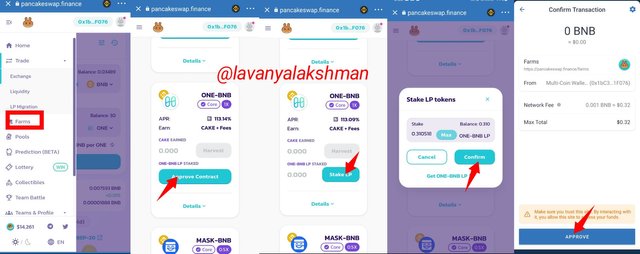

For staking those I go Pancakeswap, select Farms tab.

Then select BNB-ONE POOL.

Before staking first I need to approve that smart contract, so first I approve it by selecting the Approve Contract tab.

After approving the Stake tab, enable. On selecting Maximum LP tokens I stake My LP.

Now I successfully stake my LP tokens in Farms. From this, I get cake+fee as an additional income.

Like that we can provide liquidity in Pancakeswap along with we can Stake those LPs in Farms and Earn additional income also.

How to connect Binance exchange account with Binance smart chain a or trust wallet. Explain all the steps through a screenshot. And transfer any coin from Binance exchange to Binance smart chain.

Binance Smart Chain Network developed by Binance Exchange. So we can connect our Binance Centralized Exchange to our Binance Smart Chain very easily.

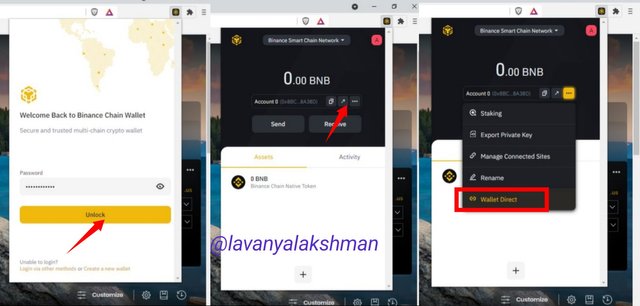

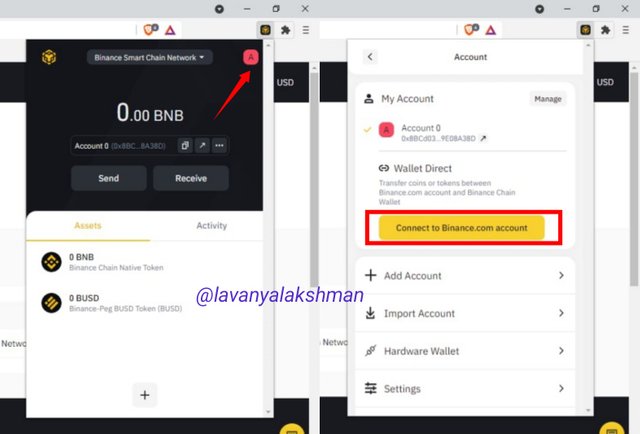

For this first, we need to unlock our Binance Smart Chain Network wallet.

After unlocking , click on 3 Dots , From this Select Wallet Direct.

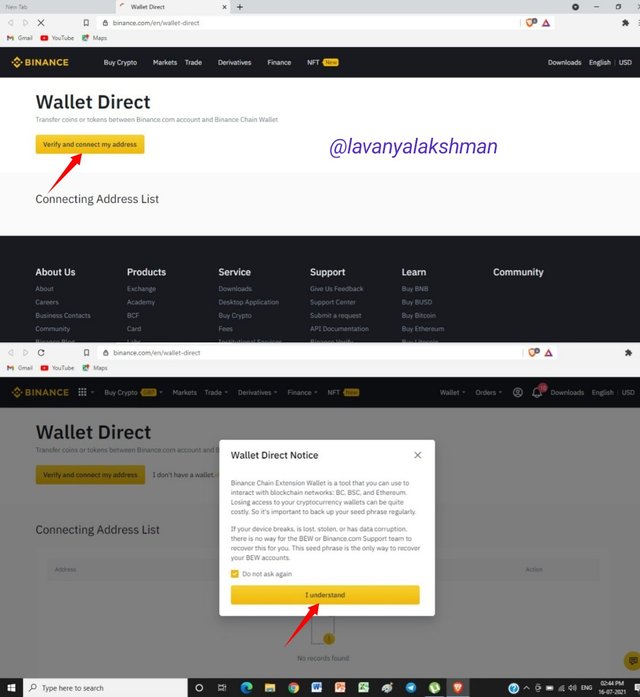

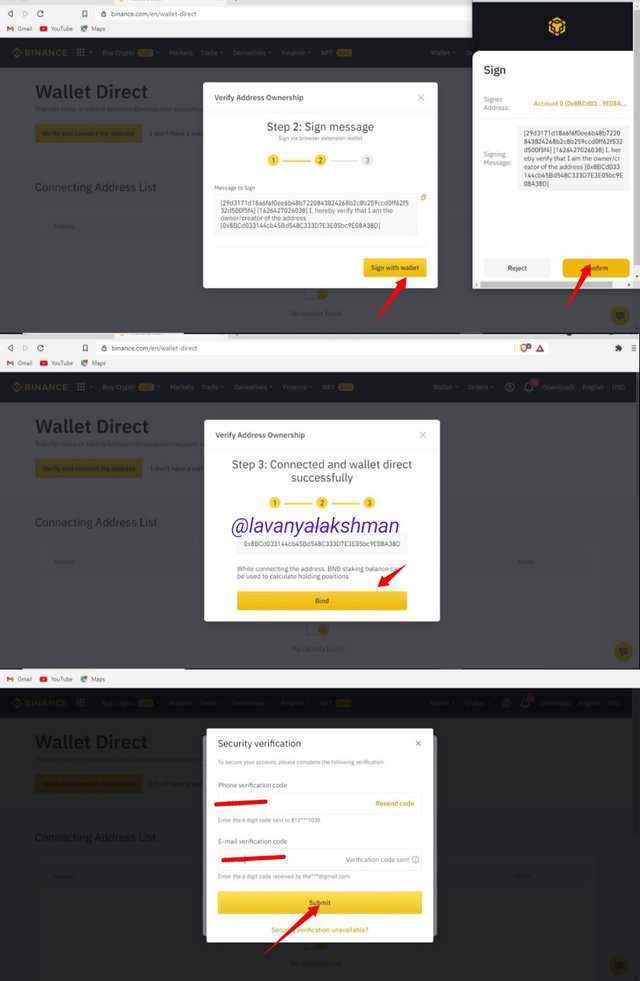

Now you get this screen, Here select Verify and connect my address tab, then it asks once again for verification for connecting. Give permission.

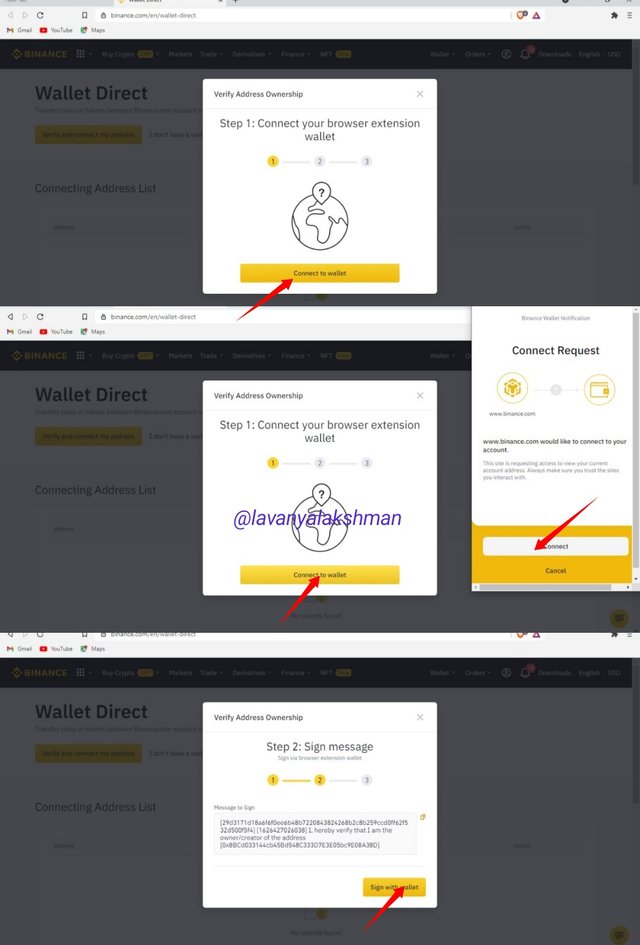

Now you get this screen, Here select the Connect To Wallet tab.

Now we get requests for connecting from Smart Chain Network, Just select the Connect tab.

Now it gives another verification for connecting the wallet.Just select Confirm Tab.

Now you get lime this scree. Just click on the Bind tab.

Then entering verification codes, Just click on the Submit tab.

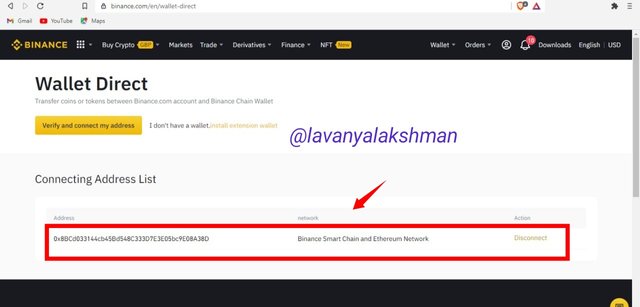

Here you can see My Binance Exchange Account successfully Bind With Binance Smart Chain Account.

Now we can handle our Binance Exchange account with Binance Smart Chain Also.

Like that we can Bind Our Binance Exchange Account to Binance Smart Chain Wallet.

Sending Coins From Binance Exchange To Binance Smart Chain.

How we normally withdraw found from Exchange to other wallets. Same process here also.

First I copy My Binance Smart Chain BUSD wallet address. Because I wish to Transfer BUSD to Binance Smart Chain that's why I copied its address.

Then Click on Account Tab, then select Connect To Binance.com Account.

Now it redirects to my Binance Exchange Account.

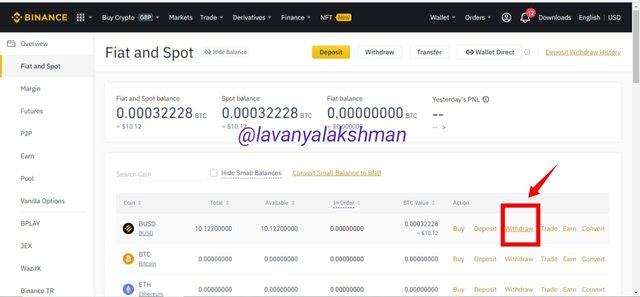

Now go to my wallet, I select BUSD, withdrawal tab.

- After entering wallet address and other details, I click the Withdraw tab.

- That's it with a few seconds that BUSD added to my Binance Smart Chain Wallet.

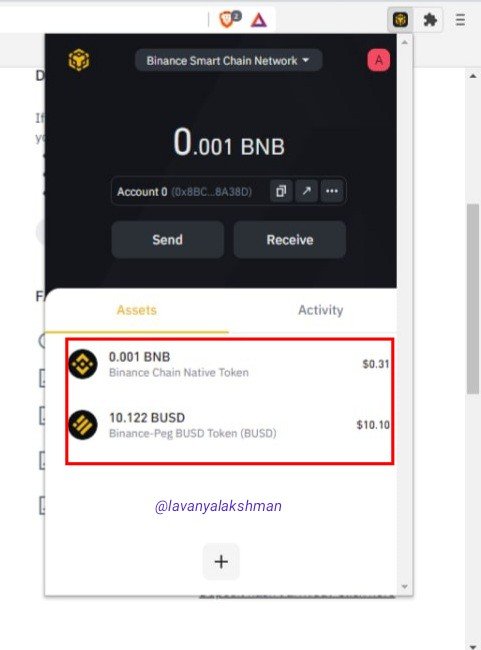

Here you can check My Balances.

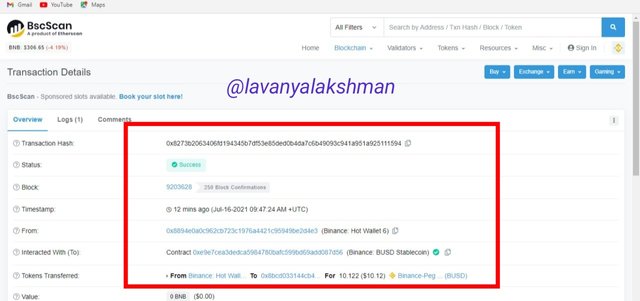

Here is My Transaction Hash and its Proof.

https://bscscan.com/tx/0x8273b2063406fd194345b7df53e85ded0b4da7c6b49093c941a951a925111594

Like that we can withdraw Binance Smart Chain supported coins to our wallet from other Centralized Exchanges also.

What is the difference between Trust Wallet and Metamask and which of them is better and why? Explain in your own words.

TrustWallet and Metamask both are working and their use cases are almost the same. But they having too little bit different from each other.

In general, we use both wallets to store our coins for the long term along with accessing Dapps and NFTs collections or trading using those.

From these Two Wallets, we can access all those Dapps, NFT projects without any issues, but for accessing some projects it only allows Metamask, Some Allow Trustwallet. But those are very minimum, but on using those we can access almost all platforms without any issues.

Metamask:-

Metamask is mainly Ethereum Network blockchain supported wallet.

But nowadays we see a lot of new projects develops their Blockchains like BSC, KAVA, MATIC, OKEX and many more for accessing those on importing its RPC we can access through Metamask very easily.

No need to create other wallets for accessing those projects. Now MataMask not only Ethereum Blockchain but Other Blockchains also supporting.

So using Metamask we can access Multi Blockchain with a single wallet. No need to create new wallets for those needs.

Metamask is available on Both Mobile and Web browsers also. At present it supporting Chrome, Brave, and Mozilla browsers, on adding it's an extension to our Browsers we can access and Dapps or NFT projects very easily.

It also has 5 million monthly active users. For accessing Dapps, Opensea projects we do no need to add anything because it is already imported with a lot of plugins, so we can access all those without any issues, without working hard.

For access just connecting our wallet to that platform is enough. Gas fee and remaining details we get instantly, on adjusting all we can finish our trade.

In Metamask our wallet gets secured with a Password and Security key. So always keep those securely. If you lost those not possible to import our wallet.

By using our Security key we can re-import our wallet when we need it. In mobile also we can re-import our wallet without any issues using a security key.

At present it supporting 11 languages. So we can use any language we need.

Metamask also doesn't hold or share our data. But it facing some issues regarding Data theft. A lot of users give complaint regarding it. Sometimes our critical personal data getting lack from the Metamask browser. Sometimes we getting phishing attacks through this Metamask Browser.

Metamask work in both Browser and Mobile, due to this we facing a lot of unnecessary issues. Sometimes it taking a huge time for opening an application. Like that small deferences, we having.

TrustWallet

TrustWallet is the worlds leading Multi Chain digital Crypto assets Wallet. In this wallet, we can store not only Ethereum also support LTC, KAVA, TRX, BNB and many more assets.

.jpeg)

This application gets popular in 2017, It has more than 10 Million Active Users.

Binance, the world’s largest cryptocurrency exchange, even acquired TrustWallet back in 2018. It gives more popularity and significantly increases its active users than after.

Now almost every trader well know and frequently using this application for their needs.

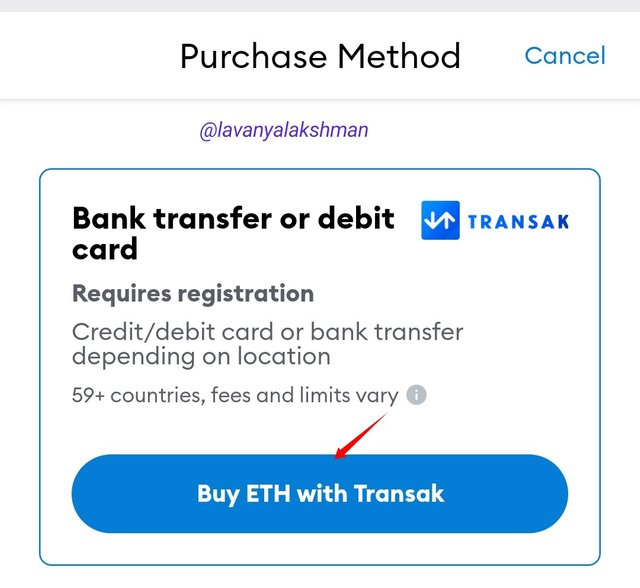

The main Different between MetaMask To TrustWallet is fiat related activities. Through Metamask we can purchase crypto assets through Visa or Master Card, But those activities are not possible through Trustwallet.

TrustWallet is only available for Mobile users only, Browser extensions not available. At present Android and IOS, users can access Trustwallet.

For creating an account no need for any Email or Password. So we get complete security on our data.

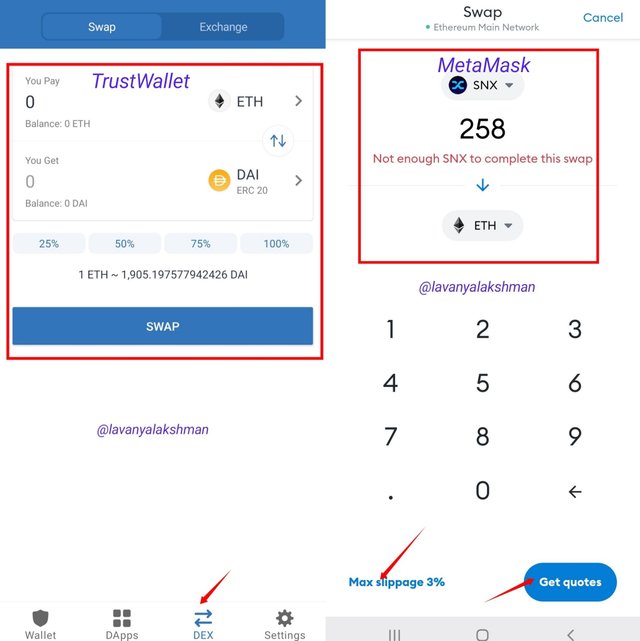

Through Trustwallet we can do DEX related achieving also. Here we can do a swipe from one asset to another one directly. This feature is now available in Metamask Mobile Application also.

At present it supports 12 languages, Here the Transaction fee is pre-defined, not possible to adjust those like in Metamask.

Using the Trustwallet security key, we can re-import our wallet when we need it. We don't get any issues accessing a single wallet on Multiple devices.

On compared to TrustWallet to Metamask, Trust Waller working smooth and faster because of supporting it, Mobile Users. So here we don't get any other issues which we face in Metamask.

Those are the Main Differences between Metamask and Trustwallet.

What is meant by PancakeSwap and Uniswap?

Pancakeswap and Uniswap Both Decentralized Exchanges, It works based on Auto Market Maker Tool. On both platforms we don't have order books, Using Liquidity pools our orders get to execute. Both having some differences, now we discuss it.

About Uniswap:-

Uniswap works in Ethereum Blockchain Network so supports only ERC-20 tokens.

In Uniswap we don't get any order books, Just execute our orders using Auto Mated Market Tool, on searching different Markets, Uniswap Provide Best Prices to us. Here Order Book was replaced by Liquidity pool.

.jpeg)

Any user can provide their liquidity in Uniswap, then earn their shares as per their Pool Share. After providing Liquidity here, we get LP tokens, Again we staking that LP we earn additional income on it.

For cresting Accounts in Uniswap no need for emails, no need identify proofs like those, Just connecting our Supported wallets Like Trustwallet and Metamask, We can finish our activities very easily.

About Pancakeswap:-

Uniswap works in Binance Smart Chain Network so supports only BEP-20 tokens.

In Pancakeswap we don't get any order books, Just execute our orders using Auto Mated Market Tool, searching different Markets, Pancakeswap Provide Best Prices to us. Here Order Book was replaced by Liquidity pool.

.jpeg)

Any user can provide their liquidity in Pancakeswap, then earn their shares as per their Pool Share. After providing Liquidity here, we get LP tokens, Again we staking that LP we earn additional income on it.

Due to high Gas fees in Uniswap, Binance Smart Chain came to Market. Sometimes those have fees we can pay $20 to $300 as per Ethereum Traffic. That's why developers introduce Binance Smart Chain. Here gas fee is very little from $0.3 to $1 maximum. On compared to Ethereum Network, that fee is very less.

That's why a lot of projects slowly enters into the BSC network, So Pancakeswap getting More Active users than Uniswap Now.

Differences Between Pancakeswap and Uniswap

Both are doing some activities in their Networks, But having some differences between them.

Native Tokens

Cake is a PancakeSwap native and Governance Token.

Using this we can do Farming and Staking. From this, we earn Additional Income. Here we get a reward in form of Cake.

This token is also Tradeable in Other Centralized Exchanges.

UNI coin is Uniswap Native Coin. Using this coin we can also do Farming and Staking in Uniswap.

For this activity, we get UNI as a reward based on our share. This coin is also Tradeable in Centralized Exchanges.

In September 2020, Uniswap gives a big Airdrop of UNI coins for their early users. This is one of the biggest airdrop in Traders life. A lot of them get huge free money.

Then after UNI price going like a rocket but not possible to beat Cake. Because Cake holders getting other governance purposes, PancakeSwap has another token called SYRUP, Here holders getting a 40% additional commission for holding the cake. So investors choose this coin more than Uni coin.

Here users can stake and unstake as per their needs, This feature attracts more users to use this facility.

Adoption

Uniswap is an older and Popular Decentralized Exchange but after arriving at Pancakeswap it losing its users. Because of Cake coin Use cases.

But Pancakeswap in Clone of Uniswap. No doubt about it. But it getting more Popular and Active users than Uniswap now.

Because of its attractive UI, ease to use in any Devices and huge returns on holding the cake, and many more features keep Pancakeswap in Number 1 position.

Transaction Costs

Etherum Network introduces the Smart Contract feature at first. It gives an open door to all Traders. This adoption of the big major update in the Crypto Industry.

After getting this update Uniswap came to market. It brings a lot of new projects and increases DEX Volume in the Market.

But in the Ethereum network we need to pay a high gas fee, Small investors do not possible use this platform because of its high gas fee.

In Uniswap, those Transaction fees are high Compared to Pancake.

Because Pancakeswap using Binance Smart Chain, here those fees in Pennies, very low and small investors also use this platform without fearing on seeing Transaction Fees.

Here we also get faster Transactions compared to Uniswap.

Number of Listed Tokens

In Uniswap we get huge Tokens than Pancakeswap. Because it is an older one, a lot of projects provide their liquidity here, So here we see a lot of tokens compared to Pancake.

At the same time here there is a lot of Fake Tokens. For Example, if you try to swap ETH to UNI. In the list, we can see 3 to 4 coins with the Name of UNI. But those are fake once.

For swapping always use it's a contract address, otherwise we lose our money.

Coming to Pancakeswap, those fake couns with a single name, we don't find most. But here also have a lot of rug pool projects.

On both platforms there are huge Rug pool projects, so always invest your money in genuine projects only.

Liquidity and Trading Volume

In Uniswap we get good liquidity and Trading Volume for swapping needs compared to Pancakeswap.

A lot of users still prefers Uniswap to Pancakeswap for their needs. But Pancakeswap one time already beat Uniswap in one-day Trading Volume.

It showing its strength and giving challenge to Uniswap. But it's not so easy to beat Uniswap in his Trading Volume.

Because a lot of users stick with Ethereum, because of its use cases and project growth. That's why they always use Uniswap for their needs.

Security and Community

Both Uniswap and Pancake swap having good communities with good security also. Because those Decentralized Exchanges so it having best security features, here our keys in our hand. So users get more control over their wallets.

Recently Pancakeswap provides Bridge Services to users. Using this we can convert our Ethereum Tokens into BSC Tokens very easily. This feature attracting a lot of users, so solely its community become stronger than the Uniswap community.

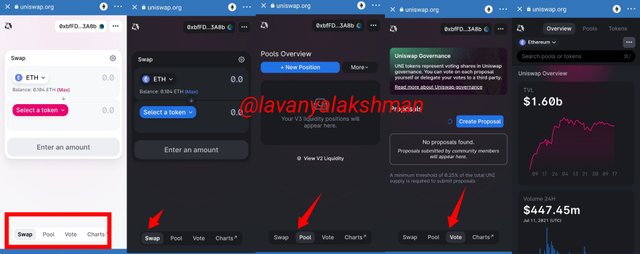

Different Features In Pancakeswap and Uniswap

In comparison to Uniswap with Pancakeswap, In Pancakeswap we get more features than Uniswap.

In Uniswap we having only swapping, Liquidity Providing, and charts only.

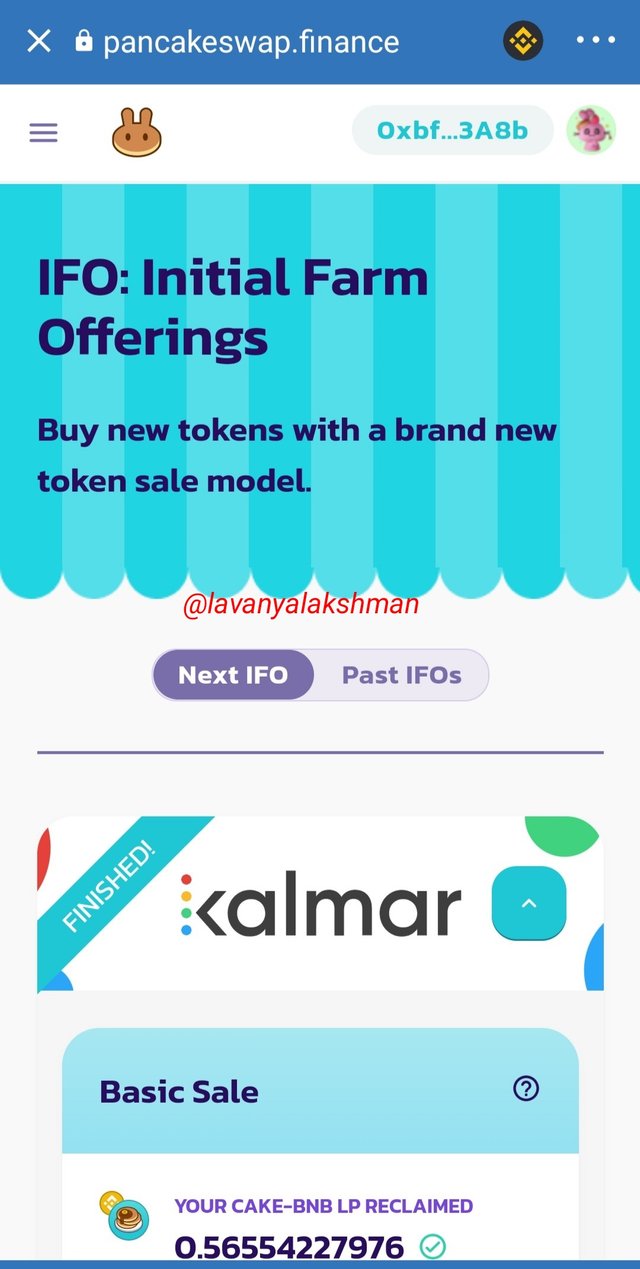

But in Pancakeswap along with it We having Many other Features like IFOs, Lottery, Price Prediction and many more.

On participating those we earn free money but those are a little bit risky.

From all features Pancakeswap IFOs are more popular,

I participate in each IFO when they conduct. But due to overflow here I getting less allocation but giving 5X returns. Very reasonable earnings we get on Participating IFOs.

Who set up Profile in Pancakeswap, they offered one free NFT to users recently. Those are tradable and possibly to Transfer from one wallet to another wallet also.

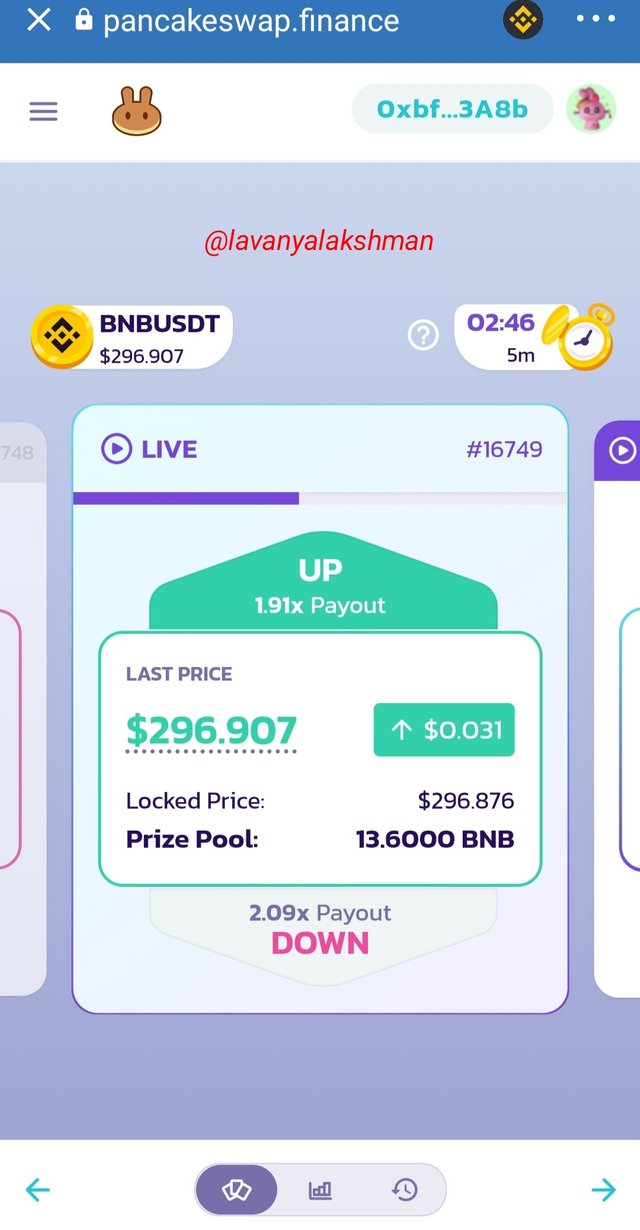

If you having good knowledge in TA, on Participating in betting games we can earn 1X returns every 5 Minutes. For participating we need BNB, those betting rewards we can claim after the end of the game. In every 5 minutes, we can participate in Betting Game.

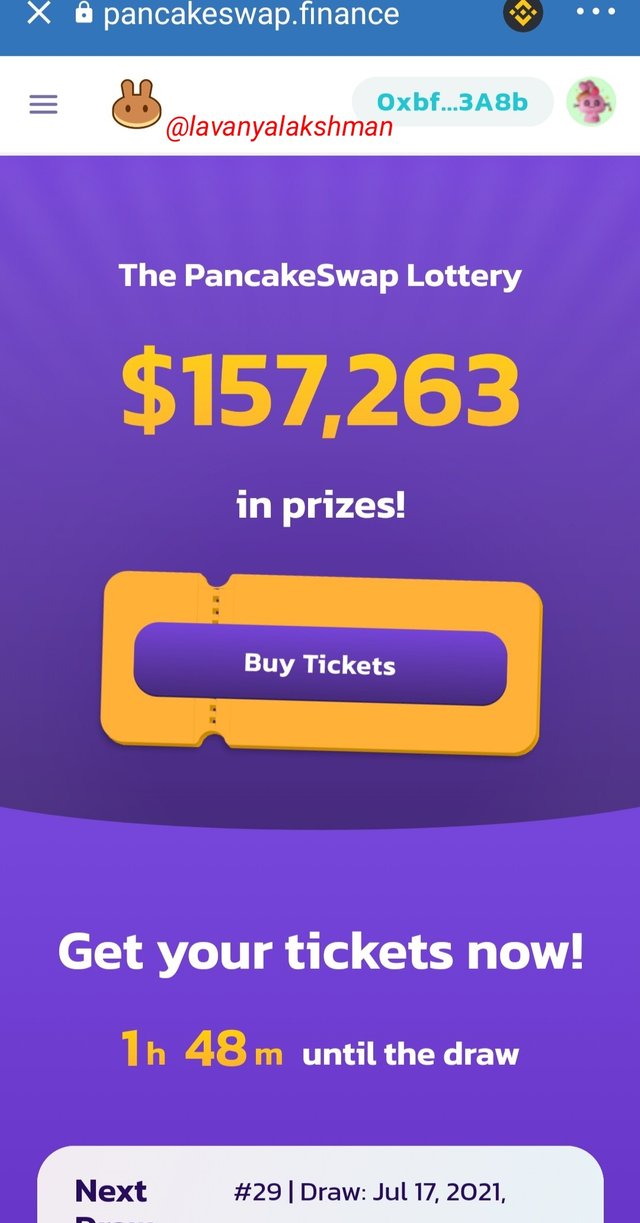

Another most popular feature in Pancakeswap is Lottery. Here luck plays a big role. As with a normal lottery system, here is also the same system we having. We need to buy a lottery ticket on paying cake, If your Ticket number win, those prize pools are added to our wallet. But it is based on luck, so not recommend.

Like that features available in Pancakeswap, but in Uniswap we don't have like those. Only swapping and liquidity pools, charts are available.

Which of these exchanges is better and why? Explain in your own words.

Coming to me I like Pancakeswap only, because of its low network fee, ease to use in Mobile, Its attractive User Interface, all give use Pancakeswap most than Uniswap.

I am a small investor, So I don't want to pay a high gas fee to swap my needed coins. That's why I choose Pancakeswap because here Gas fee is in pennies, and also give very faster Transaction compared to Uniswap.

In Uniswap some times, our swap does not execute but our Transaction fee may be deducted by our wallet. Already here we paying the high gas fee, along with if you face this issue 2 to 3 times, then our portfolio becomes zero. Like those lot of issues we having in Uniswap.

That's why I choose Pancakeswap for my needs, Not only swapping here I have many other features like Syrup pool, IFOs, Lottery, NFTs, Betting and More. All are very easy to access, even beginners also do trading here, without any issues.

So on Considering all those features, less Trading Fee, I choose PancakeSwap for my needs.

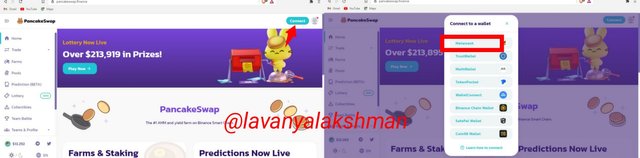

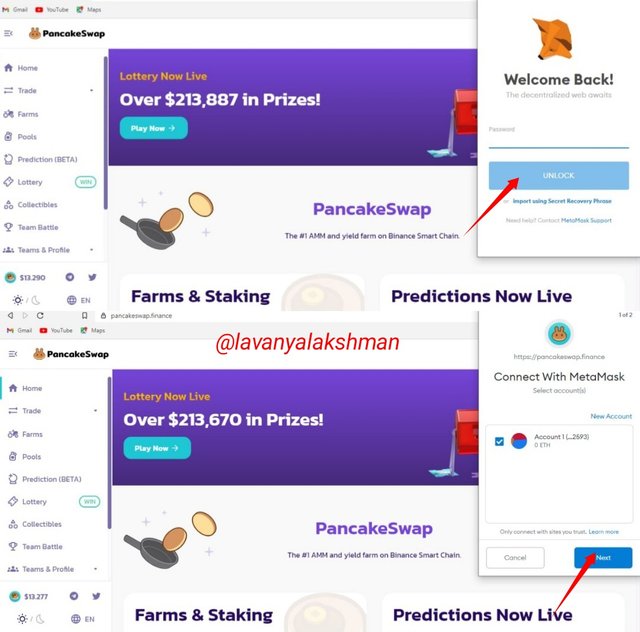

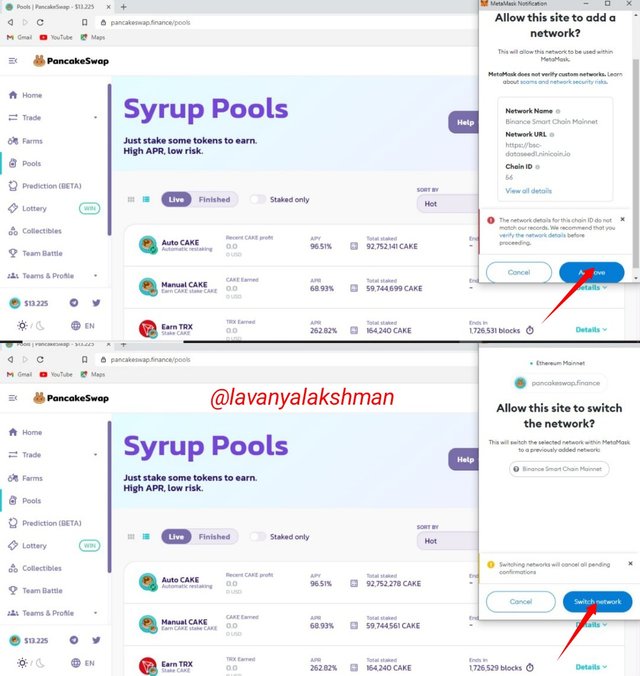

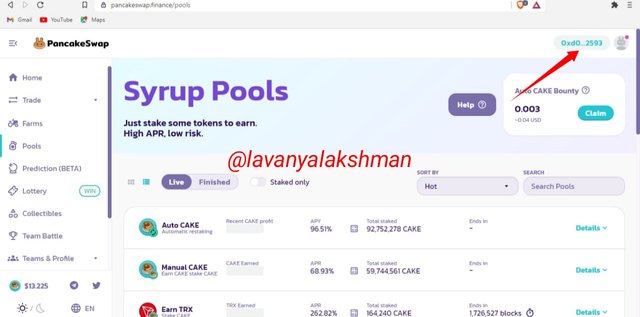

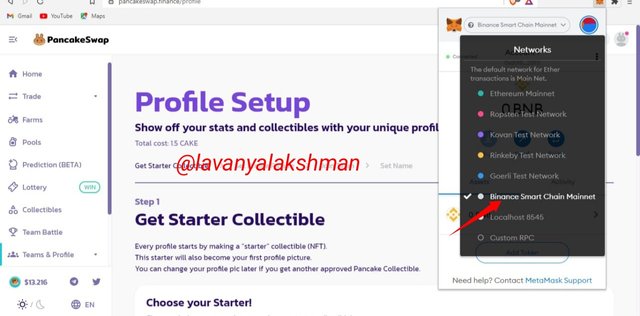

How to connect PancakeSwap with Metamask.

PancakeSwap works on BSC Network, but Metamask is Etherum based wallet, But on adding RPC of BSC in Metamask we can do our activities in PancakeSwap through Metamask Wallet, very easily.

For this Just go https://pancakeswap.finance/

Now Select Connect tab, From This list Choose Metamask.

Now Unlock your Metamask with your Metamask Password.

Now you get this screen, from this select Next tab, then click Connect tab.

Now it asks to add BSC RPC to MetaMask, just select Approve.

Now we need to Switch your Network from ETH to BSC, so just click on the Switch Network tab.

That's it now we can do any activities in PancakeSwap through Metamask Wallet.

Here you can see, My wallet address was successfully connected to PancakeSwap.

BSC RPC also added to Metamask, Then after just changing our Network we can trade in PancakeSwap, No need to add that RPC once again to our MetaMask.

Like that we can connect our MetaMask wallet To PancakeSwap very easily.

Conclusion:-

In PancakeSwap we having a lot of liquidity pools, but always choose Stable coins for long term needs.

You can add our Binance Traditional Exchange Wallet Binance Smart Chain very easily. After binding, we can do all needed activities as per our wish.

TrustWallet and MetaMask both are DEX, but each having some differences between them. In both wallets, we can store our coins very securely, as per your need you can use those.

Pancakeswap and Uniswap both are Decentralised Exchanges but work in BSC and Ethereum Networks.

We can access PancakeSwap through MetaMask also on adding BSC RPC to MetaMask.

Adding RPC is very easy, in mobile also we can access It.

Crypto is always a risky one, so be careful on securing DEX wallets Private Keys.

Hope I finish All My Tasks Correctly. If any verify me.

Thanks For Reading My Post

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 3

thank you very much for taking participate in this class

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for verifying.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit